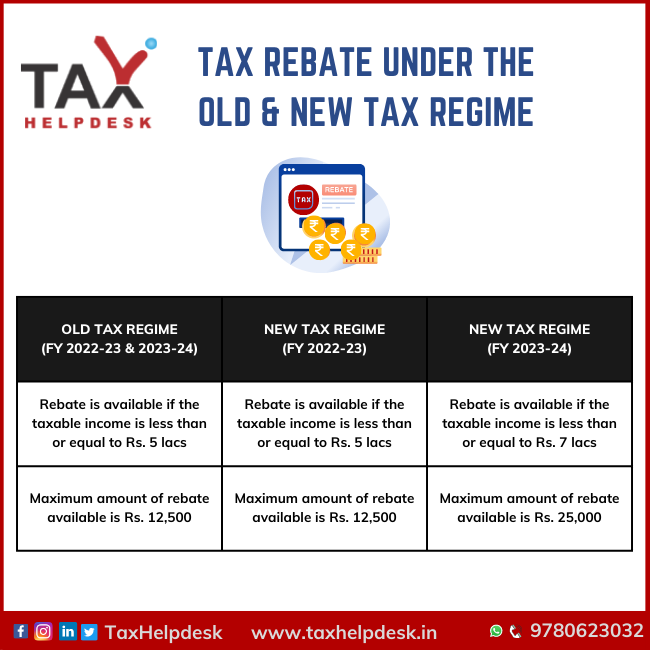

Tax Rebate In New Regime 9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed

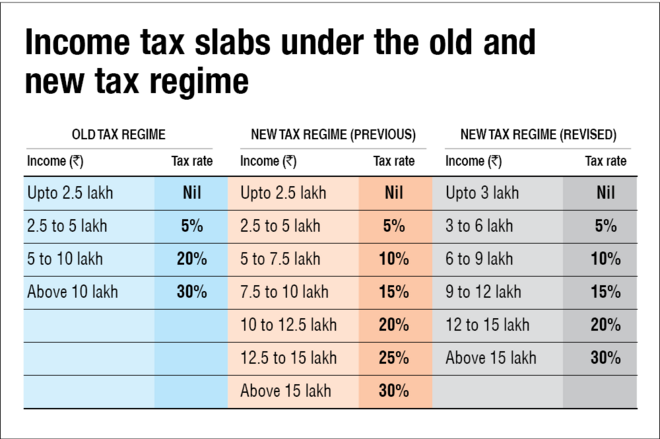

The Budget 2024 has revised the tax slabs in the New Regime providing taxpayers with an extra opportunity to save Rs 17 500 in taxes Additionally the In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs

Tax Rebate In New Regime

Tax Rebate In New Regime

https://www.valueresearchonline.com/content-assets/images/52110_468973008-old-vs-new-1__w660__.png

