Tax Rebate Health Expenses Web 25 oct 2022 nbsp 0183 32 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross

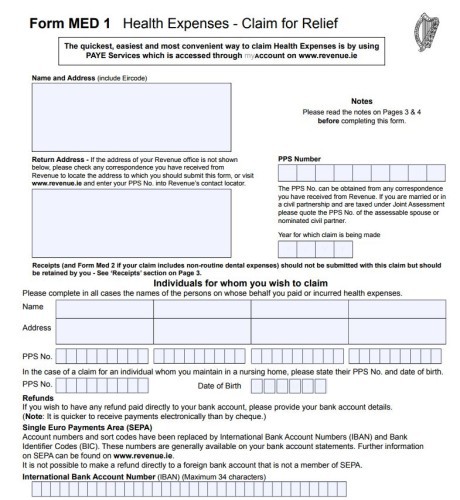

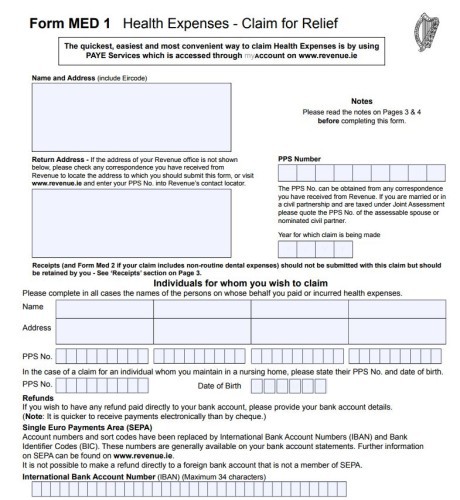

Web 24 avr 2023 nbsp 0183 32 Some of the lesser known deductible medical expenses include acupuncture addiction treatment braille publications chiropractic services for medical care contact lenses diet food exercise programs Web 16 ao 251 t 2023 nbsp 0183 32 You can claim tax relief on medical expenses you pay for yourself or for any other person You must claim tax relief within the 4 years following the year in which you

