Tax Rebate Insulation 2024 For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime limit until 2032 Note that the tax credit only covers the cost of insulation materials and not labor The insulation tax credit for 2023 features a significant

30 of product cost 1 200 maximum amount credited Annual Limits on Energy Efficient Home Improvement Tax Credits In addition to limits on the amount of credit you can claim for any particular equipment installation or home improvement there are annual aggregate limits The overall total limit for an efficiency tax credit in one year is 3 200 5 min read Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more comfortable Fokusiert Getty Images There s been a lot of buzz

Tax Rebate Insulation 2024

Tax Rebate Insulation 2024

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act 5 ways to save in 2023 with home energy tax credits In the case of property placed in service after December 31 2022 and before January 1 2024 22 Insulation Residential energy property expenditures include the following qualifying products 2017 but was retroactively extended for tax years 2018 2019 and 2020 on December 20 2019 as part of the Further Consolidated Appropriations

January 25 2024 An Update to The Purchasing Power of American Households providing a total credit of up to 1 200 annually for installing insulation or efficient windows and doors with a special credit of as much as 2 000 for electric heat pumps that provide super efficient heating and cooling including a 150 credit for a home The Inflation Reduction Act of 2022 part of the United States goal to reach net zero by 2050 provides nearly 369 billion for renewable energy equipment and energy efficient home improvements This is a powerful strategy as using low carbon building materials can significantly cut emissions while preserving a building s performance

Download Tax Rebate Insulation 2024

More picture related to Tax Rebate Insulation 2024

Massachusetts Insulation Tax Rebates

https://5cenergyinc.com/wp-content/uploads/2023/02/massachusetts-insulation-tax-rebate-1024x576.jpg.webp

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

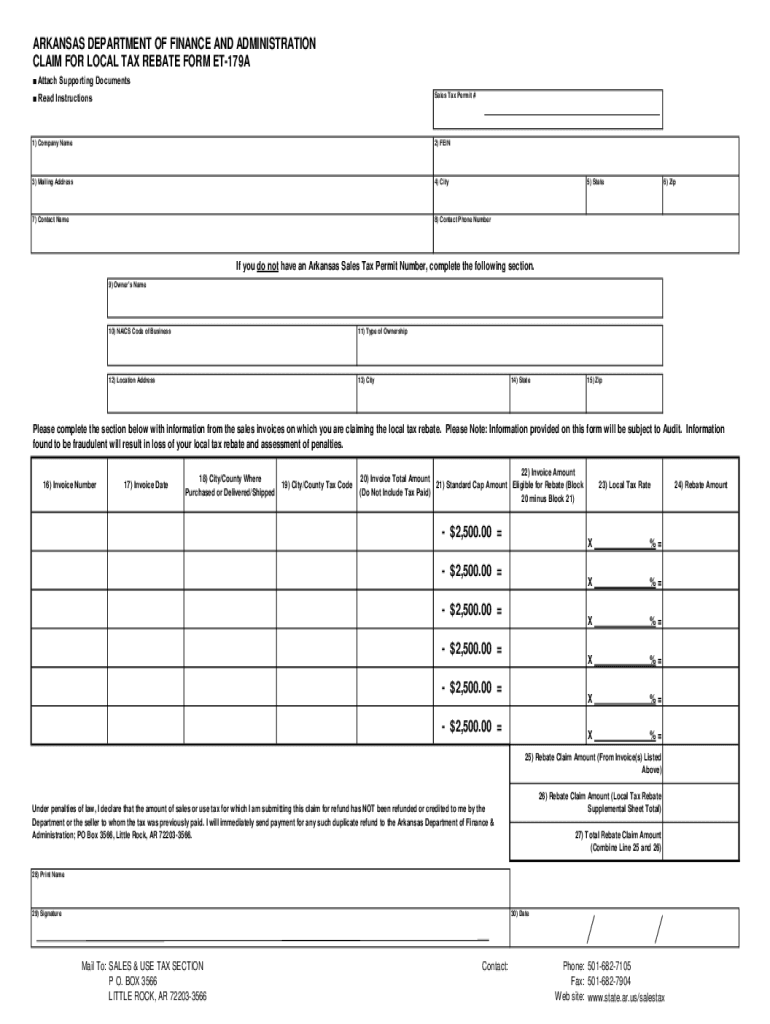

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/620/550/620550056/large.png

2024 INSULATION AND AIR SEALING REBATE APPLICATION tax classification and tax ID number must be provided etc can receive a rebate Existing attic insulation must be as specified in the measure description R 11 between R 12 and R 19 or between R 20 and R 38 excluding assembly section Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Insulation Weatherization Rebates Incentives Upgrading your home s insulation is one of the best ways to make it way more efficient and comfortable How do we know Here s some proof We re Sealed and we re home energy experts on a mission to make homes healthier more efficient and more comfortable year round On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

The New Federal Tax Credits And Rebates For Home Energy Efficiency

https://www.ny-engineers.com/hs-fs/hubfs/home insulation.jpg?width=2250&name=home insulation.jpg

https://www.joinarbor.com/resources/insulation-tax-credit

For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime limit until 2032 Note that the tax credit only covers the cost of insulation materials and not labor The insulation tax credit for 2023 features a significant

https://www.energystar.gov/about/federal_tax_credits/insulation

30 of product cost 1 200 maximum amount credited Annual Limits on Energy Efficient Home Improvement Tax Credits In addition to limits on the amount of credit you can claim for any particular equipment installation or home improvement there are annual aggregate limits The overall total limit for an efficiency tax credit in one year is 3 200

Tax Rebate Checks What Eligible Recipients Need To Know

Income Tax Rebate Under Section 87A

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Why The NJ Homestead Tax Rebate Application Is For 2013 WHYY

Printable Blank Form 4923h Mo Printable Forms Free Online

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

5 Ways To Make Your Tax Refund Bigger The Motley Fool

Rebate Insulation Program 911 Attic Insulation

The Advance Tax Rebate Scheme By Jammu And Kashmir Will Start From May 26

Tax Rebate Insulation 2024 - The Inflation Reduction Act of 2022 part of the United States goal to reach net zero by 2050 provides nearly 369 billion for renewable energy equipment and energy efficient home improvements This is a powerful strategy as using low carbon building materials can significantly cut emissions while preserving a building s performance