Tax Rebate In Usa On Business Property Loan In India Web 1 juin 2019 nbsp 0183 32 I bought an apartment in India last year it s still under construction and I have a home loan going there I live in US but I pay taxes and file returns both in US and

Web The Income Tax Act allows deduction under two heads for income from commercial property annual value a standard deduction and the deduction allowed for interest on Web According to Section 24 of the Income Tax Act 1961 commercial property owners who have taken a loan to buy construct repair or reconstruct can avail of a tax deduction of Rs 2 lakh on the interest component repaid

Tax Rebate In Usa On Business Property Loan In India

Tax Rebate In Usa On Business Property Loan In India

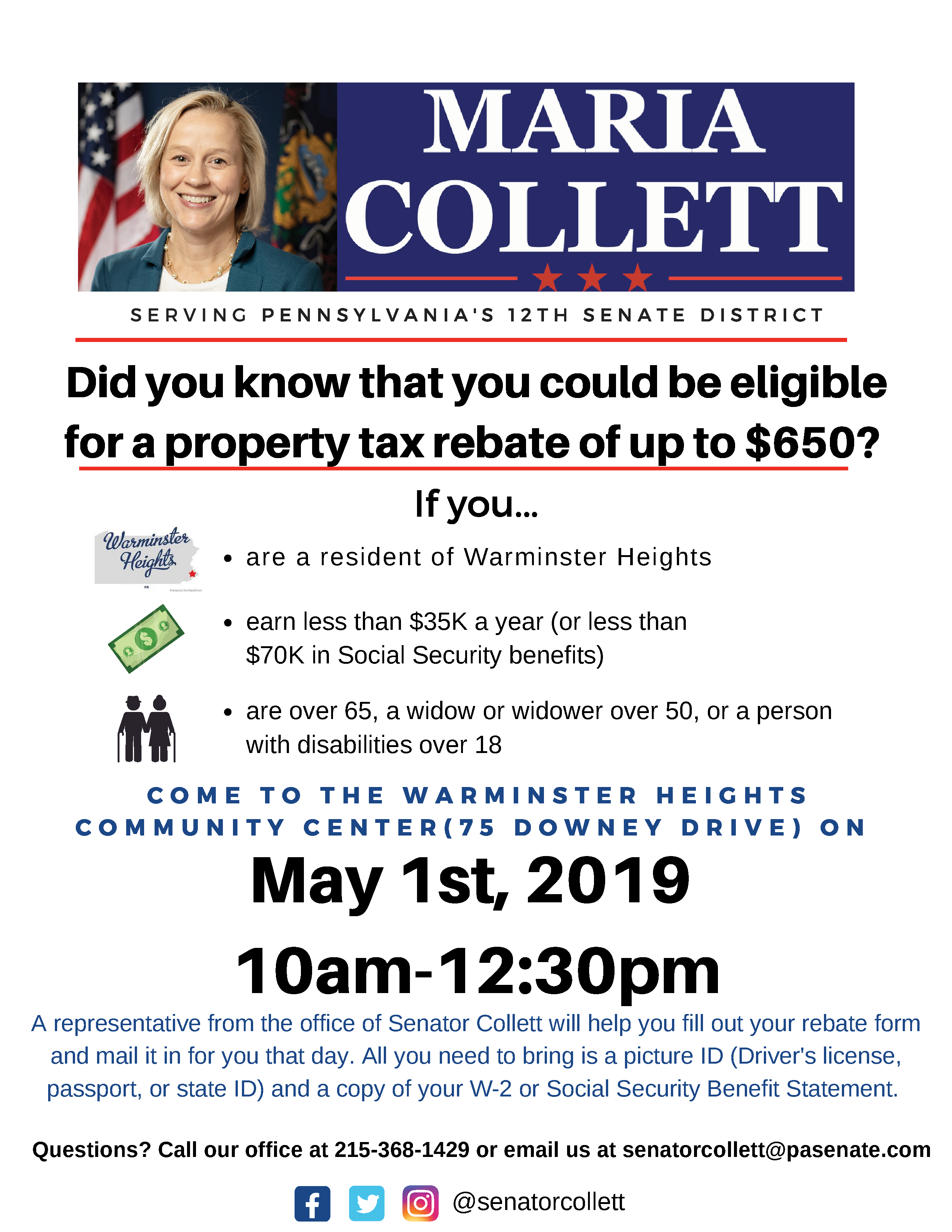

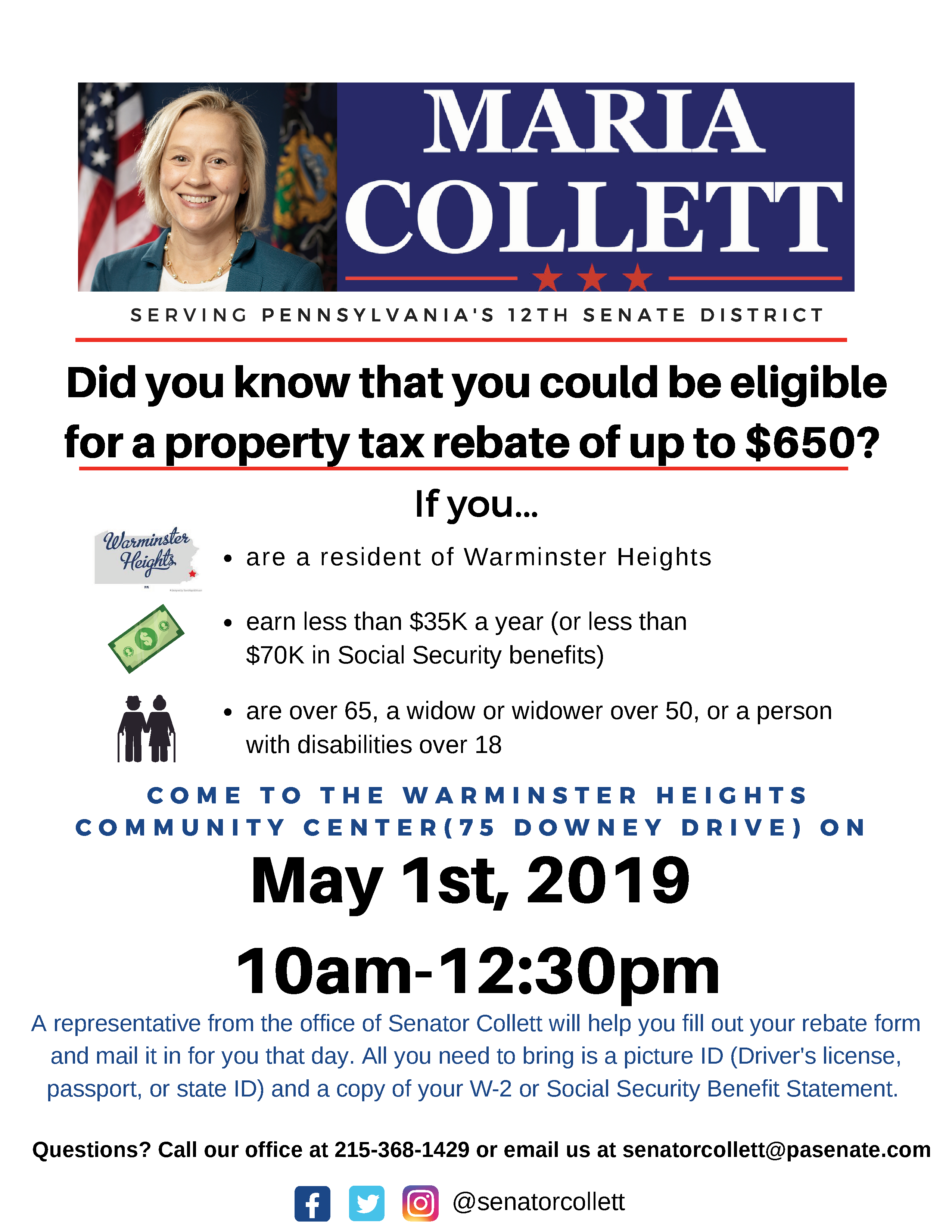

https://warminster-heights.org/wp-content/uploads/2019/04/Final-Warminster-Heights-Property-Tax-Rebate-4.png

