Tax Rebate On Home Loan Interest Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web July 7 2022 5 min read share the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Tax Rebate On Home Loan Interest

Tax Rebate On Home Loan Interest

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Home Loan Interest Rebate On Home Loan Interest In Income Tax

https://3.bp.blogspot.com/-o4djNyyA8DU/T2P0RGOd-fI/AAAAAAAAAys/XWfuzicFqlk/w1200-h630-p-k-no-nu/Untitled.gif

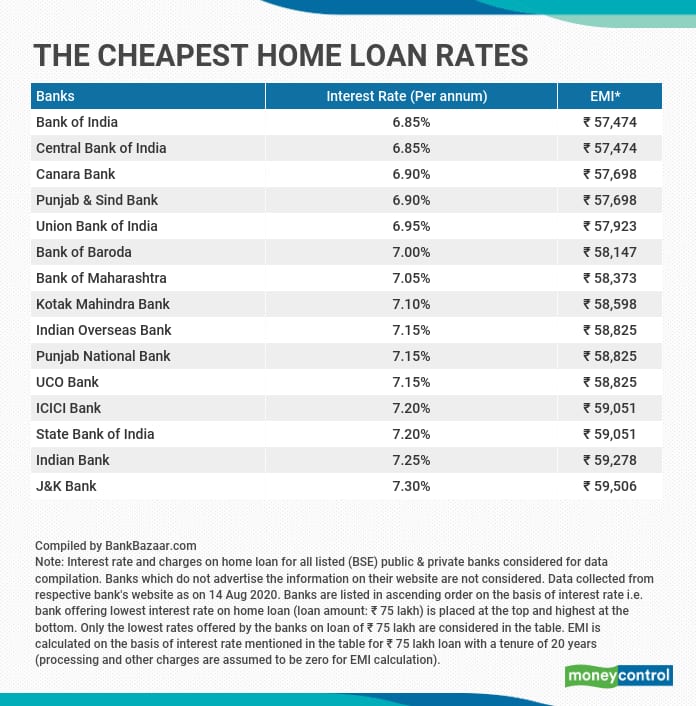

Home Loan Interest Rates 2019 Mortgage Rule Change To Lower Home

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 while Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records

Web 24 ao 251 t 2023 nbsp 0183 32 You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self occupied as well as vacant residential Web 1 f 233 vr 2021 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24B 2023 The interest portion of your EMIs paid during a year are allowed to be taken as

Download Tax Rebate On Home Loan Interest

More picture related to Tax Rebate On Home Loan Interest

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as Web 5 sept 2023 nbsp 0183 32 Benefits of Section 80EEA are offered to home loans sanctioned between 1 April 2019 and 31 March 2022 Borrowers whose loans were approved during this period

Web Mike De Socio Sept 11 2023 3 22 a m PT 5 min read Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your

Tax Benefits On Home Loan Complete Details And Doubts

https://3.bp.blogspot.com/-N4IqHJhEXFA/WJHv5VBbpUI/AAAAAAAAFhA/k6e0LrV20oUtUBO4u7O-324H6C785_KLgCEw/s1600/1.JPG

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web July 7 2022 5 min read share the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Tax Benefits On Home Loan Complete Details And Doubts

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Tax Rebate On Home Loan Interest The Economic Times

Sbi Home Loan Interest Rate Today Sale Discount Save 49 Jlcatj gob mx

Form 12BB New Form To Claim Income Tax Benefits Rebate

Form 12BB New Form To Claim Income Tax Benefits Rebate

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

Rising Home Loan Interests Have Begun To Impact Homebuyers

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Tax Rebate On Home Loan Interest - Web 3 mars 2023 nbsp 0183 32 Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Phase Home Loan Deduction Under Section