Tax Rebate In Australia Web 29 mars 2022 nbsp 0183 32 Millions of Australians will get additional tax relief worth 420 this financial year as the government tries to counter surging cost of living concerns with a pre

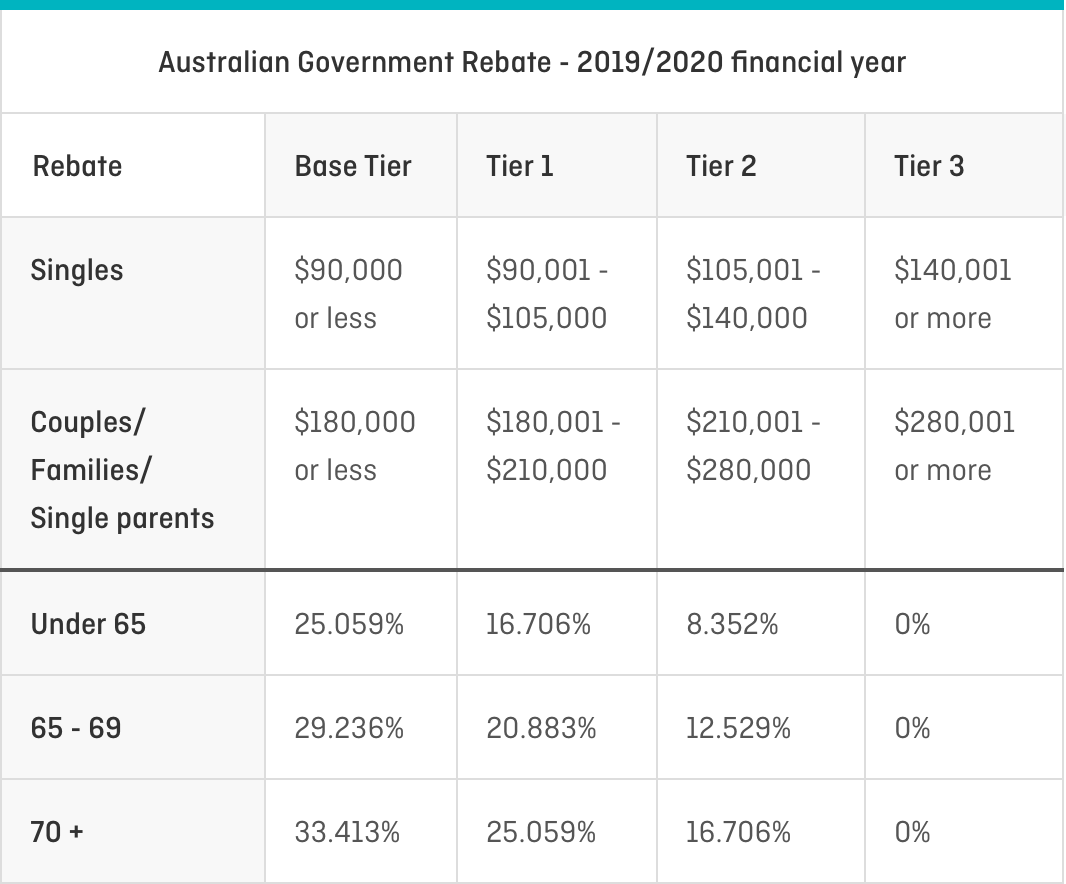

Web 6 mai 2022 nbsp 0183 32 Depending on your income you could be eligible for this rebate on your private health insurance and you can claim the rebate either as a reduction on your health Web by contacting Services Australia Completing your tax return Enter the amount you receive at one of the following Australian Government special payments if you lodge online

Tax Rebate In Australia

Tax Rebate In Australia

https://insurance.qantas.com/dist/static/table-agr-6a9b38.png

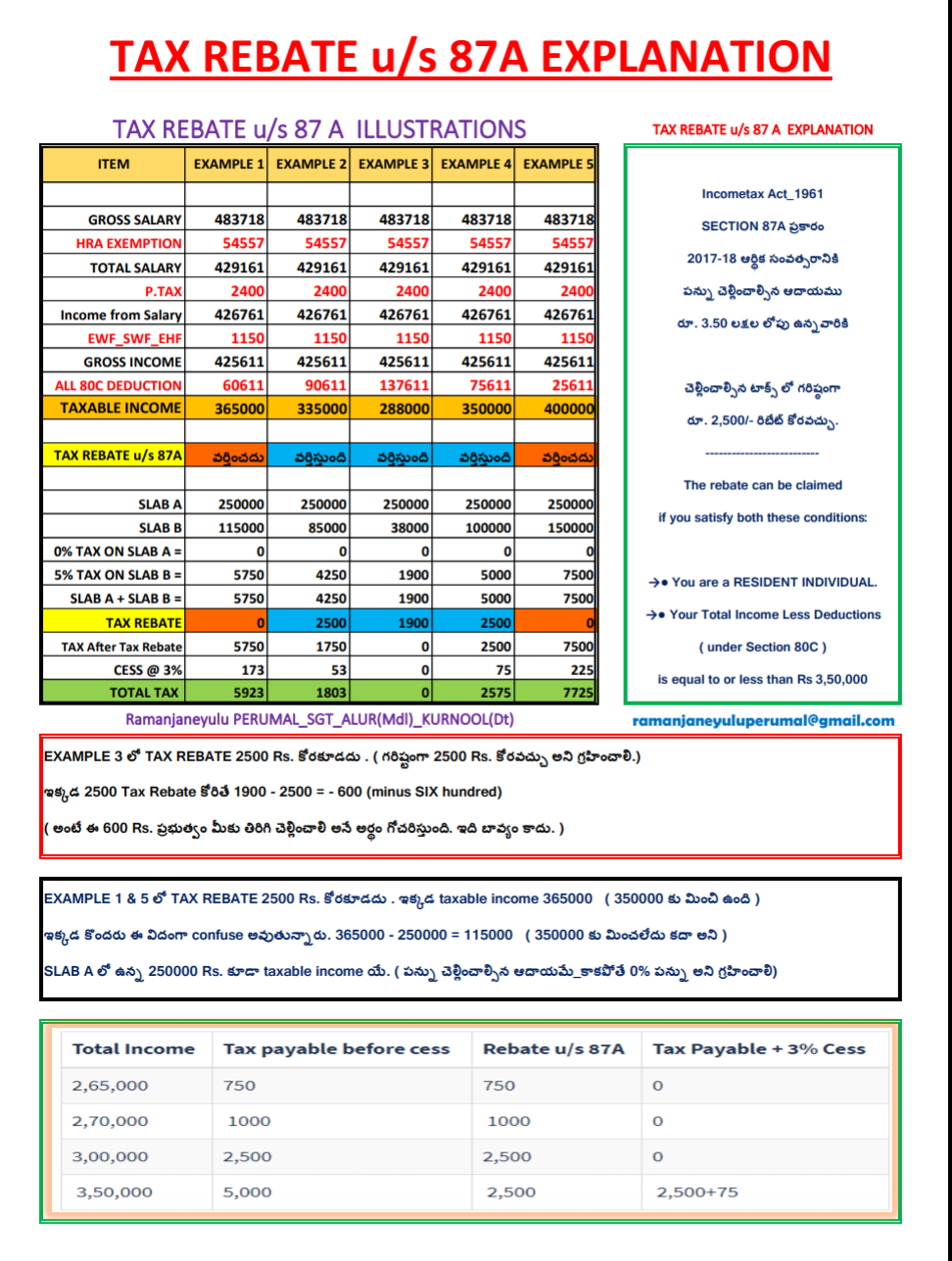

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig2/AS:433972418224137@1480478495792/Western-Australias-average-daily-maximum-temperature-for-January-Source-Australian_Q640.jpg

Web 16 juil 2021 nbsp 0183 32 If you hate doing your tax perhaps knowing the average refund is almost 3 000 will make the chore a little easier Last year the ATO refunded more than 30 billion to 10 8 million Australians Web 9 juil 2023 nbsp 0183 32 And changes in the 2022 23 financial year mean that many tax return refunds could be lower this year with some actually having to owe the Australian Taxation

Web 30 juin 2023 nbsp 0183 32 If you are eligible for the rebate you can claim the rebate either through your private health insurance provider your private health insurance provider will apply the Web The low income tax offset LITO is a tax rebate for Australian resident individuals on lower incomes Since 2012 13 the maximum amount of LITO is 445 and the offset cuts out

Download Tax Rebate In Australia

More picture related to Tax Rebate In Australia

Have You Received Your 150 Council Tax Rebate

https://s3-eu-west-1.amazonaws.com/creditladder-cdn/images/c459b3e3-4982-464e-8b4b-dd006b127354/Council_Tax_rebate.JPG

