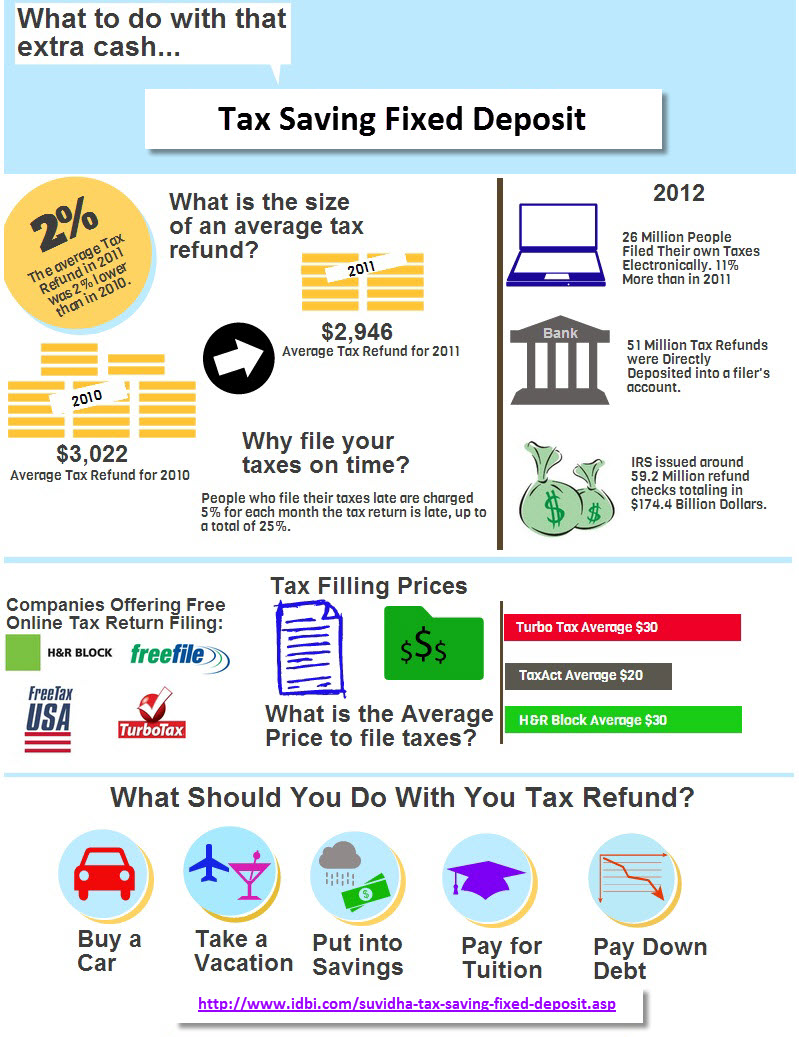

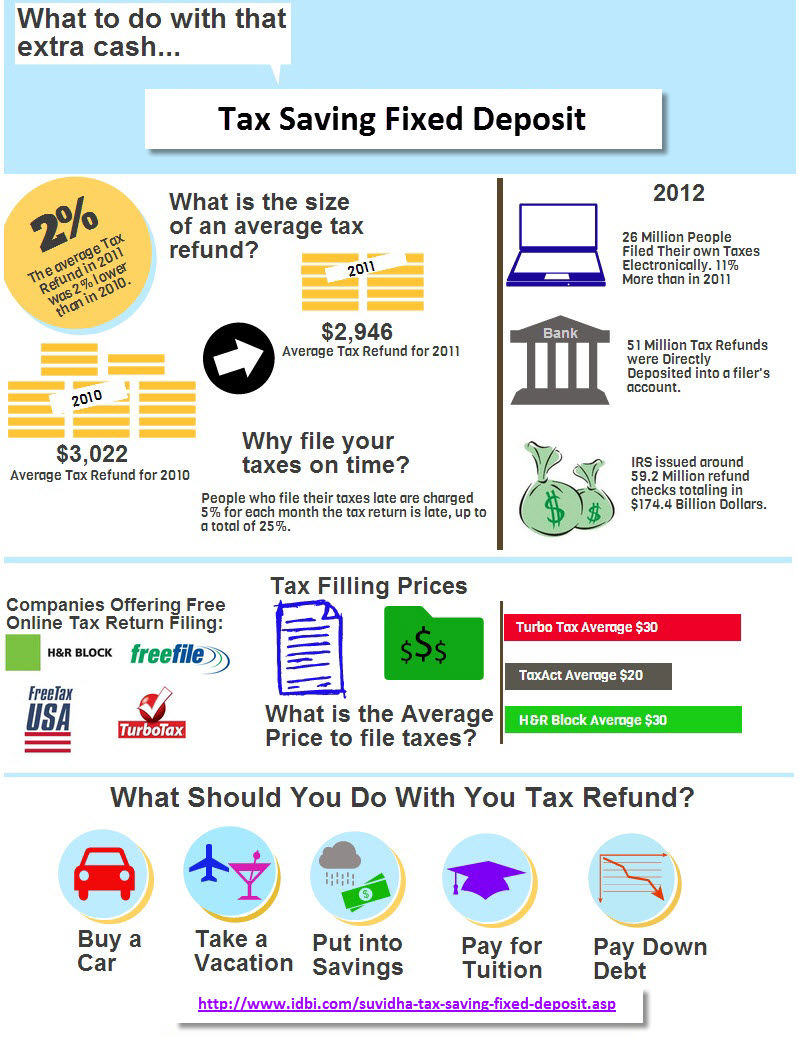

Tax Rebate On Fixed Deposit Web 8 sept 2023 nbsp 0183 32 Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

