Tax Rebate Home Loan Under Construction Web 4 ao 251 t 2021 nbsp 0183 32 Suppose you take a home loan of Rs 50 lakh for the under construction house in July 2021 And you start paying the EMI for the same immediately at least the

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan Web 14 d 233 c 2021 nbsp 0183 32 As per Section 80 of the Income Tax Act a Home Loan borrower can avail a deduction of up to Rs 1 5 Lakh on the amount paid towards the principal component of

Tax Rebate Home Loan Under Construction

Tax Rebate Home Loan Under Construction

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

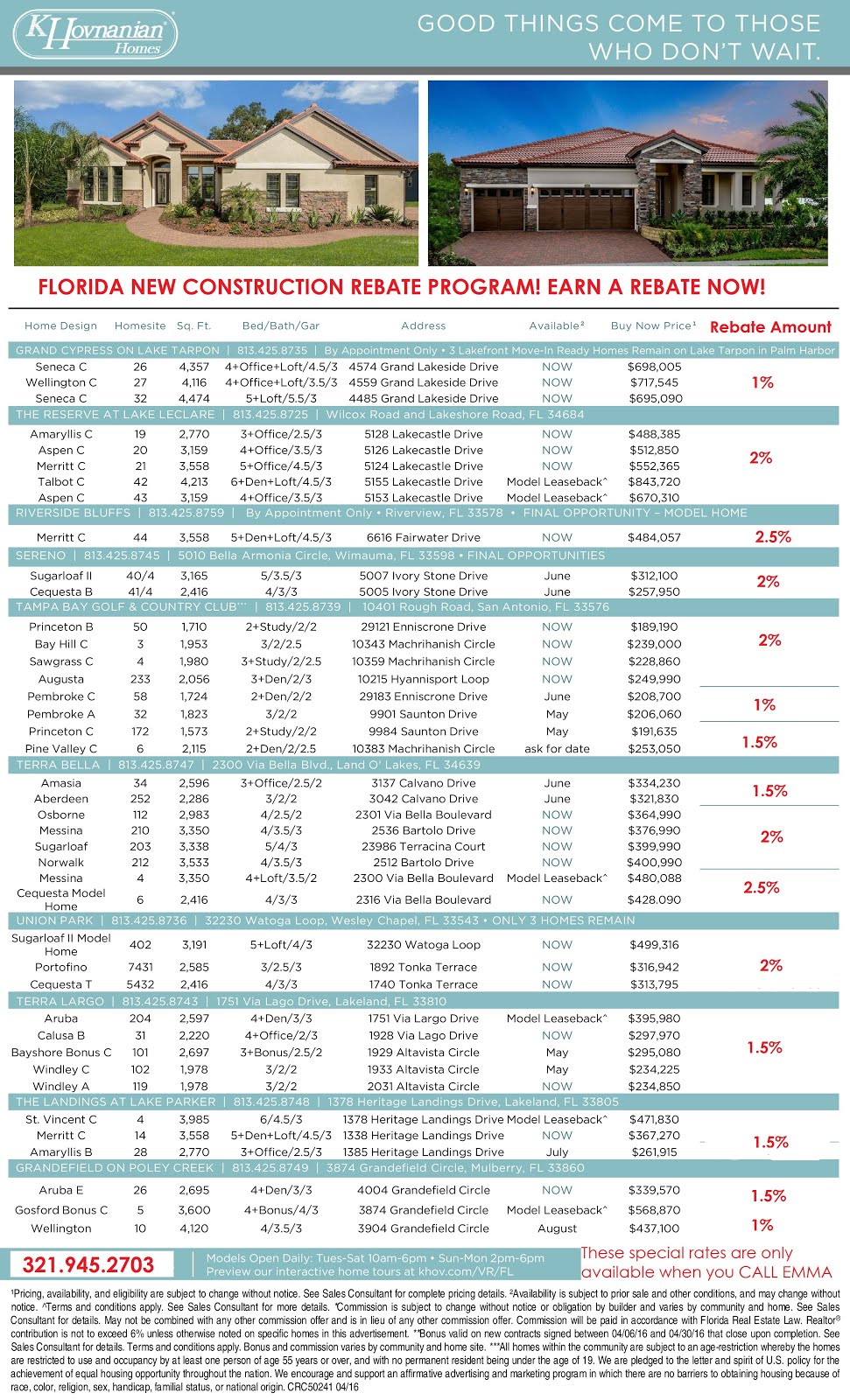

Florida New Construction Rebate Program CURRENT INVENTORY HOMES

https://i.pinimg.com/originals/69/8d/02/698d02ad79c9db5861c558c64902cb2a.jpg

Web 25 mai 2021 nbsp 0183 32 1 As under construction properties are comparatively cheaper the funds required for them would be relatively low Hence the EMI payable on the loan amount Web 1 oct 2014 nbsp 0183 32 Tax Rebate As per the provisions of Section 80C you are allowed separate deductions on principal and interest amount along with other eligible entities like ULIP

Web 1 juil 2021 nbsp 0183 32 This video is about home loan benefit on under construction pre constructed property How to claim tax deduction on interest portion u s 24 and principle por Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Download Tax Rebate Home Loan Under Construction

More picture related to Tax Rebate Home Loan Under Construction

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial Web 24 avr 2017 nbsp 0183 32 If you have a home loan for an under construction property then it is possible to claim for tax deductions A tax deduction up to 2 Lakhs on the interest payments made in a year and up to 1 5 Lakhs

Web 31 janv 2023 nbsp 0183 32 Pankaj Mathpal MD amp CEO at Optima Money Managers explained how a home loan borrower can claim an income tax rebate on home loan interest paid before Web Tax Exemption for Home Construction Loan The pre construction phase is the time between the date of borrowing and the completion of the construction The Indian

Home Loan Tax Rebate 5

https://images.tv9marathi.com/wp-content/uploads/2022/01/26170837/Home-Loan-1.jpg

Home My New Construction Rebate

http://mynewconstructionrebate.com/wp-content/uploads/2014/11/ncr-bg1.jpg

https://stableinvestor.com/2021/08/deduction-loan-interest-under...

Web 4 ao 251 t 2021 nbsp 0183 32 Suppose you take a home loan of Rs 50 lakh for the under construction house in July 2021 And you start paying the EMI for the same immediately at least the

https://navi.com/blog/tax-benefit-on-home-loan

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Home Loan Tax Rebate 5

Know How You Can Get Tax Benefits On Home Loan

K Hovnanian HUGE Rebates Leasebacks On Models Tampa Florida

How To Claim Home Loan Interest For Under Construction Property

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Fy 2019 20 A design system

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Tax Rebate Home Loan Under Construction - Web 25 mai 2021 nbsp 0183 32 1 As under construction properties are comparatively cheaper the funds required for them would be relatively low Hence the EMI payable on the loan amount