Tax Rebate On Fixed Deposit India Web 9 nov 2020 nbsp 0183 32 A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor

Web 8 sept 2023 nbsp 0183 32 Tax Exemption on Fixed Deposits Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers Web 29 juin 2022 nbsp 0183 32 Fixed Deposits Tax Saving FD for Sec 80C Deductions Benefits amp Interest Rates Risks Limits Updated on Jun 29 2022 12 14 25 AM Budget 2021 update It

Tax Rebate On Fixed Deposit India

Tax Rebate On Fixed Deposit India

https://myinvestmentideas.com/wp-content/uploads/2019/01/Best-Bank-Fixed-Deposit-FD-Rates-in-India-for-January-2019.jpeg

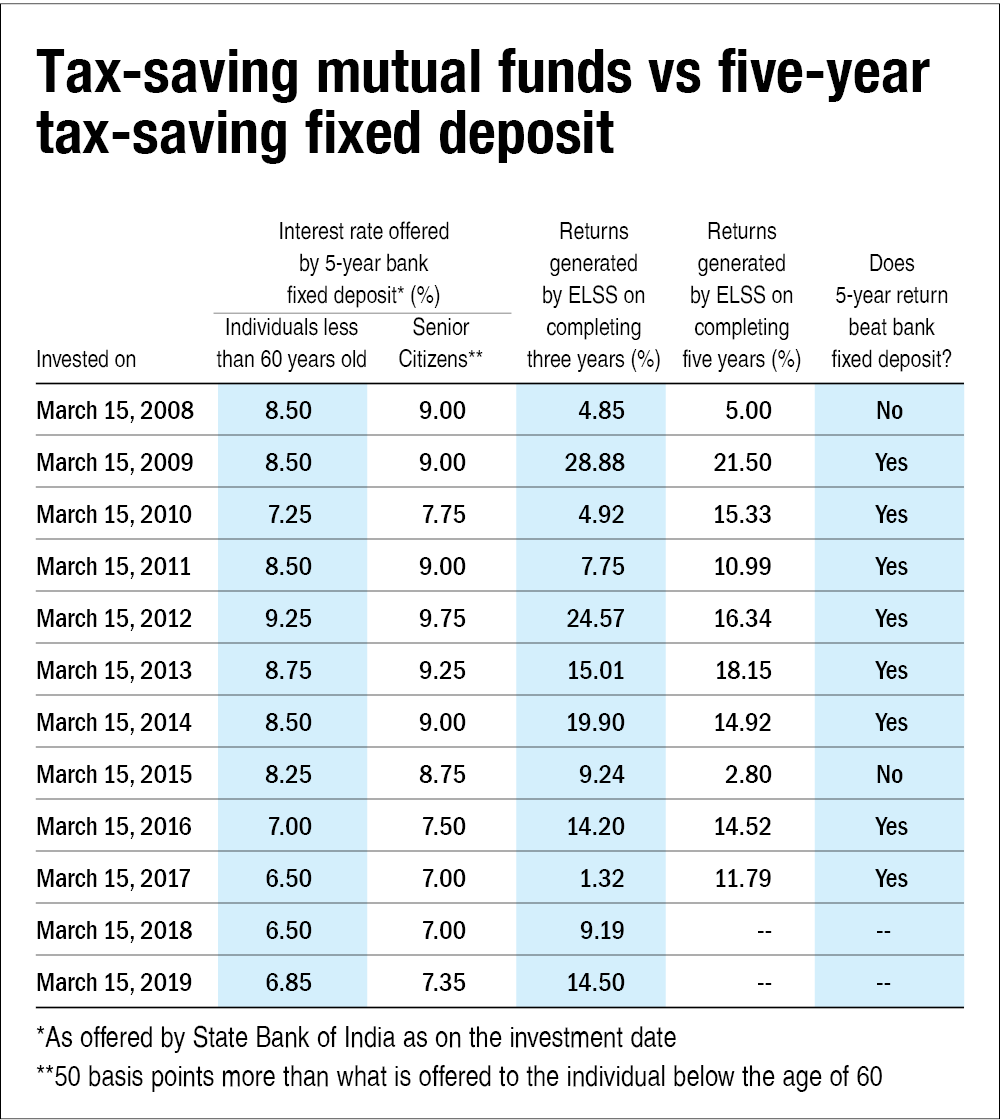

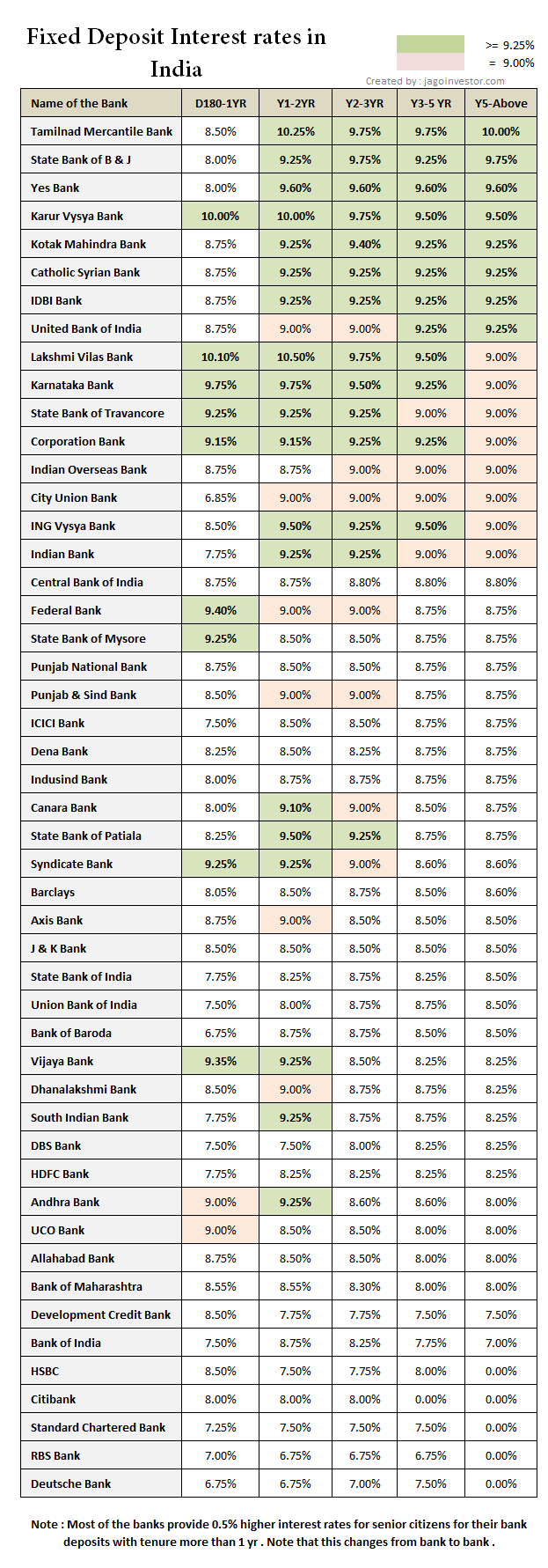

Fixed Deposits Interest Rates And Tax Rebate Value Research

https://www.valueresearchonline.com/content-assets/images/50686_20220406-elss_vs_fd-table__w1000__.png

