Tax Rebate On Donations To Charity India Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals Web 16 f 233 vr 2017 nbsp 0183 32 Effective from the assessment year 2018 19 a person can avail a maximum deduction of Rs 2 000 if the donation is made in cash

Tax Rebate On Donations To Charity India

Tax Rebate On Donations To Charity India

https://i.pinimg.com/736x/b9/c1/20/b9c12098fd27992e99156ada839c1d27--needy-people-like-you.jpg

Oxfam Tax Rebate A5 4 Page Leaflet Outside Pages Digital Charity Lab

https://www.digitalcharitylab.org/wp-content/uploads/2017/03/Oxfam-Tax-Rebate-A5-4-page-leaflet-outside-pages.jpg

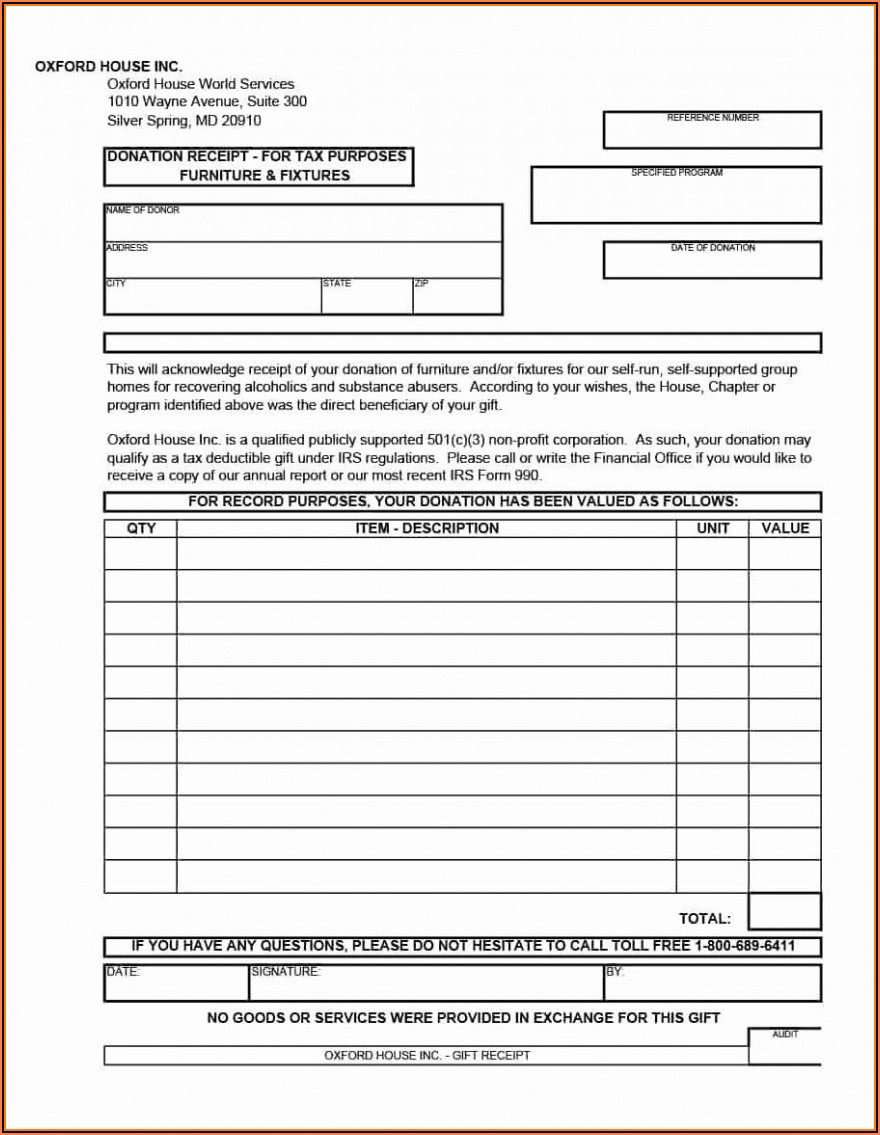

15 Donation Receipt Template Samples Templates Assistant

https://templatesassistant.com/wp-content/uploads/2016/08/Tax-Deductible-Donation-Receipt-Template.jpeg?x59089

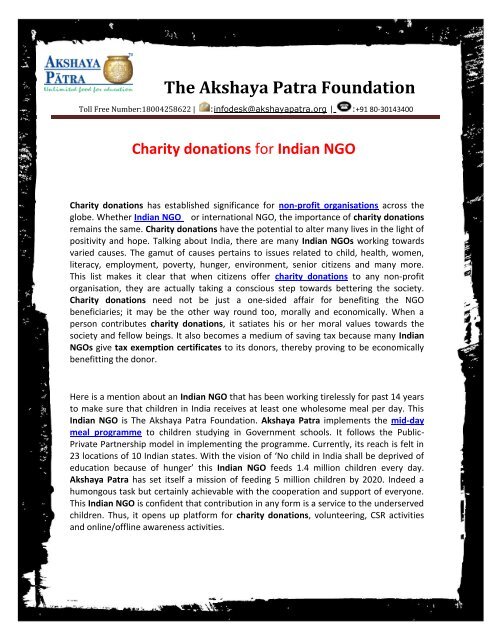

Web Deduction in respect of donations to certain funds charitable institutions etc 80G 1 In computing the total income of an assessee there shall be deducted in accordance with Web Donations above 500 to Akshaya Patra will be eligible for a 50 deduction from one s taxable income under Section 80G of the Income Tax Act By contributing to Akshaya

Web This section offers tax deductions on donations made to certain funds or charities An amount donated by an individual to an eligible charity can be claimed as a tax deduction Web WIRC of The Institute of Chartered Accountants of India 26th May 2021 Recent developments in Charity Taxation 2 Synopsis 5 27 2021 Brief background of relevant

Download Tax Rebate On Donations To Charity India

More picture related to Tax Rebate On Donations To Charity India

Campaign Gallery Oxfam Tax Rebate Letter From January 2017 Digital

https://www.digitalcharitylab.org/wp-content/uploads/2017/03/Oxfam-Tax-Rebate-Front-of-Letter-1.jpg

How To Claim Charitable Donations Charity Zakat Tax Credits How

https://i.ytimg.com/vi/Lrj0X5xH8dE/maxresdefault.jpg

Tax Rebate On Donation Sewa Bharti Malwa

https://www.sewabhartimalwa.org/images/15227663692045572952.jpg

Web 5 juil 2021 nbsp 0183 32 A deduction of 50 or 100 of the amount contributed can be availed as a deduction Donations to certain organisations may also be restricted to an upper Web 23 sept 2021 nbsp 0183 32 Deduction allowed shall be 100 or 50 of the amount donated if donation has been given to any of the below mentioned institutions or funds Deduction allowed

Web According to Section 80G of the Income Tax Act 1961 you can claim a tax deduction on the charitable donations or contributions made within the given fiscal year when you file Web 16 mai 2022 nbsp 0183 32 Millions of people often give to charity to support causes they believe in The government provides some tax benefits under section 80G of the Income tax I T Act on

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

https://medicine.nus.edu.sg/giving/wp-content/uploads/sites/8/2020/04/Illustration-3-5-1024x558-1.jpg

https://serudsindia.org/tax-benefits-charity-in…

Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

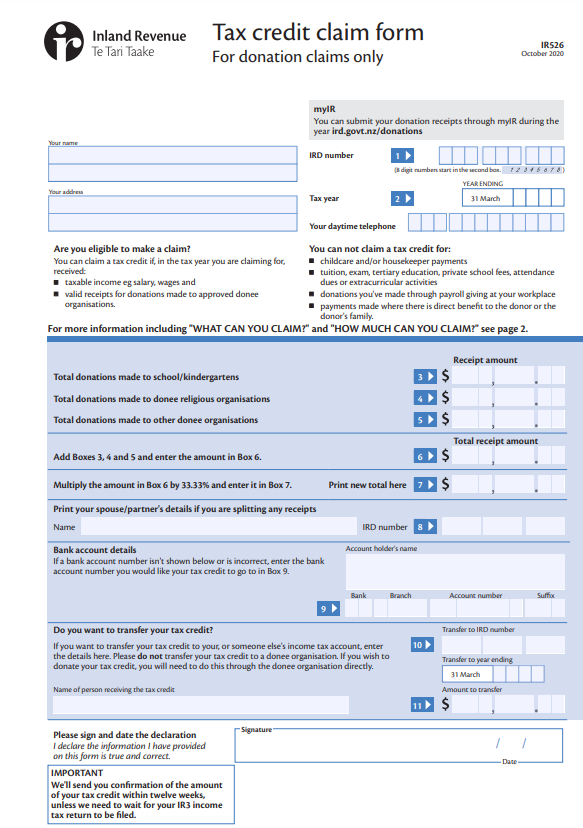

Printable Tax Deduction Form For Donations Printable Forms Free Online

How To Maximize Your Charity Tax Deductible Donation WealthFit

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Updated PN Says Tax Rebate For Community Chest Fund Discriminates

Charity Donations For Indian NGO

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

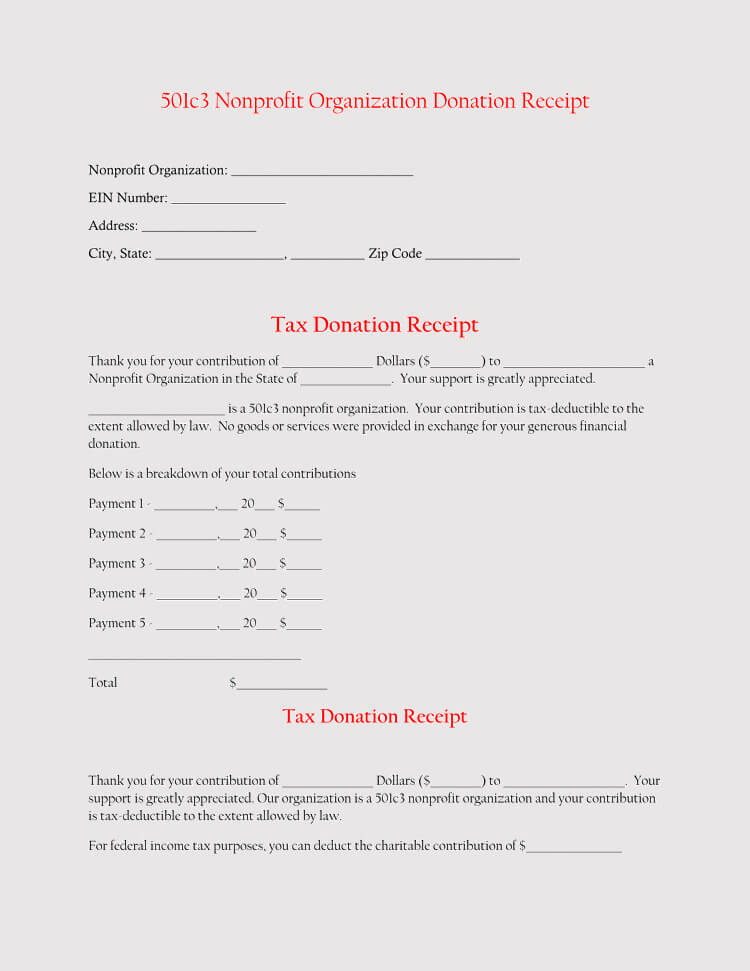

501c3 Donation Receipt Template Addictionary Download 501c3 Donation

Charitable Donation Receipt Template Template Business

Donate Your Tax Return To UNICEF NZ

Tax Rebate On Donations To Charity India - Web WIRC of The Institute of Chartered Accountants of India 26th May 2021 Recent developments in Charity Taxation 2 Synopsis 5 27 2021 Brief background of relevant