Tax Rebate Home Loan Interest Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 11 sept 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Tax Rebate Home Loan Interest

Tax Rebate Home Loan Interest

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records

Web 5 sept 2023 nbsp 0183 32 First time home buyers can claim deduction of up to Rs 50 000 under Section 80EE in a financial year against payment of home loan interest 80EE deductions can Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Download Tax Rebate Home Loan Interest

More picture related to Tax Rebate Home Loan Interest

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Tax Rebate Calculator On Home Loan TAXW

https://i.pinimg.com/originals/2d/bd/5f/2dbd5ff444ba9c2a0ba1915a2d8781b2.jpg

Understanding Home Loan Refinance Interest Rates In 2023 Money

https://i.pinimg.com/originals/1b/66/fd/1b66fda37115a14cabf98db5215efe2d.jpg

Web 2 juin 2023 nbsp 0183 32 If you paid quot points quot when you refinanced your mortgage you may be able to deduct them Points are prepaid interest you pay them upfront to get a lower interest Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability

Web 26 oct 2021 nbsp 0183 32 You can still claim deduction on home loan interest 1 min read 26 Oct 2021 05 40 PM IST Shipra Singh The tax rules still allows deduction on interest paid towards Web 1 f 233 vr 2021 nbsp 0183 32 The tax benefits for interest payment and principal repayment of home loan can be claimed by both only if they are joint owners as well as a co borrowers servicing

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Web 11 sept 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Rising Home Loan Interests Have Begun To Impact Homebuyers

