Tax Rebate Indiana 2024 Rebates for single family and multi family households for whole home retrofits with at least 20 energy savings Home Electrification and Appliance Rebates HEAR Rebates for low and moderate income single family and multi family households to purchase high efficiency equipment

The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and Massachusetts 62F Refunds Michigan Working Famlies Tax Credit Minnesota Rebate Checks Montana Tax Rebates New Mexico Rebate Checks Pennsylvania Rebate South Carolina Tax Rebate

Tax Rebate Indiana 2024

Tax Rebate Indiana 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1536x864.jpg

Indiana Tax Rebate 2023 Claim Your Tax Savings Today Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Indiana-Tax-Rebate-2023.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both The Indiana Department of Revenue DOR officially launches the 2024 individual income tax filing season following the Internal Revenue Service s schedule Commencing on January 29 2024 Hoosiers are encouraged to embrace electronic filing online payment and direct deposit for accurate and expedited tax returns and refunds Photo from Google

Explore the child tax credit and other provisions in the 2024 bipartisan tax deal Tax Relief for American Families and Workers Act of 2024 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income IR 2023 235 Dec 11 2023 WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

Download Tax Rebate Indiana 2024

More picture related to Tax Rebate Indiana 2024

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

State lawmakers last week approved a second round of rebates amounting to 200 per taxpayer on top of 125 payments that were triggered last summer by surging tax collections Roughly half of What are the energy rebate programs There are 2 rebate programs Home Efficiency Rebates also known as HER or HOMES will provide rebates for qualified energy efficiency upgrades and retrofits that achieve at least 20 energy savings Both single family and multifamily buildings are eligible

Indiana House approves 225 tax relief checks wthr Legislature takes up tax relief debate Watch on Hoosiers are now one step closer to getting a 225 tax relief check in their mailboxes To receive the 200 ATR refundable tax credit qualified taxpayers must file a 2022 Indiana resident tax return no later than Dec 31 2023 That means some Hoosiers who do not normally file a tax return due to their income will need to file a 2022 state tax return to claim the ATR as a tax credit

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://www.in.gov/oed/grants-and-funding-opportunities/homeowner-incentives/

Rebates for single family and multi family households for whole home retrofits with at least 20 energy savings Home Electrification and Appliance Rebates HEAR Rebates for low and moderate income single family and multi family households to purchase high efficiency equipment

