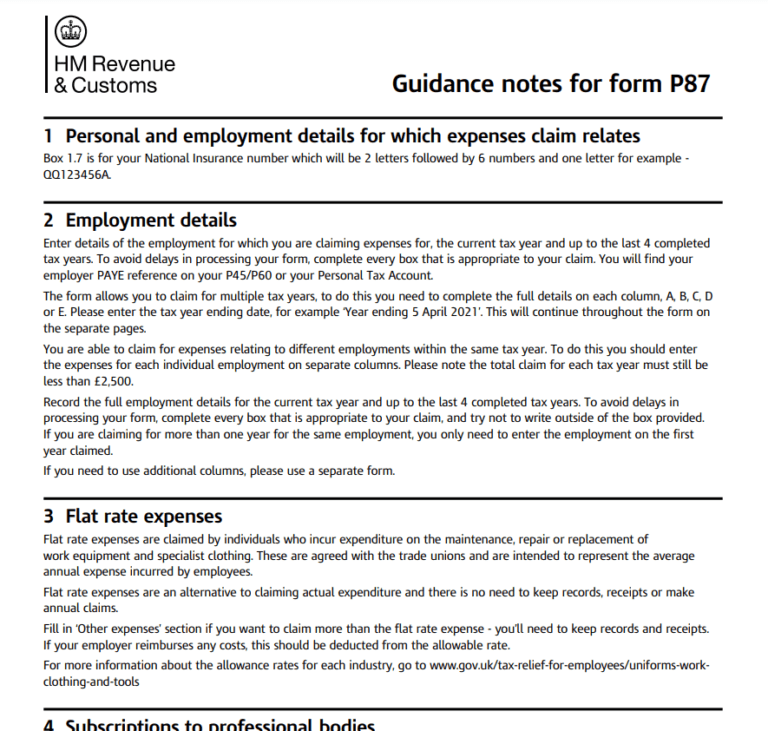

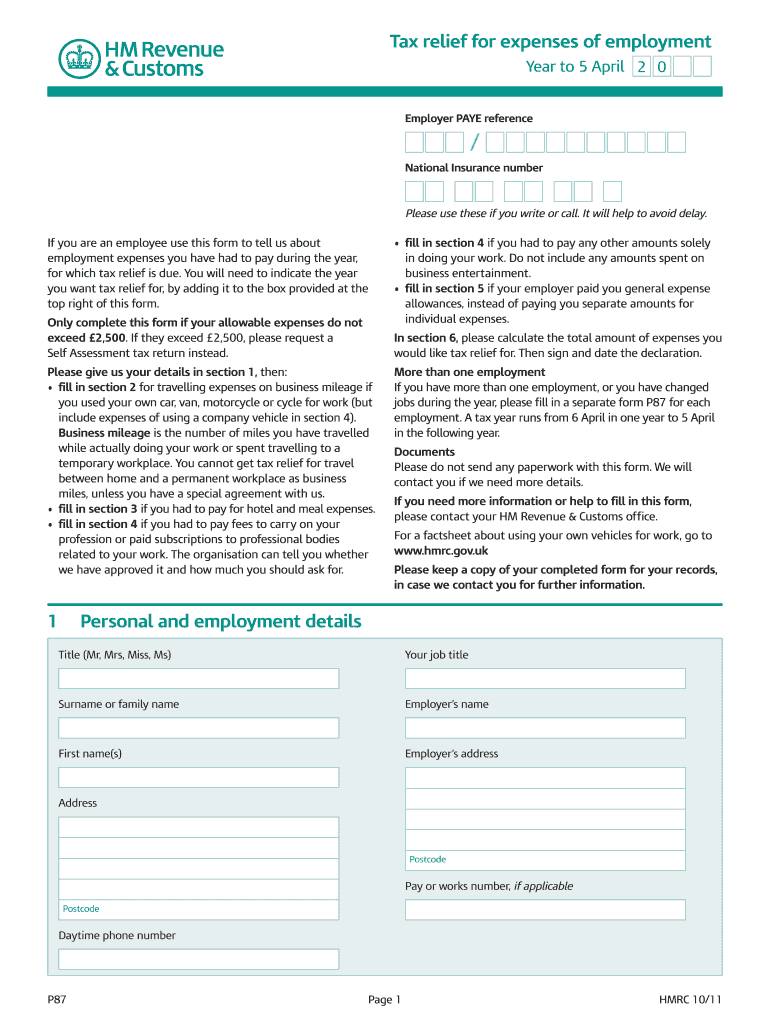

Tax Rebate Form P87 Web 5 sept 2023 nbsp 0183 32 Claim tax relief on your job expenses by post using form P87 if you cannot claim online or by phone From HM Revenue amp Customs Published 5 September 2023 Get emails about this page

Web 14 d 233 c 2022 nbsp 0183 32 If you want to use the Before 21 December 2022 use Tax relief for expenses of employment version of form P87 your form must reach HMRC by 20 December 2022 It is important to complete the Web 3 avr 2023 nbsp 0183 32 As we are in 2023 24 you can make a claim going back to the 2019 20 tax year You can complete and submit form P87 online through the Government Gateway or you can choose to complete it onscreen and

Tax Rebate Form P87

Tax Rebate Form P87

https://www.litrg.org.uk/sites/default/files/files/P87 2016 page2.jpg

P87 Claim Form Printable Printable Forms Free Online

https://www.litrg.org.uk/sites/default/files/files/P87 2016 page1.jpg

P87 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Uniform-Tax-Rebate-Form-P87-768x731.png

