Tax Rebate Malta Web Tax rebate pensions income less 9 100 multiplied by 15 with a rebate capping of 615 Example Pension income 13 000 9100 3 900 15 585 The tax

Web Tax rebate taxable pension income less 10 500 X 15 iii a Person on married rates Tax rebate taxable pension income less 12 700 X 15 iii b Person on married Web 1 janv 2022 nbsp 0183 32 Tax rebate for pensioners rules revised Malta Institute of Taxation 4 February 2022 Direct Tax News Changes to the Tax Rebate Pensioners Rules SL

Tax Rebate Malta

Tax Rebate Malta

https://sohomalta.com/wp-content/uploads/2019/10/Screenshot-2019-10-04-at-15.23.26.png

Malta s 11m Budget To Attract International Films Could Soar To 50m

https://cdn-attachments.timesofmalta.com/87be77f6bb0c781ca46216ab03199e6ab7f09d21-1668978132-6406e2a9-1920x1280.jpg

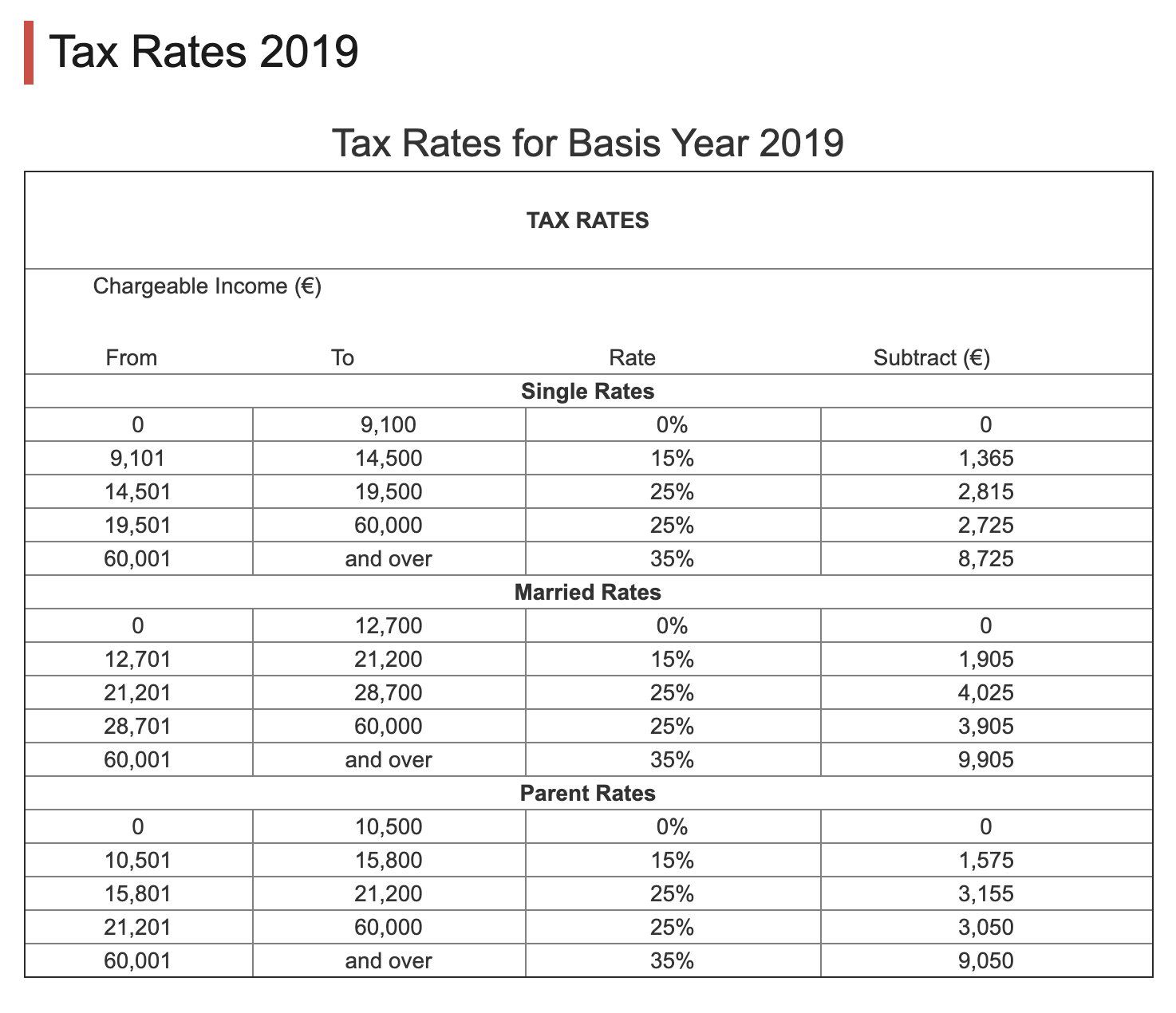

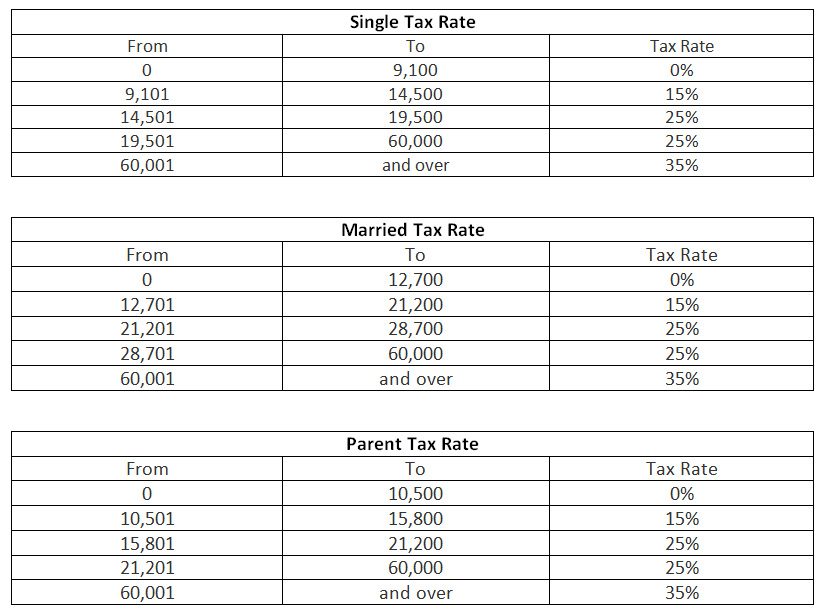

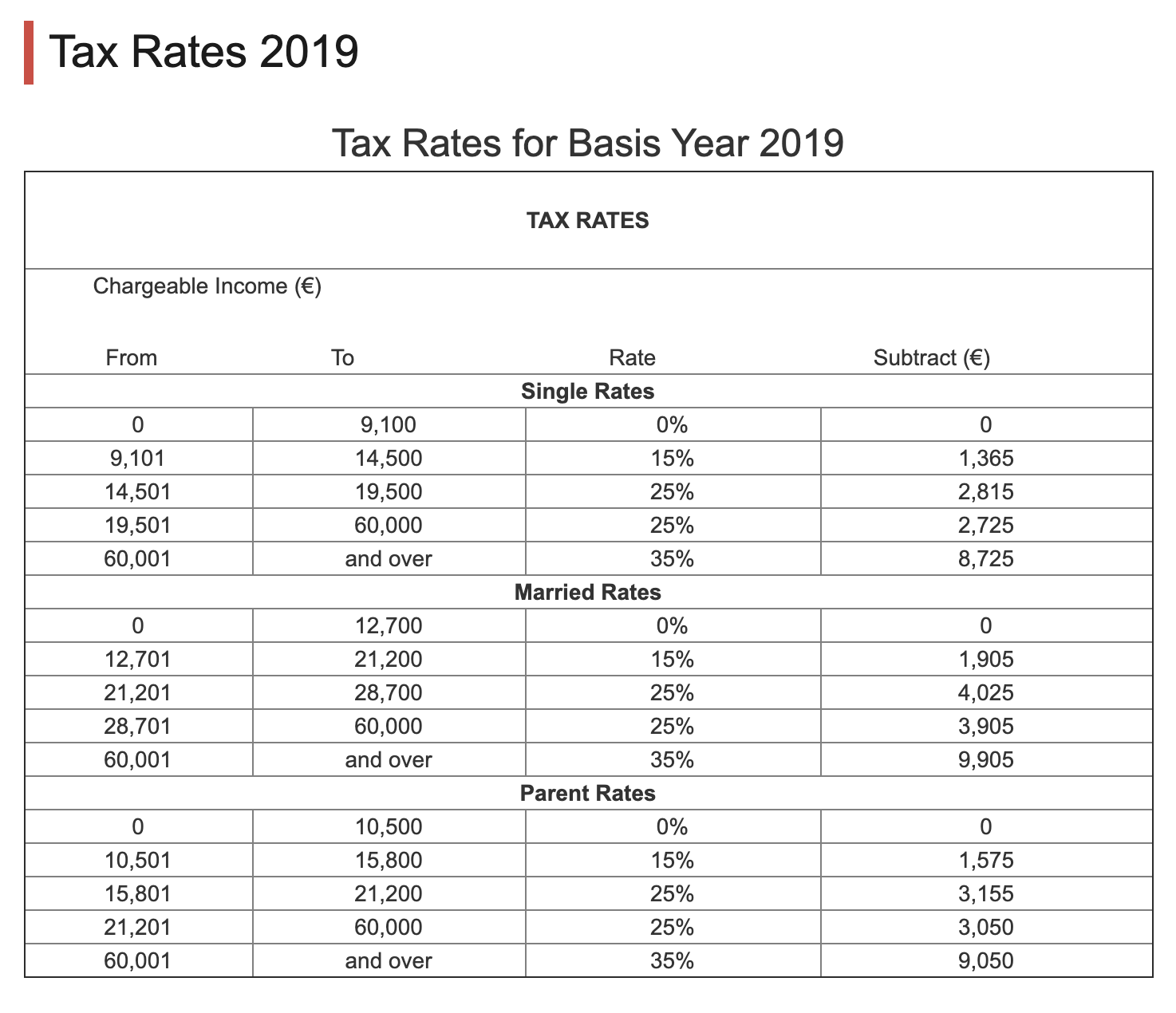

Malta Personal Tax I Papilio Services Limited

https://papilioservices.com/wp-content/uploads/2021/08/tax-table.jpg

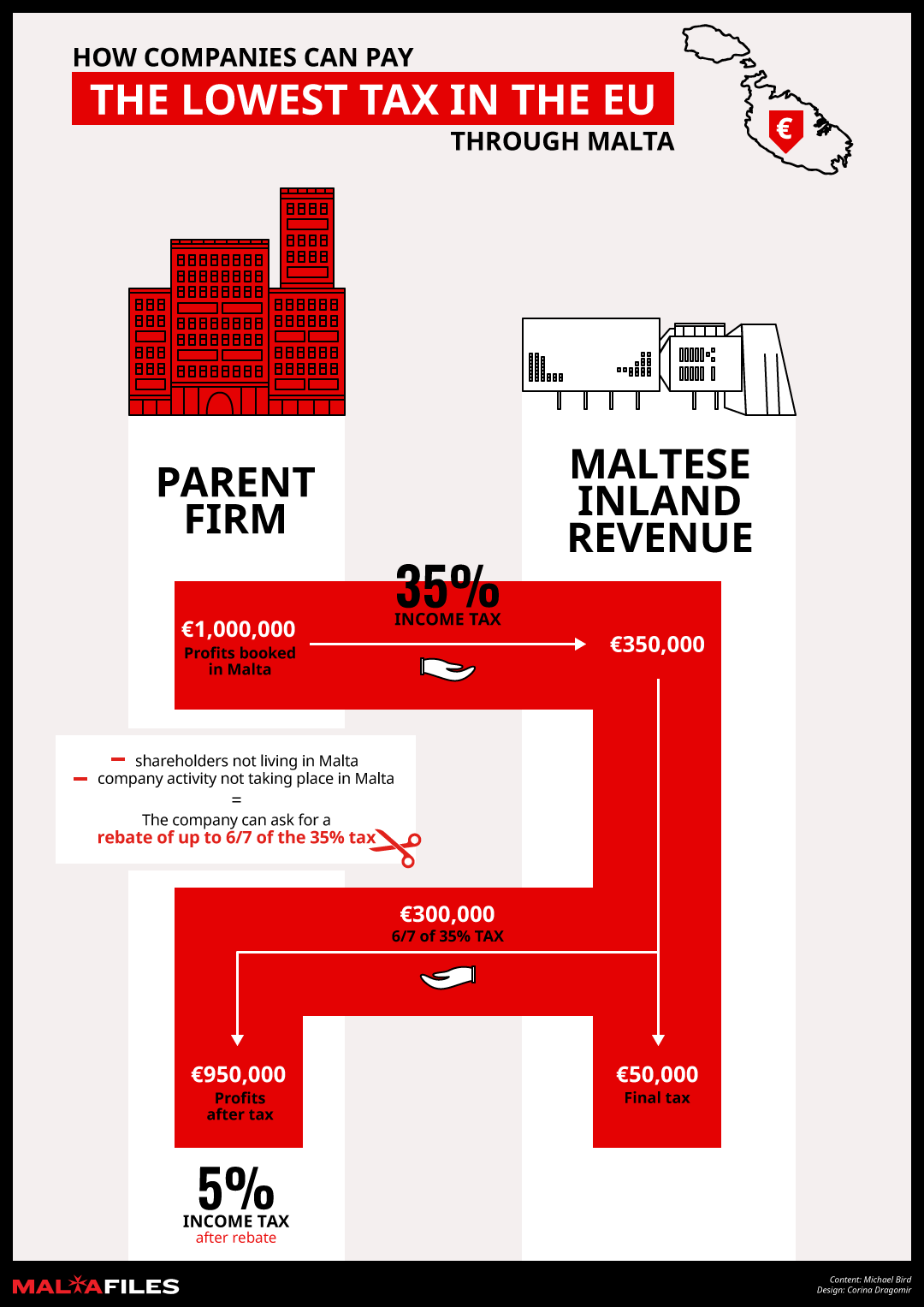

