Tax Rebate Ny 2024 Don t Miss Valuable Tax Credits This Filing Season National Earned Income Tax Credit Day Is January 26 Credits worth up to 11 888 are available to eligible New Yorkers For Release Immediate Friday January 26 2024 For media inquiries only contact Ryan Cleveland 518 457 7377 On National Earned Income Tax Credit Awareness Day January 26 the New York State Department of Taxation

Setting your 2024 New Year s resolutions We ve got one that ll help you keep more money in your pocket throughout the new year review and update your Form IT 2104 Employee s Withholding Allowance Certificate instructions Form IT 2104 is one of the forms your employer asks you to complete when you begin a new job in New York State You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

Tax Rebate Ny 2024

Tax Rebate Ny 2024

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP

Download Tax Rebate Ny 2024

More picture related to Tax Rebate Ny 2024

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers through the As of January 1 2024 the IRS allows buyers to transfer the IRA tax credit to a car dealership to reduce the upfront purchase price of a new or used EV Alternatively buyers can claim the tax credit later when filing their tax returns

The plan will also accelerate the implementation of 1 2 billion in New York s existing Middle Class Tax Cut for 6 million New Yorkers which first began to be implemented in 2018 and establish a 1 billion property tax rebate program to put money back into the pockets of more than 2 million New Yorkers who have had to endure rising costs as The federal standard deduction for a Married Joint Filer in 2024 is 29 200 00 The federal federal allowance for Over 65 years of age Married Joint Filer in 2024 is 1 550 00 New York Residents State Income Tax Tables for Married Joint Filers in 2024 Personal Income Tax Rates and Thresholds Annual

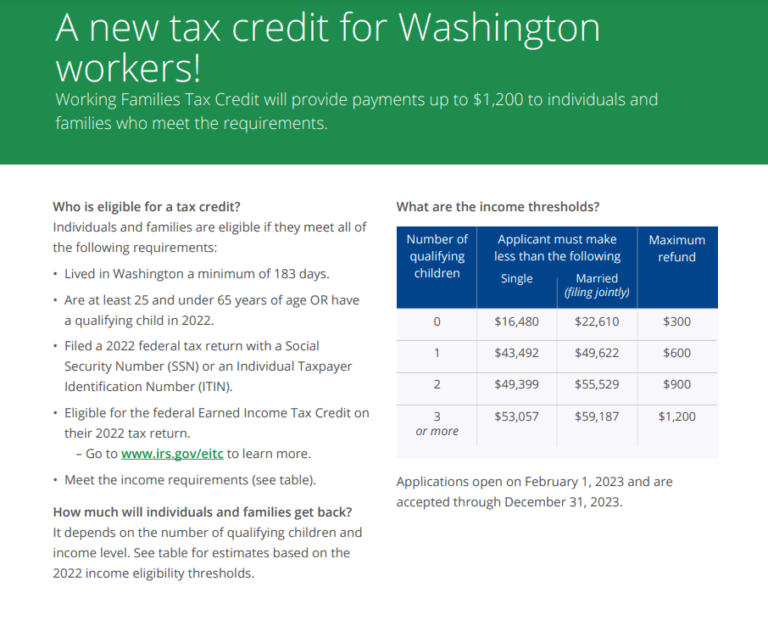

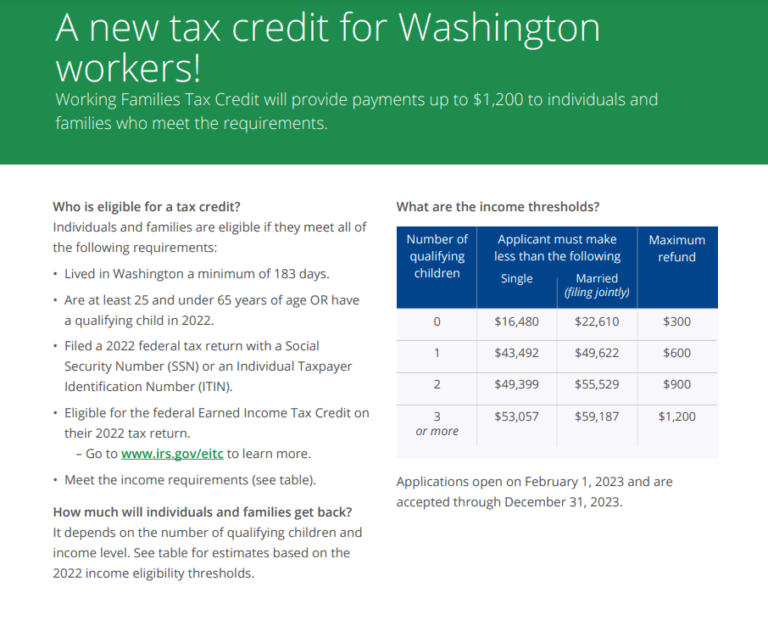

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Washington-Tax-Rebate-2023-768x626.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

https://www.tax.ny.gov/press/rel/2024/eitcday012624.htm

Don t Miss Valuable Tax Credits This Filing Season National Earned Income Tax Credit Day Is January 26 Credits worth up to 11 888 are available to eligible New Yorkers For Release Immediate Friday January 26 2024 For media inquiries only contact Ryan Cleveland 518 457 7377 On National Earned Income Tax Credit Awareness Day January 26 the New York State Department of Taxation

https://www.tax.ny.gov/

Setting your 2024 New Year s resolutions We ve got one that ll help you keep more money in your pocket throughout the new year review and update your Form IT 2104 Employee s Withholding Allowance Certificate instructions Form IT 2104 is one of the forms your employer asks you to complete when you begin a new job in New York State

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Georgia Income Tax Rebate 2023 Printable Rebate Form

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Income Tax Rebate Under Section 87A

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Tax Rebate Ny 2024 - WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline