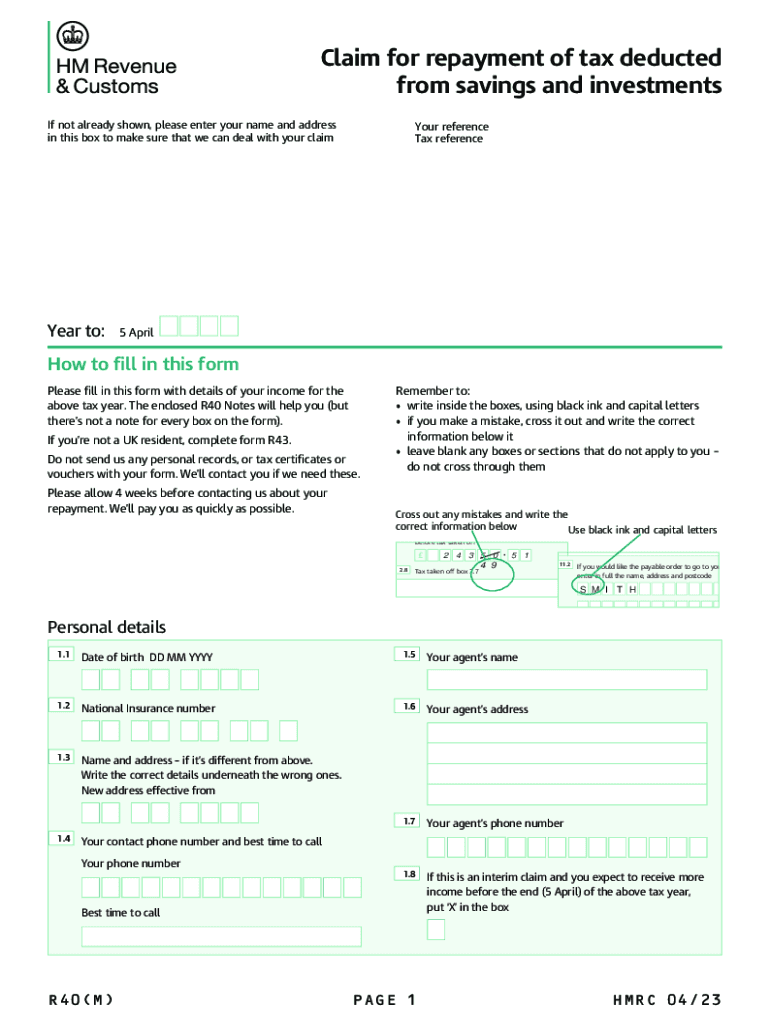

Tax Rebate Form R40 Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the form If you re not a UK

Web Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there is not a note for every box on the form If you need more

