Tax Rebate On Child Education Web 5 juil 2023 nbsp 0183 32 Dans le formulaire de d 233 claration de revenus 224 remplir en ligne les frais de scolarit 233 sont 224 indiquer dans la partie R 233 ductions d imp 244 t Cr 233 dits d imp 244 t au sein

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e Web 22 mai 2020 nbsp 0183 32 Pour d 233 duire les frais de scolarit 233 d un enfant plusieurs informations sont 224 renseigner sur la d 233 claration d imp 244 ts Il faudra notamment indiquer le nombre d enfants

Tax Rebate On Child Education

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Tax Rebate On Child Education

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/adx81n2rNGWllpIvRGOVdmKZAzs=/1200x675/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

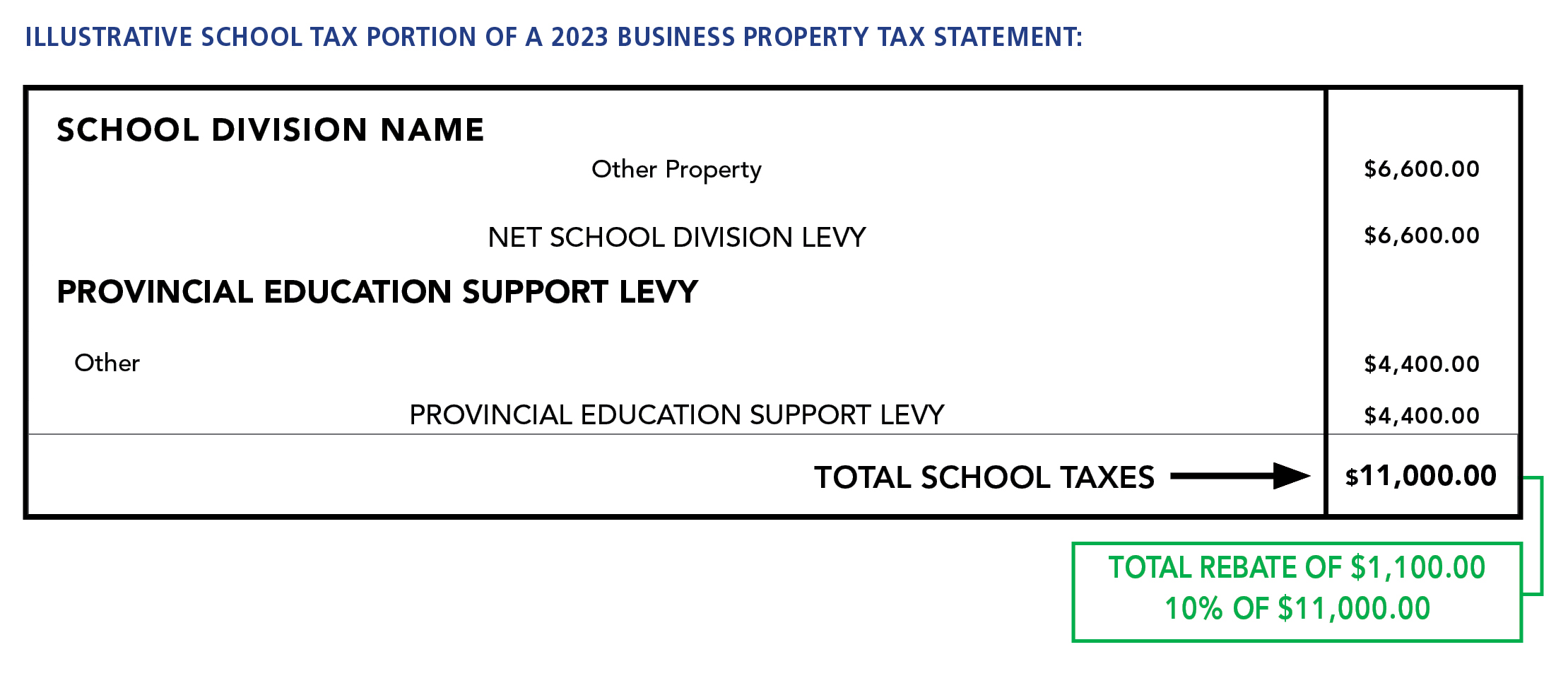

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

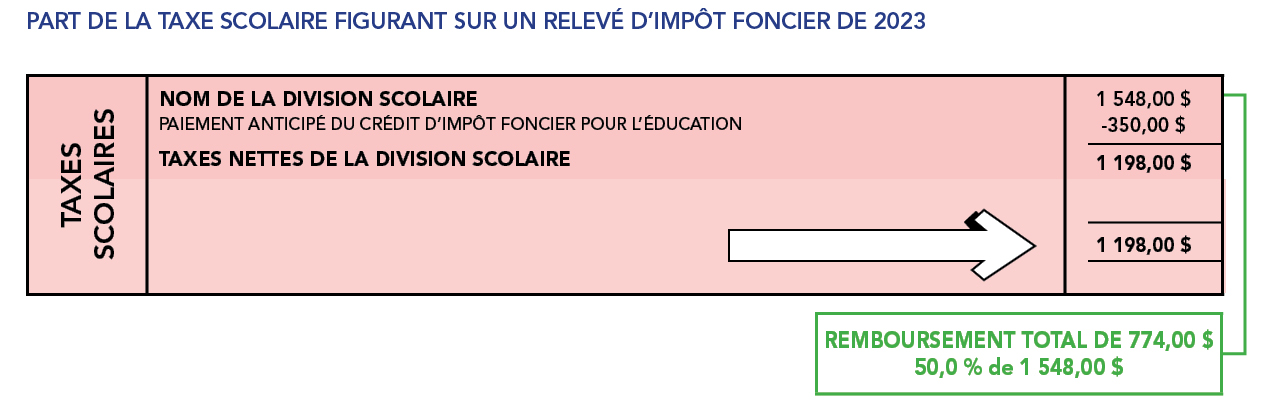

CT s New Child Tax Rebate Connecticut Association For Community Action

https://www.cafca.org/wp-content/uploads/2022/06/CTCTR-English-791x1024.jpg

Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Web 27 f 233 vr 2023 nbsp 0183 32 Updated 27 02 2023 10 21 02 AM If your employer provides you children education allowance as a part of your salary structure for the payment of education

Web 4 janv 2023 nbsp 0183 32 Montant de la r 233 duction d imp 244 t pour frais de scolarit 233 en 2023 61 d imp 244 t en moins par enfant au coll 232 ge 153 d imp 244 t en moins par enfant au lyc 233 e Web 22 juil 2023 nbsp 0183 32 Key Takeaways Under federal tax law private school tuition isn t tax deductible unless your child is attending a private school for special needs If a

Download Tax Rebate On Child Education

More picture related to Tax Rebate On Child Education

Education Rebate Income Tested

https://i2.wp.com/www.manitoba.ca/asset_library/en/edupropertytax/school-taxes.jpg

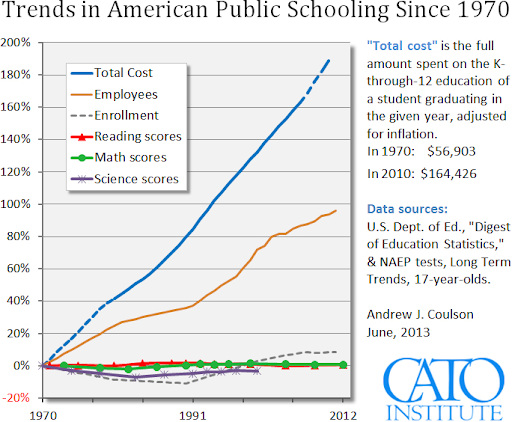

Contra Corner Rebate 165 000 In Taxes For Each Child And Let A Free

https://pbs.twimg.com/media/EeghFOZXgAEQooZ?format=png&name=small

Here s How You Calculate Your Adjusted Gross Income AGI

https://flyfin.tax/_next/image?url=https:%2F%2Fdem95u0op6keg.cloudfront.net%2Fflyfin-website%2Fself-employment-resources%2FThreeTaxBenefitsDesktop.png&w=2048&q=100

