Tax Rebate Meaning In India Web When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is refunded at the end of the

Web 3 juil 2019 nbsp 0183 32 Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax Web 11 avr 2023 nbsp 0183 32 11 April 2023 Income Tax Rebate What is rebate in income tax Income tax rebate is a benefit provided by the government to taxpayers that allows them to reduce

Tax Rebate Meaning In India

Tax Rebate Meaning In India

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Rebating Meaning In Insurance What Is Insurance Rebating The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

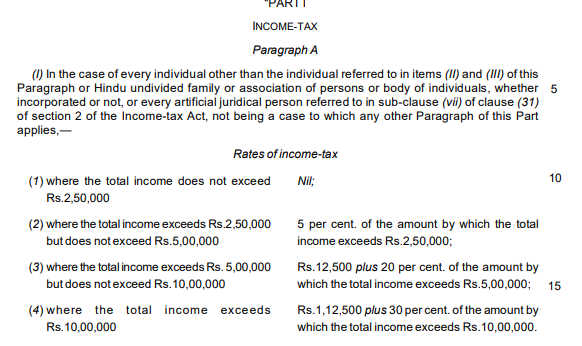

Web 16 mars 2017 nbsp 0183 32 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions Web 25 mai 2021 nbsp 0183 32 Income tax is to be paid by all individuals of the country though to claim an income tax rebate under Section 87A you need to keep the following pointers in mind

Web 24 janv 2019 nbsp 0183 32 A tax rebate is a refund on taxes when an individual has lower tax liability than the tax he or she has paid A tax rebate helps to reduce the tax burden on Web 1 avr 2016 nbsp 0183 32 India Corporate Tax credits and incentives Last reviewed 13 June 2023 Tax incentive provisions normally have conditions applicable for the period within which the

Download Tax Rebate Meaning In India

More picture related to Tax Rebate Meaning In India

Important Information You Need To Know About Tax Rebate For Taxpayers

https://thelogicalindian.com/wp-content/uploads/2019/02/Screenshot_44.png

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Web 13 juin 2023 nbsp 0183 32 Tax rebate Resident individuals are eligible for a tax rebate of the lower of the income tax or INR 12 500 where the total income does not exceed INR 500 000 Web 2 f 233 vr 2023 nbsp 0183 32 Budget 2023 pushed for greater adoption of the new tax regime in a big way by reducing the number of tax slabs increasing the basic exemption limit raising the

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax Web A refund on taxes when the liability on tax is less than the tax paid by the individual is referred to as Income Tax Rebate Taxpayers generally receive a refund on the income

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

https://gstguntur.com/wp-content/uploads/2021/05/Income-Tax-Rebate-Under-Section-87A.png

Pros And Cons Of Rebates For Companies Incentive Insights

https://incentiveinsights.com/wp-content/uploads/2022/09/inis-pros-cons-of-rebates-1024x1024.png

https://www.bankbazaar.com/tax/tax-rebate.html

Web When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is refunded at the end of the

https://cleartax.in/s/difference-between-tax-exemption-vs-tax...

Web 3 juil 2019 nbsp 0183 32 Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax

Daily current affairs

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

Tds Slab Rate For Ay 2019 20

How To Choose Between The New And Old Income Tax Regimes Chandan

Business Office Taxes

Tax Rebate Meaning In India - Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the