Tax Rebate In India For Employees Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

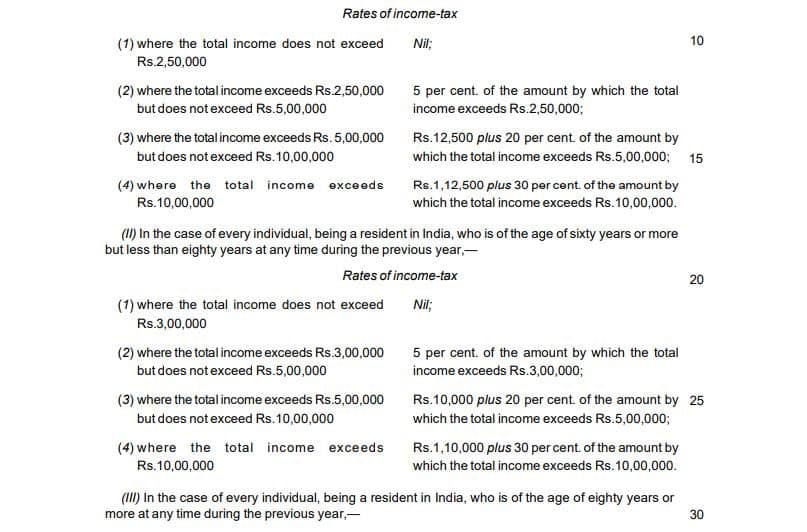

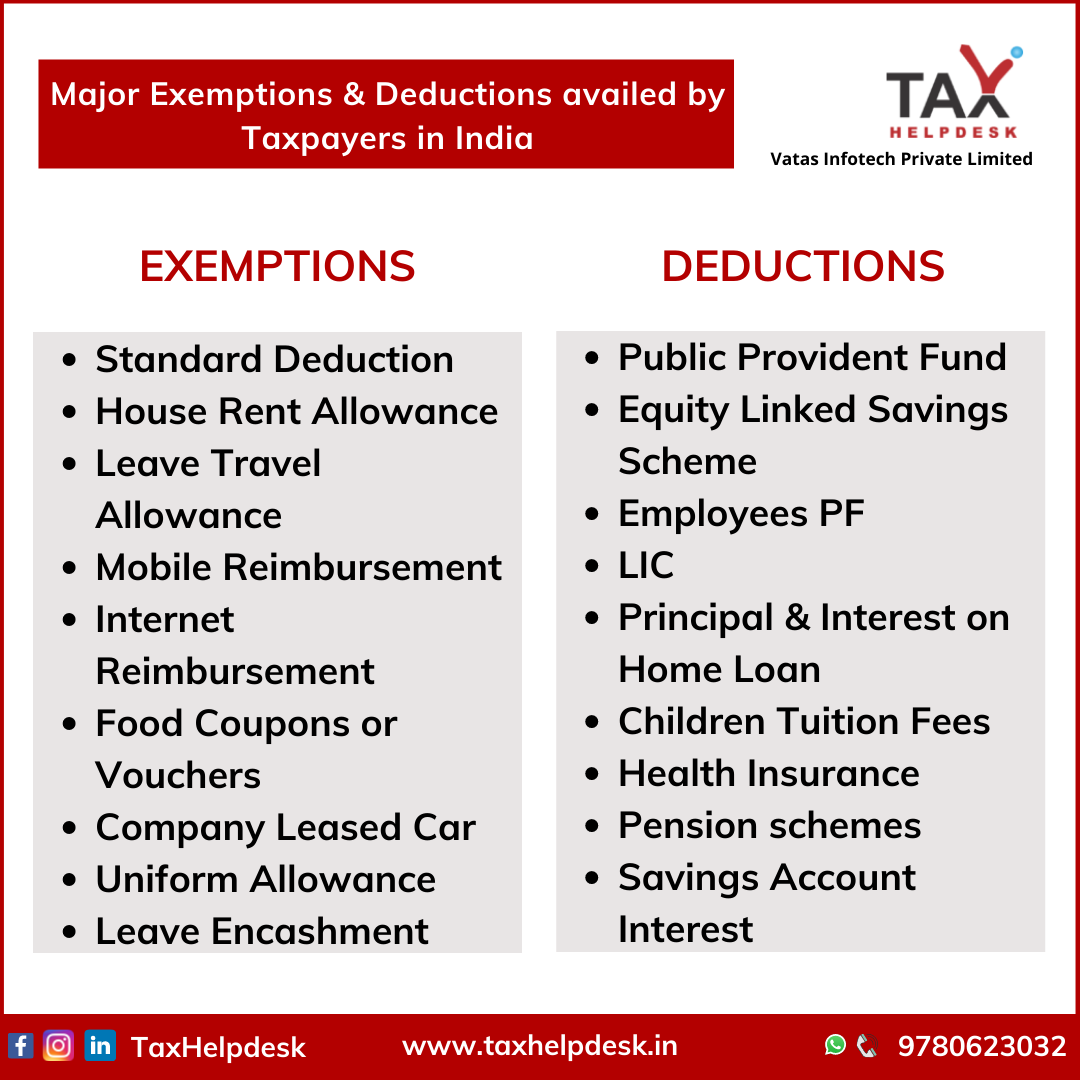

Web 15 f 233 vr 2023 nbsp 0183 32 Given below are the various tax saving options for salaried individuals under the old tax regime to save income tax for the current FY 2022 23 Common deductions Web Salary Income from capital gains Income from business or profession Income from house property Income from other sources Now the government puts forth various tax slabs

Tax Rebate In India For Employees

Tax Rebate In India For Employees

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Income Tax Slab Ay 2019 2020 In Pdf Carfare me 2019 2020

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Web Tax deduction under Chapter VIA will not be available to a taxpayer opting for the New Tax Regime u s 115BAC except for deduction u s 80CCD 2 Rebate u s 87A The rebate is Web 2 f 233 vr 2023 nbsp 0183 32 The limit of total income for rebate under section 87A of the Income tax Act 1961 has been increased from Rs 5 lakh to Rs 7 lakh for those opting for the new tax

Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with Web 30 mars 2023 nbsp 0183 32 If your company makes contributions to your NPS account you are qualified to deduct such contributions from your gross income as a salaried employee The

Download Tax Rebate In India For Employees

More picture related to Tax Rebate In India For Employees

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

https://finance.zohocorp.com/wp-content/uploads/2020/03/New-tax-rate-1536x972-1.png

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Web Tax rebate is available for individuals and Hindu Undivided Families residing in India The actual expense or Rs 40 000 whichever is less can be claimed for tax deductions You Web 1 f 233 vr 2023 nbsp 0183 32 Income Tax Rebate in Budget 2023 Live Income Tax Slabs 2023 24 Live Updates Check the latest news and updates on Personal Income Tax changes new saving investment and taxation rules in India

Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be nil of such individual in both New Web 1 nov 2022 nbsp 0183 32 TAX REBATES YOU HAVE TO FORGO IN NEW TAX REGIME If you opt for income tax option under section 115bac of Income tax act you have to forgo the

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Income Tax Rebate In Interim Budget 2019 Comes With A Big Rider India

https://english.cdn.zeenews.com/sites/default/files/Finance-Bill.jpg

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

https://economictimes.indiatimes.com/wealth/tax/tax-saving-options-for...

