Tax Rebate In Home Loan Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a home loan interest

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web income tax Sections that provide tax rebate when you take a home loan you make the home loan repayment to the lender in equated monthly installments EMIs the home

Tax Rebate In Home Loan

Tax Rebate In Home Loan

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh

Web 31 mai 2022 nbsp 0183 32 Under Section 80EEA first time homebuyers can claim additional tax benefits of up to Rs 1 5 lakh if their loan was sanctioned in FY 2019 20 extended to FY 2020 21 This exemption is over and Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Download Tax Rebate In Home Loan

More picture related to Tax Rebate In Home Loan

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web Under section 24 of the Income Tax Act you are eligible for home loan tax benefit of up to 2 lakhs for the self occupied home In case you have a second house the total tax Web 20 mars 2023 nbsp 0183 32 Fortunately you can still avail of tax benefits on home loans under section 80EE of the Income Tax Act This section offers additional tax benefits to first time homebuyers As per this provision

Web 18 juil 2023 nbsp 0183 32 About Tax Deductions for a Mortgage Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 July 18 2023 03 20 PM Web Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your home loan With the help of a home loan

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

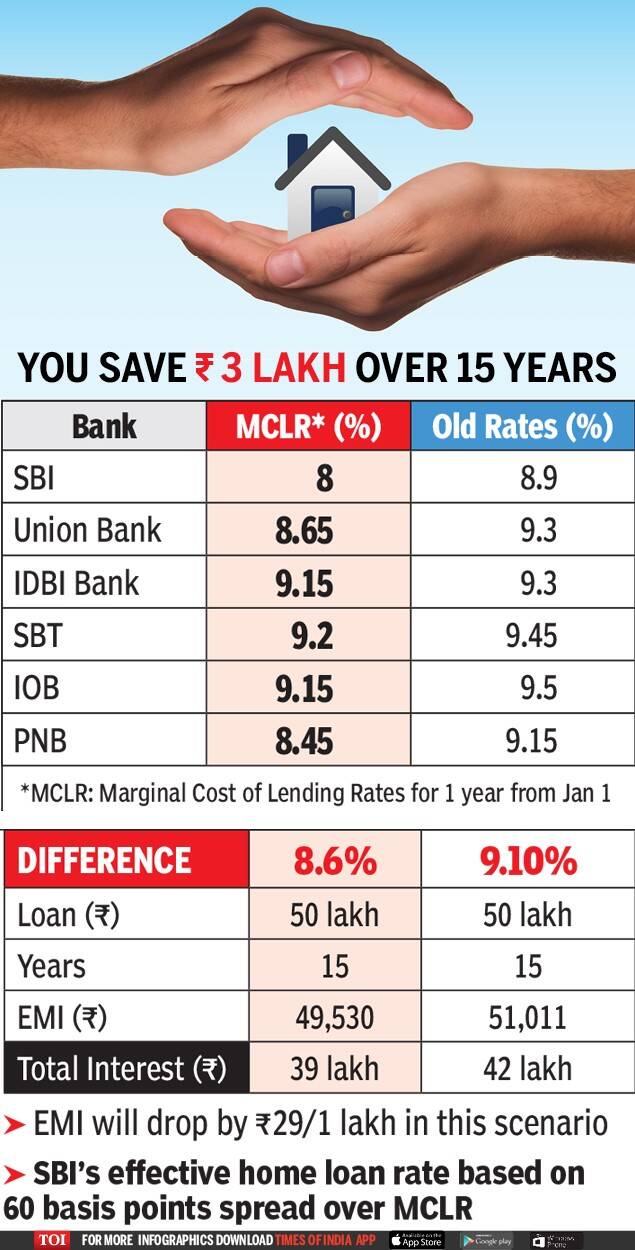

Home Loan To Become Cheapest In 6 Years As SBI Other Banks Slash Rates

https://static.toiimg.com/photo/56289211.cms

https://www.bajajfinserv.in/tax-benefits-on-home-loan

Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a home loan interest

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Section 24 Income Tax Benefit Of A Housing Loan OneMint

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Home Loan Tax Benefits In India Important Facts

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Tax Rebate Calculator On Home Loan TAXW

INCOME TAX REBATE ON HOME LOAN ON HOME LOAN CONVENTIONAL LOAN DOWN

INCOME TAX REBATE ON HOME LOAN ON HOME LOAN CONVENTIONAL LOAN DOWN

How To Claim Interest On Home Loan Deduction While Efiling ITR

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

How Do Banks Determine Home Loan Amounts LOANOLK

Tax Rebate In Home Loan - Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than