Tax Rebate Minnesota 2024 The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of the historic 2023 One Minnesota Budget signed into law by Governor Tim Walz on May 24 2023

Major changes are summarized below We will share updated guidance and tax forms for affected tax years as soon as they are available generally in early fall Individuals Individual Income Tax Tax Credits for Individuals Property Tax Refunds Other Tax Rebates and Refunds Businesses Business Income Tax The Minnesota Department of Revenue has finished processing one time tax rebate payments for eligible Minnesota taxpayers We issued nearly 2 1 million rebates totaling nearly 1 billion under a law passed in May We used previously filed 2021 income tax or property tax refund returns to determine who is eligible and payment amounts

Tax Rebate Minnesota 2024

Tax Rebate Minnesota 2024

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1bzGvG.img?w=2000&h=1000&m=4&q=75

Who Will Get A Tax Rebate In Minnesota And When Will They Get It MinnPost

https://www.minnpost.com/wp-content/uploads/2023/05/MNStateCapitolSunset740.jpg

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

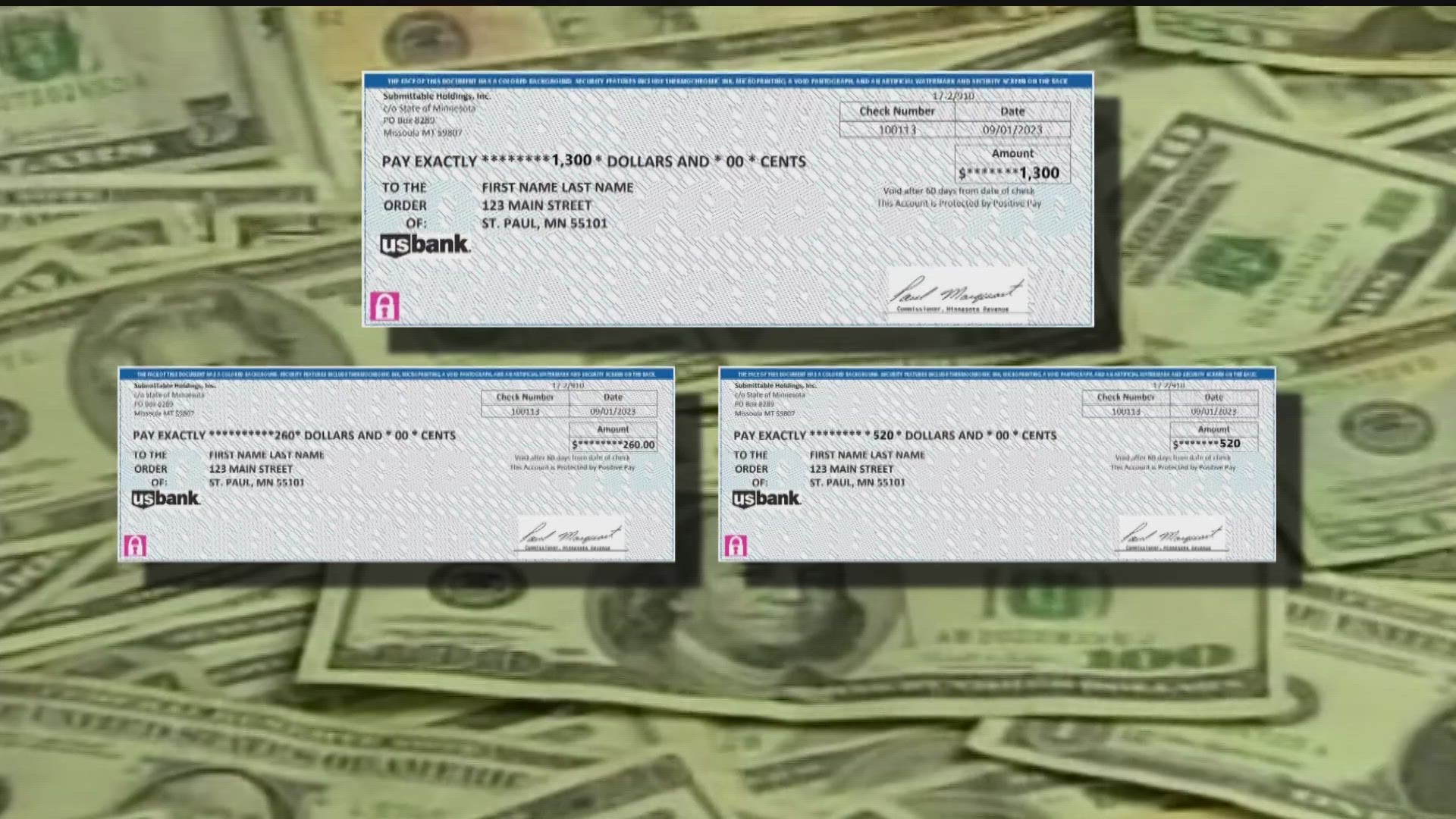

PAUL Minn Minnesotans who cashed their one time rebate check this year will owe the federal government come tax time More than 2 million Minnesotans received anywhere from 260 to 1 300 January 12 2024 2 22 PM Gov Tim Walz announces details of the rebate program providing up to 1 300 for Minnesota families during a press conference at the State Capitol in St Paul Ben

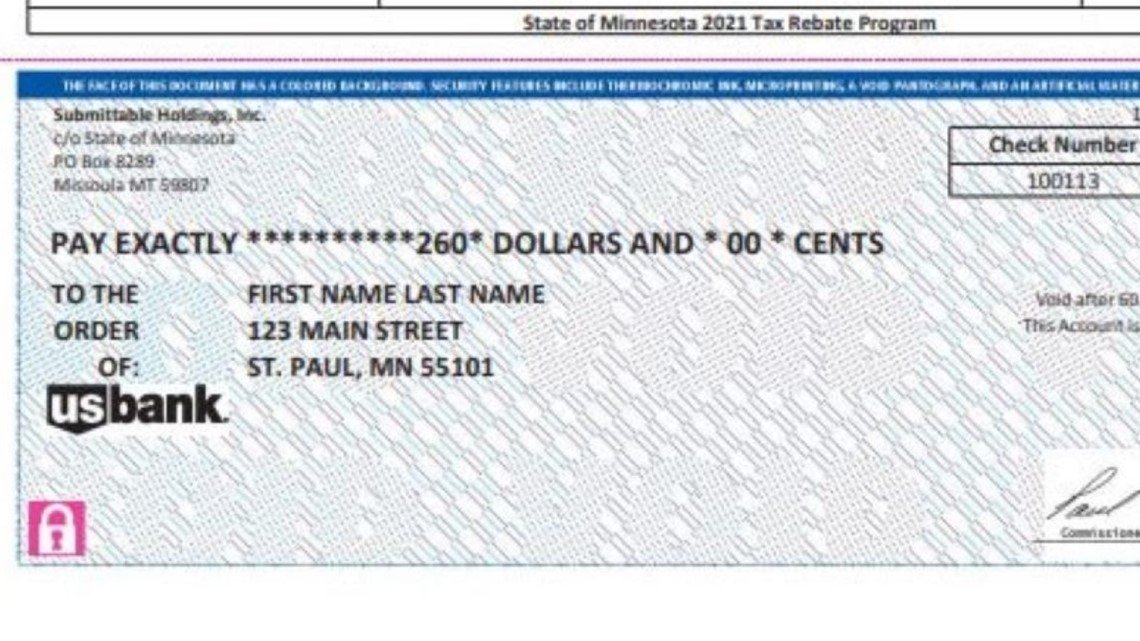

260 for individuals with adjusted gross income of 75 000 or less 520 for married couples who filed a joint return with an adjusted gross income of 150 000 or less An additional 260 added for each dependent filed on the tax return with a maximum of three dependents totaling 780 Michael J Bologna Minnesota taxpayers who banked nearly 1 billion in rebate checks earlier this year are required to pay federal income taxes on the payments in 2024 the state Department of Revenue confirmed Wednesday Revenue officials had hoped the rebates sent to 2 4 million taxpayers would enjoy tax free treatment at the federal level

Download Tax Rebate Minnesota 2024

More picture related to Tax Rebate Minnesota 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Minnesota Tax Rebate 2023 Your Comprehensive Guide PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

The Minnesota EV Rebate Explained

https://d2q97jj8nilsnk.cloudfront.net/images/minnesota-ev-rebate-tax-credit.jpg

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to In the application of the Minnesota EV Tax Rebate Program an Electric Vehicle is defined as a motor vehicle that is able to be powered by an electric motor drawing current from rechargeable storage batteries fuel cells or other portable sources of electrical current and meets or exceeds applicable regulations in Code of Federal Regulations title 49 part 571 and successor requirements

Rebate checks will be taxed by the IRS About 2 1 million Minnesotans qualified for a one time rebate check a slice of the colossal 17 6 billion budget surplus that lawmakers had to work with Depending on Minnesotans income and the size of their rebate check the federal tax could take between 26 and 286 of the rebate The Minnesota Department of Revenue says it will be