Tax Rebate Health Expenses

Tax Rebate Health Expenses

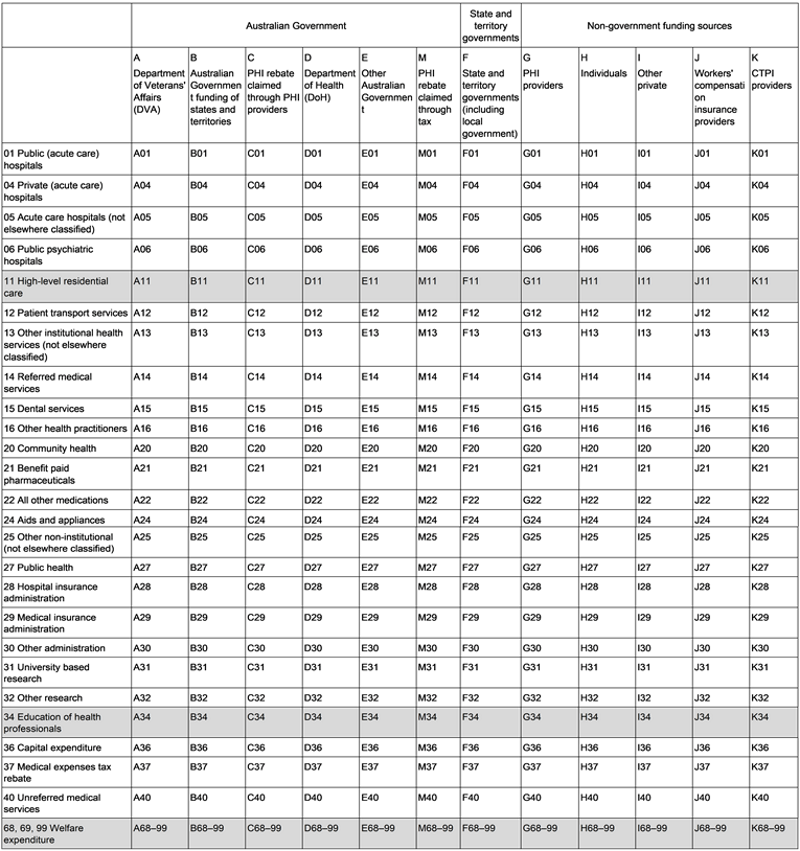

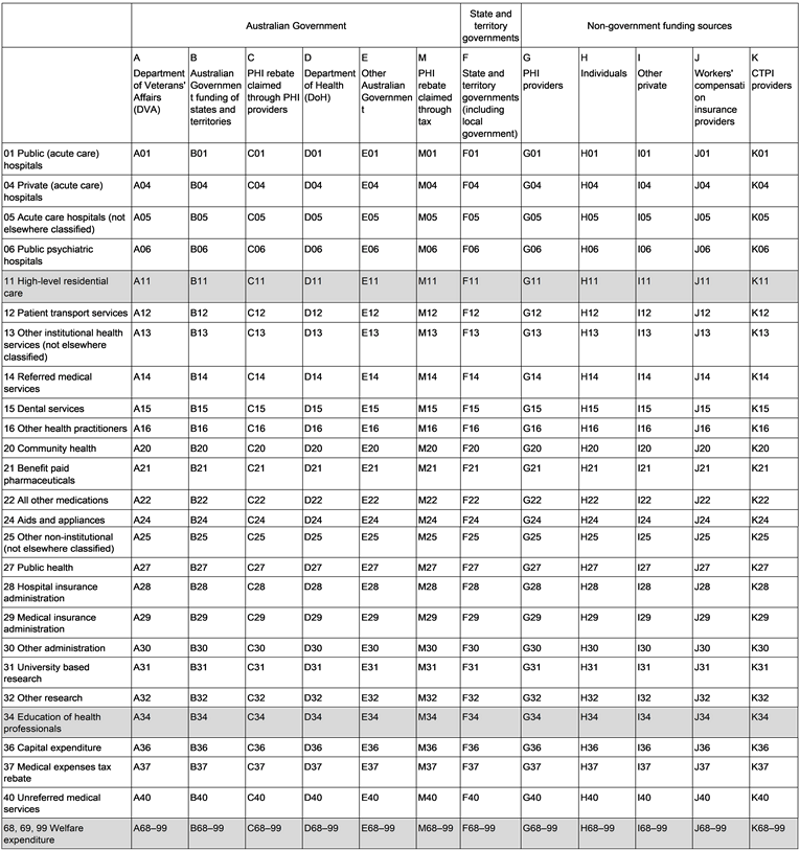

https://www.aihw.gov.au/getmedia/269f5024-7d7c-4760-bbf8-871d5654c2b4/HEA-table1.png.aspx

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Get Your Money Back On Eye Care Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/05/ITR-EyeCare-Expenses-Infographic--768x1825.png

Web 12 f 233 vr 2023 nbsp 0183 32 In 2022 the IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income if the taxpayer uses IRS Schedule A to itemize Web 10 mars 2023 nbsp 0183 32 Is Health Insurance Tax Deductible Health insurance costs may be tax deductible but it depends on how much you spent on medical care for the year and whether you re self employed The

Web Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax Web 18 d 233 c 2020 nbsp 0183 32 Jump straight to how you claim tax back on medical and dental expenses How much tax can I claim back on medical expenses You can claim tax relief on the full cost of your health expenses These

Download Tax Rebate Health Expenses

More picture related to Tax Rebate Health Expenses

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Australian Government Private Health Insurance Rebate Insurance

