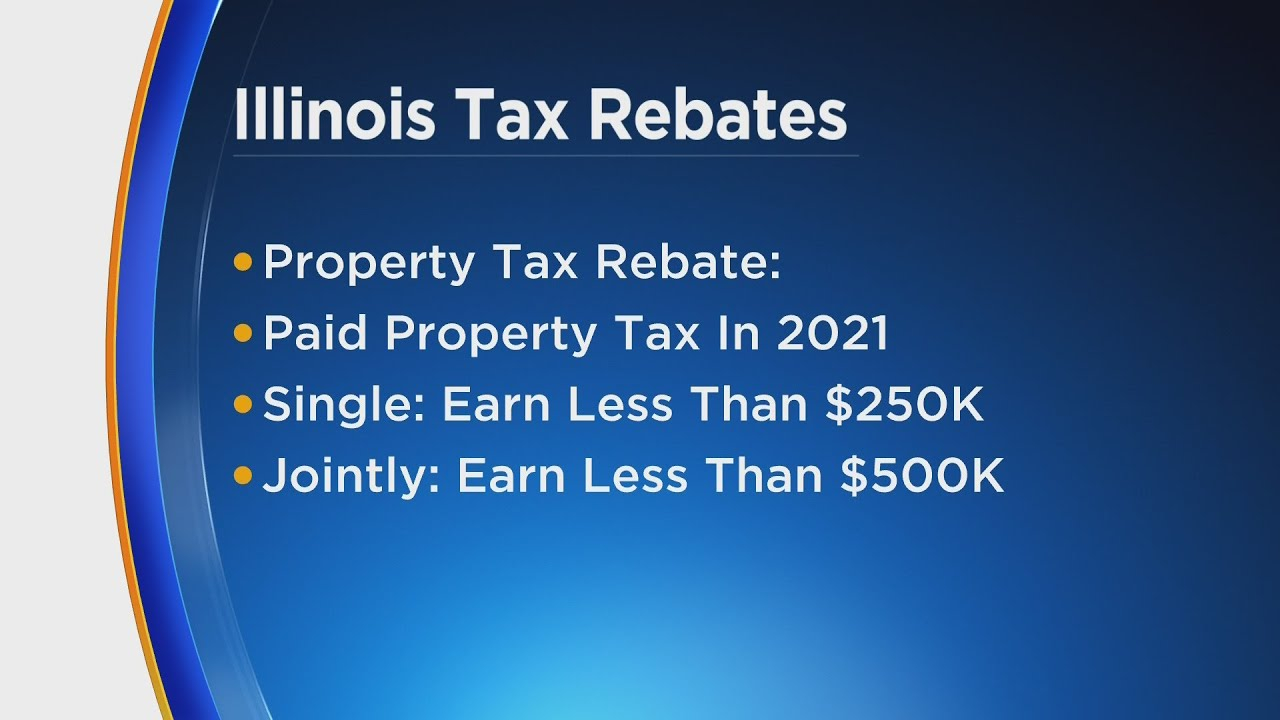

Tax Rebate Illinois 2023 Web 5 mai 2023 nbsp 0183 32 To qualify for Illinois Tax Rebates in 2023 you must meet the following criteria Be a resident of Illinois or a business operating within the state Have filed your

Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than Web 19 avr 2022 nbsp 0183 32 Illinois Gov JB Pritzker on Tuesday signed the state s 46 5 billion budget for 2023 The budget includes a plan to issue tax rebates and direct payments among

Tax Rebate Illinois 2023

Tax Rebate Illinois 2023

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/tax-rebate-payments-begin-for-millions-of-illinoisans-1.jpg

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

Nj Property Tax Rebates 2023 PropertyRebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-3.jpg

Web You qualify if you were an Illinois resident in 2021 and your adjusted gross income on your 2021 Form IL 1040 is under 400 000 if filing jointly or under 200 000 if filing as a Web 14 f 233 vr 2023 nbsp 0183 32 L 2023 S2951 P A 102 1125 effective 02 03 2023 Illinois Administrative Procedure Act Illinois adopted emergency rulemaking to provide for

Web 12 sept 2022 nbsp 0183 32 The Pritzker administration is sending income and property tax rebates to many Illinoisans struggling with inflation These tax rebates were part of the 1 8 billion Web 5 juil 2023 nbsp 0183 32 This bulletin summarizes changes for 2022 Illinois Income Tax forms and schedules for individuals and businesses 2023 Withholding Income Tax forms and

Download Tax Rebate Illinois 2023

More picture related to Tax Rebate Illinois 2023

Which States Have Property Tax Rebates PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/north-central-illinois-economic-development-corporation-property-taxes-1.png

Ameren Illinois Rebates 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Illinois-Renters-Rebate-2023-768x674.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 19 avr 2023 nbsp 0183 32 To qualify for the tax rebate program in Illinois for 2023 you must meet certain eligibility criteria including income limits and other requirements To check your eligibility visit the Illinois Department of Web 27 avr 2023 nbsp 0183 32 To qualify for the Property Tax Rebate Illinois 2023 program applicants must have an annual household income of 75 000 or less This includes all sources

