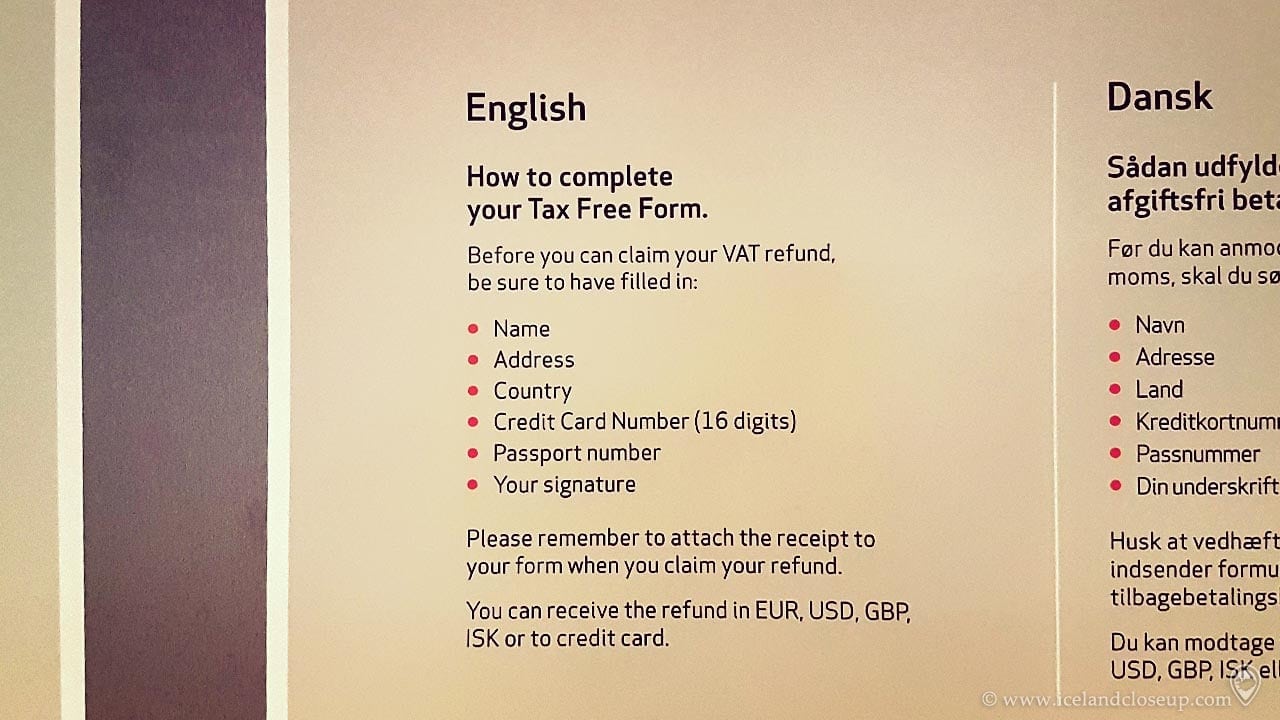

Tax Rebate Iceland Web Tax free VAT refund All non Iceland residents are tax free eligible The minimum amount on one single purchase receipt must be ISK 12 000 The original purchase receipts must

Web VAT REFUND TAX FREE Tourists who reside abroad can claim a proportional VAT refund when shopping in Iceland The refund is limited to purchases that are intended Web Receive Your Refund 01 Go Shopping Go shopping and while paying remember to ask for a Global Blue Tax Free Form Here s what you need to know to shop Tax Free Search

Tax Rebate Iceland

Tax Rebate Iceland

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig4b-600x410.gif

New 25 Tax Rebate On Film making In Iceland Iceland Monitor

https://cdn.mbl.is/frimg/7/88/788740.jpg

Instant Rebate Photos And Premium High Res Pictures Getty Images

https://media.gettyimages.com/photos/departing-tourists-at-vat-tax-refund-counter-in-keflavik-airport-picture-id868752996?s=612x612

Web They use two different tax brackets one is 11 one is 24 However the maximum amount you can get back is 14 of the retail price of any goods you bought in the higher Web 18 d 233 c 2017 nbsp 0183 32 What is tax free shopping in Iceland Tax free shopping in Iceland applies to goods that are purchased in Iceland for 6 000 ISK 56 USD or 46 00 or more In other words the original receipt must show

Web The purchase amount must be no less than ISK 4 000 VAT included per store All goods except woollens need to be shown at customs before check in At Keflav 237 k airport this applies only to tax free forms whose Web Tax issues General tax information Tax liability Taxable income Allowances deductions and credits Non resident Limited tax liability Personal tax credit Tax brackets Tax return and assessment Filing a

Download Tax Rebate Iceland

More picture related to Tax Rebate Iceland

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig1b-600x410.gif

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig7b-600x409.gif

Iceland Personal Income Tax Rate 2022 Data 2023 Forecast 1995

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=islirstax&v=202210240604V20220312

Web Any positive difference between income tax withheld and the assessed income tax state and municipal is refunded increased by 2 5 of the difference and deficit is collected Web Shoppers eligible for VAT Sales Tax Refund Non Iceland residents Currency ISK VAT rate 24 Minimum spend 12 000 ISK on the same day and in the same store Time

Web 29 juil 2019 nbsp 0183 32 The VAT in Iceland is charged at two rates the standard rate of 24 percent and the reduced rate of 11 percent on certain products Since 2015 the 24 percent Web Tax liability An individual that stays in Iceland for less than six months in a twelve month period has limited tax liability in Iceland This means he has to pay tax on income

Our Performance About Iceland

https://about.iceland.co.uk/wp-content/uploads/2022/11/ICELAND_TAX_22-1024x680.png

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig3b-600x409.gif

https://www.skatturinn.is/.../travelling-to-iceland/tax-free-vat-refund

Web Tax free VAT refund All non Iceland residents are tax free eligible The minimum amount on one single purchase receipt must be ISK 12 000 The original purchase receipts must

https://www.government.is/diplomatic-missions/embassy-of-iceland-in...

Web VAT REFUND TAX FREE Tourists who reside abroad can claim a proportional VAT refund when shopping in Iceland The refund is limited to purchases that are intended

Shop Tax Free In Iceland The Complete Guide Iceland Close Up

Our Performance About Iceland

How To Obtain A Tax Card In Iceland Electricity Bill Calculator

Iceland Minimum Wages Taxes And Payroll Expenses Icelandic YouTube

Iceland Customs And Other Import Duties Of Tax Revenue 2022

Born Before 1969 Claim These 13 Senior Rebates Iceland Oplysninger

Born Before 1969 Claim These 13 Senior Rebates Iceland Oplysninger

Corporate Taxes In Iceland In 2022 23 Complete Guide

Illinois Tax Rebate Tracker Rebate2022

Annual List Of Highest Tax Payers In Iceland Published

Tax Rebate Iceland - Web Les taux d imposition en Islande bar 232 me 2017 0 si le revenu annuel est inf 233 rieur 224 ISK 1 718 678 36 94 d imposition pour les revenus situ 233 s entre ISK 0 834 707