Business Office Taxes

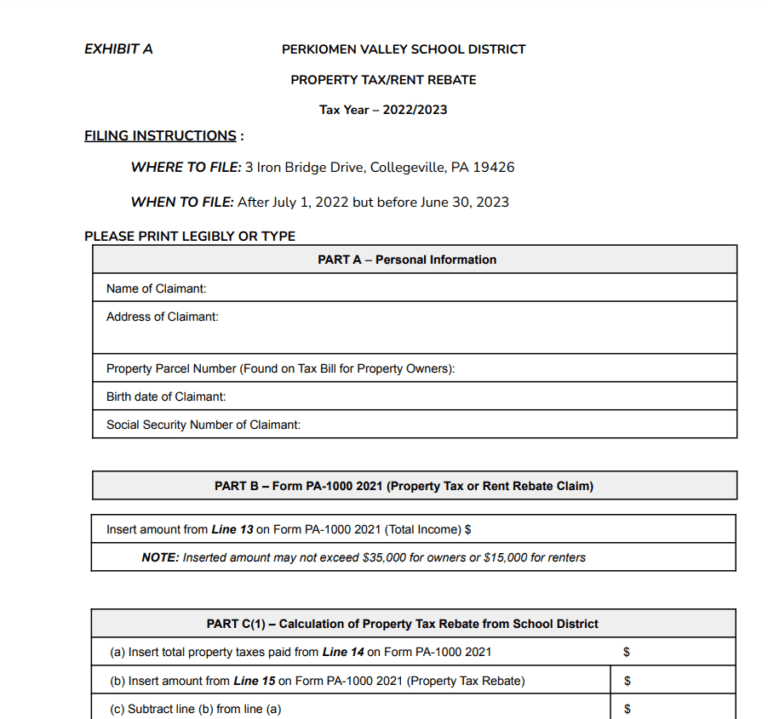

http://www.svpanthers.org/cms/lib/PA02203711/Centricity/Domain/14/PropertyTaxRebate_2018.jpg

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Web 28 juin 2022 nbsp 0183 32 The program is a way to reduce your property tax bills and help you maintain your home However there are a few requirements to be eligible You must have owned Web 10 mai 2021 nbsp 0183 32 The answer is Yes the interest you pay on your business is tax deductible that is generally subtracted from your gross income As per the Income Tax Act 1961 you can avail deduction on business loan

Web 19 sept 2022 nbsp 0183 32 Individuals can avail of tax benefits on business loans in the following ways Tax deduction on interest The interest paid by borrowers on business loans is tax deductible This lowers the interest Web Tax deductions under Section 37 1 are applicable when the loan amount is used for business purposes You can claim tax benefits on the interest charges processing fees

Download Tax Rebate In Usa On Business Property Loan In India

More picture related to Tax Rebate In Usa On Business Property Loan In India

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

https://i.ytimg.com/vi/Yo8nxqN-uJg/maxresdefault.jpg

Web 25 mai 2021 nbsp 0183 32 You can claim tax exemption from a loan against property if the loan amount is utilised for business purposes In such cases benefits can be claimed against Web Property Sale By NRI In India Tax TDS Rebate Repatriation RBI is a free printable for you This printable was uploaded at October 15 2022 by tamble in Tax Tax Rebate In Usa

Web 21 mars 2023 nbsp 0183 32 Borrowers can claim a tax rebate of up to Rs 1 5 lakh on the repayment of principal amount under Section 80C of the IT Act 1961 However to claim this deduction the house has to be held for 5 years or Web Get income tax benefits on home loan under section Section 24 80EE and 80C Know the maximum tax benefits you can claim on home loan in 2023

Tax Rebates Made Simple YouTube

https://i.ytimg.com/vi/EFZn93RDFJI/maxresdefault.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/i...

Web 1 juin 2019 nbsp 0183 32 I bought an apartment in India last year it s still under construction and I have a home loan going there I live in US but I pay taxes and file returns both in US and

https://www.elphosinvestments.com/tax-commercial-property-income-loan

Web The Income Tax Act allows deduction under two heads for income from commercial property annual value a standard deduction and the deduction allowed for interest on

Tax Rebate Services Find Out If You re Due A Tax Refund

Tax Rebates Made Simple YouTube

What Are The Best Ways To Manage Tax Rebates

Brewster Property Tax Rent Rebate Application Period Extended To End

PA Property Tax Rebate Forms Printable Rebate Form

Section 87A Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A

Top Notch Income Tax Calculation Statement How To Prepare A Cash Flow

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Ptr Tax Rebate Libracha

Tax Rebate In Usa On Business Property Loan In India - Web 10 mai 2021 nbsp 0183 32 The answer is Yes the interest you pay on your business is tax deductible that is generally subtracted from your gross income As per the Income Tax Act 1961 you can avail deduction on business loan