Tax Rebate For Travelling To Work Web 6 avr 2023 nbsp 0183 32 It is crucial to understand that the rules on what travel expenses qualify for tax relief are quite strict In particular there is generally no tax relief available for the costs of ordinary commuting that is

Web 28 mars 2014 nbsp 0183 32 7 1 There are special tax rules which give extra tax relief for travel by some employees who work abroad or come from abroad to work in the UK The full cost of Web 1 nov 2021 nbsp 0183 32 The technicalities for claiming VAT arise from the fact that each member state of the EU will now be free to set their own VAT policy with the U K The minimum

Tax Rebate For Travelling To Work

Tax Rebate For Travelling To Work

http://cdn.newsapi.com.au/image/v1/5968db818412c0133b9c520f420add51

Claim Work Travel Expenses This Can Boost Your Tax Refund Work

https://i.pinimg.com/originals/5b/4f/97/5b4f97e3557f889aa11332955fd1cd74.jpg

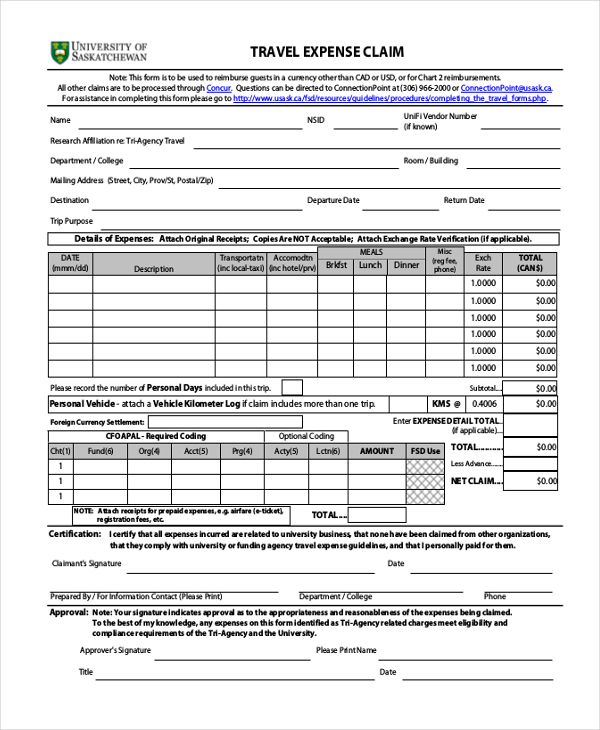

FREE 11 Sample Travel Expense Claim Forms In MS Word PDF MS Excel

https://images.sampleforms.com/wp-content/uploads/2016/09/Sample-Travel-Expence-Claim-Form.jpg

Web 18 mai 2023 nbsp 0183 32 More than 800 000 taxpayers claimed tax refunds for work expenses during the 2021 to 2022 tax year but while the average claim was 163 125 over 70 of claimants missed out on getting the full Web A mileage tax rebate example using 10 000 business miles 10 000 miles 45p per mile 163 4500 Mileage 163 4500 20 tax relief 163 900 In this example if you were paying tax

Web 45p per mile for the first 10 000 miles of work travel in a year 25p per mile for any additional travel after that These rates are for cars and vans If you travel by Web 2 mars 2023 nbsp 0183 32 HMRC may provide tax relief if costs fall into the following categories Public transport costs Hotel accommodation if you have to stay overnight Food and drink Congestion charges and tolls Parking fees