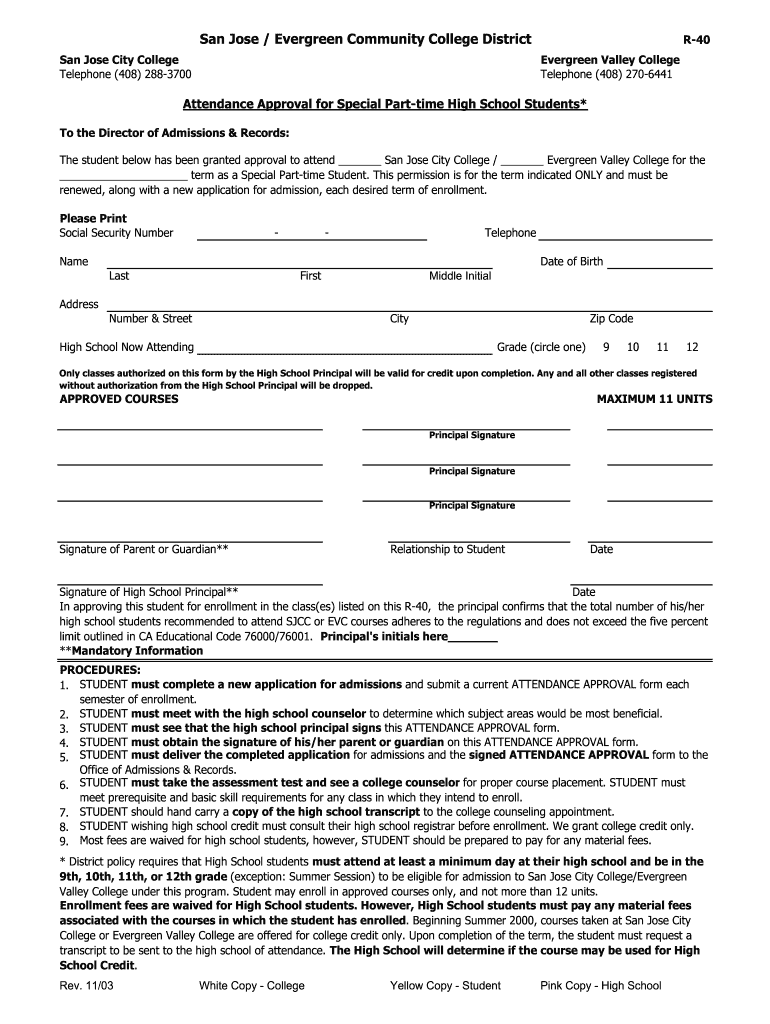

Tax Rebate Form R40

Tax Rebate Form R40

http://www.litrg.org.uk/sites/default/files/files/R40 1.5.jpg