Web 11 ao 251 t 2023 nbsp 0183 32 The combination of certain tax treaties and Maltese domestic law lowers the Maltese tax rate on certain companies receiving certain industrial assistance i e mainly Web 25 oct 2022 nbsp 0183 32 Tax rebate for parents whose children attend qualifying sports cultural and artistic activities to be increased from 100 to 300 Tax credit of 200 for parents of

Web 10 oct 2022 nbsp 0183 32 10 October 2022 1 min read A new tax exemption pertaining to pension income has been introduced through the publication of Legal Notice LN 98 of 2022 Web Individuals subject to tax at married rates will see their tax refund range between 65 and 140 whereas individual subject to tax at the single and parents rates will benefit from a

Download Tax Rebate Malta

More picture related to Tax Rebate Malta

Every Year Malta Wipes Out 2 Billion In Foreign Tax By Giving

http://content.maltatoday.com.mt/ui_frontend/thumbnail/684/0/10_-_11_screen_shot.png

Malta s Total Revenue From Taxes And Social Contributions Decreases

https://www.independent.com.mt/file.aspx?f=198247&width=630&height=340

Infographic malta tax Daphne Caruana Galizia

https://daphnecaruanagalizia.com/wp-content/uploads/2017/05/infographic-malta-tax-1.png

Web 21 janv 2021 nbsp 0183 32 Legal Notice 2 of 2021 increased the maximum annual tax credit granted in terms of the PRS Rules Previously an individual who contributes to a qualifying Web Home Content Editor Eligibility for the Tax Refund Che que The beneficiaries of this tax refund cheque are citizens who were in employment in 2021 and whose income did not

Web 11 ao 251 t 2023 nbsp 0183 32 Last reviewed 11 August 2023 Malta taxes individuals who are both domiciled and ordinarily resident in Malta on their worldwide income Any person who is Web 18 oct 2021 nbsp 0183 32 The tax rebate on pension income will be increased such that pension income of a maximum of 14 318 will not be taxed Married couples applying the married

Malte Taux D imp ts Sur Le Revenu Personnel

https://d3fy651gv2fhd3.cloudfront.net/charts/malta-personal-income-tax-rate.png?s=mltirstax&v=202008282300V20200716&lang=all

Relocating To Malta A Tax Analysis Ecovis Global

http://www.ecovis.com/en/wp-content/uploads/2014/12/grafik.gif

https://cfr.gov.mt/en/individuals/Pages/Tax-Rebate-on-Pensions...

Web Tax rebate pensions income less 9 100 multiplied by 15 with a rebate capping of 615 Example Pension income 13 000 9100 3 900 15 585 The tax

https://cfr.gov.mt/en/individuals/Pages/Pensioners.aspx

Web Tax rebate taxable pension income less 10 500 X 15 iii a Person on married rates Tax rebate taxable pension income less 12 700 X 15 iii b Person on married

SPORTMALTA

Malte Taux D imp ts Sur Le Revenu Personnel

2007 Tax Rebate Tax Deduction Rebates

Have You Received Your 150 Council Tax Rebate

Taxation Malta s Attractive Tax System Bencini Demajo Corporate

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Section 87A Tax Rebate Under Section 87A

Guide To Malta s Tax Rates Malta Guides

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Tax Rebate Malta - Web 10 oct 2022 nbsp 0183 32 10 October 2022 1 min read A new tax exemption pertaining to pension income has been introduced through the publication of Legal Notice LN 98 of 2022