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

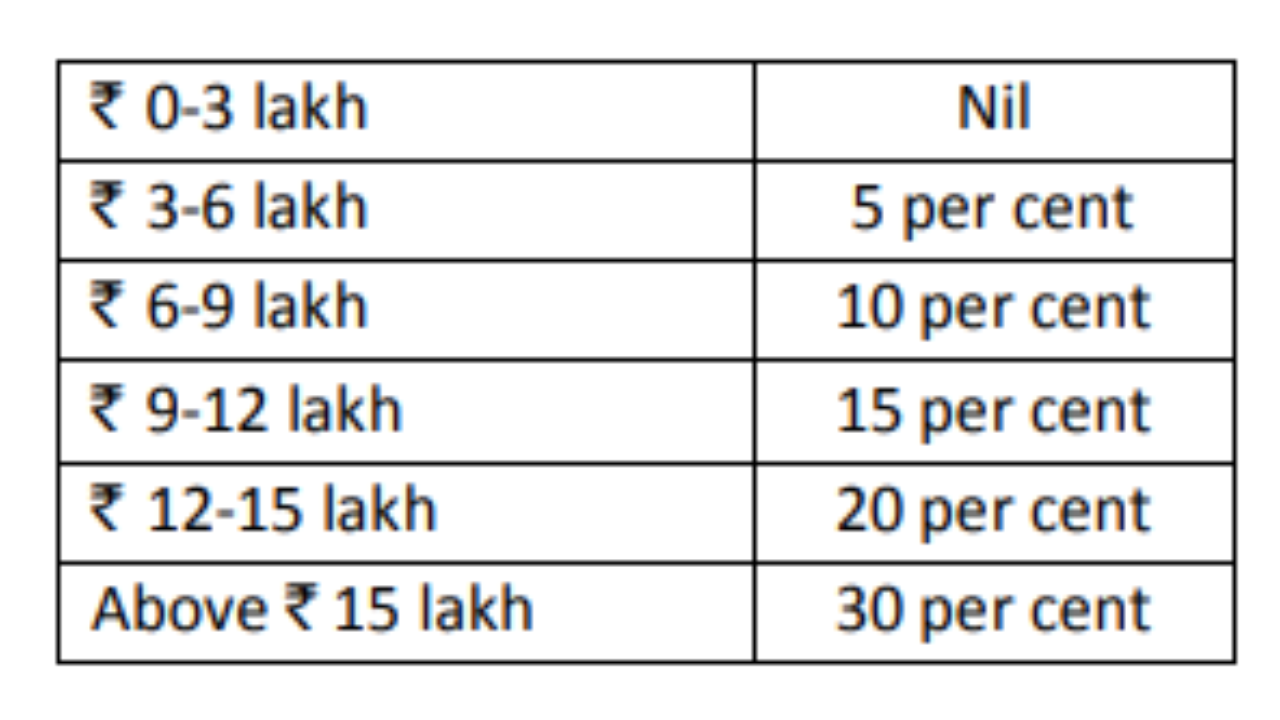

Income tax slabs for FY2023 24 under the new tax regime are as follows Impact The changes in the income tax slabs under the new tax regime have made it Know all the changes announced in the new tax regime from income tax slabs to standard deduction limit in Budget 2024 This is due to tax rebate of up to Rs

The new tax slabs under the new income tax regime will be effective from April 1 2024 Assessment Year 2025 26 The proposed structure widens the income The Section 87A rebate has been increased under the new tax regime for taxable incomes up to Rs 7 lakh Individuals with taxable income of less than Rs 7 lakh

Download Tax Rebate In New Regime

More picture related to Tax Rebate In New Regime

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

https://www.tbsnews.net/sites/default/files/styles/social_share/public/images/2023/05/10/p1_infograph_no-more-tax-rebate-for-secondary-share.png

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/tax-graphic-1.jpg?itok=AFs3rjIf

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

10 Tax Rebate up to Rs 7 lakh 9 00 001 12 00 000 15 12 00 001 15 00 000 20 the Standard deduction from 50 000 to 75 000 for individuals opting In the Old Tax Regime the Section 87A rebate is available only to individuals with taxable income of up to Rs 5 lakhs However in the New Tax Regime this rebate is extended

[desc-10] [desc-11]

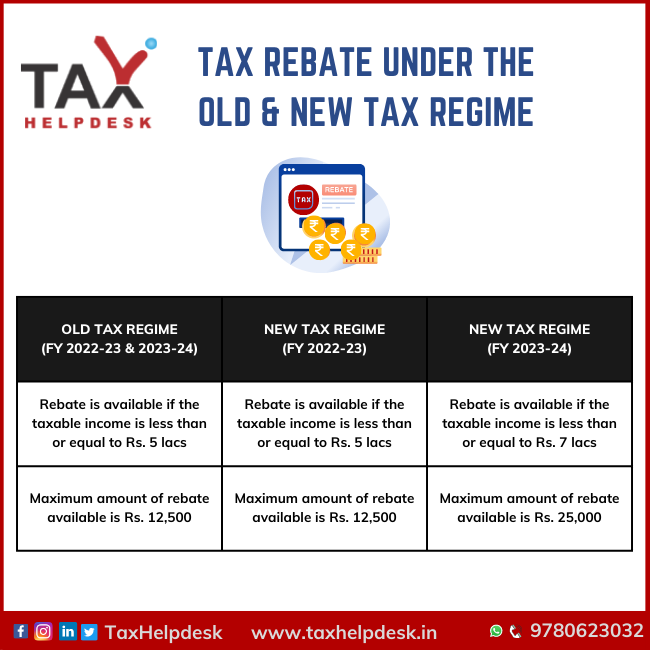

Tax Rebate Under The Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/Tax-rebate-under-the-old-new-tax-regime.png

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/ezgif.com-gif-maker_78-sixteen_nine.jpg?VersionId=xUwpmYRrPS0rtimFBRBauVHLpBCu3Uq9&size=690:388

https://www.incometax.gov.in/iec/foportal/sites...

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed

https://cleartax.in/s/income-tax-slabs

The Budget 2024 has revised the tax slabs in the New Regime providing taxpayers with an extra opportunity to save Rs 17 500 in taxes Additionally the

Income Tax Clarification Opting For The New Income Tax Regime U s

Tax Rebate Under The Old New Tax Regime

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Finance News Latest Financial News Finance News Today In Bangladesh

Income Tax Slab For 2023 24 Pdf Printable Forms Free Online

Income Tax Slab For 2023 24 Pdf Printable Forms Free Online

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Tax Rebate In New Regime - The new tax slabs under the new income tax regime will be effective from April 1 2024 Assessment Year 2025 26 The proposed structure widens the income