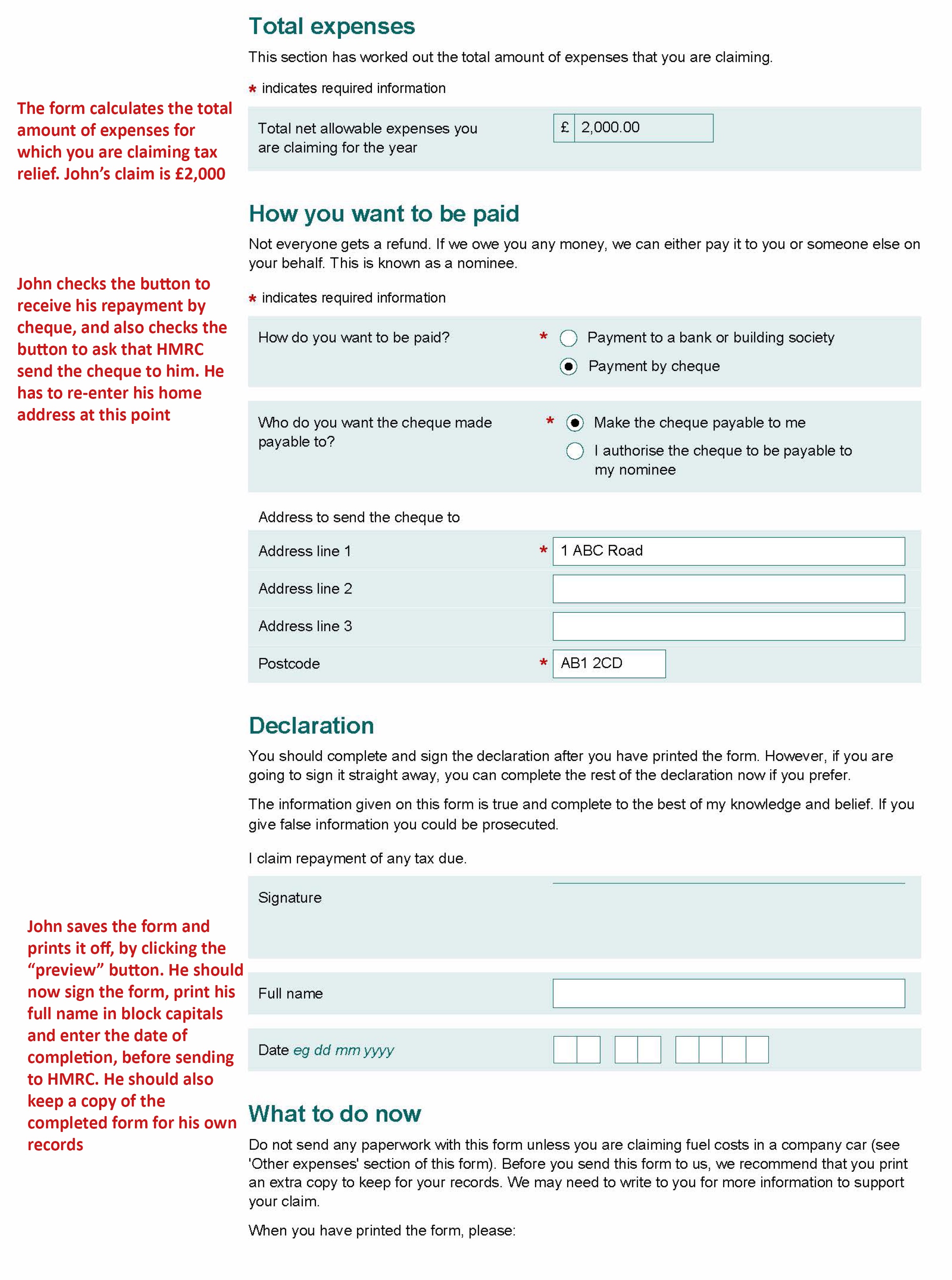

Web 24 mai 2022 nbsp 0183 32 The P87 expenses claim form will become a prescribed form in May 2022 Regulations were laid 7 March 2022 to enable HMRC to prescribe the format of the form P87 from 7 May 2022 Many Web 21 mars 2022 nbsp 0183 32 From 7 May HMRC is mandating the use of the standard P87 form for claiming income tax relief on employment expenses on gov uk and will reject claims that are made on substitute claim forms The other options will remain available

Web 29 nov 2022 nbsp 0183 32 Since May 2022 the format of claims for tax relief on employment expenses has been mandated HMRC s version of the P87 form must be used for claims made by post From 21 December 2022 claims made on P87 forms must include the following Web 29 mars 2022 nbsp 0183 32 29 March 2022 HM Revenue and Customs HMRC has released a new form for P87 claims which will enable them to standardise and streamline the claims process The form allows for multiple tax years and multiple employments to be included

Download Tax Rebate Form P87

More picture related to Tax Rebate Form P87

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes

https://www.litrg.org.uk/sites/default/files/files/P87 form 2019 FINAL_Page_3.jpg

P87 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/433/100433977/large.png