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

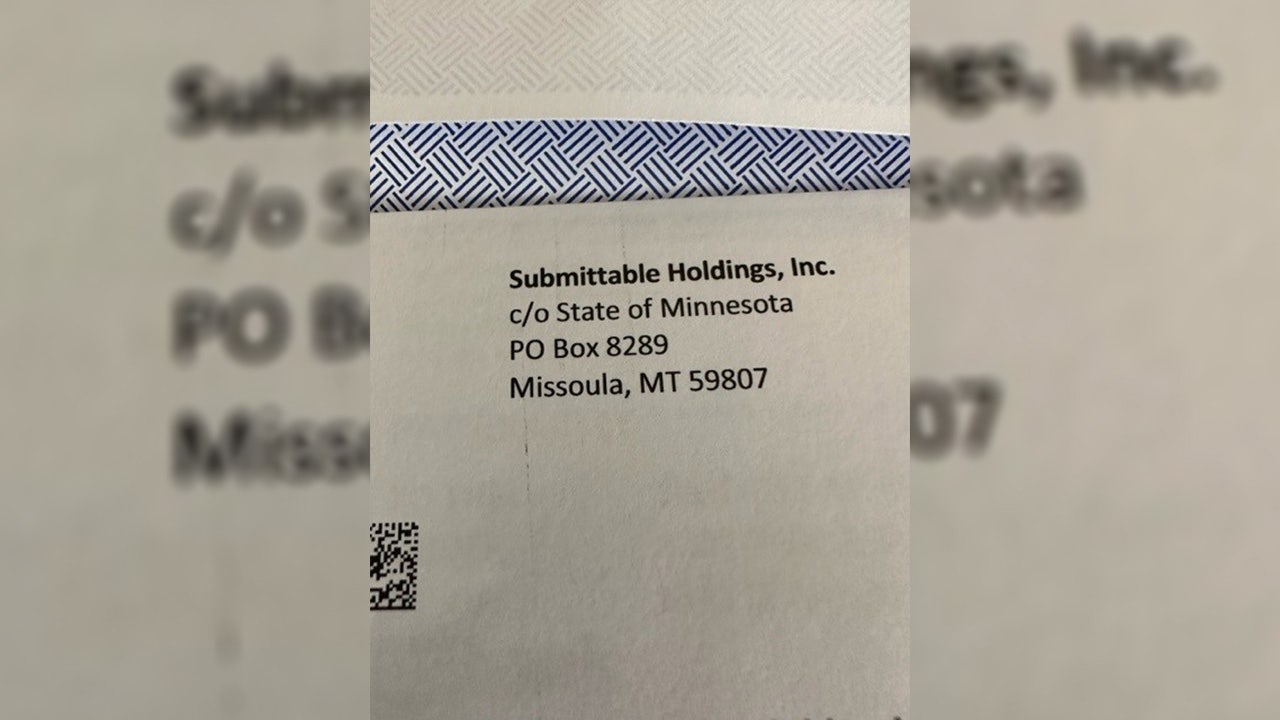

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

https://media.kare11.com/assets/KARE/images/c6c0f926-4792-46a8-9d55-d297c077d911/c6c0f926-4792-46a8-9d55-d297c077d911_1920x1080.jpg

https://www.revenue.state.mn.us/press-release/2023-07-10/department-revenue-announces-process-one-time-tax-rebates

The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of the historic 2023 One Minnesota Budget signed into law by Governor Tim Walz on May 24 2023

https://www.revenue.state.mn.us/tax-law-changes

Major changes are summarized below We will share updated guidance and tax forms for affected tax years as soon as they are available generally in early fall Individuals Individual Income Tax Tax Credits for Individuals Property Tax Refunds Other Tax Rebates and Refunds Businesses Business Income Tax

Property Tax Rebate Pennsylvania LatestRebate

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Minnesota Rebate Checks And Child Tax Credit In 2023

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

3 States Trying To Lower Taxes On Social Security Income

3 States Trying To Lower Taxes On Social Security Income

Minnesota Revenue Department To Reissue Uncashed Rebate Checks Kare11

Minnesota Tax Rebate Checks May Look Like Junk Mail

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Tax Rebate Minnesota 2024 - This matches a federal tax provision and is estimated to generate over 435 million in fiscal years 2024 2025 This policy in addition to other smaller tax increases will raise 1 billion in fiscal years 2024 2025 according to the tentative agreement The House and Senate differ on another sales tax tax increase this time for transit