https://news.yahoo.com/indiana-tax-cuts-significant-changes-014849426.html

The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

Income Tax Rebate Under Section 87A

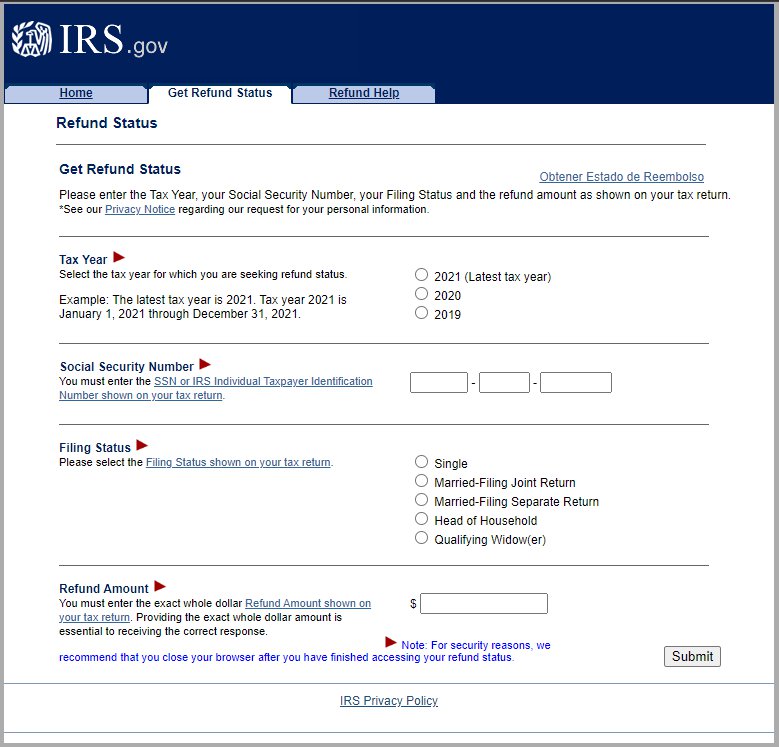

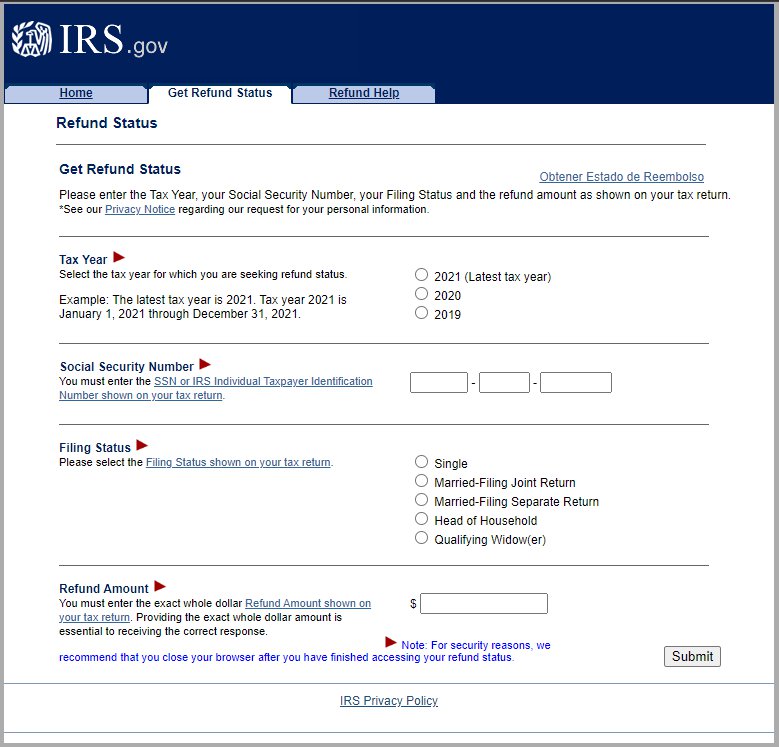

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

How To Increase The Chances Of Getting A Tax Refund CherishSisters

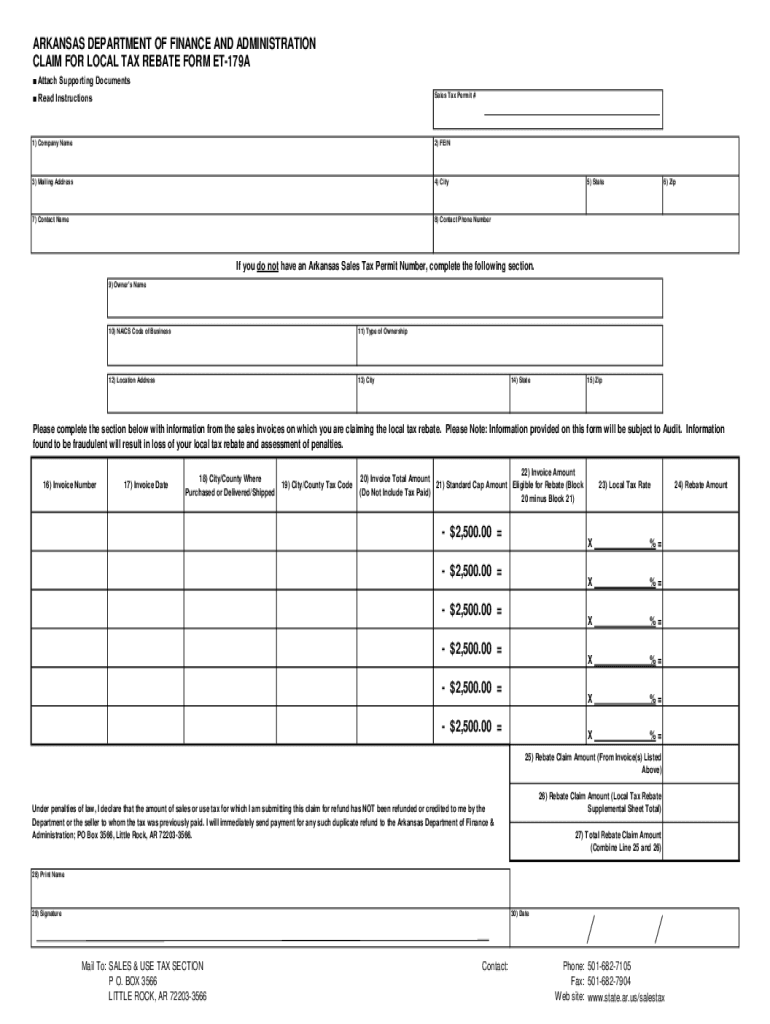

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Tax Rebate Indiana 2024 - Explore the child tax credit and other provisions in the 2024 bipartisan tax deal Tax Relief for American Families and Workers Act of 2024 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income