P87 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/57/100057253/large.png

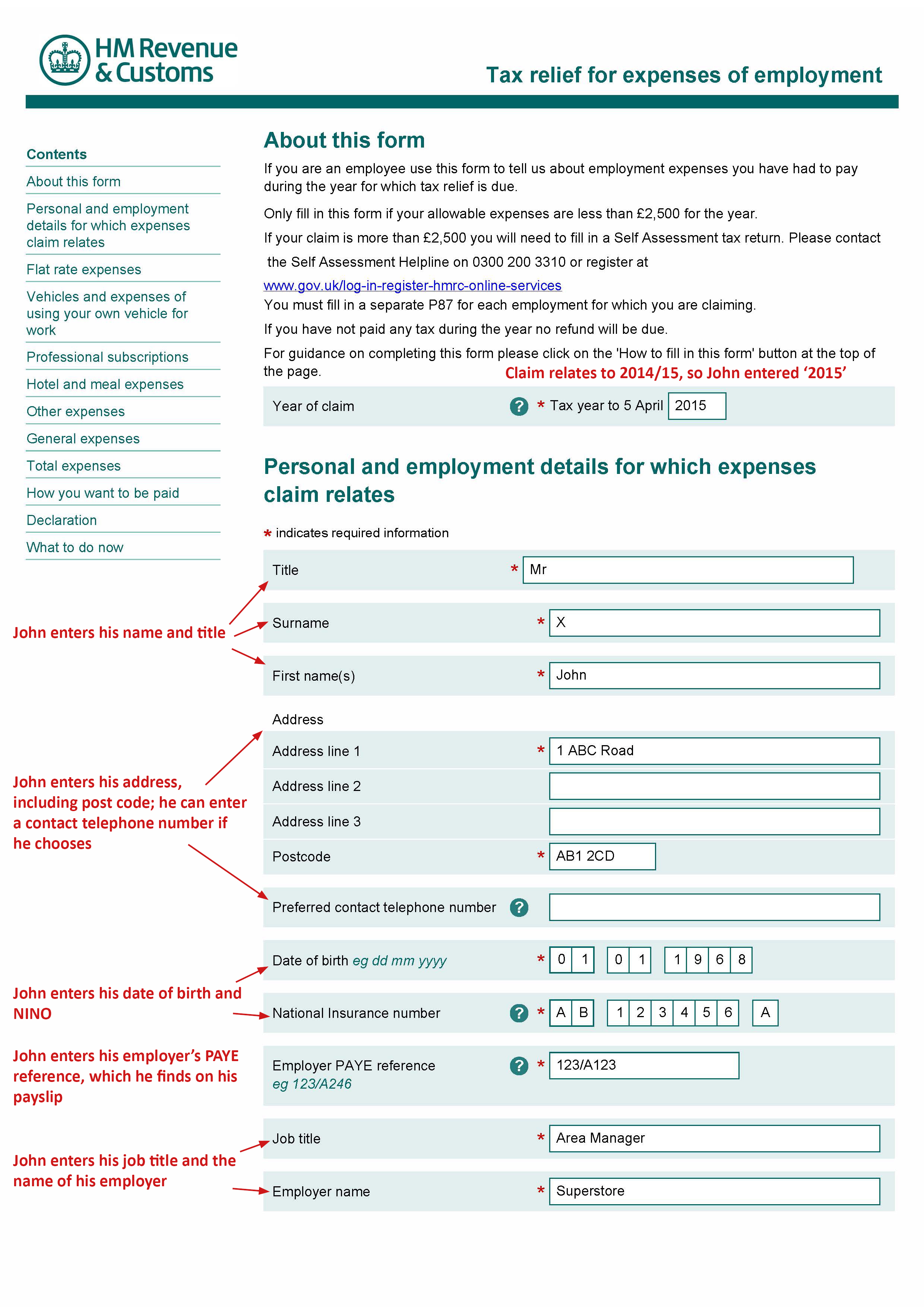

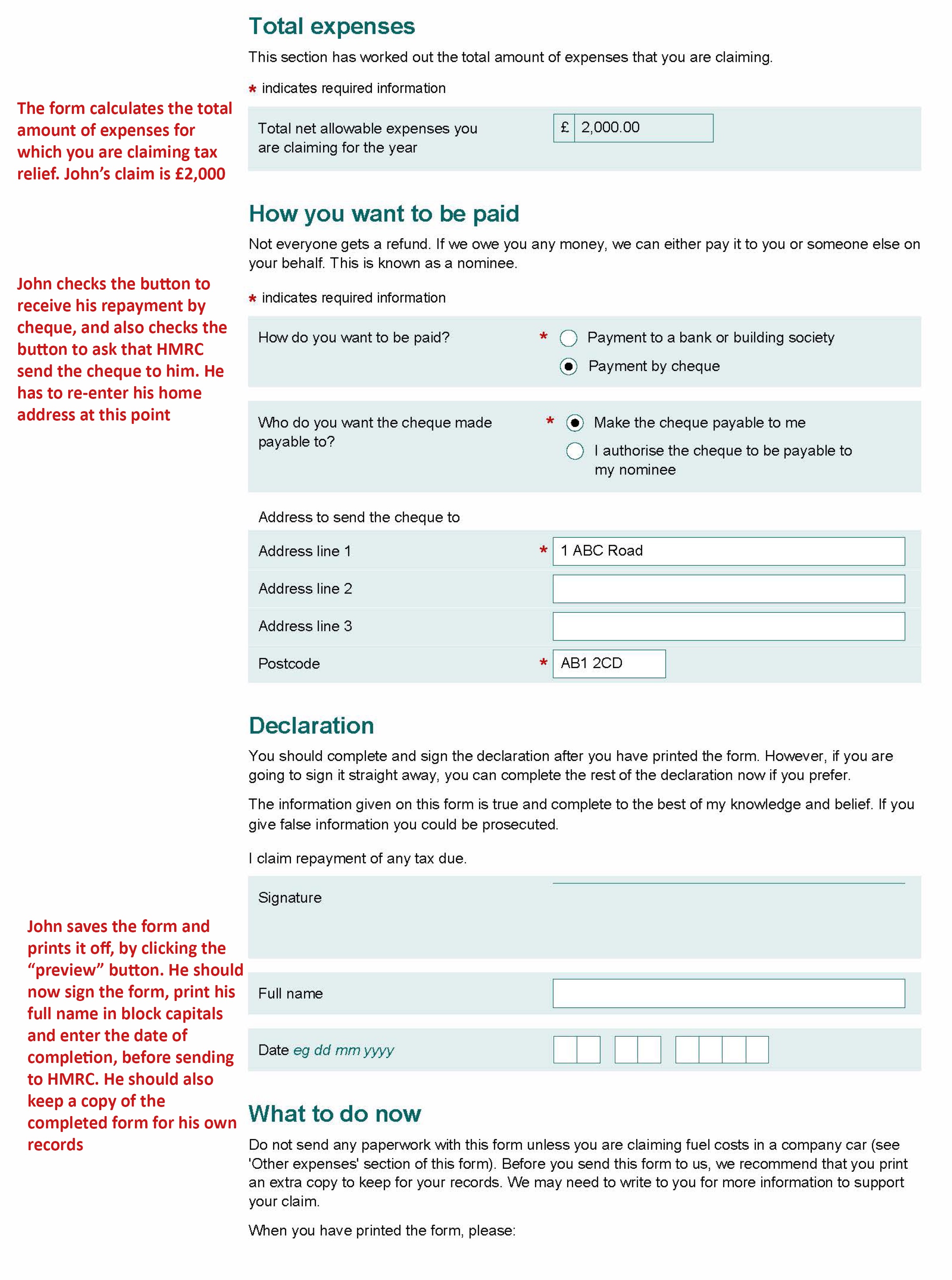

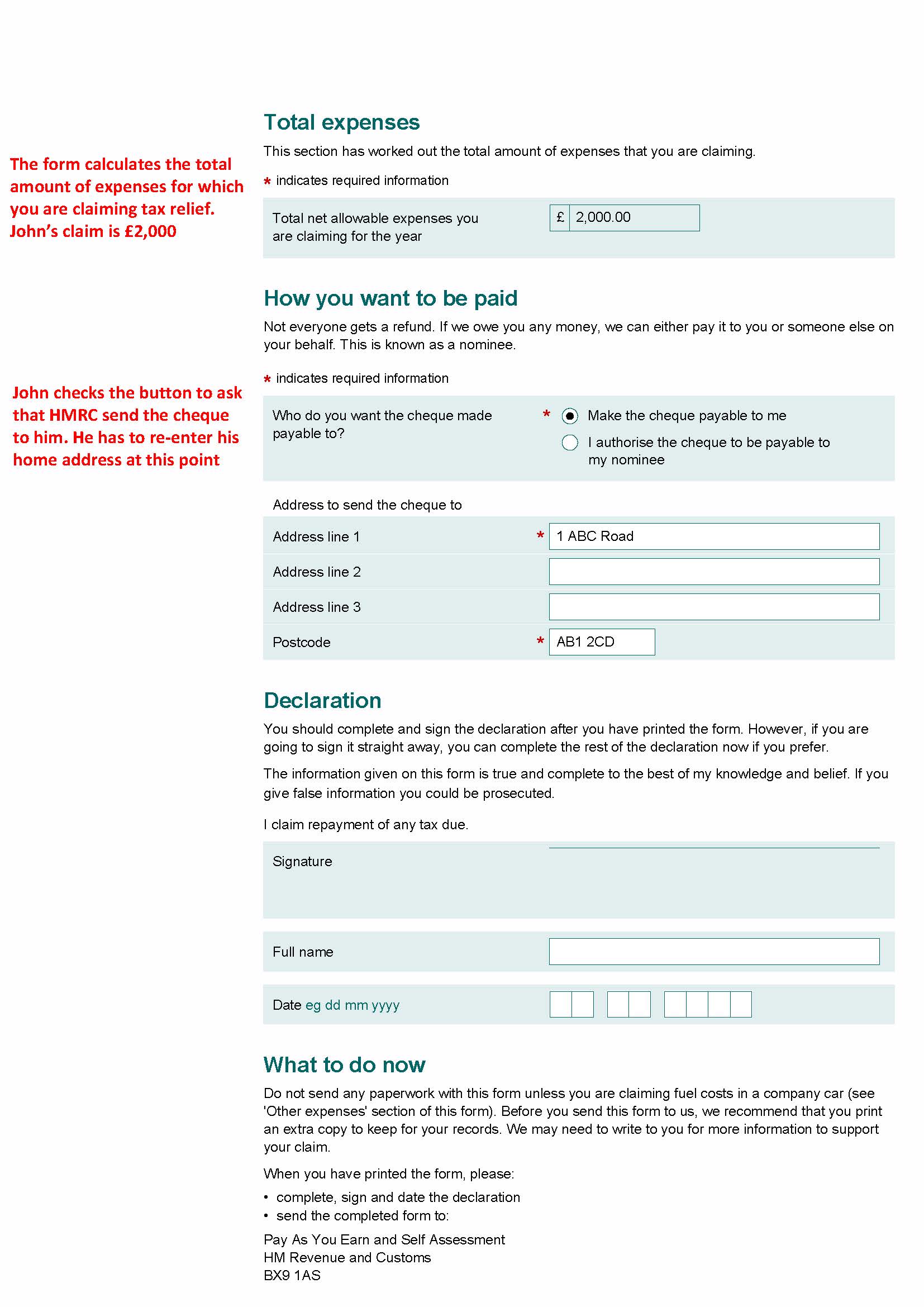

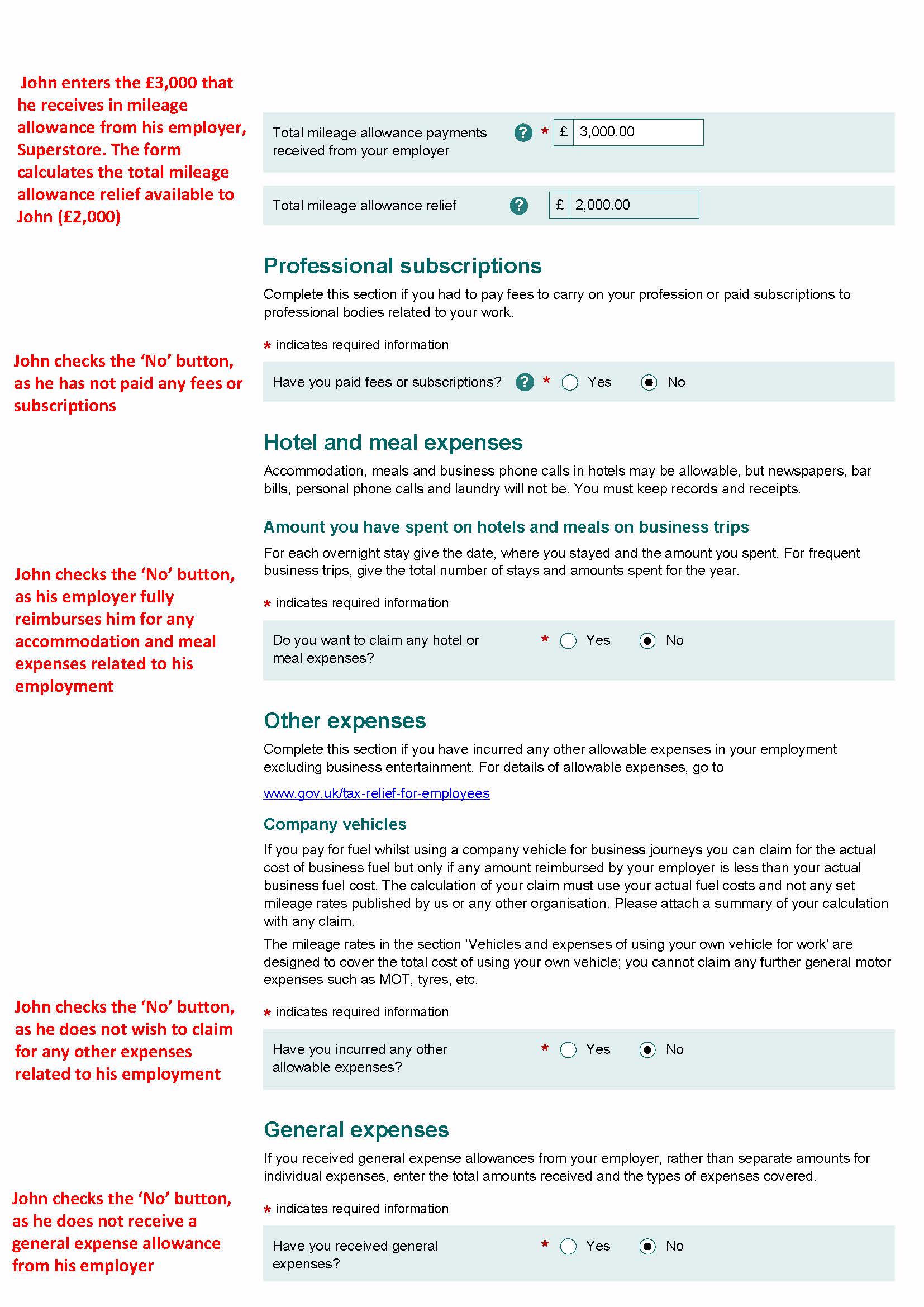

Web You can use Form P87 to claim tax relief if You re an employee Your allowable expenses for the tax year are less than 163 2 500 When can t I use HMRC Form P87 You can t use Form P87 if You re self employed You ve already completed a self assessment tax Web A P87 form is the document you use to use to claim tax relief for your work expenses You can only claim your tax rebates with a P87 if you re an employee If you re self employed you tell HMRC about your expenses through the Self Assessment system

Web 30 janv 2023 nbsp 0183 32 How Much Tax Rebate What to Do If Your Expenses Are Over 163 2500 Evidence Required by HMRC What is a P87 Form A P87 form is for any employee who is entitled to claim tax relief on expenses they incurr in the course of their employment This Web A P87 is the code for the form Tax Relief for Expenses of Employment and can be used to claim tax relief on work related expenses The form should only be used by employed taxpayers under PAYE and not by the self employed who complete a tax return Do I

Hmrc P87 Printable Form Printable Forms Free Online

https://www.litrg.org.uk/sites/default/files/files/P87 2016 page5.jpg

Working From Home Tax Relief Form P87 The Tax Implications Of Working

https://goselfemployed.co/wp-content/uploads/2019/02/p87-form-online-1024x652.png

https://www.gov.uk/guidance/send-an-income-tax-relief-claim-for-job...

Web 5 sept 2023 nbsp 0183 32 Claim tax relief on your job expenses by post using form P87 if you cannot claim online or by phone From HM Revenue amp Customs Published 5 September 2023 Get emails about this page

https://www.cipp.org.uk/resources/news/hmrc …

Web 14 d 233 c 2022 nbsp 0183 32 If you want to use the Before 21 December 2022 use Tax relief for expenses of employment version of form P87 your form must reach HMRC by 20 December 2022 It is important to complete the