Download Tax Rebate For Travelling To Work

More picture related to Tax Rebate For Travelling To Work

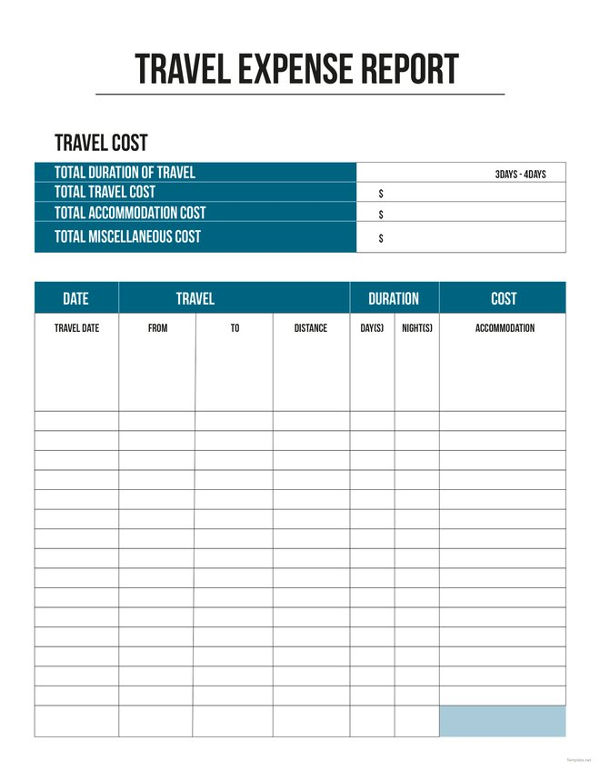

Travel Expense Sheet Template Free Free Printable Templates

https://images.template.net/wp-content/uploads/2015/05/Free-Travel-Expense-Report-Template.jpg

Leaving The UK Permanently You Could Be Entitled To A Tax Rebate

https://i.pinimg.com/originals/c7/73/81/c773813f9eb11d4aa1f758ce6e60917a.jpg

Travelling Expenses Tax Deductible Malaysia Paul Springer

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

Web 11 sept 2023 nbsp 0183 32 Barcelona is increasing its tourist tax in 2023 Barcelona s tourist tax will be increased over the next two years city authorities have announced Since 2012 visitors Web In general if you have to go to a temporary place of work for less than 24 months you should be eligible to claim back travel expenses What s more as part of your travel

Web The tax treatment of employee travel expenses is quite complicated In outline you can claim travel which you necessarily have to undertake in the course of your employment Web Work travel expenses are a big part of most tax rebate claims so it s worth knowing the terrain before you set yours rolling HMRC won t automatically give you a mileage tax

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-1.png

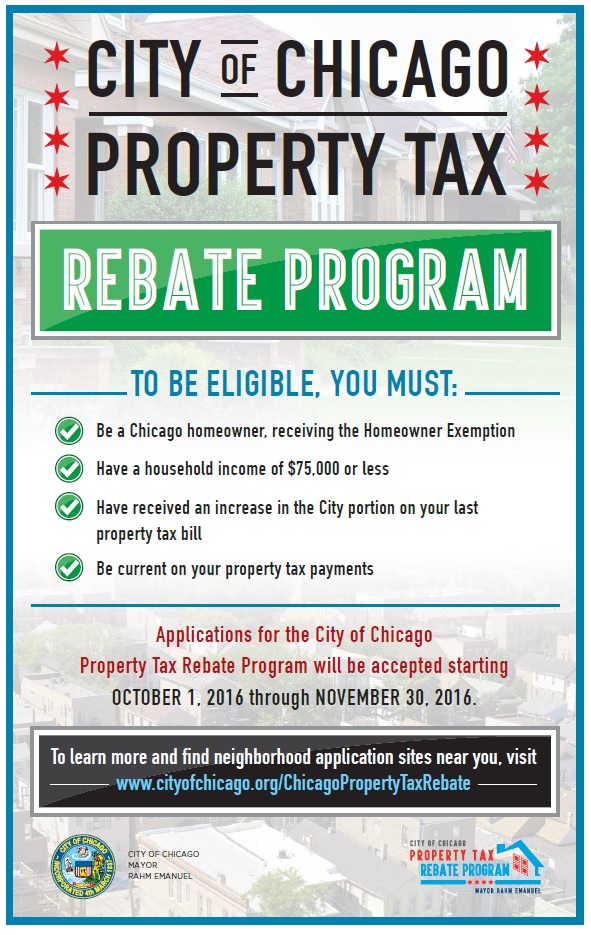

Uptown Update Property Tax Rebate Program Open Through November

https://4.bp.blogspot.com/-O9R4XCiPJUQ/WBWQyxv0nRI/AAAAAAAAN-M/A4WEO8G29mgbbWYzJj03YfOk_WrrHF4_wCLcB/s1600/TaxRebateProgram.jpg

https://www.litrg.org.uk/tax-guides/employme…

Web 6 avr 2023 nbsp 0183 32 It is crucial to understand that the rules on what travel expenses qualify for tax relief are quite strict In particular there is generally no tax relief available for the costs of ordinary commuting that is

https://www.gov.uk/guidance/special-tax-rules-on-foreign-travel-490...