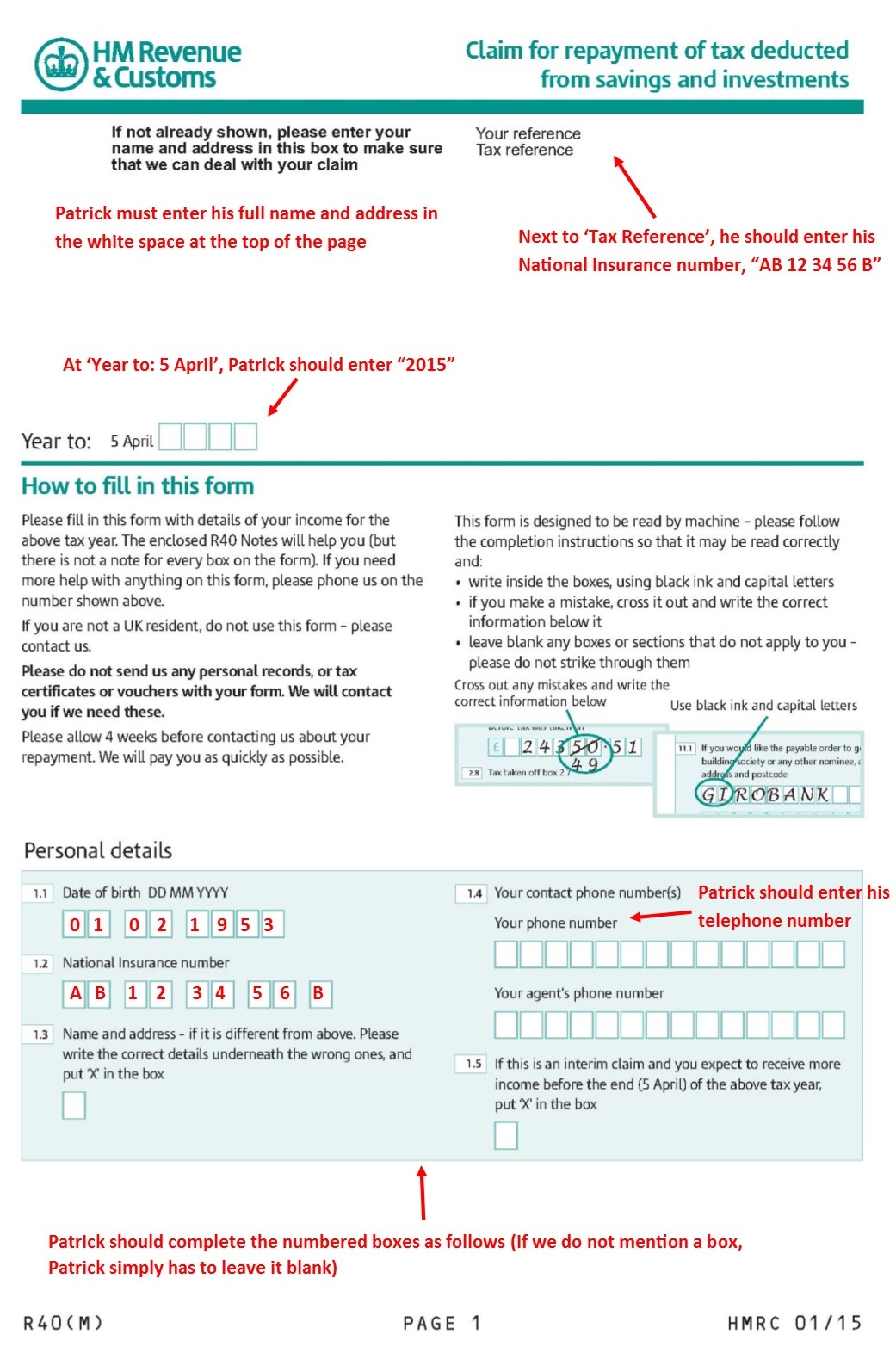

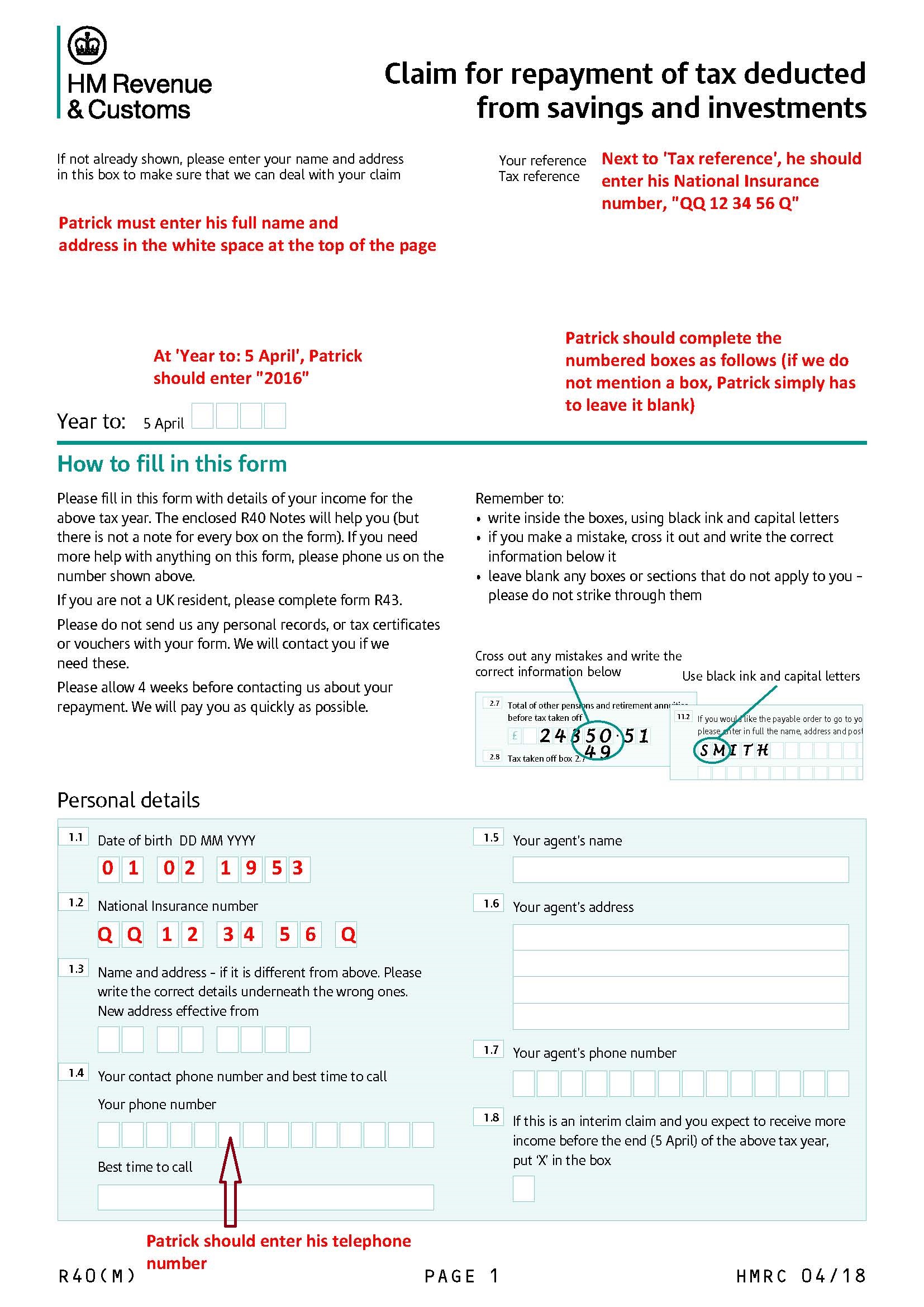

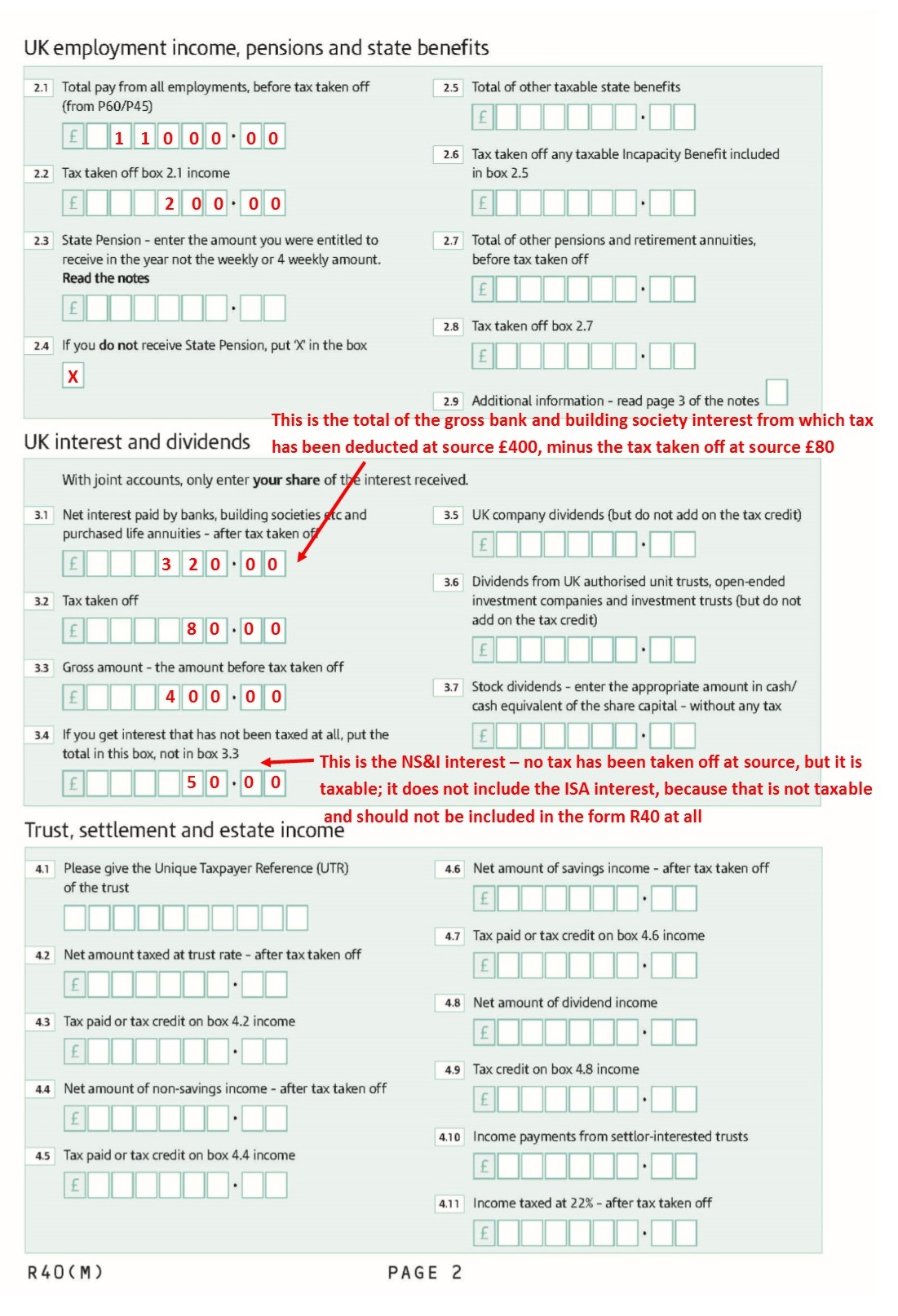

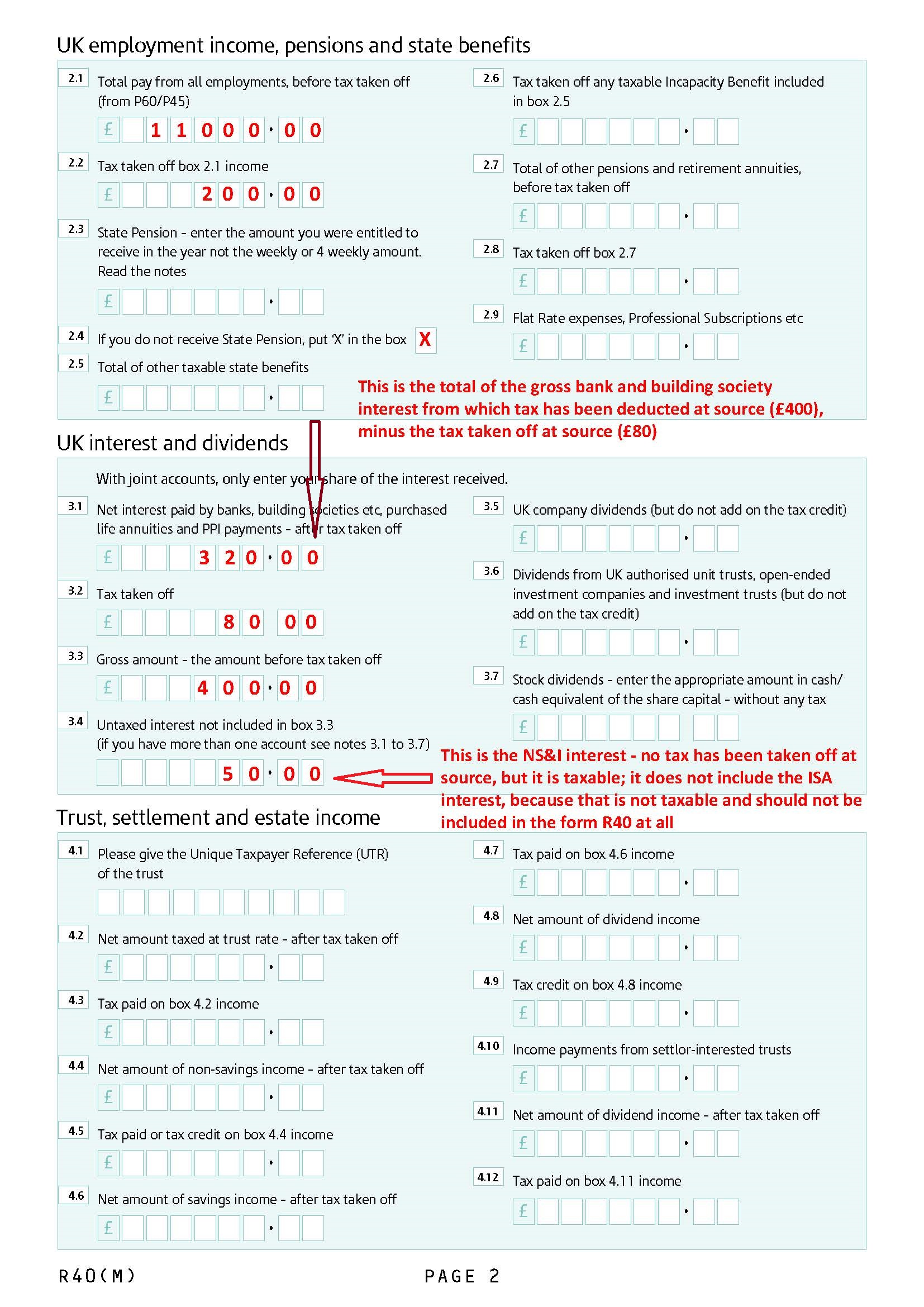

