Tax Rebate Illinois 2024 The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

MyTax Illinois facilitates free filing and taxpayers can also use tax prep software or consult professionals The platform allows payments inquiry responses and refund status checks Taxpayers who file error free returns should receive a direct deposit refund in about four weeks The tax filing deadline is April 15 2024 Tax Credits 2024 This bulletin is written to inform you of recent changes it does not replace statutes rules and regulations or court decisions For information or forms Visit our website at tax illinois gov Register and file your return online at mytax illinois gov For registration questions call or email us at 217 785 3707 REV CentReg illinois gov

Tax Rebate Illinois 2024

Tax Rebate Illinois 2024

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

The tax filing deadline is Monday April 15 Tax credits Depending on circumstances taxpayers may be able to reduce the amount of taxes owed through tax credits Harris said Some popular tax credits include the Illinois K 12 Education Expense Credit and the Property Tax Credit and the Illinois Earned Income Tax Credit EITC Anyone who filed taxes as a single person will receive 50 If you filed jointly you ll be given a 100 rebate 50 per person Those with dependents will receive up to 300 according to the

If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of Here s everything else you need to know about the rebates Income tax rebates Who qualifies You must have been an Illinois resident in 2021 with an adjusted gross income on your 2021 Form IL

Download Tax Rebate Illinois 2024

More picture related to Tax Rebate Illinois 2024

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Illinois Income Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023.png

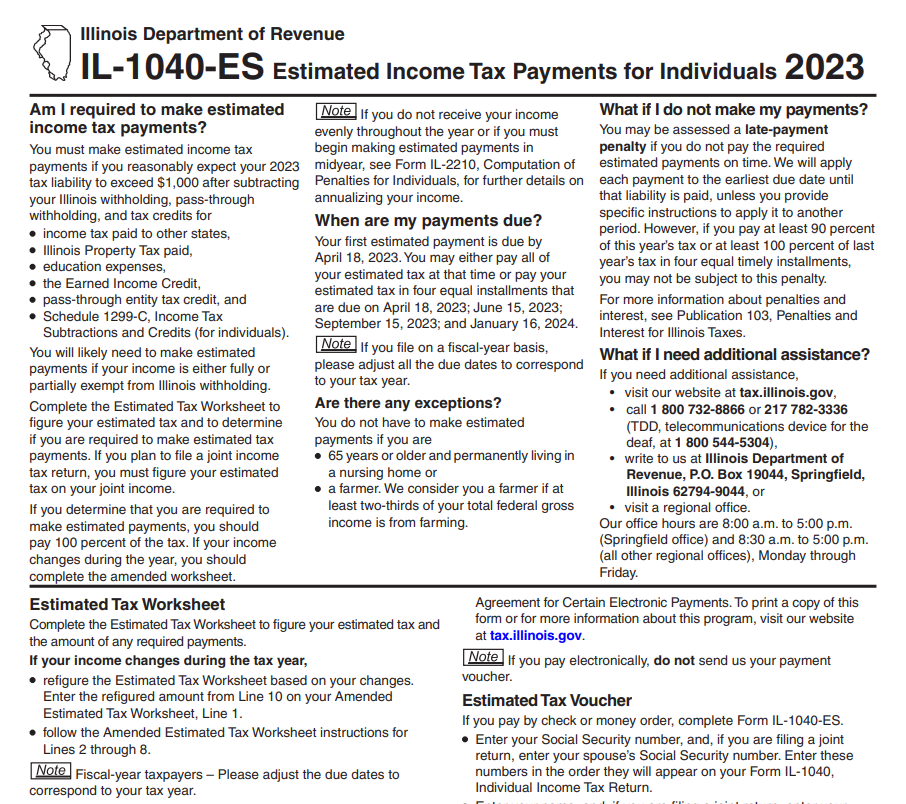

Form IL 1040 PTR the Property Tax Rebate Form is available on IDOR s website at tax illinois gov rebates Taxpayers eligible for both rebates will receive one payment The Tax tables below include the tax rates thresholds and allowances included in the Illinois Tax Calculator 2024 Illinois provides a standard Personal Exemption tax deduction of 2 625 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024

Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January 29th 2024 That is also the same day

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

https://news.yahoo.com/illinois-tax-season-2024-heres-210017466.html

MyTax Illinois facilitates free filing and taxpayers can also use tax prep software or consult professionals The platform allows payments inquiry responses and refund status checks Taxpayers who file error free returns should receive a direct deposit refund in about four weeks The tax filing deadline is April 15 2024 Tax Credits

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Missouri State Tax Rebate 2023 Printable Rebate Form

Tax Rebate FAQs Rep Thaddeus Jones

Illinois Ev Tax Rebate 2023 Tax Rebate

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

How Does Illinois s Property Tax Rebate Work

Tax Rebate Illinois 2024 - Here s everything else you need to know about the rebates Income tax rebates Who qualifies You must have been an Illinois resident in 2021 with an adjusted gross income on your 2021 Form IL