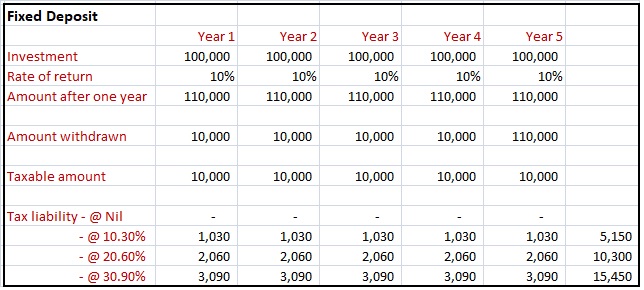

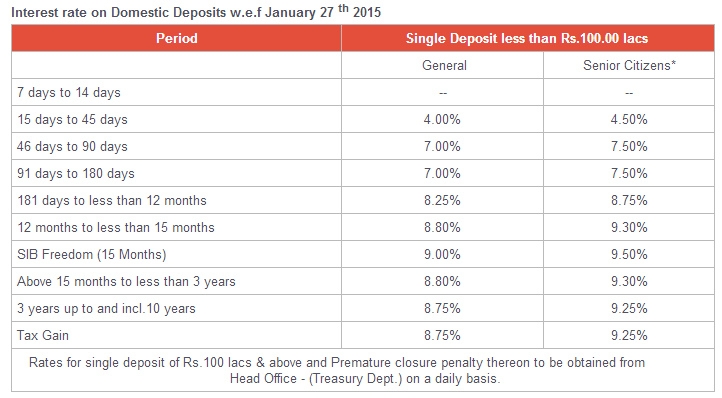

Best Fixed Deposit Interest Rates In Bank July 2019

https://myinvestmentideas.com/wp-content/uploads/2019/07/Best-Fixed-Deposit-Interest-Rates-in-Bank-in-in-India-in-July-2019.jpeg

