Tax Rebate On Donations To Ngo Web Vous pouvez sous certaines conditions d 233 duire de l imp 244 t une partie des frais engag 233 s dans le cadre du b 233 n 233 volat Les dons faits par les particuliers 224 certaines associations d int 233 r 234 t g 233 n 233 ral donnent droit 224 une r 233 duction d imp 244 t sur le revenu aux taux de 66 ou 75 organismes d aide aux personnes en difficult 233 et ce

Web 2 juin 2010 nbsp 0183 32 Certains dons effectu 233 s 224 des organismes qui ont leur si 232 ge 224 l 233 tranger font b 233 n 233 ficier au contribuable d une r 233 duction d imp 244 t Les dons consentis 224 des organismes 233 trangers peuvent ouvrir droit 224 une r 233 duction d imp 244 t sur le revenu s ils poursuivent des objectifs et pr 233 sentent des caract 233 ristiques similaires aux organismes Web 15 juin 2022 nbsp 0183 32 You can avail of tax benefits on donations to NGOs under section 80G Here s a list of 10 NGOs you can consider donating to By Future Generali Updated On Sep 24 2022 9 min 28 5K In This Article Show What is Section 80G

Tax Rebate On Donations To Ngo

Tax Rebate On Donations To Ngo

https://i.pinimg.com/736x/b9/c1/20/b9c12098fd27992e99156ada839c1d27--needy-people-like-you.jpg

Sponsor For An NGO For Children And Build A Better Society Akshaya Patra

http://4.bp.blogspot.com/-NNZsk69b0E0/Uvr72ww5x3I/AAAAAAAACc8/lcSh8X96nws/s1600/Akshaya-Patra-donate-for-children-save-Tax.png

How To Get Maximum Tax Rebate On Donation In USA

https://i0.wp.com/www.transparenthands.org/wp-content/uploads/2018/10/How-to-Get-maximum-Tax-rebate-on-Donation-in-USA.jpg?fit=770%2C385&ssl=1

Web Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity How this works depends on whether you Web 28 sept 2021 nbsp 0183 32 These taxpayers including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions to qualifying charities during 2021 The maximum deduction is 600 for married individuals filing joint returns

Web TAX EXEMPTION ON DONATIONS UNDER SECTION 80G A voluntary help either in terms of money or kind towards needy people is known as charity It not only makes you feel happy from within but when you donate you can also save some tax Web 8 juil 2016 nbsp 0183 32 1 Deduction allowable on cash basis in other words if it is paid in F Y 2015 16 then you can claim the same on the same F Y only 2 Deduction is allowable 50 of the amount donated if donation amount id 10000 then deduction can be claimed Rs 5000 3

Download Tax Rebate On Donations To Ngo

More picture related to Tax Rebate On Donations To Ngo

Tax Rebate Digital Tax Filing Taxes Tax Services

https://i.pinimg.com/originals/d1/08/d6/d108d680f501d43a50b64f8f43eae623.png

FREE 36 Printable Receipt Forms In PDF MS Word

https://images.sampletemplates.com/wp-content/uploads/2017/03/Donation-Receipt-Tax-Form.jpg

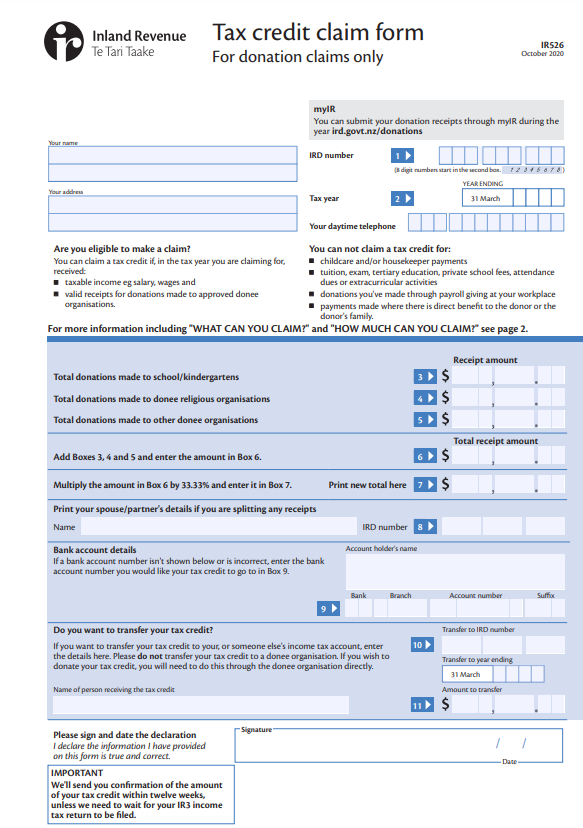

Donate Your Tax Return To UNICEF NZ

https://cdn.filestackcontent.com/cZXomloxQsCvENF8Me5N

Web 11 juil 2023 nbsp 0183 32 Nerdy takeaways Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes Web You can claim tax deductions on the donations made to an NGO provided the NGO is registered under Section 80G of the Income Tax Act 1961 Not only that helping those in need of your support also makes you happy and fulfilled