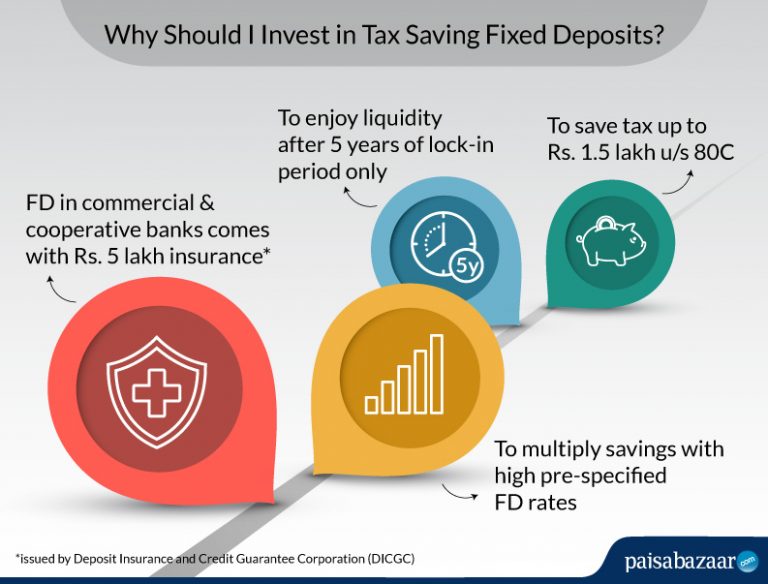

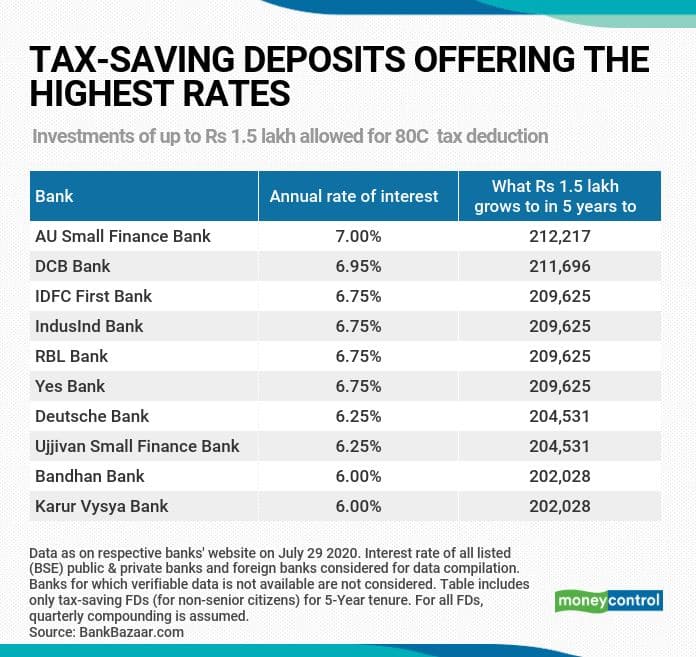

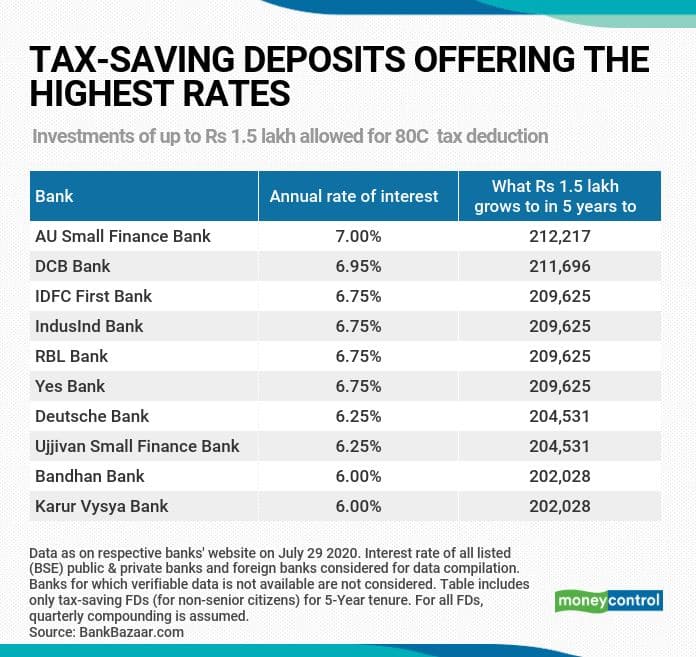

Web 9 nov 2020 nbsp 0183 32 Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in Web Tax Benefits on Fixed Deposits Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed

Tax Rebate On Fixed Deposit

Tax Rebate On Fixed Deposit

https://i.visual.ly/images/tax-saving-fixed-deposit_56e6931be8000.jpg

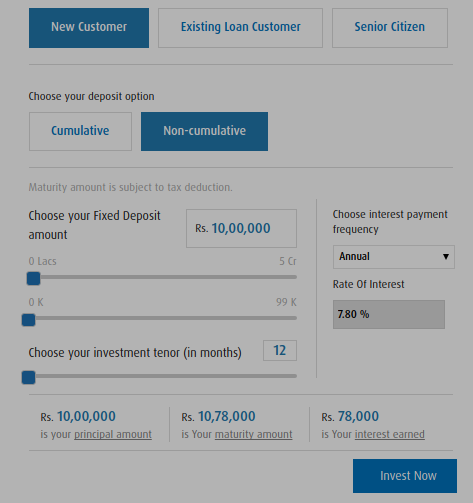

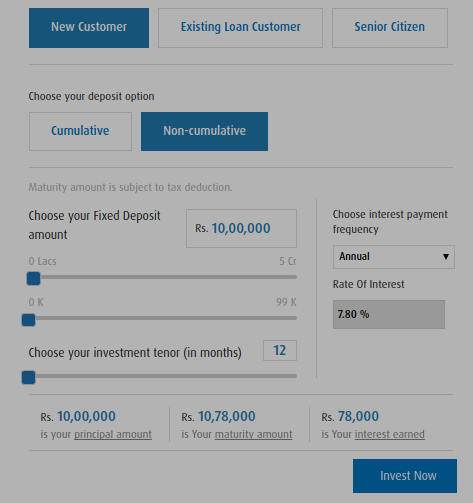

Finding All Tax Liabilities Using A Fixed Deposit Calculator Fixed

https://fixeddepositcalculator.files.wordpress.com/2017/05/fd-calculatore28093bajaj.png?w=473

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web 6 avr 2022 nbsp 0183 32 Are fixed deposits eligible for a tax rebate 06 Apr 2022 A fixed deposit with a bank can be renewed or extended multiple times on maturity for a similar duration for Web 18 janv 2022 nbsp 0183 32 18 January 2022 Income Tax Fixed deposits are popular saving instruments that allow you to earn interest for depositing an amount for a fixed period

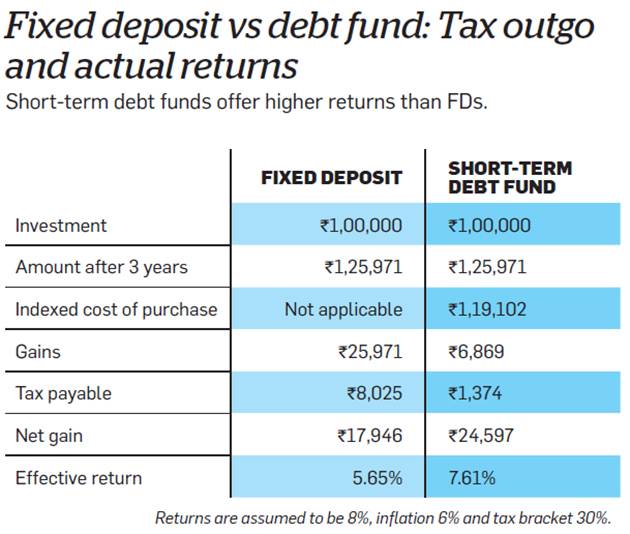

Web 29 juin 2022 nbsp 0183 32 Advantages of FD Limitations of FD FD Calculator FD or ELSS Which is the Best Who Should Invest in Fixed Deposit Taxation on FD Earnings Frequently Web 8 d 233 c 2022 nbsp 0183 32 No an income from a fixed deposit is not tax free The interest on FD is chargeable to income tax at the slab rates Moreover an investment in a tax saving 5

Download Tax Rebate On Fixed Deposit

More picture related to Tax Rebate On Fixed Deposit

Ambank Fixed Deposit Rate 2020 Ambank Cash Rebate Visa Platinum 10

http://oppasharing.com/wp-content/uploads/2020/05/cover-ambank-fixed-deposti-2020-1280x720.jpg

2 Reasons Why You Should Stop Investing In Fixed Deposits Immediately

http://www.jagoinvestor.com/wp-content/uploads/files/debt-fund-fixed-deposits-taxation.jpg

Benefits Of Fixed Deposits FDs In India

https://www.paisabazaar.com/wp-content/uploads/2020/02/fixed-deposit-benefits.jpg

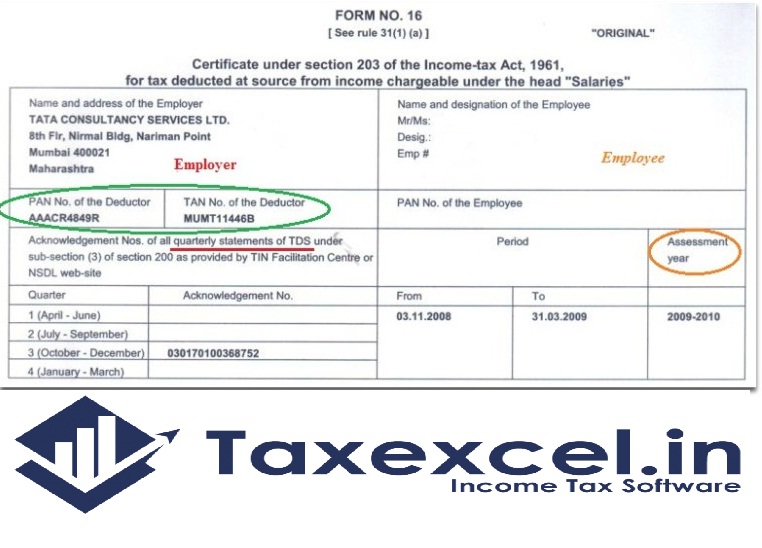

Web 4 avr 2023 nbsp 0183 32 What is TDS On FD Interest earned on fixed deposit FD is fully taxable Banks deduct tax if your FD interest from a single bank exceeds the prescribed limit Web 17 avr 2022 nbsp 0183 32 Interest earned on fixed deposits is taxable as per the Income Tax Act 1961 If you have FD in one or more bank accounts you should aggregate FD interest from all

