Tax Rebate On Fd In India Web 9 nov 2020 nbsp 0183 32 A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can

Web 14 avr 2017 nbsp 0183 32 Fixed Deposits FDs allow you to exploit the complete potential of Section 80C to deduct Rs 1 5 lakh from your taxable income It also ensures capital protection Web 8 sept 2023 nbsp 0183 32 Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction

Tax Rebate On Fd In India

Tax Rebate On Fd In India

https://myinvestmentideas.com/wp-content/uploads/2019/01/Best-Bank-Fixed-Deposit-FD-Rates-in-India-for-January-2019.jpeg

Best FD Rates In India Small Finance Banks Dec 2018

https://myinvestmentideas.com/wp-content/uploads/2018/12/Best-FD-Rates-in-India-Small-Finance-Banks-Dec-2018.jpeg

Bank FD Rates In India In Dec 2013 Myinvestmentideas

https://myinvestmentideas.com/wp-content/uploads/2013/12/Bank-FD-rates-in-Dec-2013-Interest-rate-chart.jpg

Web 12 nov 2020 nbsp 0183 32 Let s get to know how much taxable amount you can save on an FD Account A Fixed Deposit is safe investment option available in India Whether you want to open Web Tax Benefits on Fixed Deposits Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed

Web 8 d 233 c 2022 nbsp 0183 32 The tax deduction is limited to the actual amount of interest the taxpayer receives Senior Citizen A senior citizen can claim a tax deduction of up to Rs 50 000 Web Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post

Download Tax Rebate On Fd In India

More picture related to Tax Rebate On Fd In India

Latest Bank Interest FD Rates In India Jun 2013 Myinvestmentideas

http://myinvestmentideas.com/wp-content/uploads/2013/06/Latest-Bank-Interest-FD-rates-in-India-Jun-2013-Chart.jpg

Best Interest Rates On Tax Saving FD In India Jan 2013

https://myinvestmentideas.com/wp-content/uploads/2012/12/Best-interest-rates-on-tax-saving-FD-in-India–Jan-2013-531x625.png

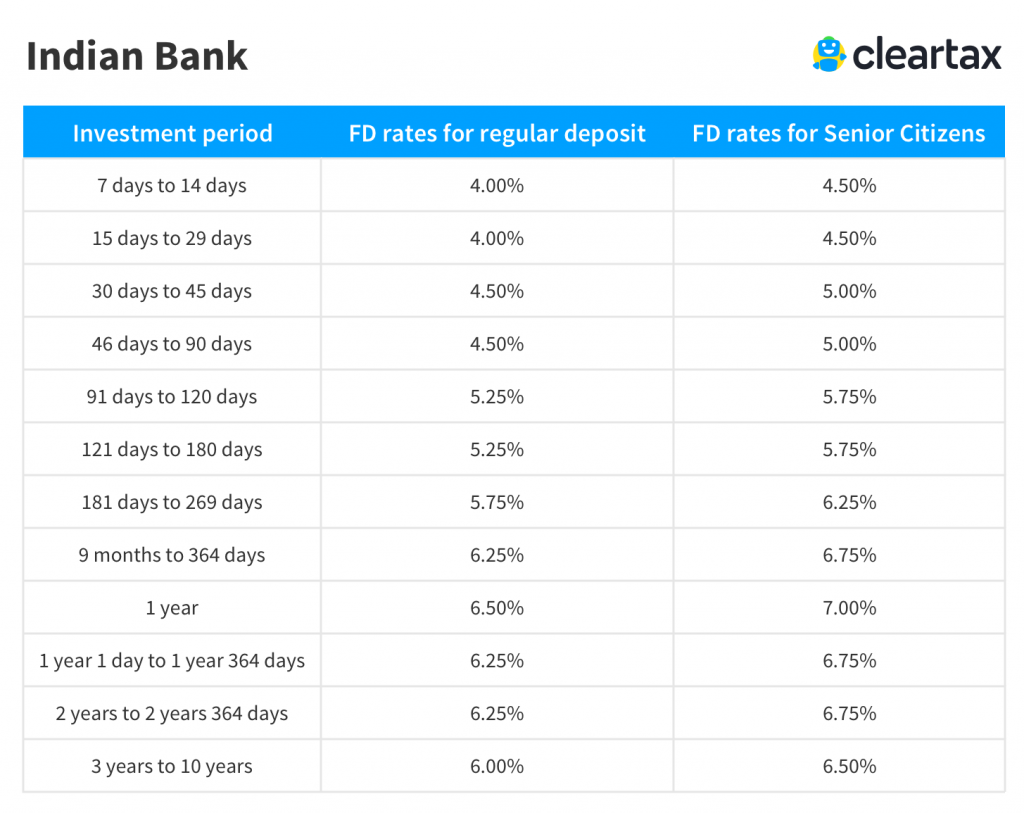

Indian Bank FD Interest Rates 2019 Indian Bank Fixed Deposit

https://assets1.cleartax-cdn.com/s/img/20180119122623/Indian-Bank-1024x813.png

Web A tax saving FD gives you access to tax rebates of up to 1 5 Lakhs annually under Section 80C of the Income Tax Act 1961 However to enjoy such fixed deposit tax Web Here is everything you need to know about income tax on interest on fixed deposits When is interest on FD taxable The interest earned on an FD is taxable It is added to your total income and taxed at the slab rates that

Web 20 juin 2018 nbsp 0183 32 How is interest income on FD taxed Interest income from FDs is taxable as Income from other sources under the provisions of the Income Tax Act 1961 the Act Web 18 janv 2022 nbsp 0183 32 18 January 2022 Income Tax Fixed deposits are popular saving instruments that allow you to earn interest for depositing an amount for a fixed period You will get

Best FD Rates In India Small Finance Banks Dec 2018

https://myinvestmentideas.com/wp-content/uploads/2018/12/Best-FD-Rates-in-India-for-Senior-citizens-Small-Finance-Banks-Dec-2018.jpeg

Latest Bank Interest FD Rates In India Aug 2013 Myinvestmentideas

https://i0.wp.com/myinvestmentideas.com/wp-content/uploads/2013/08/Latest-Bank-Interest-FD-rates-in-India-Aug-2013-Comparison-chart.jpg

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Web 9 nov 2020 nbsp 0183 32 A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Web 14 avr 2017 nbsp 0183 32 Fixed Deposits FDs allow you to exploit the complete potential of Section 80C to deduct Rs 1 5 lakh from your taxable income It also ensures capital protection

Latest Fixed Deposit Interest Rates In India Aug 2014

Best FD Rates In India Small Finance Banks Dec 2018

Ambank Fixed Deposit Rate 2020 Ambank Cash Rebate Visa Platinum 10

How Much Taxes Have To Be Paid On FD For 1 Crore Rs Quora

Best Investment Options Best Tax Saving Schemes In India For 2012

Latest Bank Interest FD Rates In India May 2013 Myinvestmentideas

Latest Bank Interest FD Rates In India May 2013 Myinvestmentideas

2018 Standard Deduction Chart

Tax Rebate For Individual Deductions For Individuals reliefs

Latest Bank Fixed Deposit FD Interest Rates In India Sep 2013

Tax Rebate On Fd In India - Web Tax Benefits on Fixed Deposits Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed