Tax Rebate On Home Loan Interest And Principal Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web July 7 2022 5 min read share the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Web 11 sept 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Tax Rebate On Home Loan Interest And Principal

Tax Rebate On Home Loan Interest And Principal

http://thismatter.com/money/real-estate/images/mortgage-payments-interest-principal-portions.gif

Home Loan Repayments Principal And Interest Or Interest Only

https://www.realestate.com.au/blog/images/519x1024-fit%2Cprogressive/2017/08/30112149/Bankwest_Infographic_v5-519x1024.jpg

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

https://i.stack.imgur.com/dLnok.jpg

Web 25 mars 2016 nbsp 0183 32 Tax Benefit on Home Loan Interest amp Principle F Y 2022 23 Updated on March 21 2023 CA PRADEEP KUMAWAT Latest Income Tax News amp Articles Taxes in India 5 Minutes Read Interest on Home Web 31 mai 2022 nbsp 0183 32 1 Section 80C Tax Deduction On Principal Amount It allows you to claim a yearly tax exemption of Rs 1 5 lakh from your taxable income on the principal repayment amount Individuals and HUF Hindu

Web You can avail of a home loan tax benefit on both principal repayment and the interest component of your EMI Here s how Section 80C Deductions under this section can Web 26 sept 2021 nbsp 0183 32 How To Fill Home Loan Interest and Principal in Income Tax Return Home Loan Tax Benefit in 2021 22 In this video I have tried to explain the knowledge abou

Download Tax Rebate On Home Loan Interest And Principal

More picture related to Tax Rebate On Home Loan Interest And Principal

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

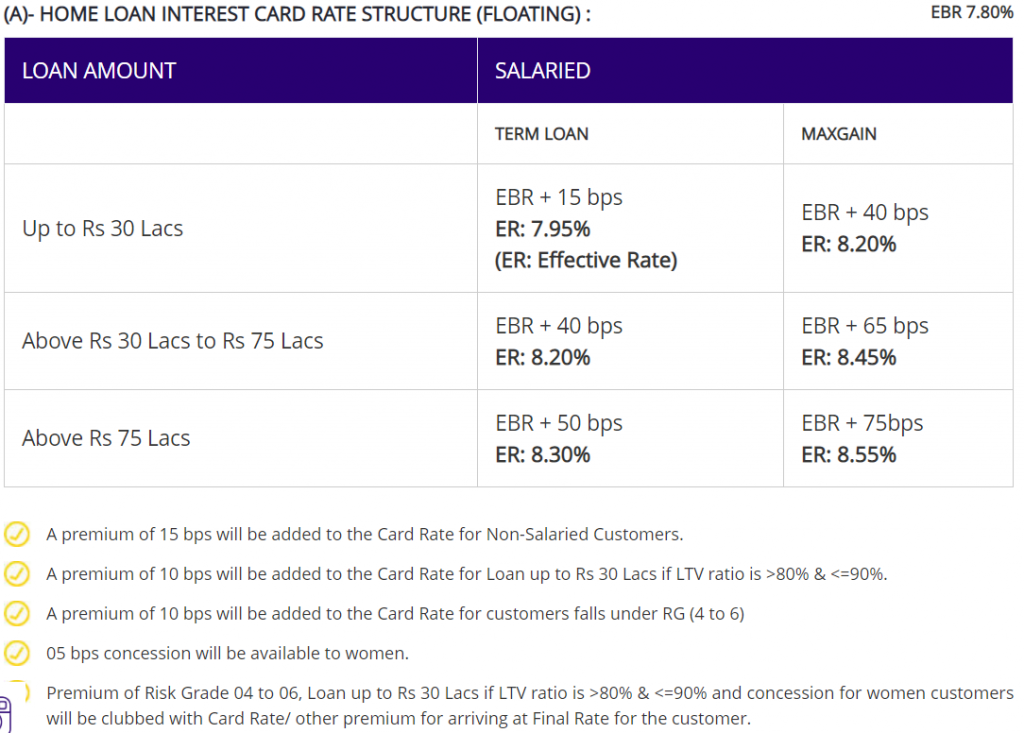

Oct 2016 Best Home Loan Interest Rates In 2016

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Home Loan Interest Rates Low Home Loan Rates What You Need To Know

https://www.apnaplan.com/wp-content/uploads/2020/01/SBI-Home-Loan-Interest-Rate-wef-1-January-2020-1024x733.png

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs Web 3 mars 2023 nbsp 0183 32 There is numerous Income tax rebate on a home loan that comes with home loans when you purchase a property and drastically lower your tax bill Both Interest payments and principal are part of a loan

Web 1 f 233 vr 2021 nbsp 0183 32 The tax benefits for interest payment and principal repayment of home loan can be claimed by both only if they are joint owners as well as a co borrowers servicing Web Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can claim

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

https://images.moneycontrol.com/static-mcnews/2022/08/home-loan-700X700.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web July 7 2022 5 min read share the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the

Loan Principal Definition Deltapart

Rising Home Loan Interests Have Begun To Impact Homebuyers

Home Loan EMI Calculator 2023 Free Excel Sheet Stable Investor

How To Calculate Interest Paid On A Loan And Principal Paid

Loan Amortization With Extra Principal Payments Using Microsoft Excel

Online Free Stuffs Free Home Mortgage Calculator For Microsoft Excel

Online Free Stuffs Free Home Mortgage Calculator For Microsoft Excel

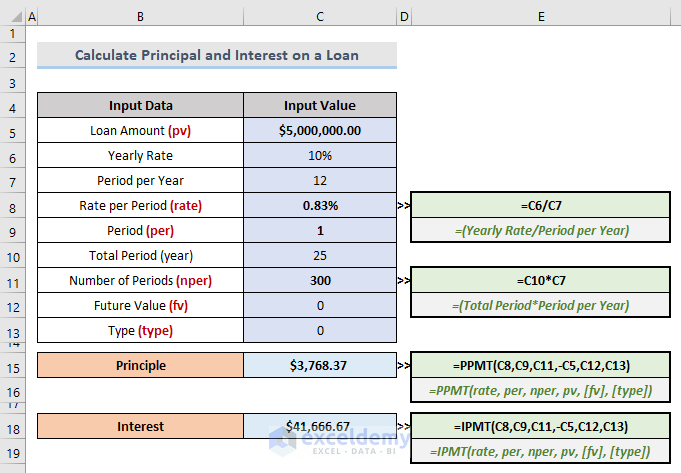

How To Calculate Principal And Interest On A Loan In Excel ExcelDemy

How To Calculate Your Home Loan Payment For 2023 Funaya Park

How To Calculate Loan Principal And Interest In Excel

Tax Rebate On Home Loan Interest And Principal - Web 31 mars 2019 nbsp 0183 32 The home loan tax benefit provided by the IT Act includes deductions towards both the repayment of the principal as well as the interest every year Home