Web The bank doesn t charge tax on Fixed Deposit if your overall income is less than Rs 2 5 lakh in a year However some lenders may ask you to submit Form 15G or 15H to claim Web 9 janv 2018 nbsp 0183 32 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Tax saving Fixed Deposits For Senior Citizens Know Benefits Other

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/09/17/996754-retirementplanning-thinkstock.jpg

https://www.paisabazaar.com/fixed-deposit/tax-exemption-on-fixed-dep…

Web 8 sept 2023 nbsp 0183 32 Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Web 9 nov 2020 nbsp 0183 32 Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in

Best Tax Saving FD Schemes In 2020 Paisabazaar

Illinois Tax Rebate Tracker Rebate2022

Fixed Deposits Best Investment Or Not With Automatic Income Tax Form

Are Fixed Deposits A Good Option For Tax Savings Kanakkupillai

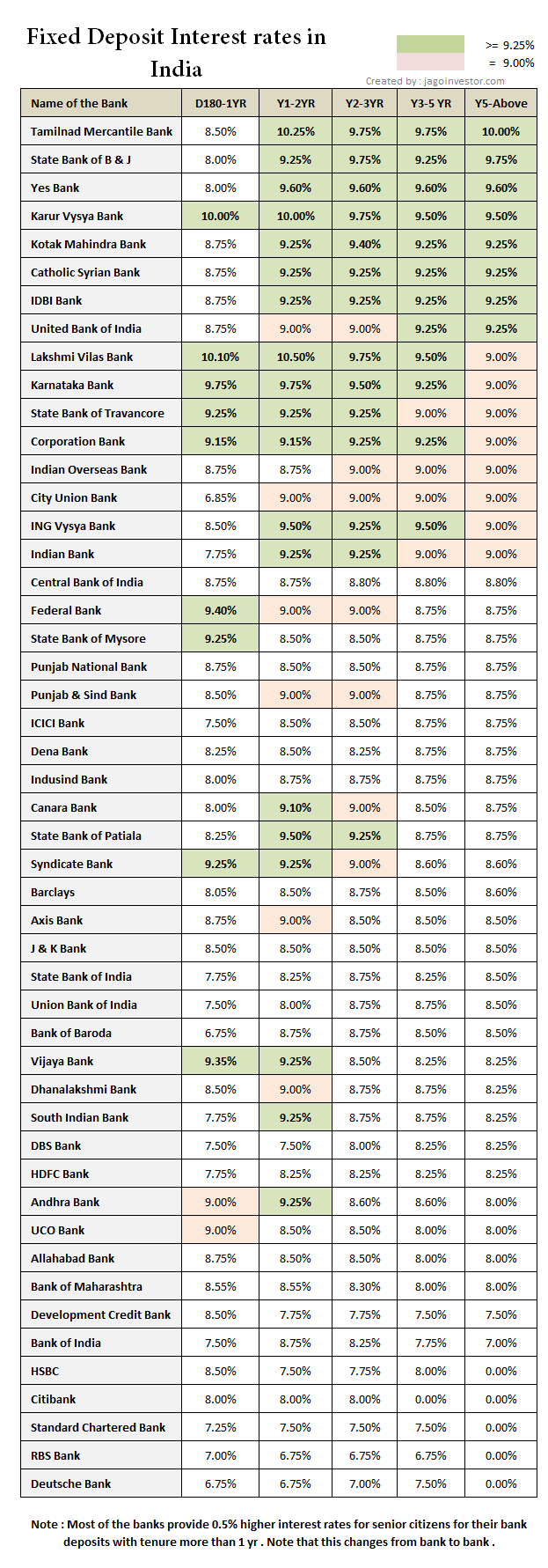

Highest Fixed Deposit Interest Rates In India Best Banks

10 Tax saving Fixed Deposits That Offer The Best Interest Rates

10 Tax saving Fixed Deposits That Offer The Best Interest Rates

Entries For Fixed Deposit FD Fixed Deposit And Interest Entries

Application For Rebate Of Property Taxes Niagara Falls Ontario

ApnaPlan Personal Finance Investment Ideas

Tax Rebate On Fixed Deposit - Web 29 juin 2022 nbsp 0183 32 Advantages of FD Limitations of FD FD Calculator FD or ELSS Which is the Best Who Should Invest in Fixed Deposit Taxation on FD Earnings Frequently