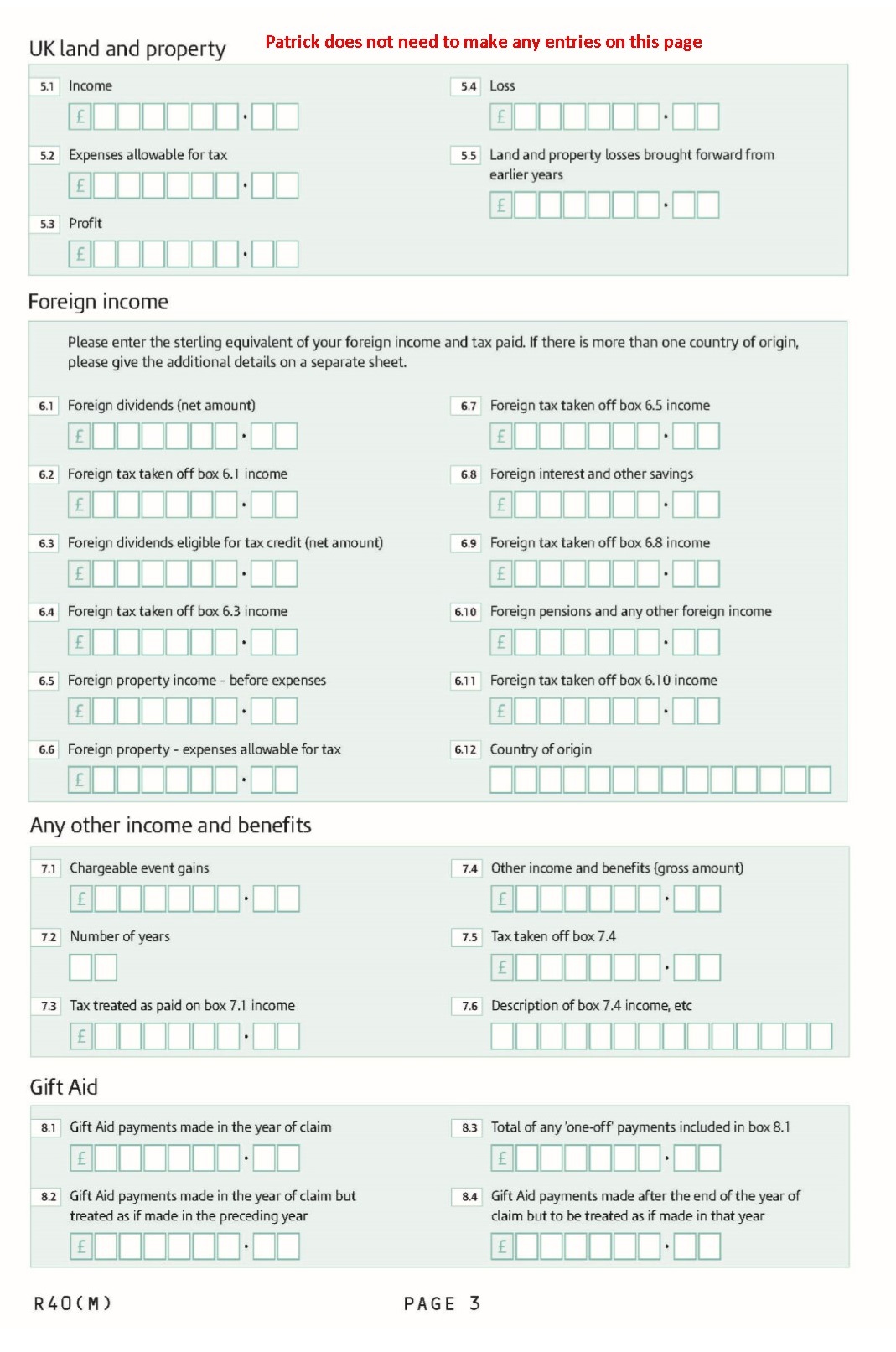

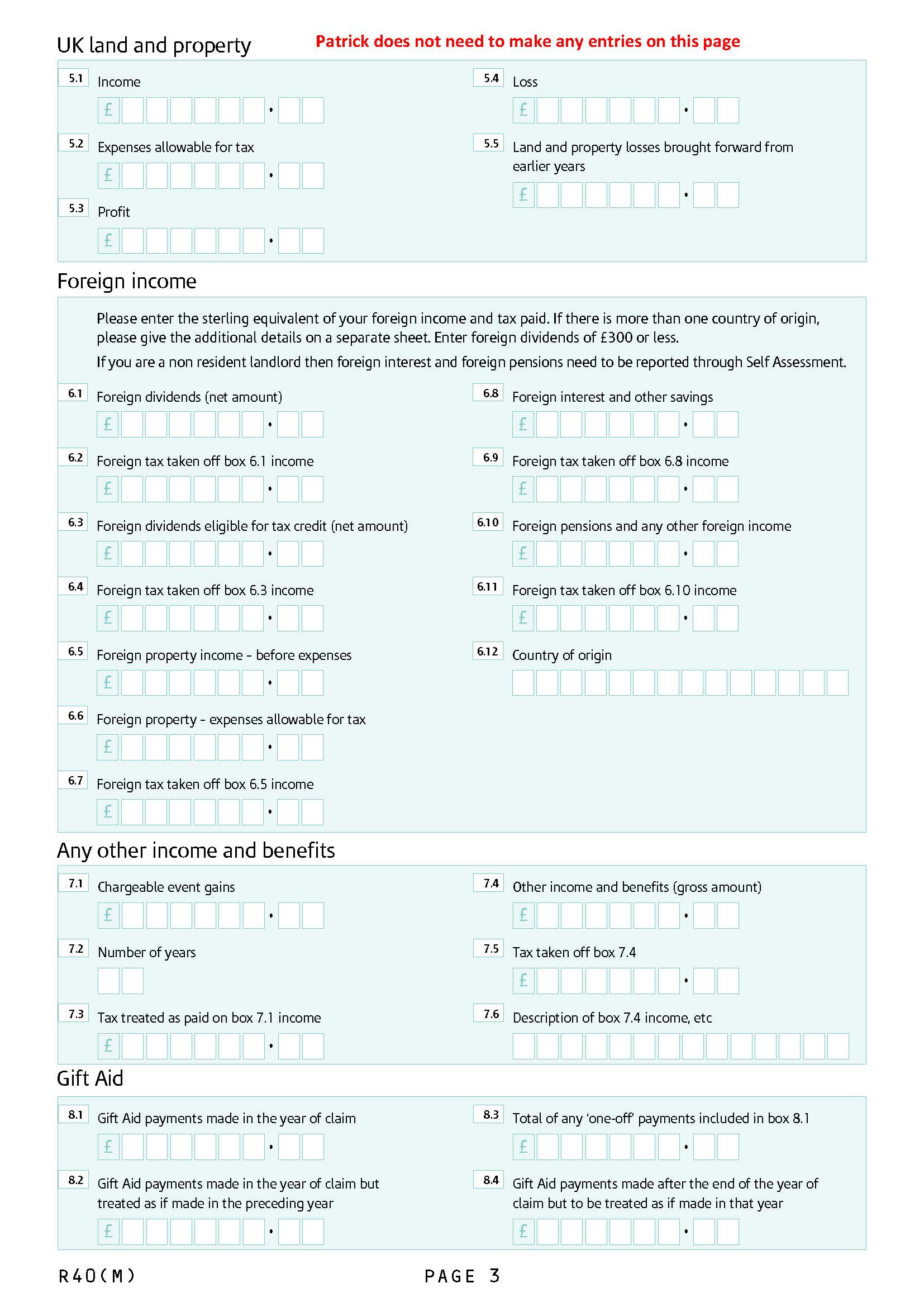

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_M_2018 annotated form FINAL_Page_1.jpg

