Tax Rebate Germany Web 15 sept 2022 nbsp 0183 32 15 September 2022 by Abi Carter Anyone who works from home in Germany can look forward to more tax relief next year after the federal government opted to continue and expand its home office flat

Web 1 d 233 c 2022 nbsp 0183 32 Starting in 2023 people working from home will be able to deduct 1 000 per year for working from home up from the previous annual amount of 600 Here s what Web 30 mars 2022 nbsp 0183 32 The basic rule is that anyone who received more than 410 via the scheme in 2021 is obliged to file an income tax return this year Incidentally this applies to all of

Tax Rebate Germany

Tax Rebate Germany

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate-768x561.jpg

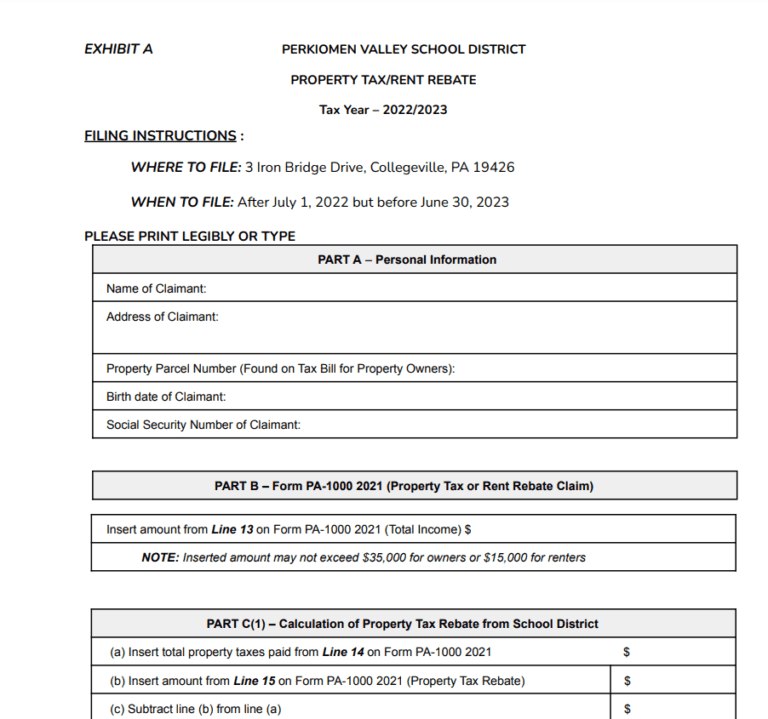

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

SC TAX REBATE 2022 800 TAX REBATE SOUTH CAROLINA SENDING WHEN LINE

https://i0.wp.com/coinmarketbag.com/wp-content/uploads/2022/11/SC-TAX-REBATE-2022-800-TAX-REBATE-SOUTH-CAROLINA.jpg

Web 16 juin 2020 nbsp 0183 32 All expenses that qualify as tax deductions in Germany will need to be properly documented via the different forms made available by the tax authorities Web 30 juin 2023 nbsp 0183 32 Corporate Tax credits and incentives Last reviewed 30 June 2023 Germany does not offer tax incentives except in very limited circumstances not usually

Web As explained in the German Income tax system you have the possibility of receiving a refund in the following situations if There are Business expenses Werbungskosten Web 20 oct 2021 nbsp 0183 32 If eligible you can claim up to 5 euros per day that you work from home for a maximum of 120 days a total of 600 euros However the 5 euro flat rate only applies to days on which you work exclusively from

Download Tax Rebate Germany

More picture related to Tax Rebate Germany

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

It s Not Difficult For The Export Tax Rebate Of Foreign Trade Industry

https://biz-crm-waimao.su.bcebos.com/biz-crm-waimao/maichongxing/history/online/article/img/2022/03/04/fa14d578e0752394b28e6fd6b586d1c0ac20c2ec.jpeg

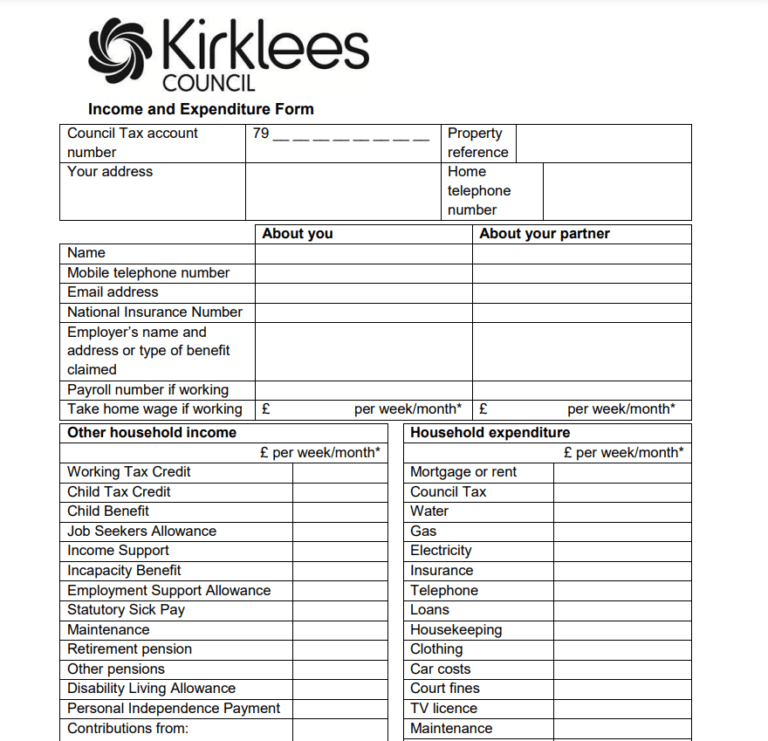

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/Council-Tax-Rebate-Form-Kirklees-768x741.png

Web For married expats the Steueramt Tax Agency will usually classify both partners in Tax Class 4 by default if no salary information is provided However it might be in your best Web Il y a 1 jour nbsp 0183 32 September 11 2023 at 4 26 AM PDT Germany may extend a tax reduction program for energy intensive companies by another year as the government seeks ways

Web 21 ao 251 t 2023 nbsp 0183 32 Who is exempt from income tax in Germany No one is exempt from paying tax in Germany if their income exceeds the tax free personal allowance 10 347 in 2023 However some people can get Web Foreign artists athletes license grantors and directors remuneration creditors can claim relief from German withholding tax under Section 50a ITA if a double taxation

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

https://image.ibb.co/jBQewm/taxrebateonline.jpg

https://www.iamexpat.de/expat-info/german-e…

Web 15 sept 2022 nbsp 0183 32 15 September 2022 by Abi Carter Anyone who works from home in Germany can look forward to more tax relief next year after the federal government opted to continue and expand its home office flat

https://www.thelocal.de/20221201/germany-to-extend-and-increase-tax...

Web 1 d 233 c 2022 nbsp 0183 32 Starting in 2023 people working from home will be able to deduct 1 000 per year for working from home up from the previous annual amount of 600 Here s what

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

2021 Illinois Property Tax Rebate Printable Rebate Form

Missouri State Tax Rebate 2023 Printable Rebate Form

Germany Wastes Billions On Bizarre Projects

Council Tax Rebate 2022 Apply Online

P55 Tax Rebate Form Business Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

Tips To Finding Tax Rebates Without The Hassle

Council Tax Rebate All The Steps You Must Take If You re Not On

Tax Rebate Germany - Web As explained in the German Income tax system you have the possibility of receiving a refund in the following situations if There are Business expenses Werbungskosten