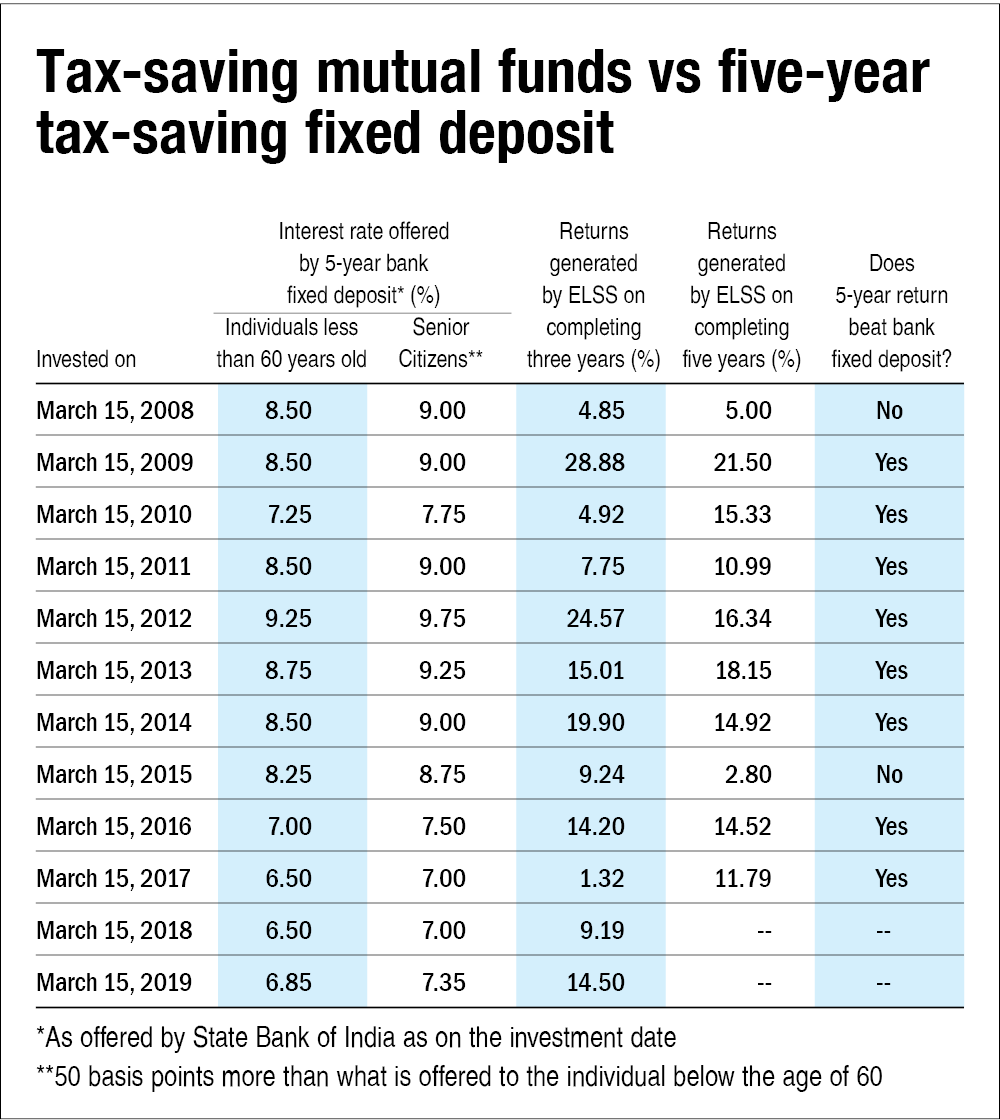

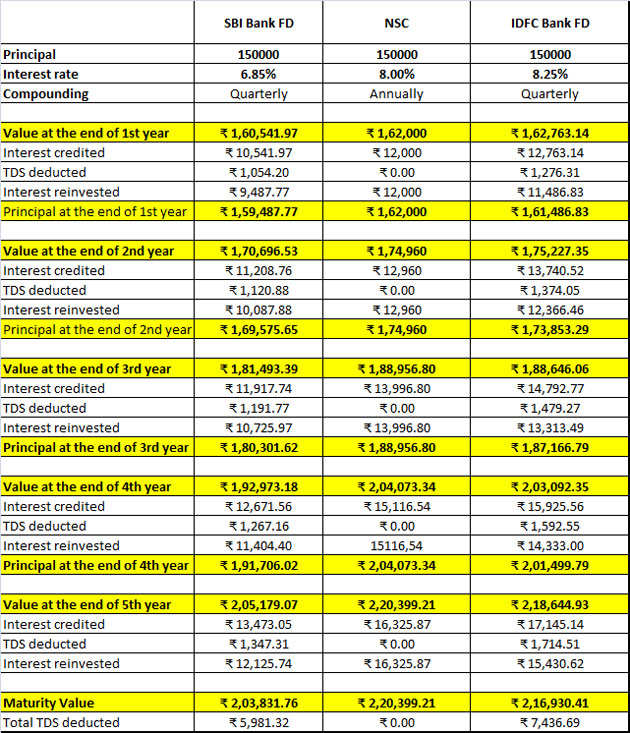

Web 12 nov 2020 nbsp 0183 32 The bank doesn t charge tax on Fixed Deposit if your overall income is less than Rs 2 5 lakh in a year However some lenders may ask you to submit Form 15G or Web Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed deposits can be avoided

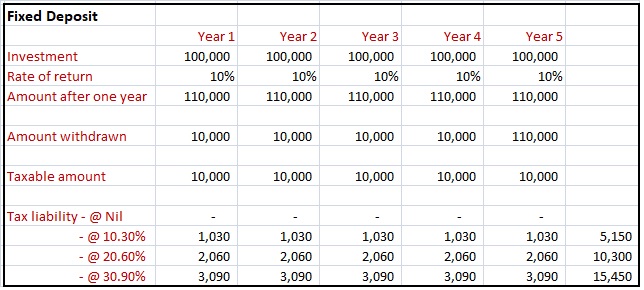

Web 6 avr 2022 nbsp 0183 32 For instance Union Bank of India is currently offering an annualised return of 5 30 per cent on a fixed deposit of three years However do note that fixed deposits with a lock in period of three years are not eligible for tax benefit under section 80C of Web 4 avr 2023 nbsp 0183 32 What is TDS On FD Interest earned on fixed deposit FD is fully taxable Banks deduct tax if your FD interest from a single bank exceeds the prescribed limit

Download Tax Rebate On Fixed Deposit India

More picture related to Tax Rebate On Fixed Deposit India

Latest SBI Fixed Deposit Rates In Dec 2018

https://myinvestmentideas.com/wp-content/uploads/2018/12/SBI-NRO-Fixed-Deposit-Rates-in-India-Dec-2018-Revised.jpeg

Indian Bank Fixed Deposit Interest Rates

https://images.livemint.com/r/LiveMint/Period2/2017/09/28/Photos/Processed/web_Fixed-deposit-rates_28-Sep_thursday.jpg