2015 Form UK R40 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/76/790/76790899/large.png

Web 3 avr 2023 nbsp 0183 32 As we are in 2023 24 you can make a claim going back to the 2019 20 tax year It is possible to use the form to claim a repayment of tax relating to the current tax year known as an interim claim if you know Web These notes will help you complete the form R40 You need to complete a separate claim for each tax year The tax year starts on 6 April and finishes on the following 5 April If

Web 19 nov 2014 nbsp 0183 32 Find Income Tax forms for tax refunds allowances and reliefs savings and investments and leaving the UK Web 6 juin 2023 nbsp 0183 32 Home Income Tax Guidance Claim personal allowances and tax refunds if you live abroad How to claim a refund on tax and personal allowances on UK income if

Download Tax Rebate Form R40

More picture related to Tax Rebate Form R40

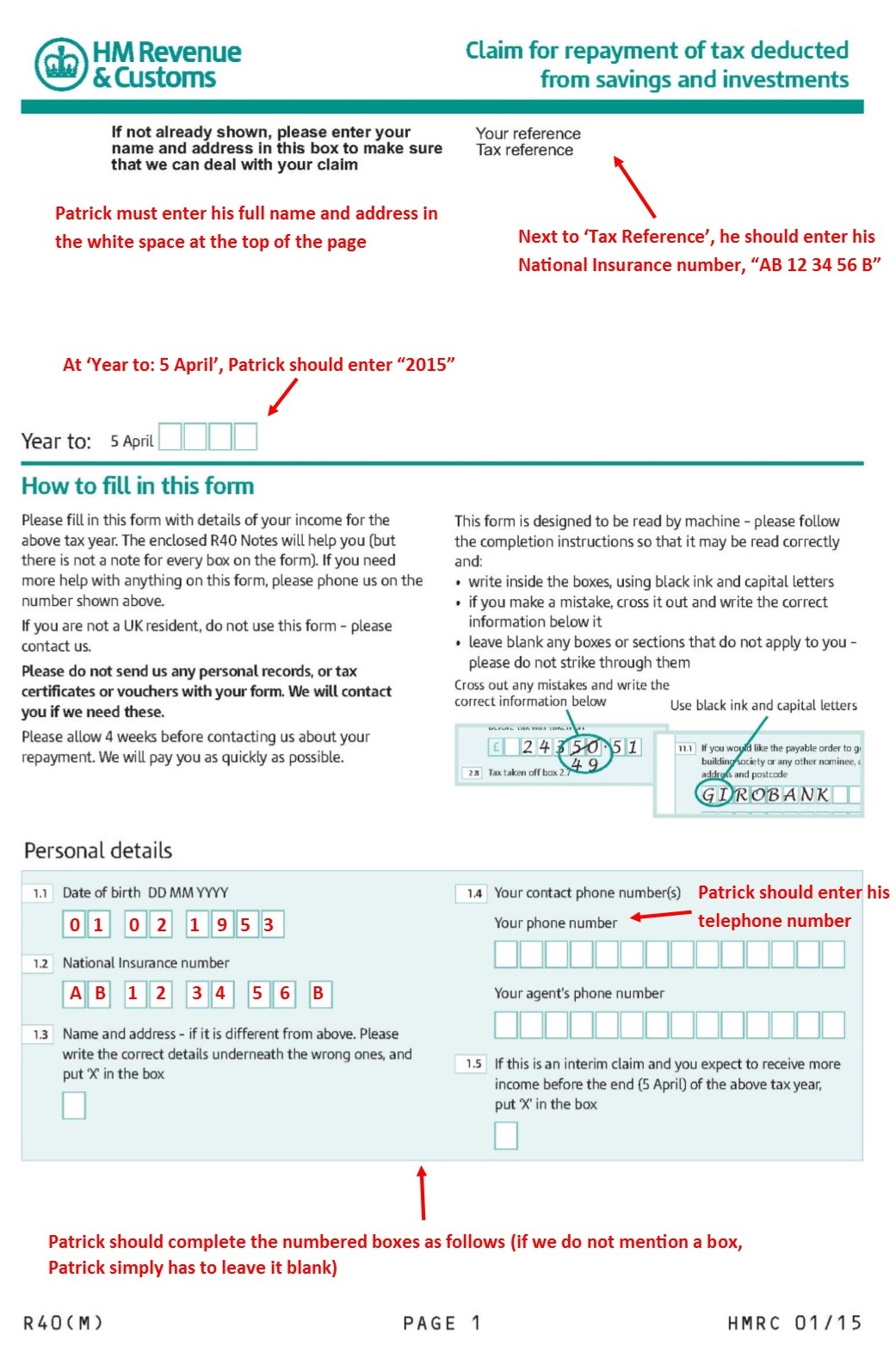

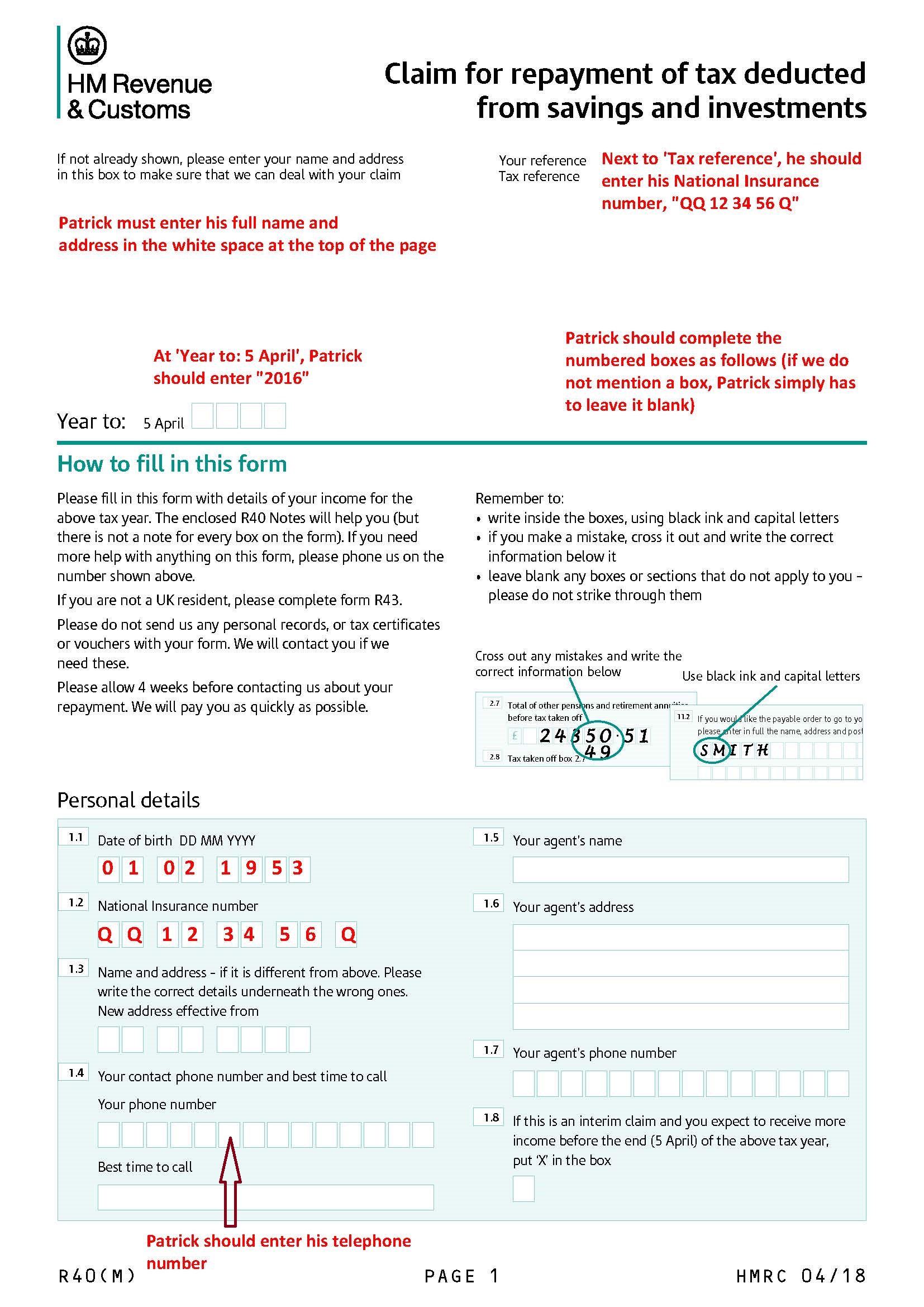

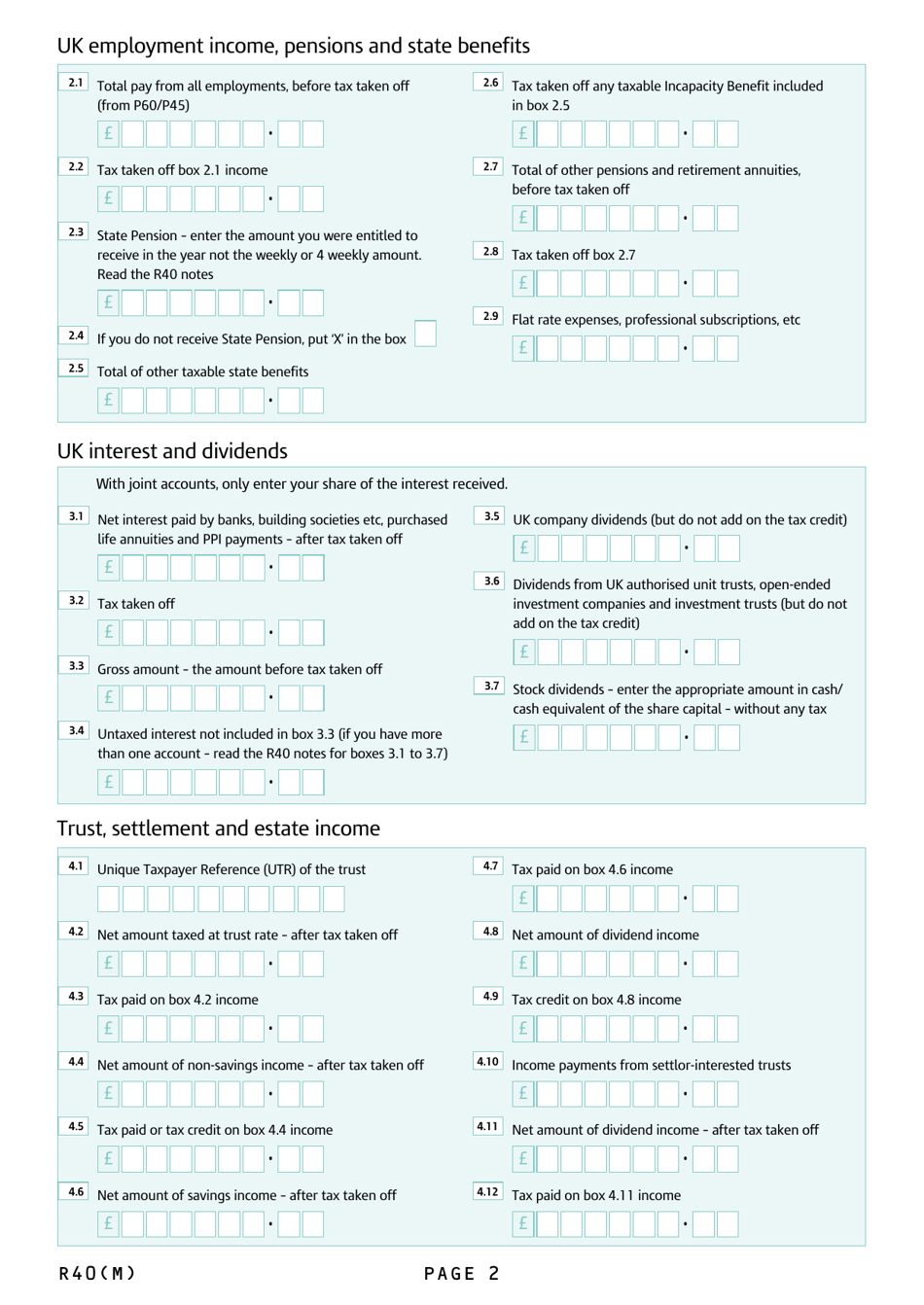

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

http://www.litrg.org.uk/sites/default/files/files/R40 2.1.jpg

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_M_2018 annotated form FINAL_Page_2.jpg

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

http://www.litrg.org.uk/sites/default/files/files/R40 3.5.jpg

Web You were given income from the trust in August 2022 You need to register for Self Assessment before 5 October 2023 If you re a basic rate taxpayer You will not owe any Web 3 f 233 vr 2023 nbsp 0183 32 The HMRC Tax Refund Form R40 PPI is a tool for individuals in the UK who believe that they have been taxed on their personal pension income at the incorrect rate By completing the form and

Web These notes will help you complete the form R40 You need to complete a separate claim for each tax year The tax year starts on 6 April and finishes on the following 5 April If Web An R40 Form is for you to reclaim overpaid tax on the interest you ve earned from savings investments or life annuities that you ve purchased To be considered for a refund you

