Tax Rebate Home Loan Interest Before Possession Web 16 mai 2013 nbsp 0183 32 However the total amount of interest paid on home loan prior to possession of house property as can be claimed as pre construction interest in 5

Web 12 janv 2022 nbsp 0183 32 Yes you can claim deductions on the interest paid on the house loan before possession albeit after the construction is complete and the property is ready Web 28 janv 2014 nbsp 0183 32 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial year can be

Tax Rebate Home Loan Interest Before Possession

Tax Rebate Home Loan Interest Before Possession

https://www.livemint.com/lm-img/img/2023/06/22/600x338/Home_loan_1687401215877_1687401216035.jpg

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Payment View

https://support.insitebanking.com/welcome/documentation/insite8documentation/content/Resources/Images/MainMenu/Inquiry/Loan_Inquiry/Bottom_Panel/rebates_button.png

Web 3 ao 251 t 2019 nbsp 0183 32 Income Tax Deduction from Interest Paid on House before getting Possession CMA Vr Dr Pawan Jaiswal 252K subscribers Subscribe 9 6K views 3 Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Web 4 ao 251 t 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get some Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on

Download Tax Rebate Home Loan Interest Before Possession

More picture related to Tax Rebate Home Loan Interest Before Possession

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web Yes it is possible to claim a tax rebate on Home Loan before possession Know how tax exemptions on the interest component of a Home Loan work in the case of under Web 28 mai 2022 nbsp 0183 32 Yes you can claim deductions on the interest paid on house loan before possession albeit after the construction is complete and the property is ready for

Web Si le contribuable a b 233 n 233 fici 233 d un 233 co pr 234 t 224 taux z 233 ro pour effectuer ses travaux il n a pas le droit au cr 233 dit d imp 244 t li 233 224 la d 233 fiscalisation de la r 233 sidence principale Pour le calcul Web 9 sept 2023 nbsp 0183 32 A home loan borrower can end up losing up to 85 of tax benefits available on the home loan premium payment if the builder fails to deliver possession of the

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 mai 2013 nbsp 0183 32 However the total amount of interest paid on home loan prior to possession of house property as can be claimed as pre construction interest in 5

https://www.tatacapital.com/blog/loan-for-home/home-loan-tax-benefits...

Web 12 janv 2022 nbsp 0183 32 Yes you can claim deductions on the interest paid on the house loan before possession albeit after the construction is complete and the property is ready

How To Lower Loan Interest Rates

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loan Tax Rebate 5

Tax Rebate Lanka Bangla Asset Management Company Limited

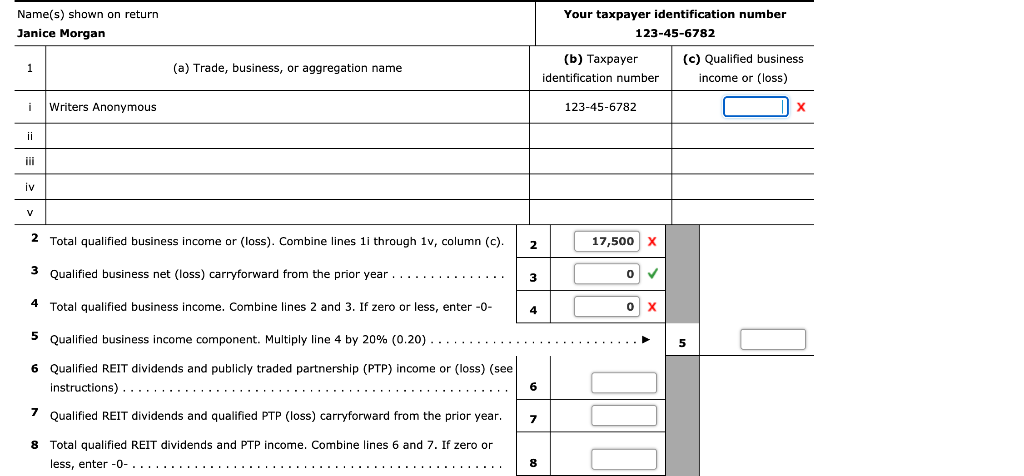

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Review Of Fido Loans Apk Ideas Rivergambiaexpedition

Realtors Seek Tax Rebate On House Loans

Tax Rebate Home Loan Interest Before Possession - Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession can be claimed over the next 5