Are Home Loan Interest Rates Going Up Funaya Park

How To Lower Loan Interest Rates

Income Tax Rebate On Home Loan Fy 2019 20 A design system

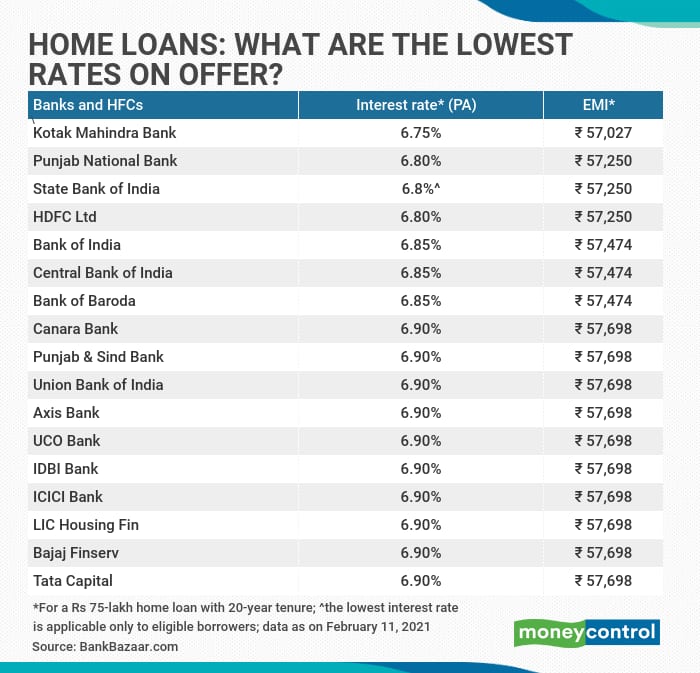

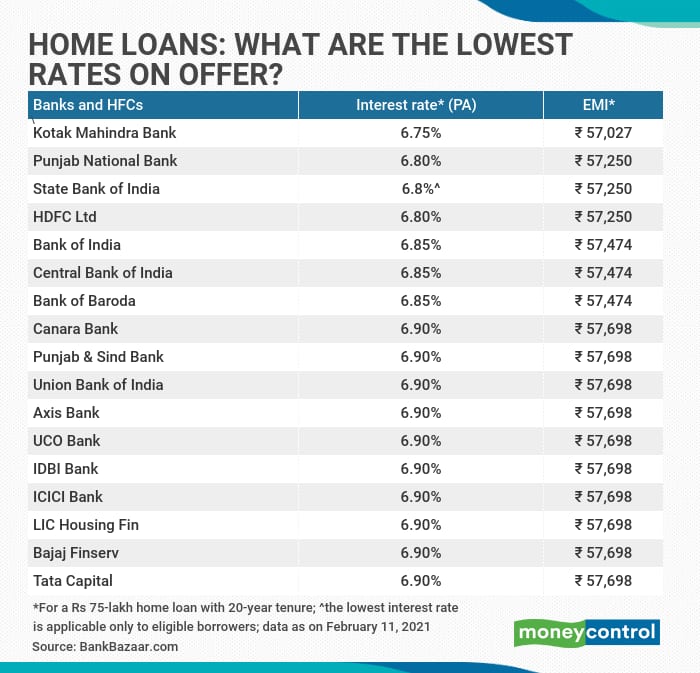

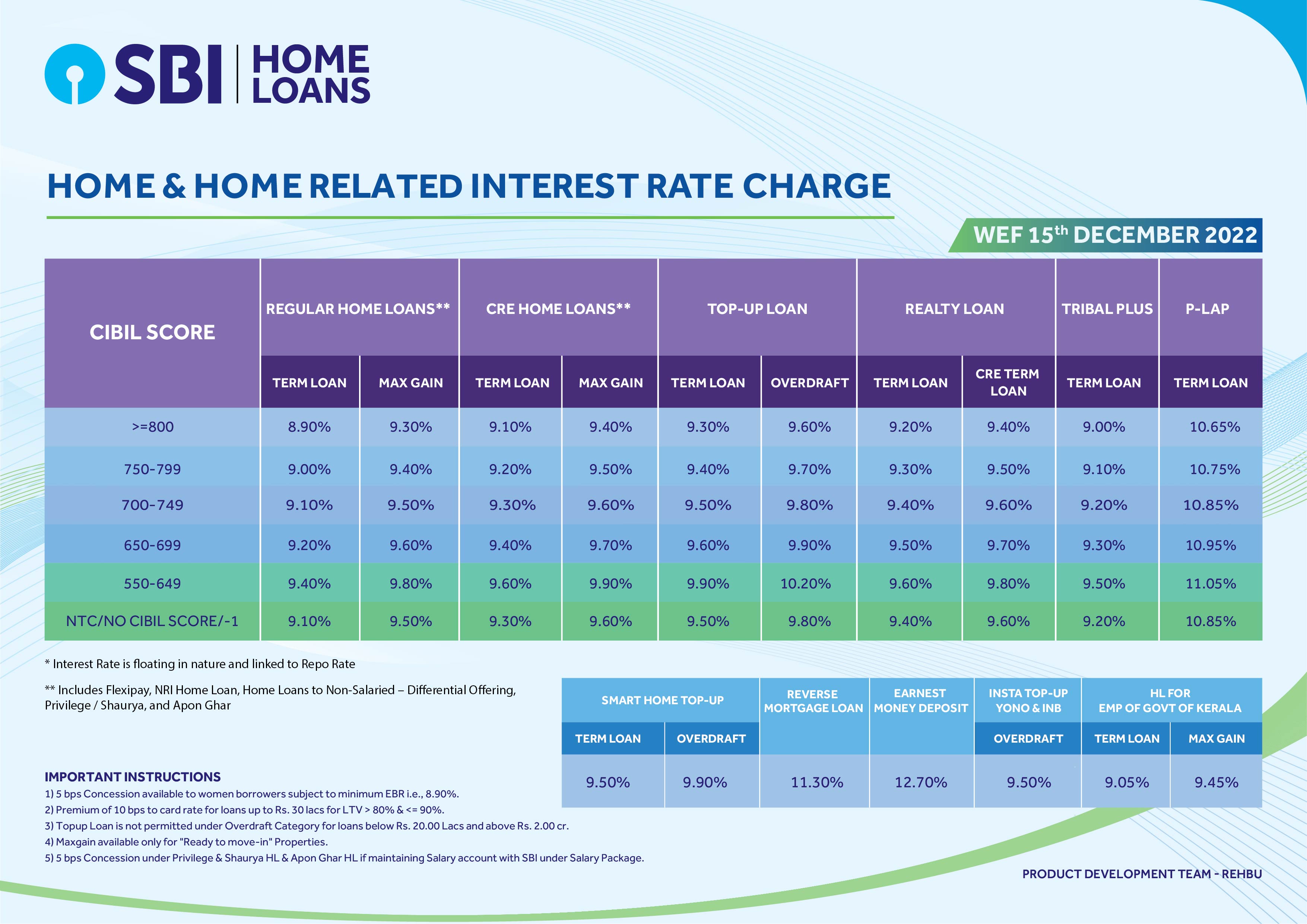

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Home Loans Interest Rates Current Interest Rates

Home Loan Tax Rebate 5

Where To Get A Car Loan

Tax Rebate Home Loan Interest - Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records