Current Fixed Deposit Interest Rates In India Mar 14

https://myinvestmentideas.com/wp-content/uploads/2014/03/Latest-bank-FD-interest-rates-in-India-Mar-2014.jpg

Web 20 juin 2018 nbsp 0183 32 An individual can avail tax deductions up to Rs 150 000 on the investments made in fixed deposits if the same is made in a scheduled bank for a period of not less Web Section 80TTA of the Income Tax Act 1961 provides a deduction of up to INR 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits Who can Claim 80TTA Deduction Can NRIs Avail of a Deduction under 80TTA

Web From April 2019 onwards if the interest on FD is more than 40 000 then PAN users would be liable to pay 10 as tax and non PAN users would pay 20 tax on interest earned Web 15 f 233 vr 2023 nbsp 0183 32 It will face a tax of Rs 31 200 tax rate of 30 and 0 4 cess The TDS on FDs is 10 if the interest amount for the entire financial year exceeds Rs 10 000 for AY

57 Tax Cut On Debt Mutual Funds Vs Fixed Deposits Sanjay Matai The

https://2.bp.blogspot.com/-A6id6lQzHcA/WfQw2DeJkaI/AAAAAAAADP0/LvVTHRP3mhEEpAwGejeCZ18JG9LVanInACLcBGAs/s1600/tax-on-fixed-deposits.jpg

Highest Fixed Deposit Interest Rates In India Best Banks

https://www.jagoinvestor.com/wp-content/uploads/files/img/ji/fixed-deposit-interest-rates-india.png

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Web 9 nov 2020 nbsp 0183 32 A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor

https://www.paisabazaar.com/fixed-deposit/tax-exemption-on-fixed-dep…

Web 8 sept 2023 nbsp 0183 32 Tax Exemption on Fixed Deposits Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers

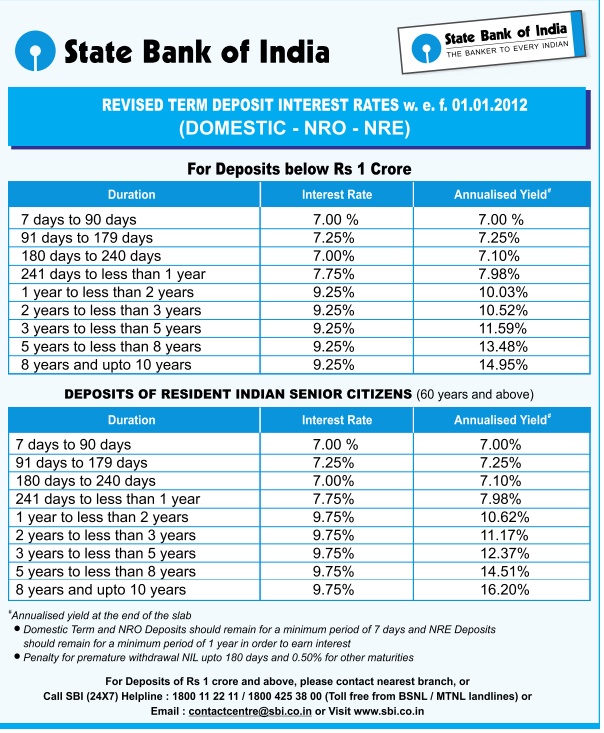

SBI Fixed Deposit Rates For January 2012

57 Tax Cut On Debt Mutual Funds Vs Fixed Deposits Sanjay Matai The

Bank Of India FD Interest Rates BOI Fixed Deposit

12 Interest Rate Bank Deposit For You

Fixed Deposit Interest Income Taxation For FY 2020 21 AY 2021 22

Ambank Fixed Deposit Rate 2020 Ambank Cash Rebate Visa Platinum 10

Ambank Fixed Deposit Rate 2020 Ambank Cash Rebate Visa Platinum 10

Top 18 5 Year Fixed Deposit Tax Free Calculator En Iyi 2022

Best Company Fixed Deposit Schemes In India Should You Invest

Best Fixed Deposit Rates Of All Indian Banks

Tax Rebate On Fixed Deposit India - Web Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed deposits can be avoided