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

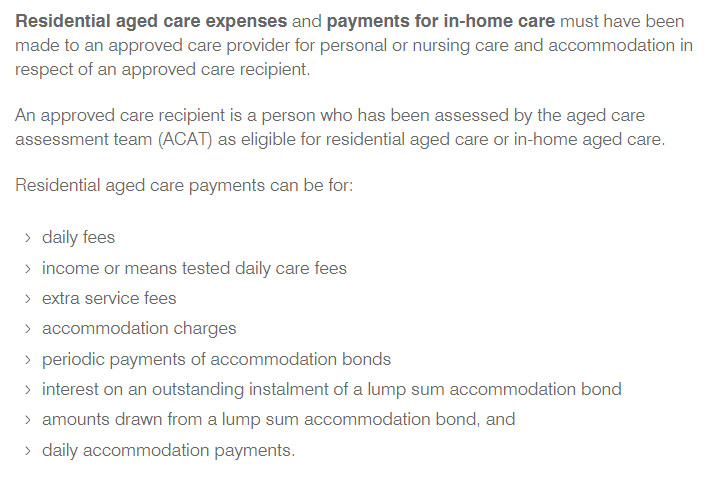

Claiming The Medical Offset Tax Rebate

https://daughterlycare.com.au/wp-content/uploads/2019/07/medical-expense-payments.jpg

Web 9 mars 2023 nbsp 0183 32 Health expenses are claimed through your Income Tax Return If you are a Pay As You Earn PAYE taxpayer you also have the option to claim relief in real time Web 12 janv 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems

Web 17 sept 2020 nbsp 0183 32 The amount that insurers are refunding to policyholders this fall would be almost double the 1 4 billion or so refunded a year ago with about 7 9 million people Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

https://www.pdffiller.com/preview/391/382/391382225/large.png

10 Sample Expense Report Forms Sample Templates

https://images.sampletemplates.com/wp-content/uploads/2016/12/09154252/Member-Health-Expense-Report-Form.jpg

https://www.investopedia.com/terms/m/medical-expenses.asp

Web 25 oct 2022 nbsp 0183 32 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross

https://turbotax.intuit.com/tax-tips/health-care…

Web 24 avr 2023 nbsp 0183 32 Some of the lesser known deductible medical expenses include acupuncture addiction treatment braille publications chiropractic services for medical care contact lenses diet food exercise programs