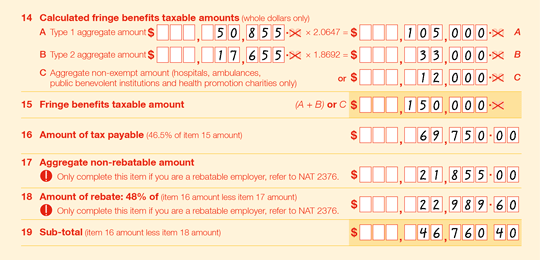

Non profit Organisations Operating An Eligible Public Benevolent

https://www.ato.gov.au/uploadedImages/Content/SME/Images/39720_10.png?n=2499

Council Tax Rebate Single Person

https://i.pinimg.com/originals/d1/47/f8/d147f83ab6290db56cac475c08a5fb25.jpg

Web 18 avr 2023 nbsp 0183 32 The Tourist Refund Scheme TRS allows travellers to claim a 10 rebate on the price paid for almost anything bought in Australia That 10 is initially paid up front in the form of the broad based 10 GST Web 18 avr 2023 nbsp 0183 32 In Australia the headline rate is more generous than prior to 2021 due to recent amendments However it can be complex in its calculation The rates are A refundable tax offset equal to the

Web between 45 001 and 66 667 you will get 325 minus 1 5 cents for every 1 above 45 000 We will work out your offset and reduce your tax payable by this amount Low Web If you bring goods back into Australia for which a GST refund via the TRS has been claimed the goods must be declared and if the value of those goods combined with any

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig1/AS:433972418224133@1480478495629/Map-of-Australia-illustrating-the-2006-Remoteness-Structure-Source-ABS-the-2006_Q640.jpg

https://www.abc.net.au/news/2022-03-29/federal-budget-low-and-middle...

Web 29 mars 2022 nbsp 0183 32 Millions of Australians will get additional tax relief worth 420 this financial year as the government tries to counter surging cost of living concerns with a pre

https://www.news.com.au/checkout/life/money/tax-rebate/news-story/6c...

Web 6 mai 2022 nbsp 0183 32 Depending on your income you could be eligible for this rebate on your private health insurance and you can claim the rebate either as a reduction on your health

