Tax Rebate In Nigeria Web 1 sept 2023 nbsp 0183 32 As a result of the consolidated relief allowance of at least 21 of gross income the top marginal tax rate is 18 96 for income above NGN 20 million as only

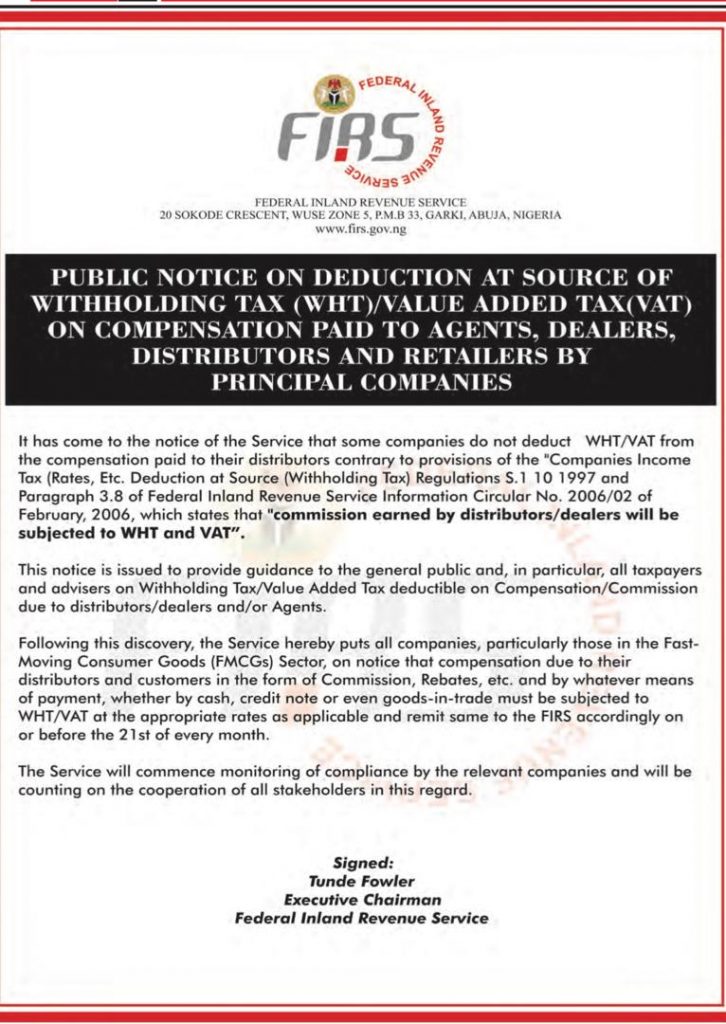

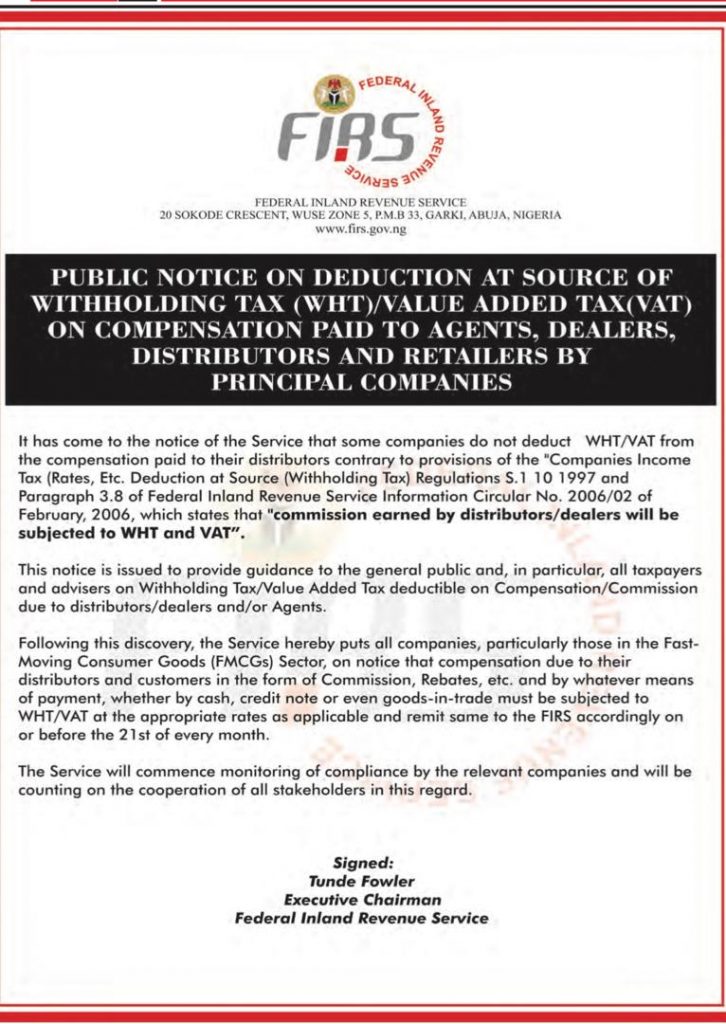

Web 22 sept 2022 nbsp 0183 32 The PITA imposes a tax on the total income of taxable persons subject to a few exemptions which may be found under the Third Schedule to the PITA Third Web 11 October 2019 Taxing trade incentives in Nigeria a conundrum Introduction Trade incentives ranging from commissions to volume discounts and rebates are one of the

Tax Rebate In Nigeria

Tax Rebate In Nigeria

https://aataxmanagement.com/blog/wp-content/uploads/2019/08/WHT-VAT-PUBLIC-NOTICE-726x1024.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

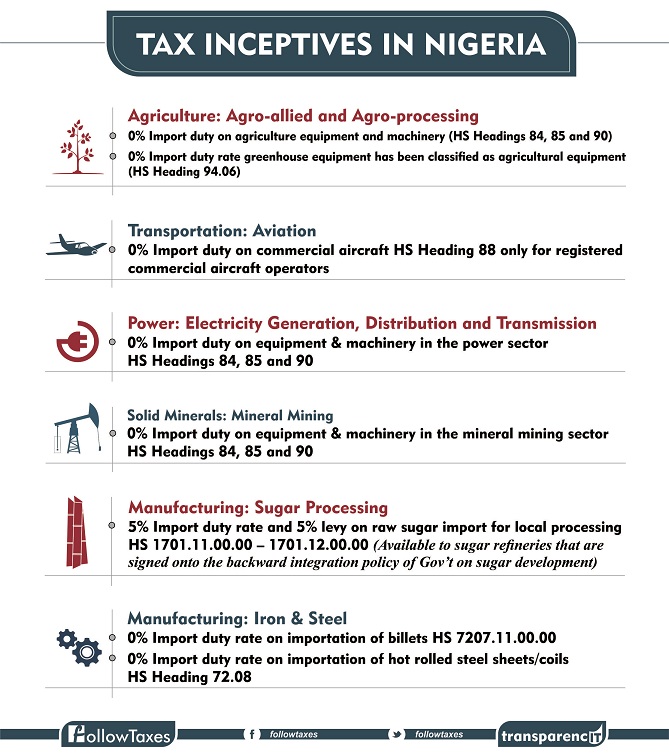

Tax Incentives In Nigeria TransparencIT

https://transparencit.com/wp-content/uploads/2019/07/t2.jpg

Web 16 mai 2019 nbsp 0183 32 In getting a tax refun in Nigeria the underlisted items must be presented by the Taxpayer before a Tax Refund can be processed The taxpayer must be registered Web 1 sept 2023 nbsp 0183 32 Last reviewed 01 September 2023 Individuals resident in Nigeria are taxable on their worldwide income In the case of employment a non resident person is

Web 11 f 233 vr 2019 nbsp 0183 32 The above notwithstanding tax authorities in Nigeria usually view discounts and rebates with skepticism Sometimes they seek to adjust the income tax Web 6 d 233 c 2022 nbsp 0183 32 Nigeria s proven natural gas reserves according to the Department of Petroleum Resources DPR have risen to 209 5 trillion cubic feet TCF as of January 1

Download Tax Rebate In Nigeria

More picture related to Tax Rebate In Nigeria

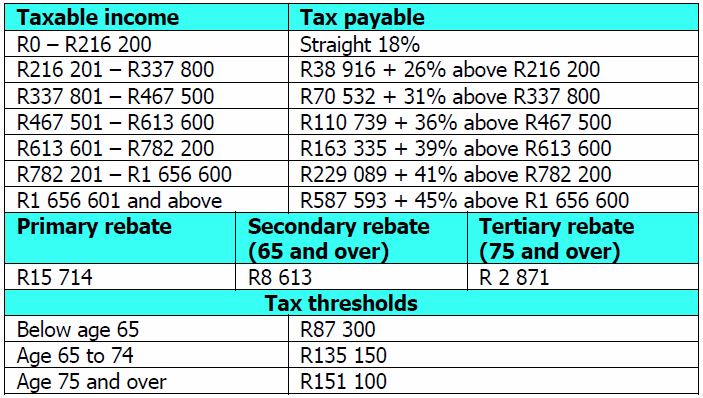

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Council Tax Rebate Unexclusive Bloggers Diaporama

https://www.hyndburnbc.gov.uk/wp-content/uploads/2022/03/council-tax-rebate.png

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Web 24 janv 2019 nbsp 0183 32 The Nigerian Tax Incentives and Relief Policy Saka Muhammed Olokooba Chapter First Online 24 January 2019 115 Accesses Objectives The main objective of Web The Nigeria Income Tax Calculator is designed for Tax Resident Individuals who wish to calculate their salary and income tax deductions for the 2023 Tax Assessment year 1