Web 22 mai 2023 nbsp 0183 32 The Illinois Income Tax Rebate 2023 is a state government initiative aimed at providing financial relief to eligible individuals and businesses It is a form of tax refund Web 5 avr 2023 nbsp 0183 32 Illinois Tax Rebate 2023 The Illinois Tax Rebate 2023 is a program offered by the state of Illinois to provide financial relief to taxpayers who have experienced

2023 Rebates And Tax Credits For HVAC Upgrades Alsip IL

https://doornbos.com/wp-content/uploads/2023/01/BDekEMBc.jpeg

Know New Rebate Under Section 87A Budget 2023

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

https://www.tax-rebate.net/illinois-tax-rebates-2023

Web 5 mai 2023 nbsp 0183 32 To qualify for Illinois Tax Rebates in 2023 you must meet the following criteria Be a resident of Illinois or a business operating within the state Have filed your

https://www.nbcchicago.com/news/local/irs-issues-clarification-on...

Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

2023 Rebates And Tax Credits For HVAC Upgrades Alsip IL

2022 State Of Illinois Tax Rebates Kakenmaster Tax Accounting

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

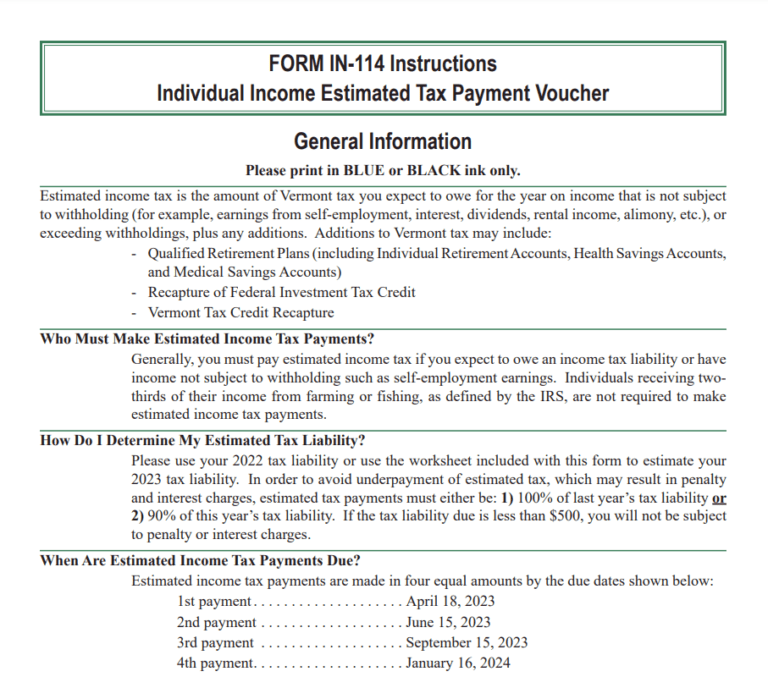

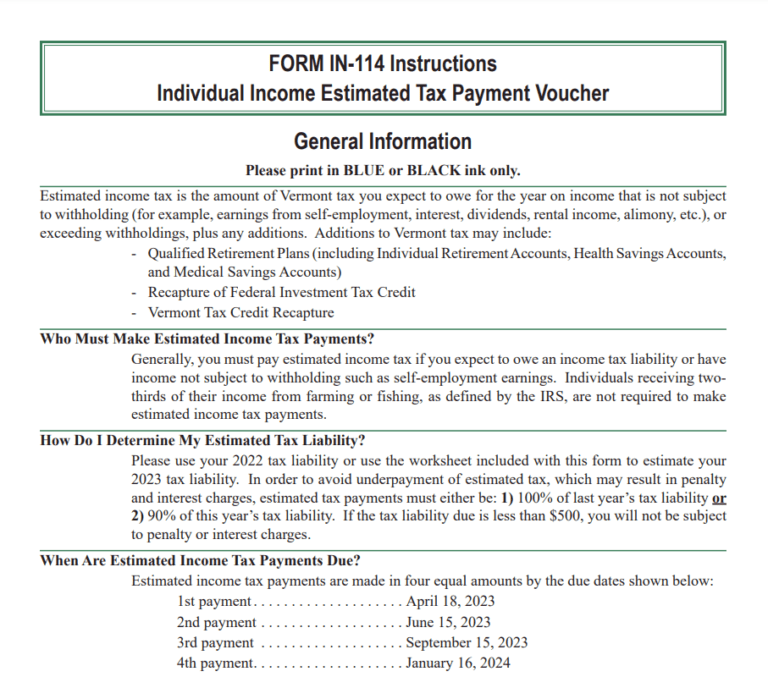

Vermont Tax Rebate 2023 Printable Rebate Form

Vermont Tax Rebate 2023 Printable Rebate Form

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

Tax Rebate Illinois 2023 - Web You qualify if you were an Illinois resident in 2021 and your adjusted gross income on your 2021 Form IL 1040 is under 400 000 if filing jointly or under 200 000 if filing as a