Web 21 oct 2019 nbsp 0183 32 You can gain donation tax rebate under Section 80G for donations made to those institutions or relief funds which are prescribed for tax exemption The donations in section 80G are eligible for deductions of up to either 100 or 50 What are the subsections of Section 80G Web Donation s made to HelpAge India amp Akshaya Patra qualified for 100 rebate u s 80GGA what is the fate of donations made as such in the previous year 2017 18 relevant to Assessment year 2018 19 Reply

Tips For Making Donations To NGOs Charities Under Section 80G By

https://image.isu.pub/170131130953-a754fbfa7b1be45d733a324780b244f7/jpg/page_1.jpg

Tax Rebate On Donation Sewa Bharti Malwa

https://www.sewabhartimalwa.org/images/15227663692045572952.jpg

https://www.srconseil.fr/fiche_pratique/benevolat-et-reduction-dimpot

Web Vous pouvez sous certaines conditions d 233 duire de l imp 244 t une partie des frais engag 233 s dans le cadre du b 233 n 233 volat Les dons faits par les particuliers 224 certaines associations d int 233 r 234 t g 233 n 233 ral donnent droit 224 une r 233 duction d imp 244 t sur le revenu aux taux de 66 ou 75 organismes d aide aux personnes en difficult 233 et ce

https://leparticulier.lefigaro.fr/jcms/c_95729/les-dons-a-l-etranger...

Web 2 juin 2010 nbsp 0183 32 Certains dons effectu 233 s 224 des organismes qui ont leur si 232 ge 224 l 233 tranger font b 233 n 233 ficier au contribuable d une r 233 duction d imp 244 t Les dons consentis 224 des organismes 233 trangers peuvent ouvrir droit 224 une r 233 duction d imp 244 t sur le revenu s ils poursuivent des objectifs et pr 233 sentent des caract 233 ristiques similaires aux organismes