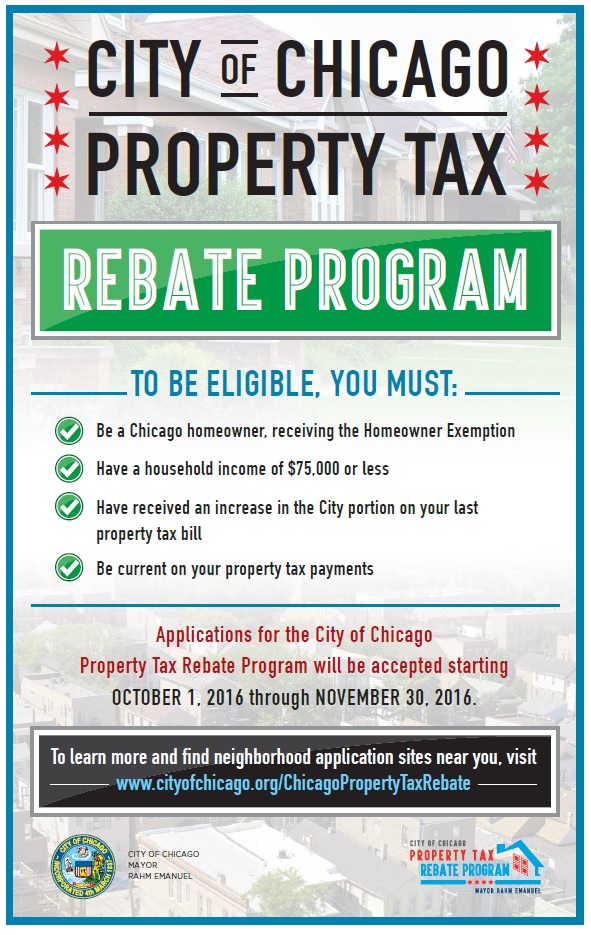

Uptown Update Property Tax Rebate Program Open Through November

What Is Australian Government Rebate On Private Health Insurance

Muth Encourages Eligible Residents To Apply For Extended Property Tax

Council Tax Rebate Energy

2022 Deductions List Name List 2022

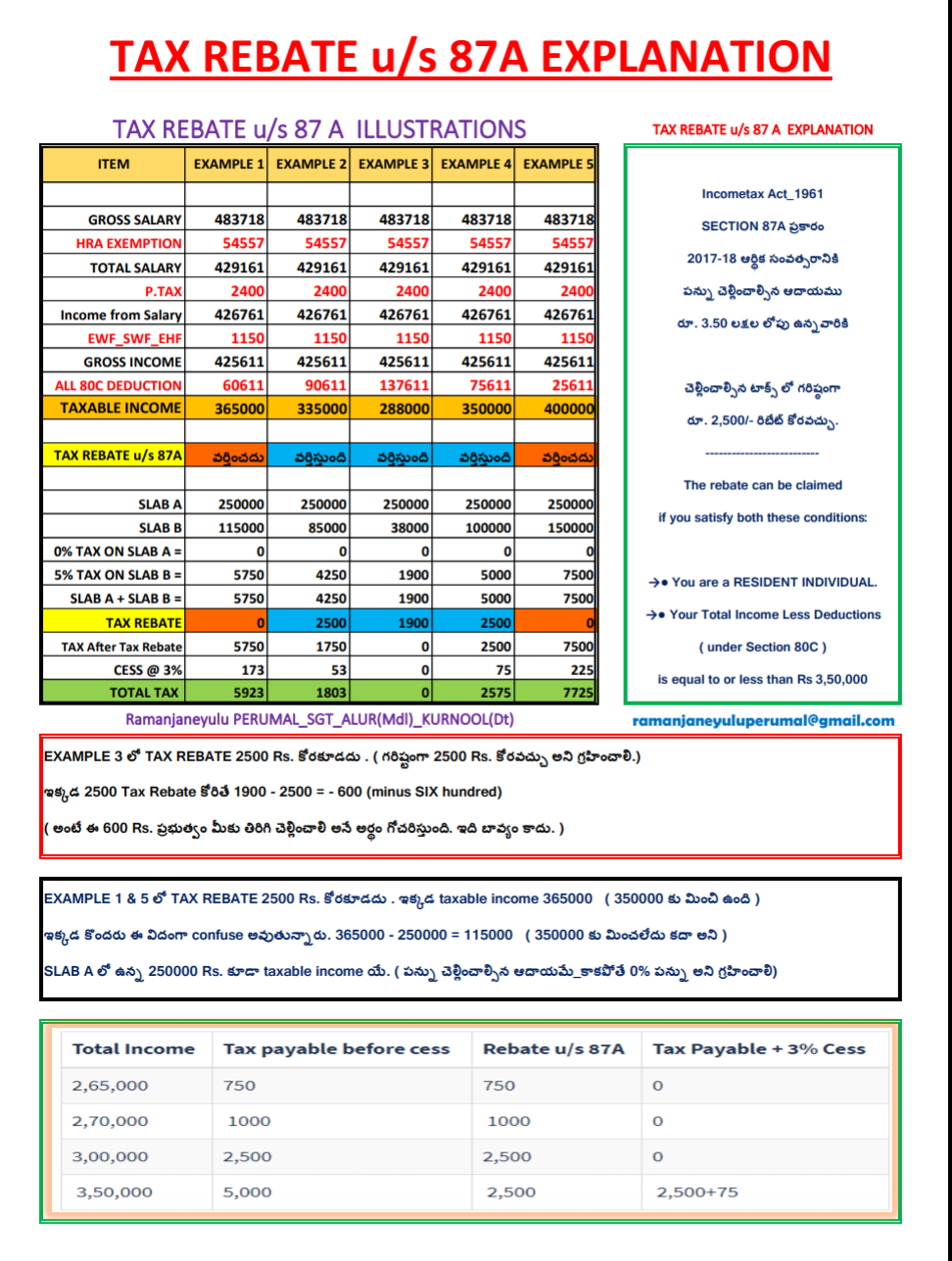

TAX REBATE 2017 18 Clarification Under Section 87 A MANNAMweb

TAX REBATE 2017 18 Clarification Under Section 87 A MANNAMweb

Figure 1 Source Www ato gov au

Budget Highlights For 2021 22 Nexia SAB T

Rebating Meaning In Insurance What Is Insurance Rebating The

Tax Rebate In Australia - Web For Australian residents the tax free threshold is currently 18 200 meaning the first 18 200 of your income is tax free but you are taxed progressively on income above