Tax Rebate On Home Loan Interest Before Possession Web 16 mai 2013 nbsp 0183 32 Any pre construction interest is allowed to be deducted in five equal installments within the Rs 1 5 lakh limit i e including the current year interest payment

Web 12 janv 2022 nbsp 0183 32 Tax deductions on interest paid pre possession of the property Taking a house loan to purchase your dream home is now more convenient than ever as you Web 3 ao 251 t 2019 nbsp 0183 32 9 6K views 3 years ago In this video we have discussed about how to claim income tax deduction from interest paid on loan for a house or property before getting

Tax Rebate On Home Loan Interest Before Possession

Tax Rebate On Home Loan Interest Before Possession

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

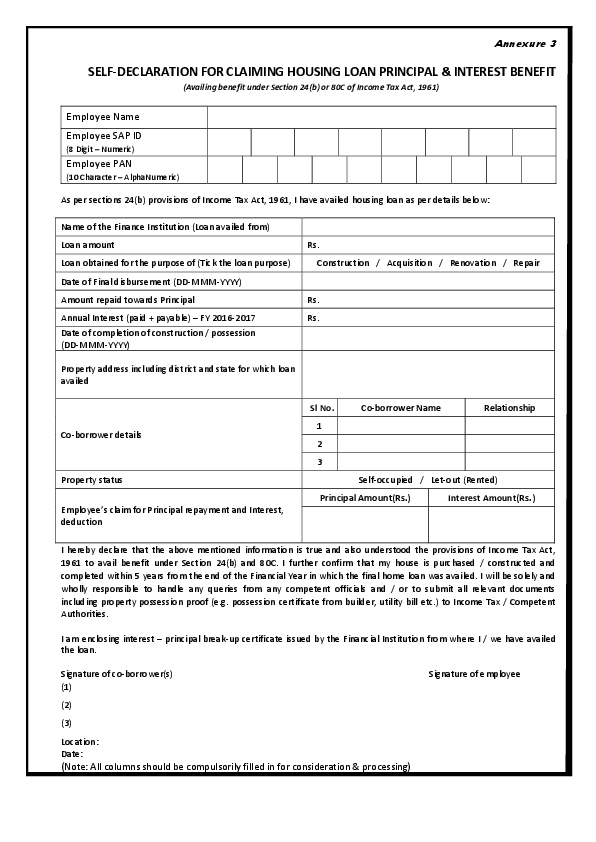

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

https://3.bp.blogspot.com/-pZ5VeMeXKq4/WFdWf7wSr7I/AAAAAAAADsQ/bmB9t4Yn_b8XW1PA-J15RmXGXB7kd0dEwCLcB/s1600/One%2Bby%2BOne%2BForm%2B16%2B4.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B Web 4 ao 251 t 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get some

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web Yes it is possible to claim a tax rebate on Home Loan before possession Know how tax exemptions on the interest component of a Home Loan work in the case of under

Download Tax Rebate On Home Loan Interest Before Possession

More picture related to Tax Rebate On Home Loan Interest Before Possession

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Home Loan Interest Rates 2019 Mortgage Rule Change To Lower Home

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the Web 6 avr 2016 nbsp 0183 32 04 January 2014 Dear Experts Kindly consider below scenario I took a housing loan in year 2009 for under construction flat in Noida full advance payment I

Web 17 f 233 vr 2023 nbsp 0183 32 Under Construction Property Tax Benefit As Per IT Act 1961 Section 80EE Section 80EE of the Income Tax Act offers an extra under construction property tax Web 24 d 233 c 2021 nbsp 0183 32 Since the house is is being sold within five years from the end of the financial year in which possession of the house was obtained any pre EMI rebate claimed by

ITR Filing You Can Claim Interest Paid Before Possession Even If You

https://www.livemint.com/lm-img/img/2023/06/22/600x338/Home_loan_1687401215877_1687401216035.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 mai 2013 nbsp 0183 32 Any pre construction interest is allowed to be deducted in five equal installments within the Rs 1 5 lakh limit i e including the current year interest payment

https://www.tatacapital.com/blog/loan-for-home/home-loan-tax-benefits...

Web 12 janv 2022 nbsp 0183 32 Tax deductions on interest paid pre possession of the property Taking a house loan to purchase your dream home is now more convenient than ever as you