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

Tips For Making Donations To NGOs Charities Under Section 80G By

Sample Official Donation Receipts Canada ca Donate Receipts

Tax Exemption 80G Certificate

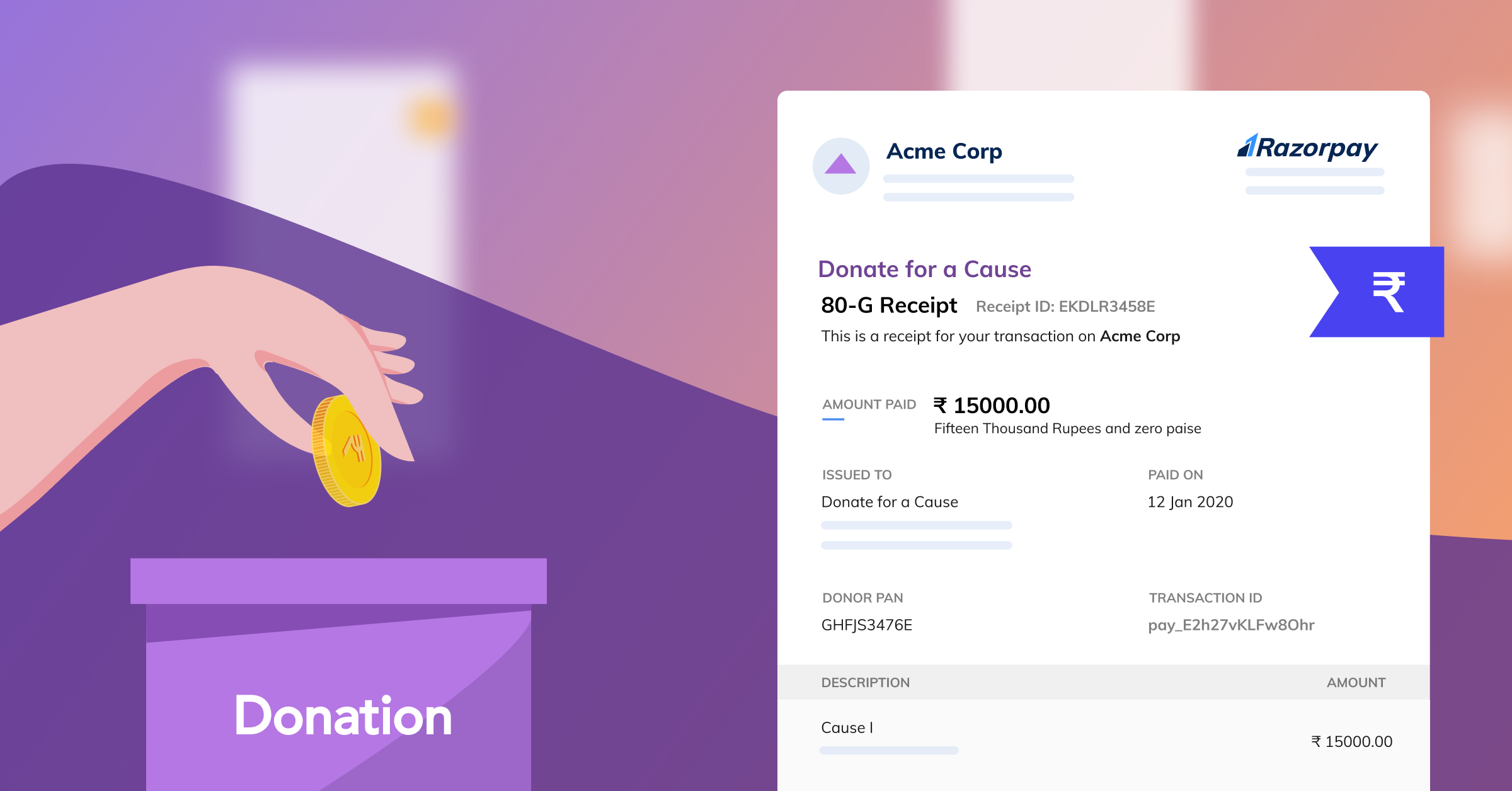

Simplifying 80G Receipts For NGOs With Razorpay Payment Pages

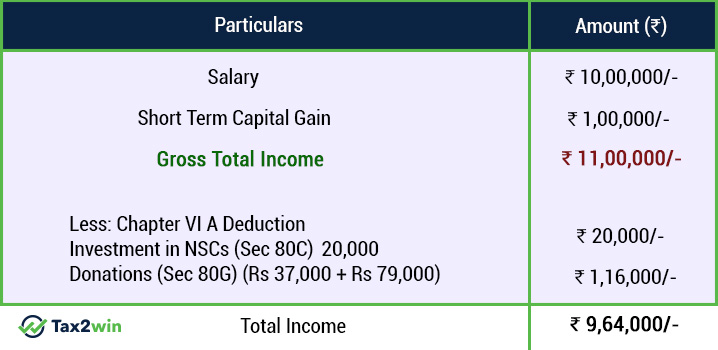

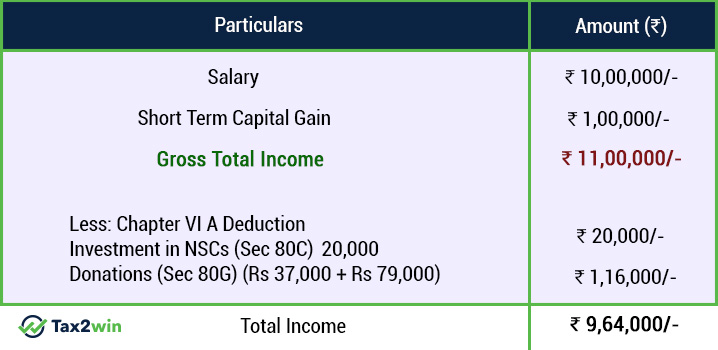

Chapter VI A 80G Deduction For Donation To Charitable Institution

Chapter VI A 80G Deduction For Donation To Charitable Institution

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

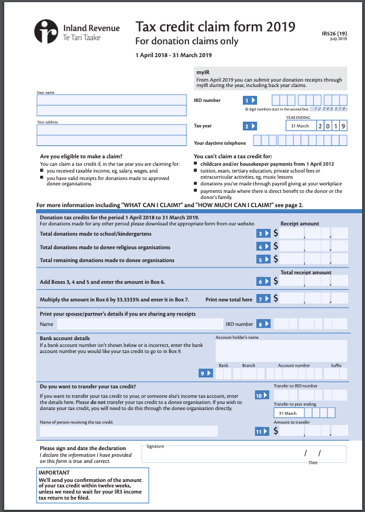

Donate Your Tax Return To UNICEF NZ

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

Tax Rebate On Donations To Ngo - Web 28 sept 2021 nbsp 0183 32 These taxpayers including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions to qualifying charities during 2021 The maximum deduction is 600 for married individuals filing joint returns