Web Business or trade only partially carried on or deemed to be carried on in Nigeria 7 Relevant tax authority may assess and charge tax on the turnover of a business etc 8 Web 11 nov 2019 nbsp 0183 32 Tax rebate Section 33 4 d of Personal Income Tax Act PITA allows a deducon of the annual amount of any premium paid by an individual in respect of

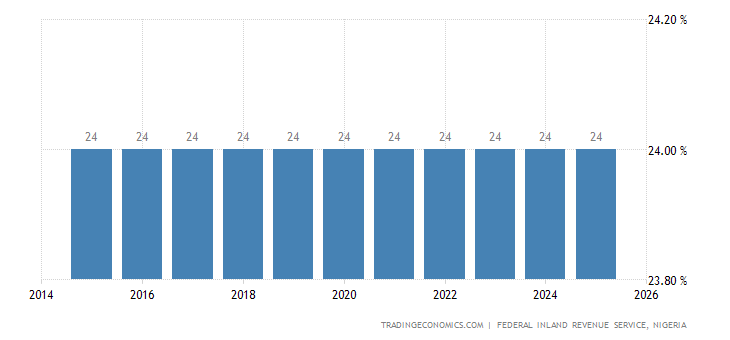

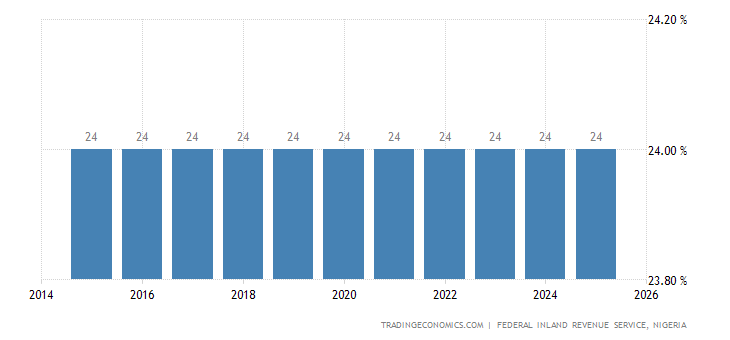

Nigeria Personal Income Tax Rate 2022 Data 2023 Forecast 2011

https://d3fy651gv2fhd3.cloudfront.net/charts/nigeria-personal-income-tax-rate.png?s=nigeriaperinctaxrat&v=202107132317V20220312

How To Calculate Tax Returns In Nigeria Tax Walls

https://i0.wp.com/nairametrics.com/wp-content/uploads/2016/07/Tax-payable.jpg?ssl=1

https://taxsummaries.pwc.com/nigeria/individual/deductions

Web 1 sept 2023 nbsp 0183 32 As a result of the consolidated relief allowance of at least 21 of gross income the top marginal tax rate is 18 96 for income above NGN 20 million as only

https://taxaide.com.ng/2022/09/22/tax-reliefs-available-under-the...

Web 22 sept 2022 nbsp 0183 32 The PITA imposes a tax on the total income of taxable persons subject to a few exemptions which may be found under the Third Schedule to the PITA Third

How To Calculate Tax Returns In Nigeria Tax Walls

Nigeria Personal Income Tax Rate 2022 Data 2023 Forecast 2011

Section 87A Tax Rebate Under Section 87A

How To Calculate Tax Returns In Nigeria Tax Walls

Tax Rebates 2022 IRS To Send Up To 750 To Each Eligible Taxpayer In

Nigeria Corporate Tax Rate 2022 Take profit

Nigeria Corporate Tax Rate 2022 Take profit

How Do I Claim The Recovery Rebate Credit On My Ta

Impact Of Taxation On Gov Revenue Generation In Nigeria

Pin On Tigri

Tax Rebate In Nigeria - Web 10 janv 2022 nbsp 0183 32 Failure by an employer to file the Returns within the statutory timeline attracts a fine of 500 000 and 50 000 upon conviction for corporate entities and