Web 28 mars 2014 nbsp 0183 32 7 1 There are special tax rules which give extra tax relief for travel by some employees who work abroad or come from abroad to work in the UK The full cost of

2007 Tax Rebate Tax Deduction Rebates

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Working From Home Tax Rebate Form 2022 Printable Rebate Form

How Do I Claim The Recovery Rebate Credit On My Ta

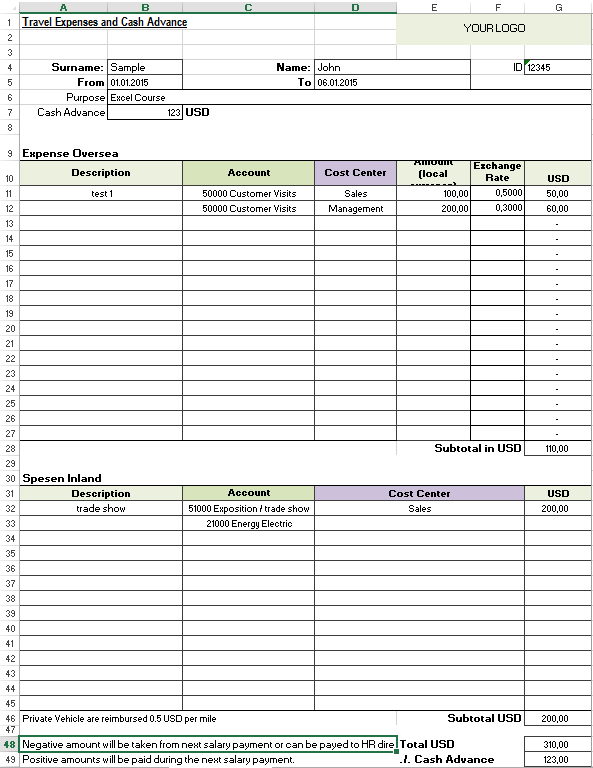

Excel Template Free Travel Expense Report Template For Microsoft

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Can The Self employed Claim Tax Rebates For PPE Or Safety Boots

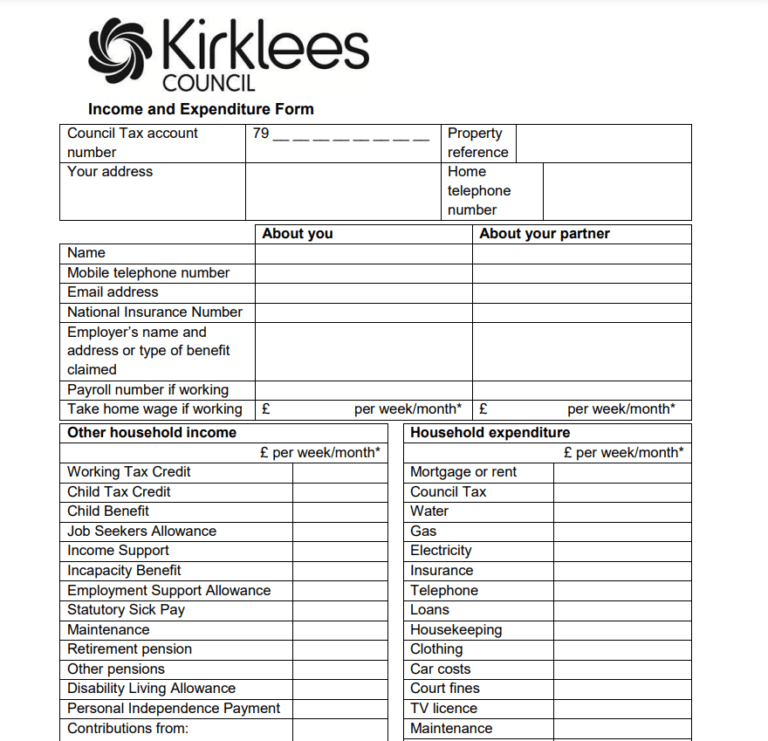

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Tax Rebate For Travelling To Work - Web 2 mars 2023 nbsp 0183 32 HMRC may provide tax relief if costs fall into the following categories Public transport costs Hotel accommodation if you have to stay overnight Food and drink Congestion charges and tolls Parking fees