Web 7 sept 2023 nbsp 0183 32 The Canada child benefit helps with the cost of raising your family If you have a child under 18 years old you may be eligible for this tax free monthly payment Web The qualified education expenses would be 4 000 and the AGI and MAGI would be 23 500 The tax liability before any credits would be 413 Jane would be able to

Web Most private schools in the UK have charitable status allowing them to take advantage of various tax concessions to be eligible they must prove that they provide public benefit Web 22 oct 2018 nbsp 0183 32 Tax rebate of 300 per child intended to make up for increased school fees Parents who send their children to independent schools will be able to claim an

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

https://thevillage.org/wp-content/uploads/2022/07/ChildTaxRebate-002_web.jpg

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

https://accessagency.org/wp-content/uploads/2022/06/Story-Get-your-2022-Child-Tax-Rebate.png

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg?w=186)

https://droit-finances.commentcamarche.com/impots/guide-impots/2675...

Web 5 juil 2023 nbsp 0183 32 Dans le formulaire de d 233 claration de revenus 224 remplir en ligne les frais de scolarit 233 sont 224 indiquer dans la partie R 233 ductions d imp 244 t Cr 233 dits d imp 244 t au sein

https://www.toutsurmesfinances.com/impots/frais-de-scolarite-quel-a...

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

Province Du Manitoba Imp t Foncier Pour L ducation

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

/do0bihdskp9dy.cloudfront.net/07-07-2022/t_4b2a4f654eea40f384b59c1c647973cc_name_file_1280x720_2000_v3_1_.jpg)

VIDEO State Holds Webinar To Teach People How To Register For Child

2022 Child Tax Rebate

30 Child Care Tax Rebate 2022 Carrebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

WarwickPost Police Government Politics Events News In Warwick RI

2022 Child Tax Rebate Stratford Crier

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Tax Rebate On Child Education - Web 4 janv 2023 nbsp 0183 32 Montant de la r 233 duction d imp 244 t pour frais de scolarit 233 en 2023 61 d imp 244 t en moins par enfant au coll 232 ge 153 d imp 244 t en moins par enfant au lyc 233 e