Tax Rebate List 2024 IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of qualifying EVs for the tax rebate in 2024 The automotive world is in the middle of a seismic change Electric cars are becoming ever more prominent on our

Tax Rebate List 2024

Tax Rebate List 2024

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

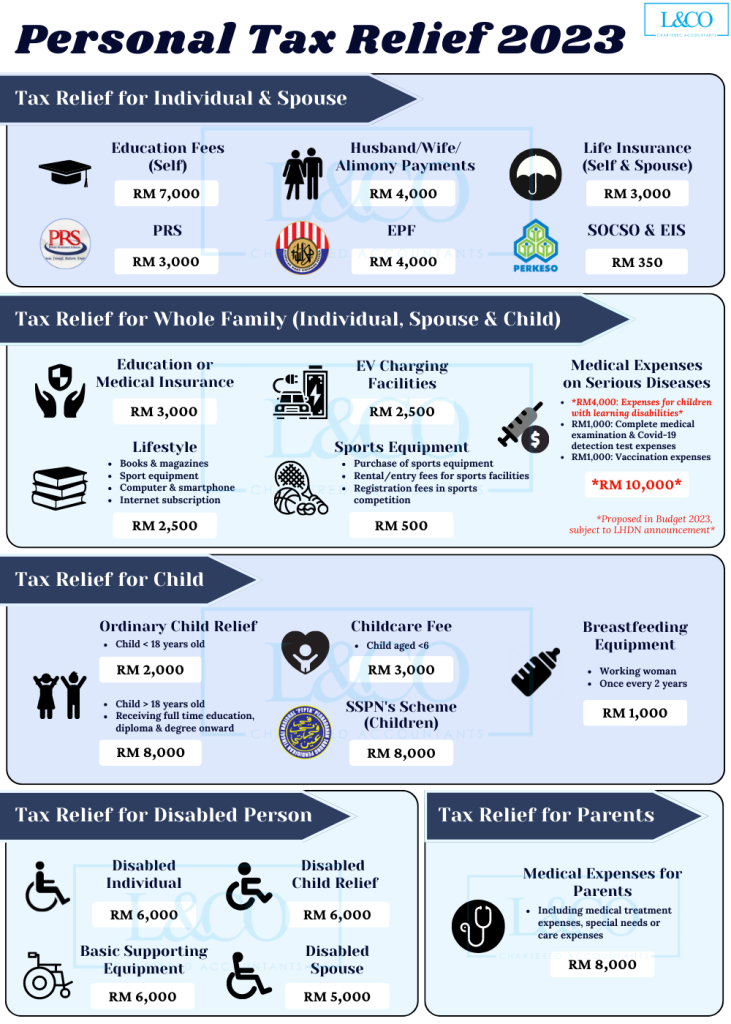

Personal Tax Relief Y A 2023 L Co Accountants

https://landco.my/wp-content/uploads/2023/07/Personal-Tax-Relief-2023-731x1024.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit The EV Tax Credit Now Acts Like an Instant Rebate Changes to the EV tax credit in 2024 allow an immediate discount on an EV purchase but there are additional requirements that shorten the list

To claim the credit for vehicles placed in service before January 1 2024 file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with your tax return Starting January 1 2024 credit eligibility and amount will be determined at the time of sale using the IRS Energy Credits Online website 2022 2024 Ford Escape Plug in Hybrid with an MSRP limit of 80 000 2022 2024 Jeep Grand Cherokee PHEV 4xe with an MSRP limit of 80 000 2022 2024 Jeep Wrangler PHEV 4xe with an MSRP limit of

Download Tax Rebate List 2024

More picture related to Tax Rebate List 2024

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The rules surrounding EV tax rebate eligibility will change in the US in 2024 There are still a lot of unanswered questions about which cars will be eligible for the full 7 500 federal incentive

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax A new law now offers a tax rebate on some used EVs and PHEVs purchased from dealers The final sale price must be 25 000 or less for vehicles at least 2 model years old and the buyer s

Personal Tax Relief 2021 L Co Accountants

https://landco.my/wp-content/uploads/2021/11/Personal-Tax-Relief-2021-724x1024.png

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Personal Tax Relief 2021 L Co Accountants

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Income Tax Rebate Under Section 87A

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

How To Increase The Chances Of Getting A Tax Refund CherishSisters

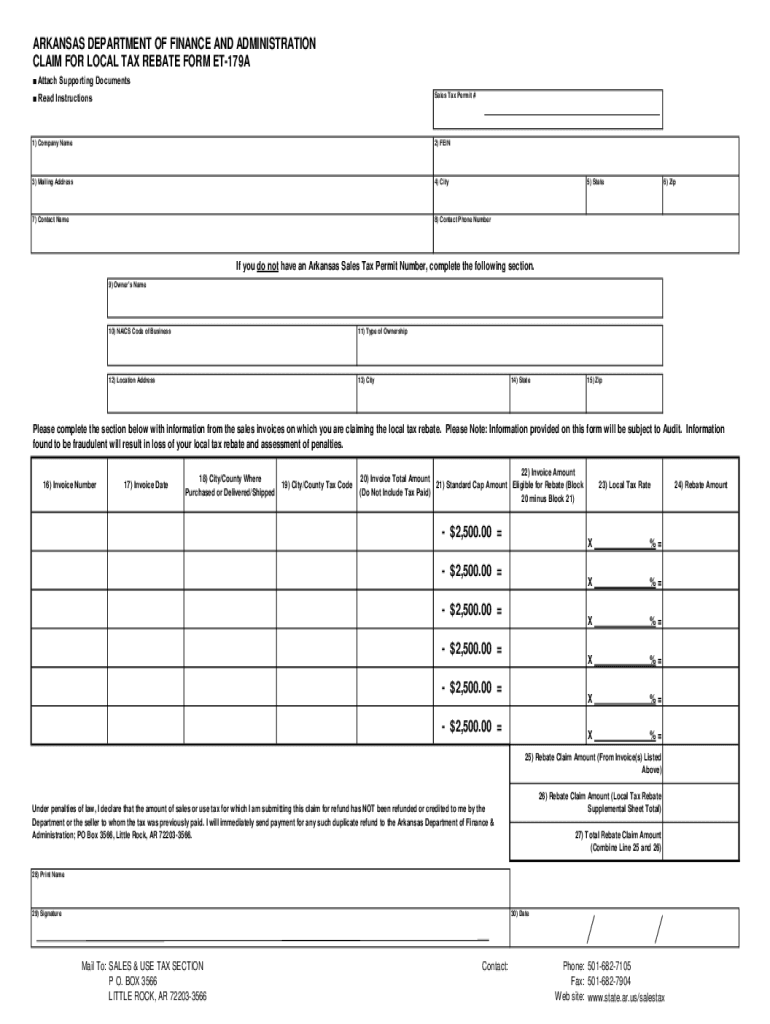

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Tax Rebate List 2024 - To claim the credit for vehicles placed in service before January 1 2024 file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with your tax return Starting January 1 2024 credit eligibility and amount will be determined at the time of sale using the IRS Energy Credits Online website