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

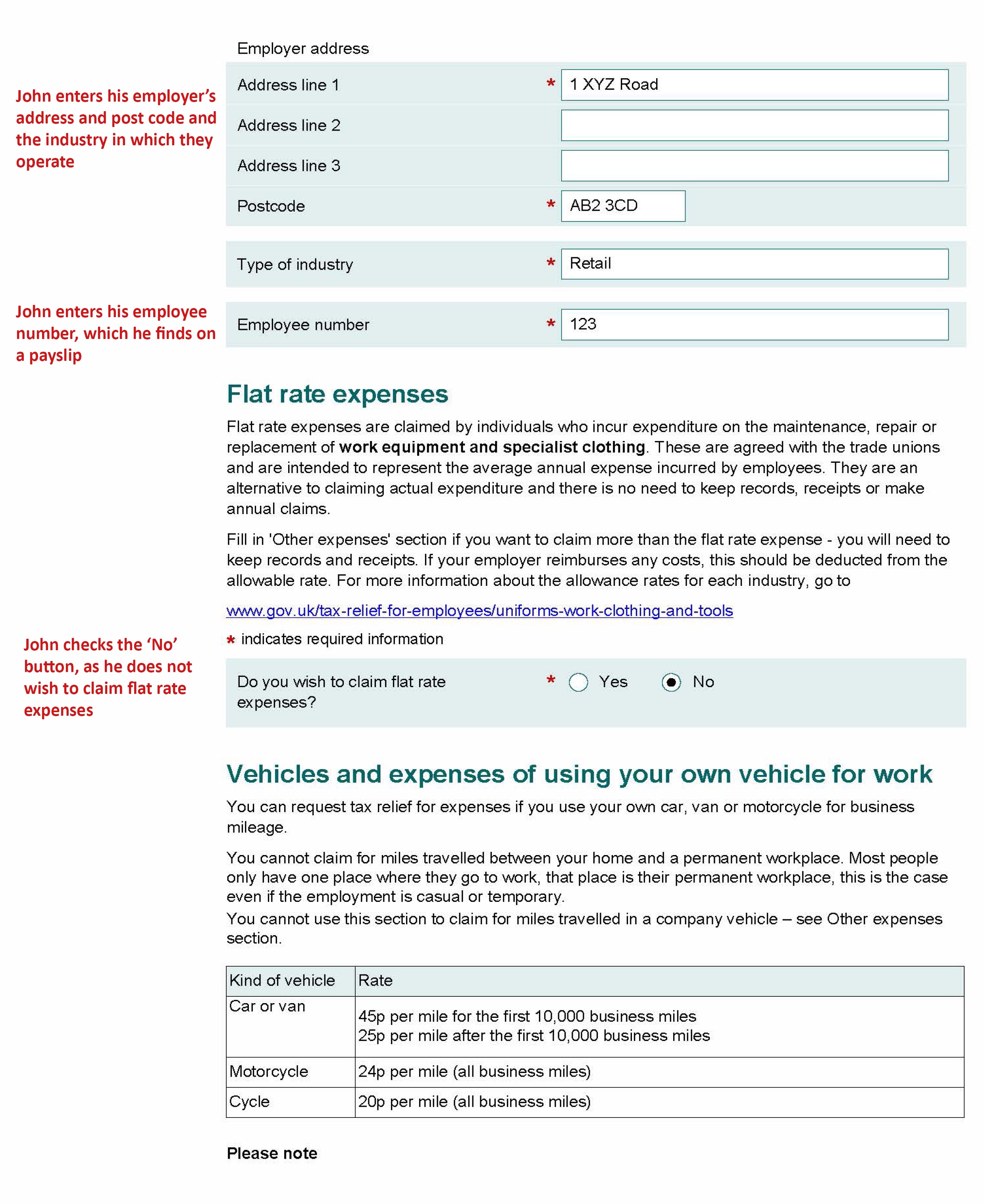

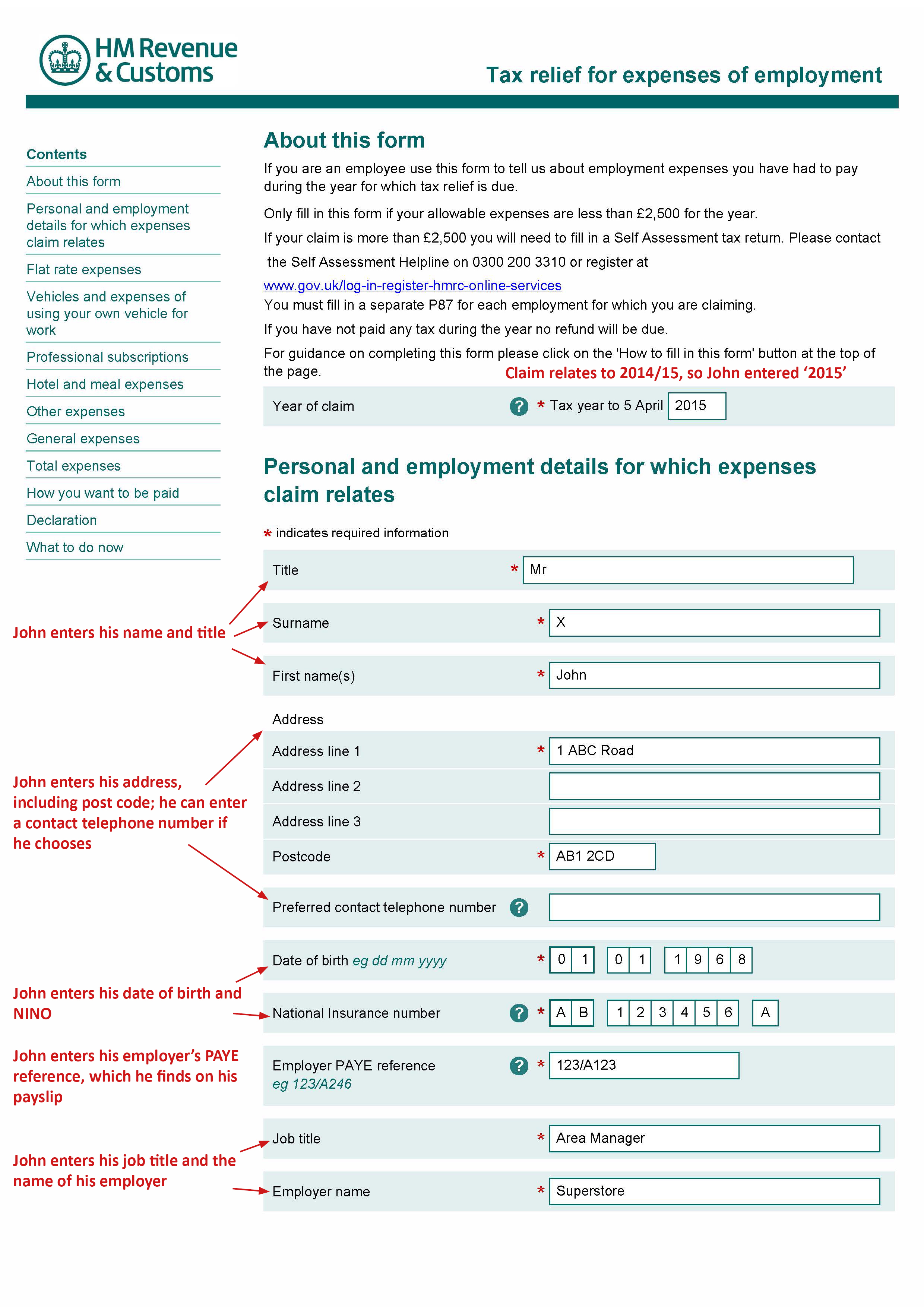

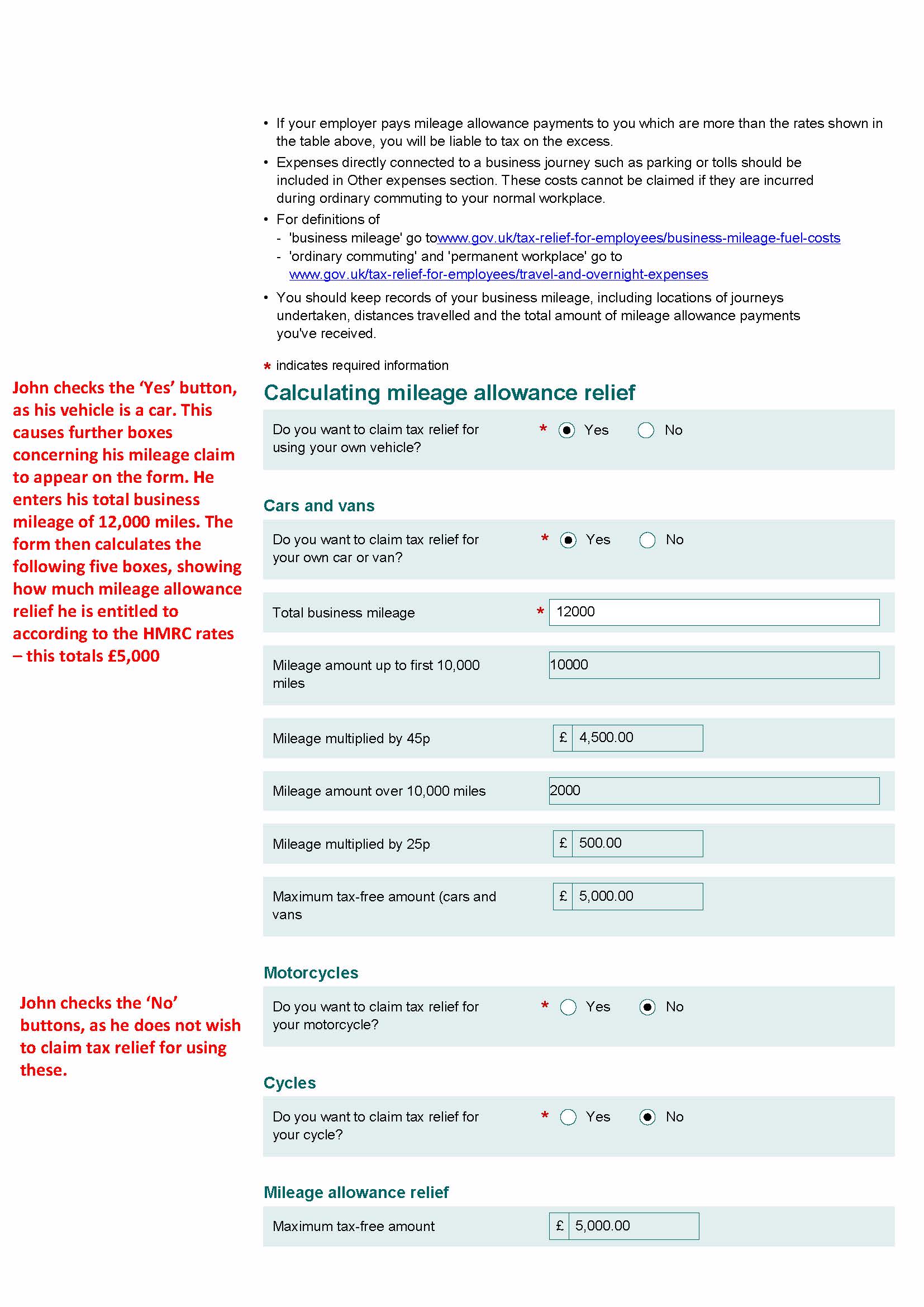

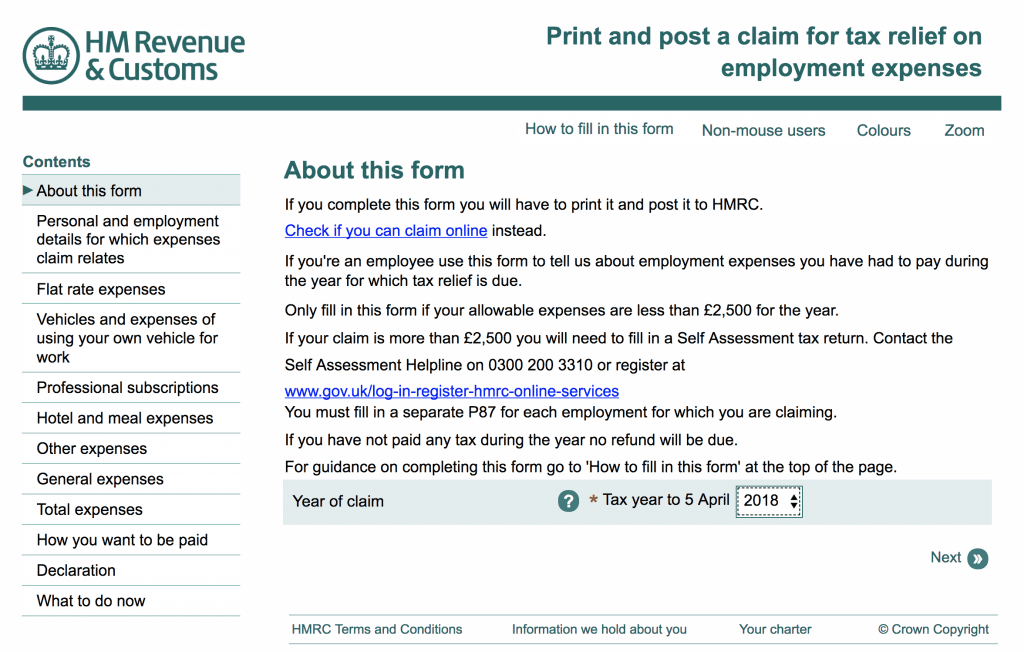

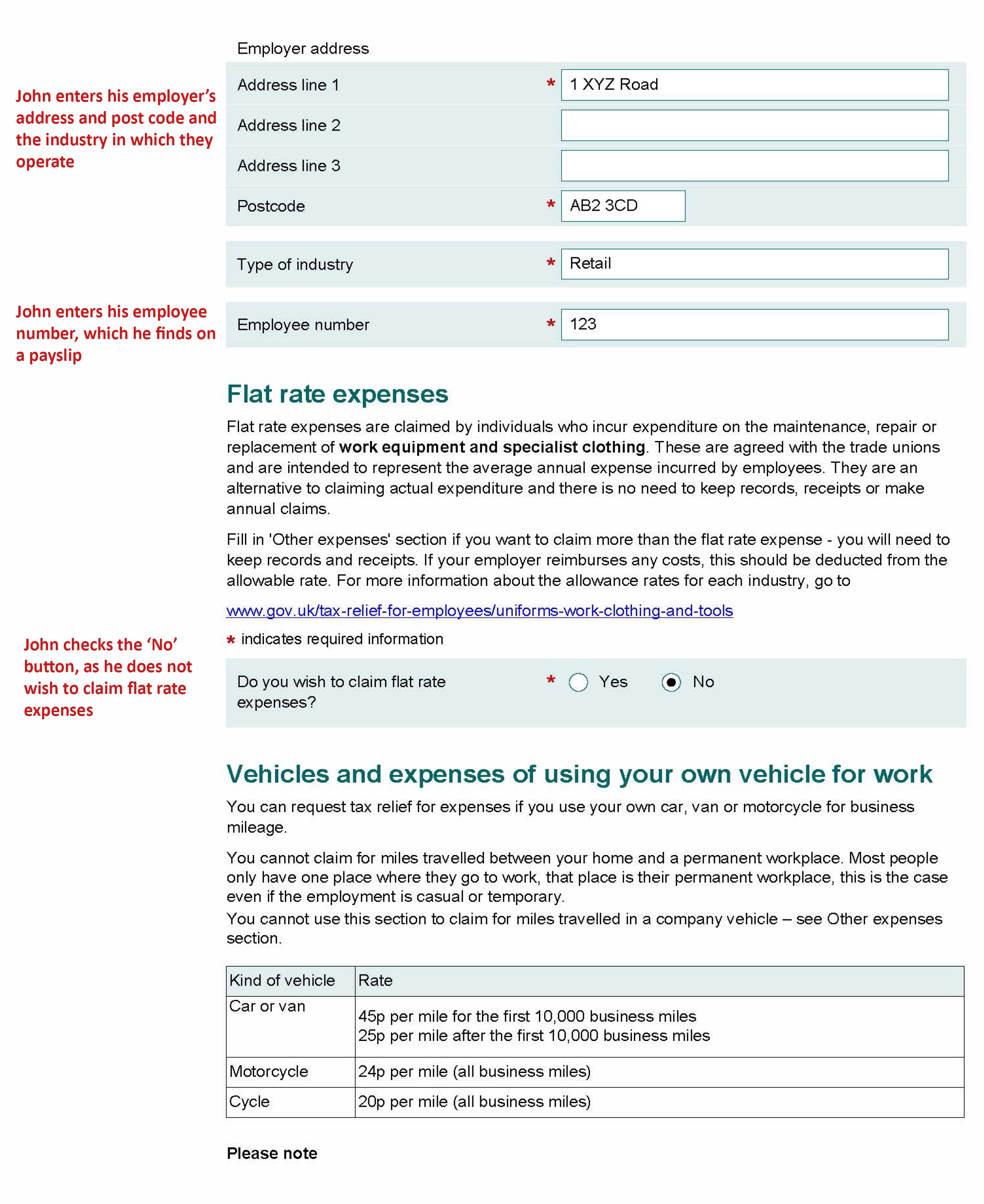

How To Fill Out Your P87 Tax Form FLiP

How To Fill Out Your P87 Tax Form FLiP

How To Fill Out Your P87 Tax Form FLiP

Tax Rebate Form P87 - Web A P87 form is an HMRC form that you need to use to claim income tax relief on certain employment expenses These expenses are the ones that you are required to pay for yourself for work purposes but your employer doesn t give you the money back for You