Housing Loan Interest Rate Cumants

ITR Filing You Can Claim Interest Paid Before Possession Even If You

Best Home Loan Interest Rates In India Current Home Loan Interest

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

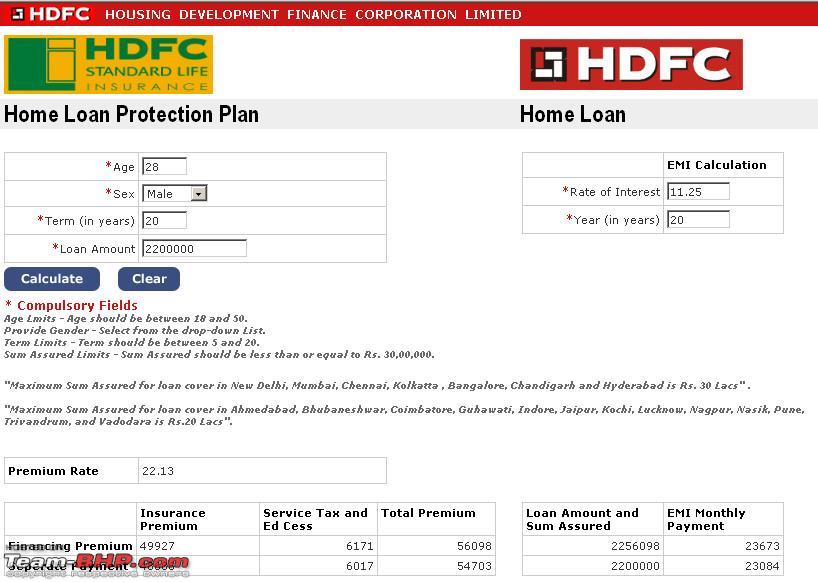

Hdfc Home Loan Interest Rate Reduction For Existing Customers

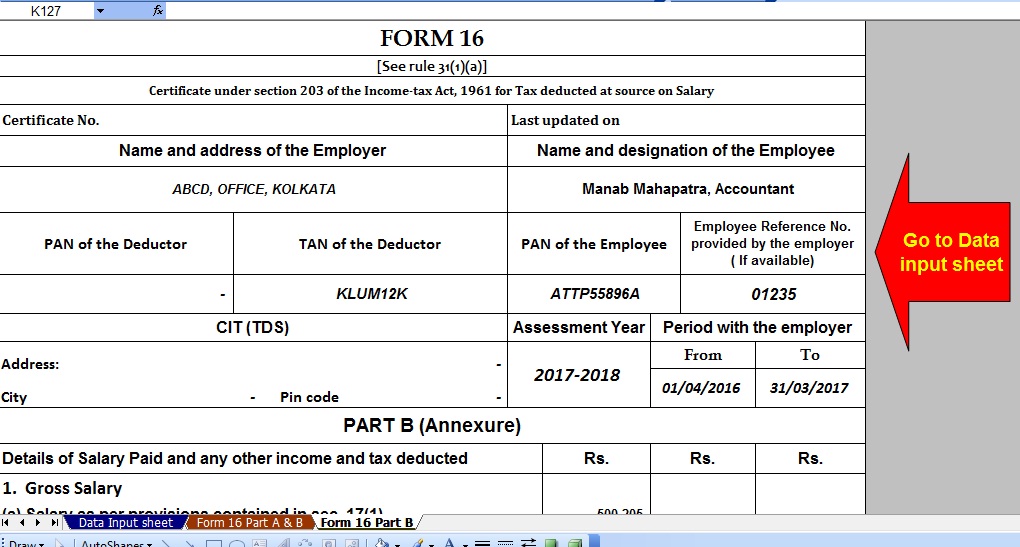

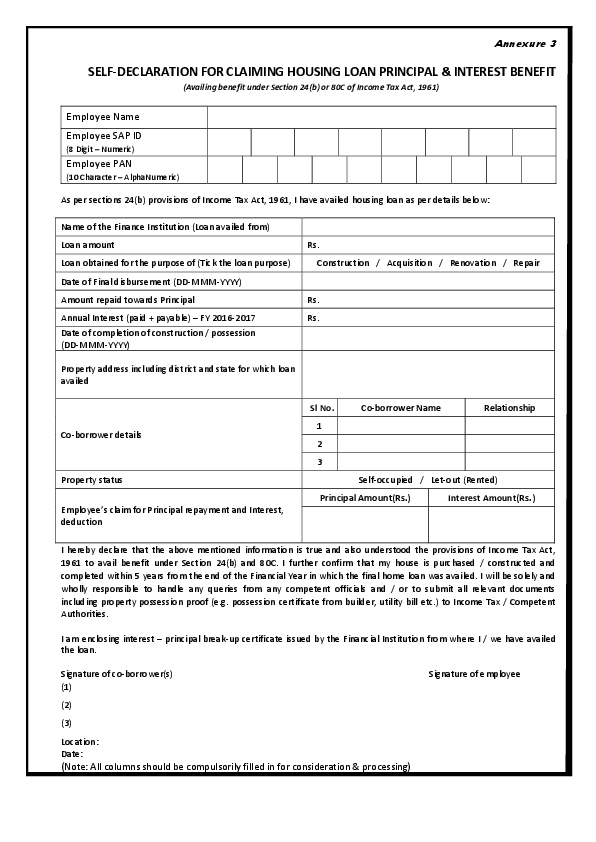

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

Home Loan Interest Rate Home Sweet Home Insurance Accident

Microfinance Loan Application Form

Lowest Home Loan Interest Rate Loan Interest Rates Home Loans

Tax Rebate On Home Loan Interest Before Possession - Web 9 sept 2023 nbsp 0183 32 Homeowners with loans can now enjoy 2 more years of tax benefits in case of any delay in property possession The amount of benefit that can be availed is still