Web 15 f 233 vr 2023 nbsp 0183 32 Given below are the various tax saving options for salaried individuals under the old tax regime to save income tax for the current FY 2022 23 Common deductions

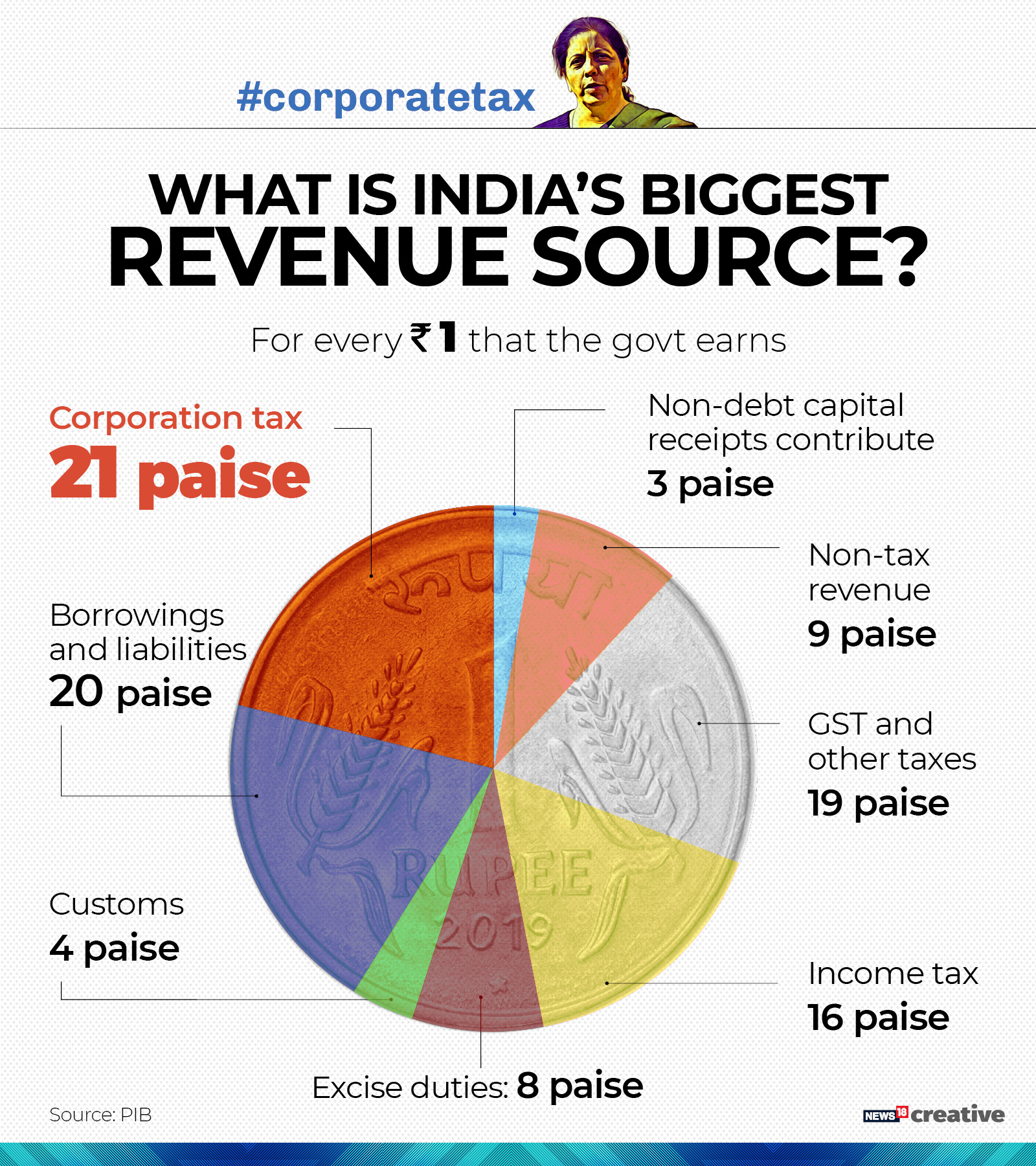

All About Corporate Tax In India For Your Business SME Infoline

Income Tax Deductions List FY 2019 20

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Tax Rebate For Individual Deductions For Individuals reliefs

What Are The Best Ways To Manage Tax Rebates

Tax Rebate In India For Employees - Web 14 f 233 vr 2022 nbsp 0183 32 Income tax deductions for salaried employees 2021 22 Section 80 of the Income Tax Act allows several tax deductions to salaried employees Let s look at some