Tax Rebate On Home Renovation Loan Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

Web 22 sept 2021 nbsp 0183 32 Section 24 of the Income Tax Act 1961 provides that you can avail a deduction of up to Rs 30 000 per annum on home renovation loans This is included Web As per Section 24 of the Income Tax Act 1961 home improvement loan tax exemption is applicable on the interest paid against the home improvement loan However this tax

Tax Rebate On Home Renovation Loan

Tax Rebate On Home Renovation Loan

https://www.okinsulation.ca/assets/components/phpthumbof/cache/Upgrade_Location_2.d7fd283ae259bacb27459c18b8e11278.png

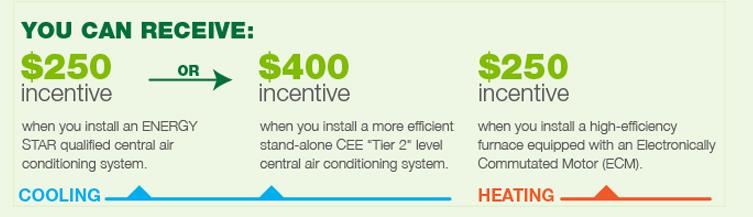

Ontario Home Renovation Rebates Which Are Right For You

https://www.gni.ca/uploads/upload/GNI-HER-Infographic.jpg

Q A With Cunningham Home Renovation Loans Home Renovation Loan Home

https://i.pinimg.com/originals/cb/62/f9/cb62f9b761d7df95037c0880da26d10f.jpg

Web Interest that is payable on loans taken for home improvement are tax deductible up to Rs 30 000 per annum There are some simple steps that are needed to apply for a home Web 30 ao 251 t 2022 nbsp 0183 32 However this tax rebate on home improvement loans has a maximum limit of Rs 30 000 per annum This home improvement loan tax relief shares the overall tax

Web 8 d 233 c 2019 nbsp 0183 32 Under Section 24 of the Income Tax Act you can avail up to Rs 30 000 tax benefits per annum on your home improvement loan However note that this deduction Web 12 juil 2021 nbsp 0183 32 Notably if the home improvement loan is taken for a second home you can claim a tax deduction on interest repaid of up to Rs 30 000 over and above the interest

Download Tax Rebate On Home Renovation Loan

More picture related to Tax Rebate On Home Renovation Loan

Pin On Home Renovation Rebates

https://i.pinimg.com/736x/6f/b1/b3/6fb1b36225619470910b502e46aa736c.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web 9 ao 251 t 2023 nbsp 0183 32 Aug 9 2023 9 00 am ET Text Many Americans will save thousands of dollars on home renovations when new rebates for a range of energy efficient upgrades kick in Web Tax benefit A house renovation loan fetches you a tax benefit on the interest component that is you can avail a deduction of up to Rs 30 000 per annum under section 24 for

Web 17 mai 2019 nbsp 0183 32 Taxpayers who avail of a top up home loan for repairs or renovation of a house can claim a deduction for interest paid on such loans Under the Act the Web 5 f 233 vr 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

How To Qualify For A Renovation Loan In 2023 Funaya Park

https://i.pinimg.com/originals/7e/1c/1d/7e1c1da0dd42267abdd04e0366744b8f.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

https://loantap.in/blog/what-are-the-tax-benefits-available-on-a-home...

Web 22 sept 2021 nbsp 0183 32 Section 24 of the Income Tax Act 1961 provides that you can avail a deduction of up to Rs 30 000 per annum on home renovation loans This is included

HomeStyle Renovation Loan Buy And Renovate In One Loan

How To Qualify For A Renovation Loan In 2023 Funaya Park

Renovation Loans Comparison Home Renovation Loan Home Improvement

Save Money And Get Comfy With Energy efficient Insulation Before

Download Renovation Estimate Template Estimate Template Renovation

FHA 203k Quick Reference Home Renovation Loan Home Equity Home

FHA 203k Quick Reference Home Renovation Loan Home Equity Home

Home Renovation Rebate Programs Capture Energy

Top 5 Home Renovation Rebates And Tax Credits For 2020 Renco

Can You Get A Rebate On Home Renovations Kavaleer Renovations Flickr

Tax Rebate On Home Renovation Loan - Web Interest that is payable on loans taken for home improvement are tax deductible up to Rs 30 000 per annum There are some simple steps that are needed to apply for a home