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

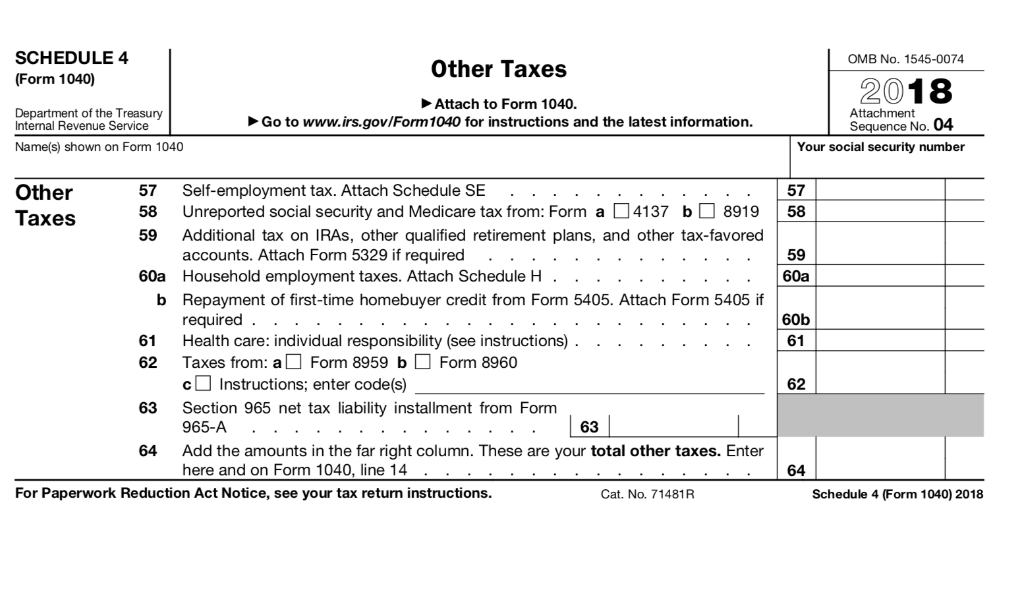

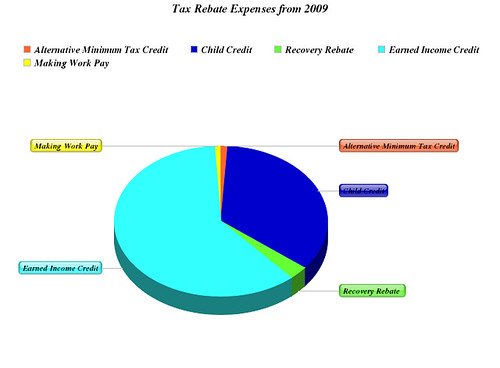

Tax Rebate Expenses From 2009 Maddogg41283 Flickr

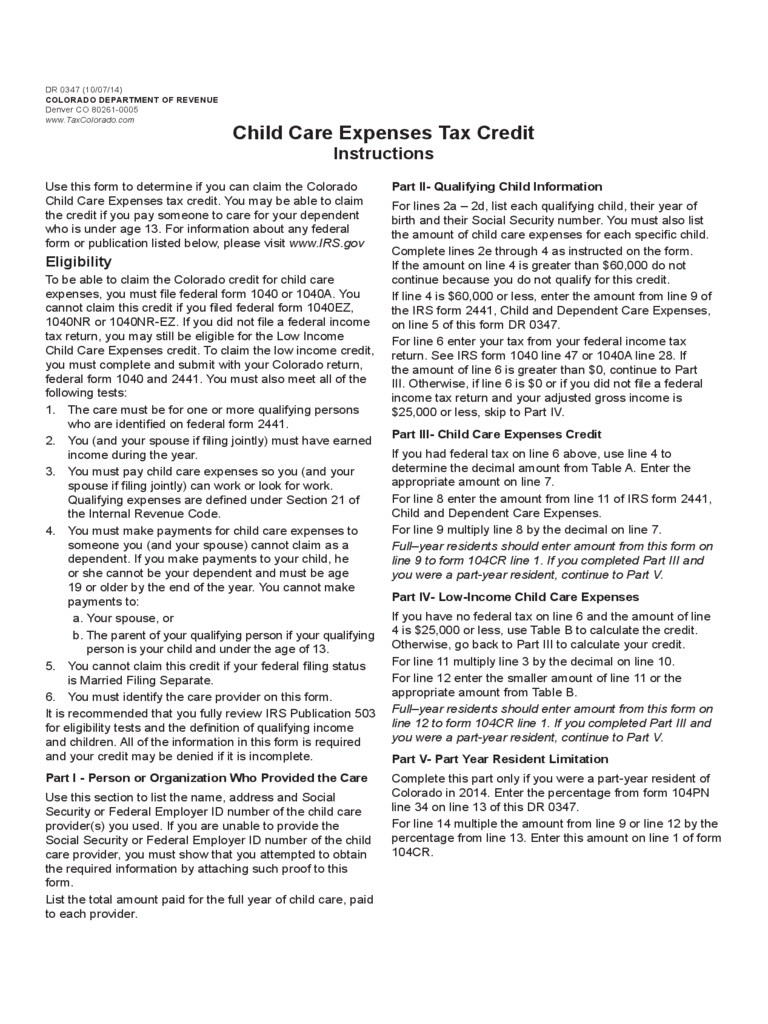

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

EXCEL TEMPLATES Medical Bill Tracker Template

Why Do So Few Irish People Claim Back Their Medical Expenses

Why Do So Few Irish People Claim Back Their Medical Expenses

Medics Money Tax Rebate Guide PDF Taxes Expense

Medical Bill Invoice Template Excel PDF Word XLStemplates

Deferred Tax And Temporary Differences The Footnotes Analyst

Tax Rebate Health Expenses - Web Last Reviewed October 2022 When your claiming a tax rebate HMRC doesn t care what work you do From nurses and midwives to physiotherapist and healthcare assistants