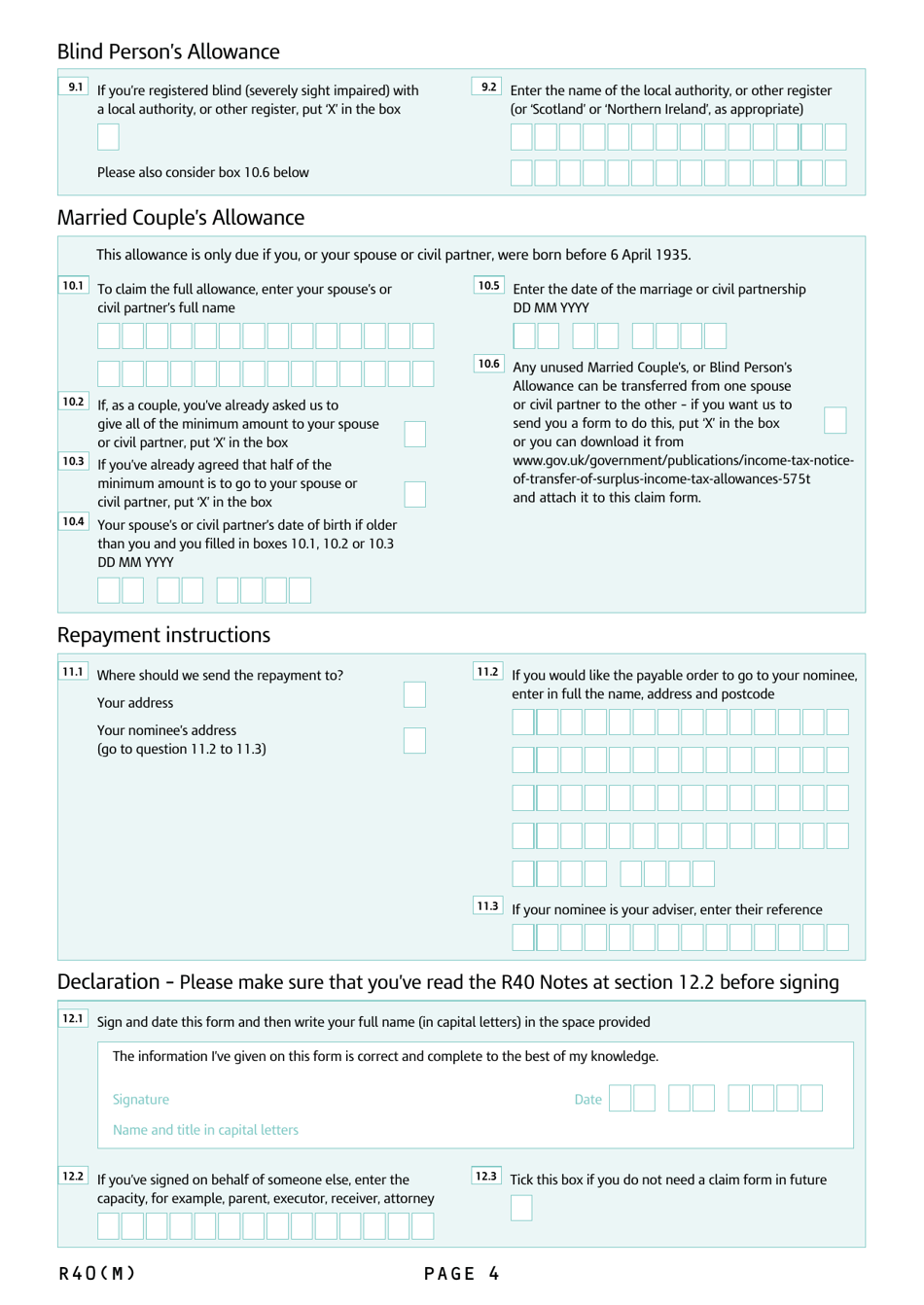

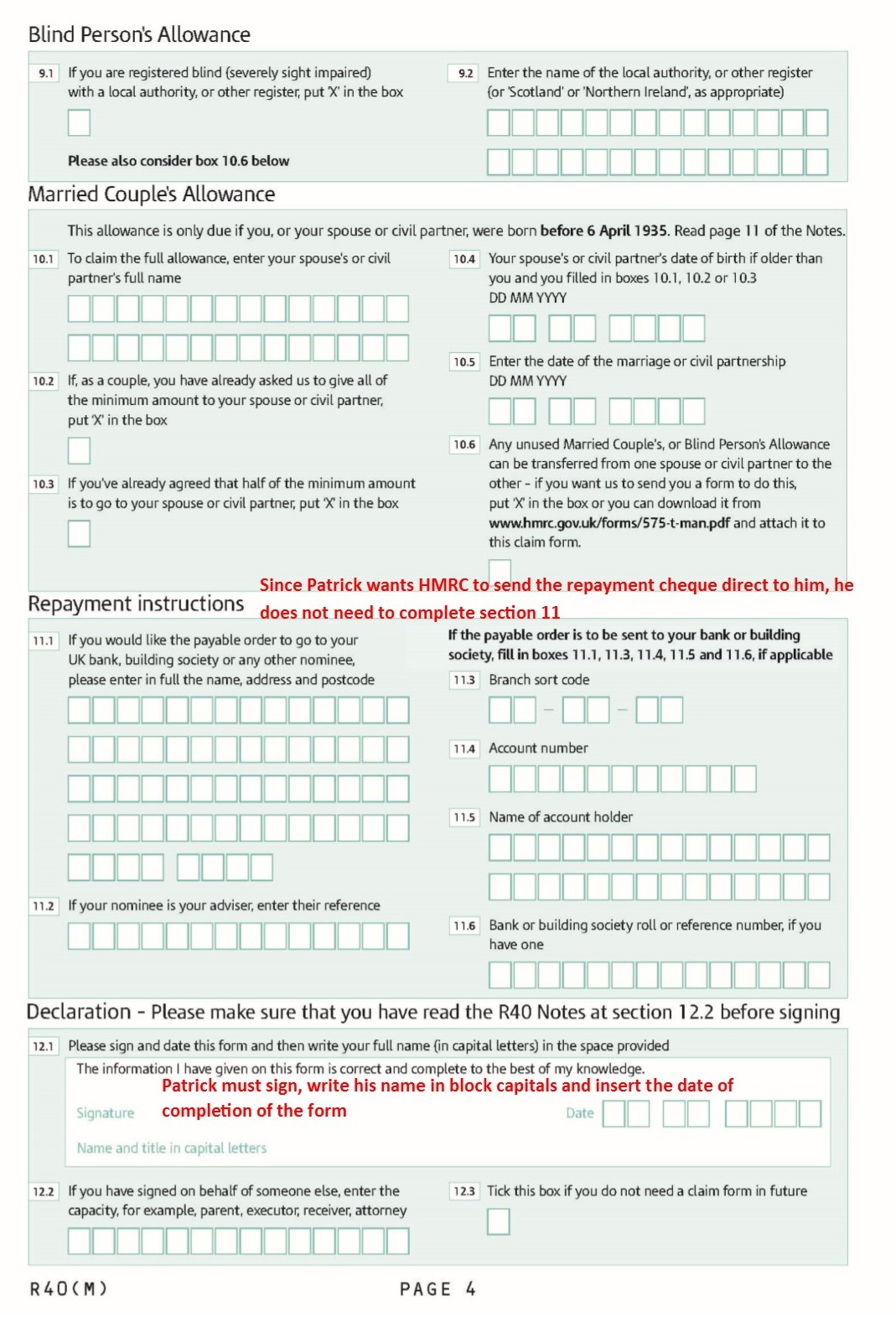

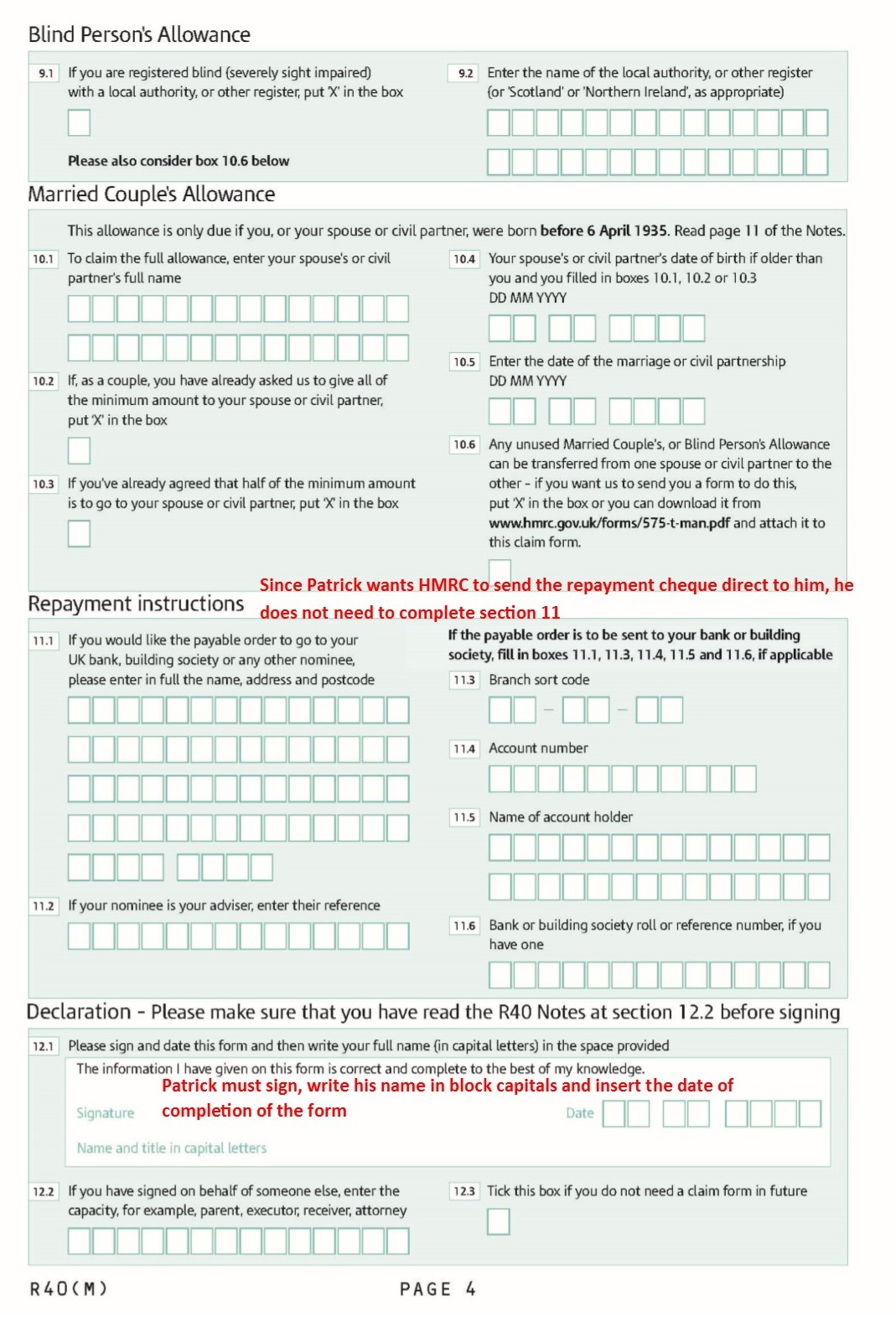

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_annotated_form_Page_4.jpg

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_M_2018%20annotated%20form%20FINAL_Page_3.jpg

https://assets.publishing.service.gov.uk/.../file/1172652/R40…

Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the form If you re not a UK

https://www.gov.uk/.../contact/repayments-where-to-send-claim-forms

Web Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and

