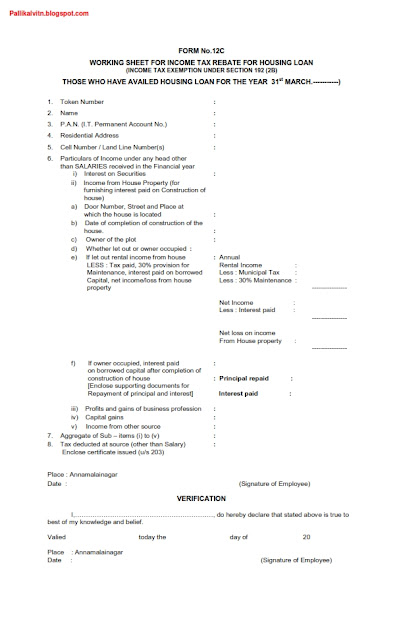

Tax Rebate Loan Repayment Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web To facilitate convenient repayment of the loan tax authorities provide a moratorium period of up to one year to the borrower from the date of completing the course to start repaying the loan Effectively one can Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Tax Rebate Loan Repayment

Tax Rebate Loan Repayment

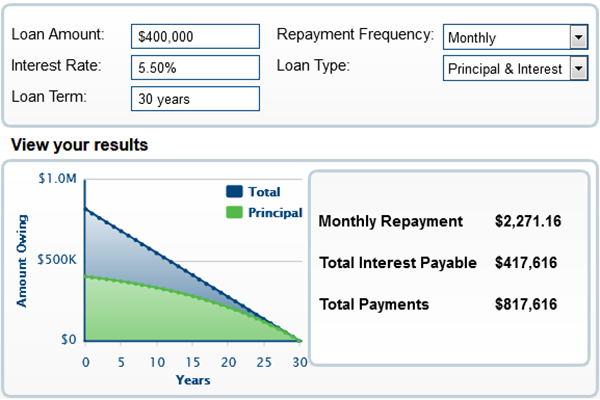

https://www.mirren.com.au/wp-content/uploads/2018/02/Loan-Repayment-Calculator-1.png

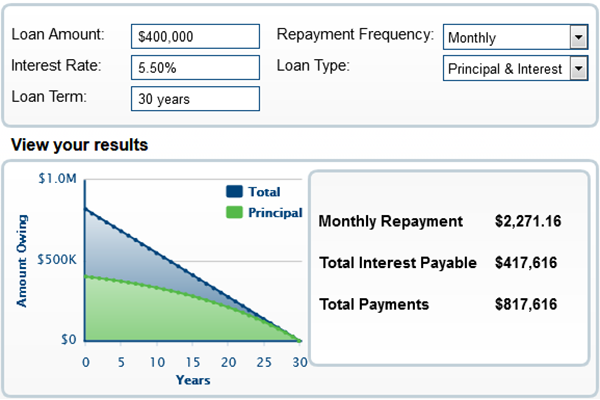

Parent Plus Loan Repayment Calculator TaurabMaies

https://lendedu.com/wp-content/uploads/2016/03/federal-student-loan-repayment-options-1.png

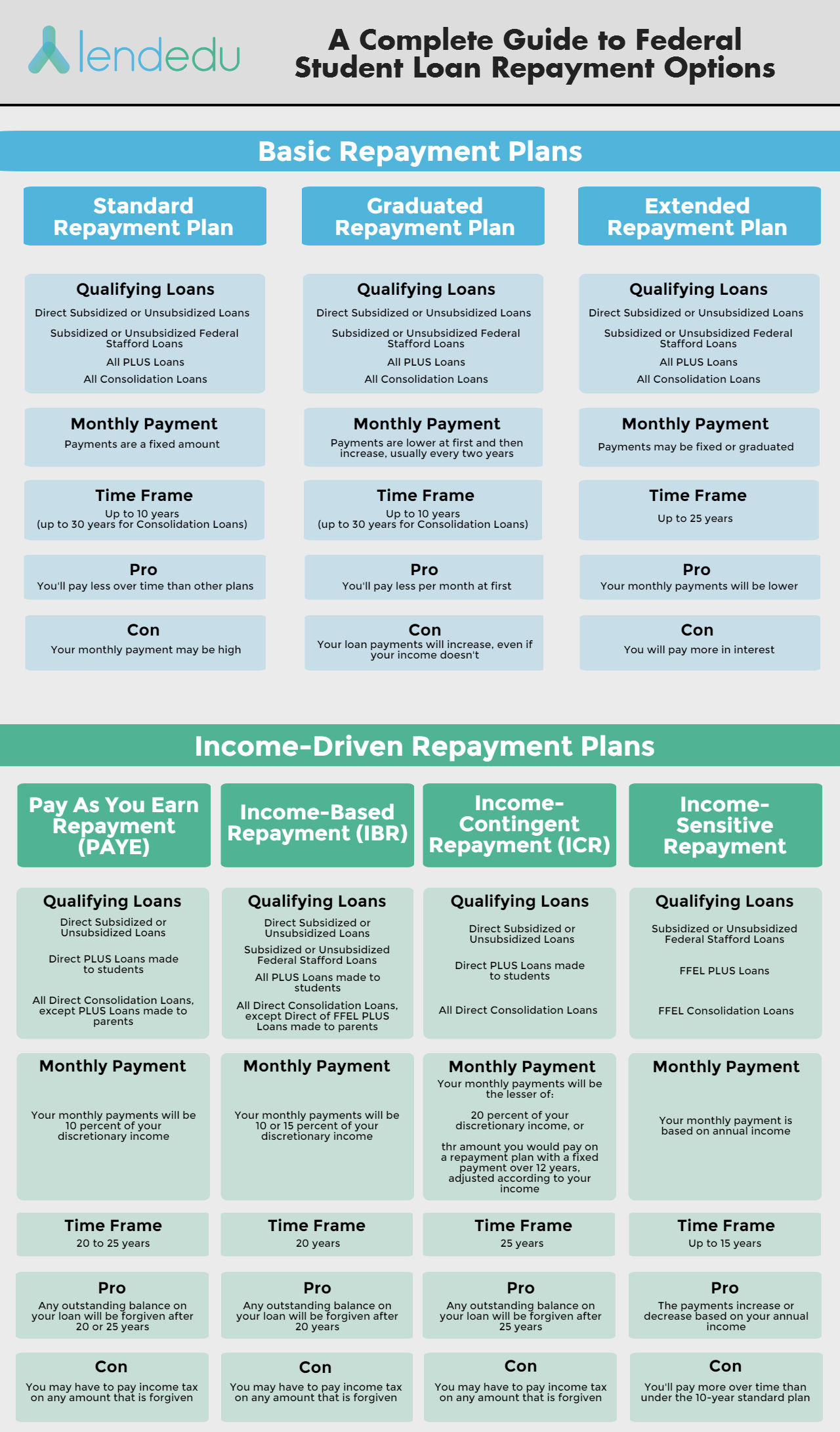

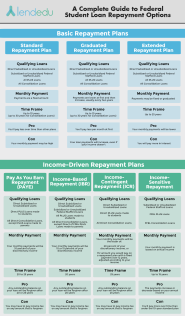

What Is An Income based Repayment IBR Student Loan Repayment Plan

https://d3tc5xafqqxqk8.cloudfront.net/wp-content/uploads/2020/11/25180439/image4-2-768x402.png

Web Section 80E Deduction for Repayment of Interest on Education Loan If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Web Comment faire une demande de remboursement de cr 233 dit d imp 244 t en ligne Puis je pr 233 tendre au cr 233 dit imp 244 t recherche Puis je pr 233 tendre au cr 233 dit d imp 244 t famille Puis

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return Web 6 sept 2023 nbsp 0183 32 2 Choose Your Student Loan Repayment Plan Wisely After you see how much you owe in student loan debt there s a good chance you ll need to take a

Download Tax Rebate Loan Repayment

More picture related to Tax Rebate Loan Repayment

Dah Sing Bank Limited

http://www.dahsing.com/edm/images/edm_pl_1209_emif/edm_pl_1209_emif_5_e.gif

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s640/FORM12C_2015_16_001.jpg

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Web Il y a 2 jours nbsp 0183 32 Income Based Repayment IBR IBR sets monthly payments between 10 and 20 of your discretionary income extending the loan term to 20 or 25 years At the Web 5 sept 2023 nbsp 0183 32 The Biden administration s new student loan repayment plan has enrolled 4 million people in the two weeks since it launched in late July Education Department

Web Il y a 11 heures nbsp 0183 32 It s an income driven repayment plan meaning that monthly payments scale to how much you make and your family size The plan replaces the Revised Pay Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

2007 Tax Rebate Tax Rebates Taxes History Deduction

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Volume Rebate Agreement Template Creative Template Inspiration

https://images.template.net/wp-content/uploads/2017/06/Agreement-Form-for-Loan-Repayment.jpg

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

https://www.etmoney.com/blog/education-loa…

Web To facilitate convenient repayment of the loan tax authorities provide a moratorium period of up to one year to the borrower from the date of completing the course to start repaying the loan Effectively one can

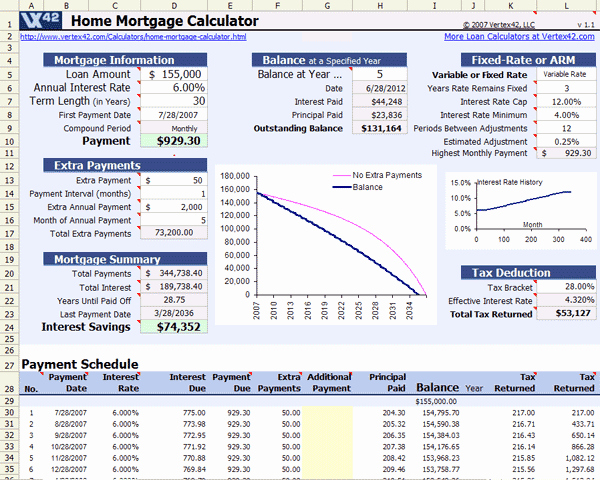

50 Calculating Mortgage Payments In Excel Ufreeonline Template

2007 Tax Rebate Tax Rebates Taxes History Deduction

Loan Repayment Formula EmmalineShane

FREE 6 Sample Income Based Repayment Forms In PDF

P55 Tax Rebate Form Business Printable Rebate Form

Pin On Financial Aid

Pin On Financial Aid

How Do Banks Determine Home Loan Amounts LOANOLK

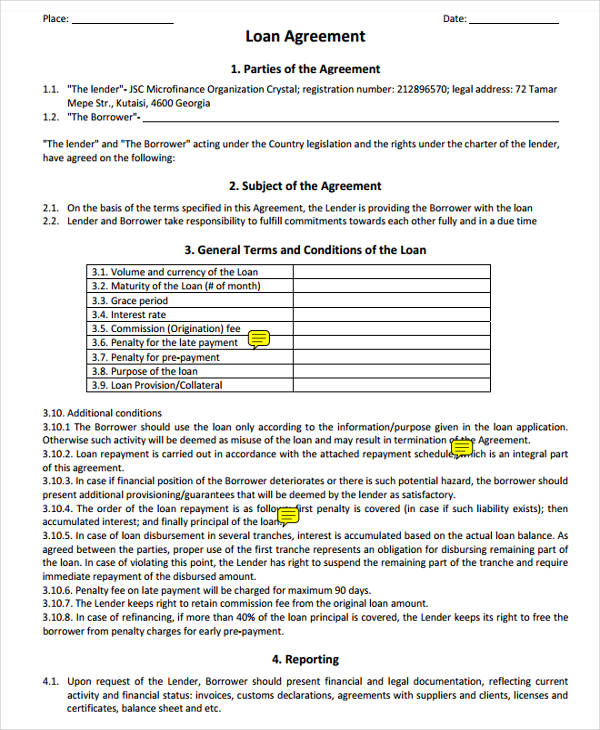

Microfinance Loan Application Form

Do Not Overestimate Tax Benefits On Home Loan Repayment

Tax Rebate Loan Repayment - Web Section 80E Deduction for Repayment of Interest on Education Loan If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the