R40 Form Fill Out And Sign Printable PDF Template SignNow

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Form Fill Out Sign Online DocHub

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

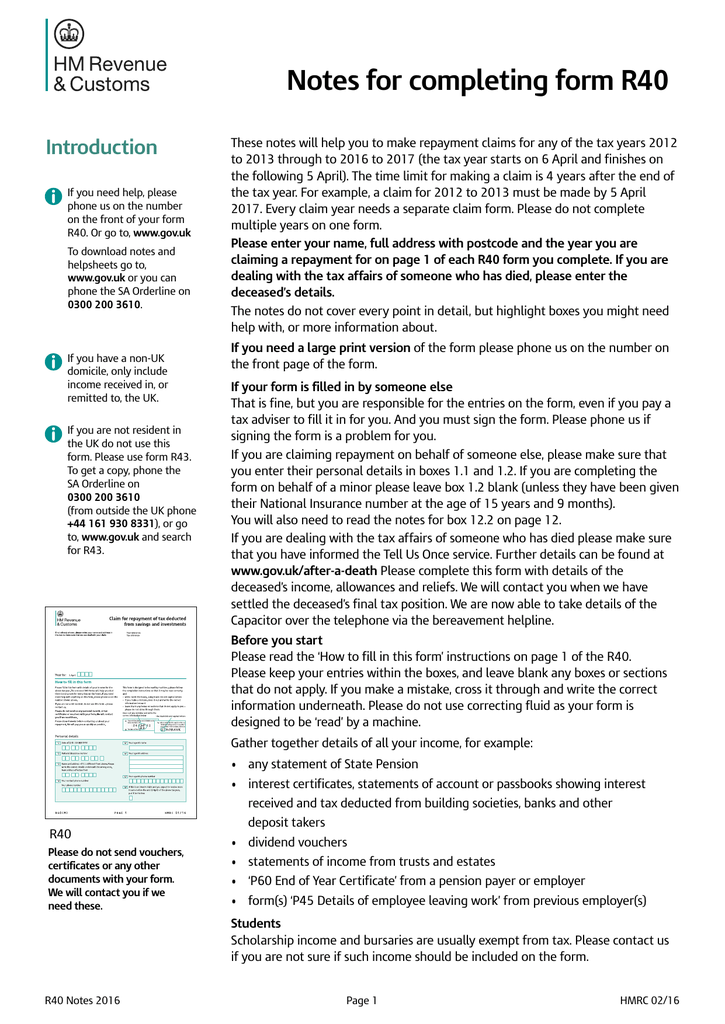

Notes For Completing Form R40

R40 Notes Notes For Completing Form R40

What Is An R40 Form

Tax Rebate Form R40 - Web These notes will help you to make repayment claims for any of the tax years 2010 11 to 2014 15 the tax year starts on 6 April and finishes on the following 5 April The time