Tax Rebate On House Loan Interest Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Tax Rebate On House Loan Interest

Tax Rebate On House Loan Interest

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

10 Things From The Union Budget 2014 That Could Impact Property Inves

https://image.slidesharecdn.com/10thingsfromtheunionbudget2014thatcouldimpactpropertyinvestments-140722082100-phpapp02/95/10-things-from-the-union-budget-2014-that-could-impact-property-investments-1-638.jpg?cb=1406018069

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Download Tax Rebate On House Loan Interest

More picture related to Tax Rebate On House Loan Interest

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

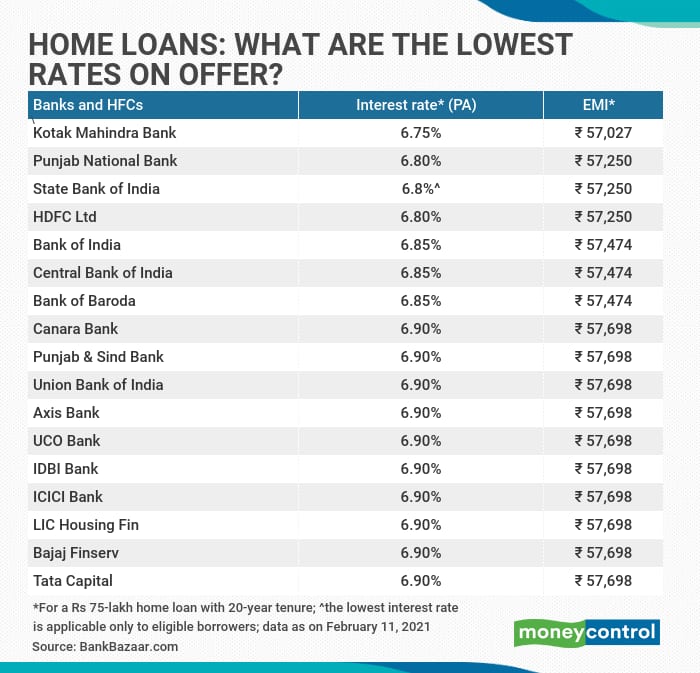

How To Lower Loan Interest Rates

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records Web Tax saving on home loan increases the affordability of your home loan With the help of a home loan tax benefit calculator you can find out your exact tax exemption My Annual

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you Web 26 oct 2021 nbsp 0183 32 The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The new tax structure introduced in Budget 2020 does

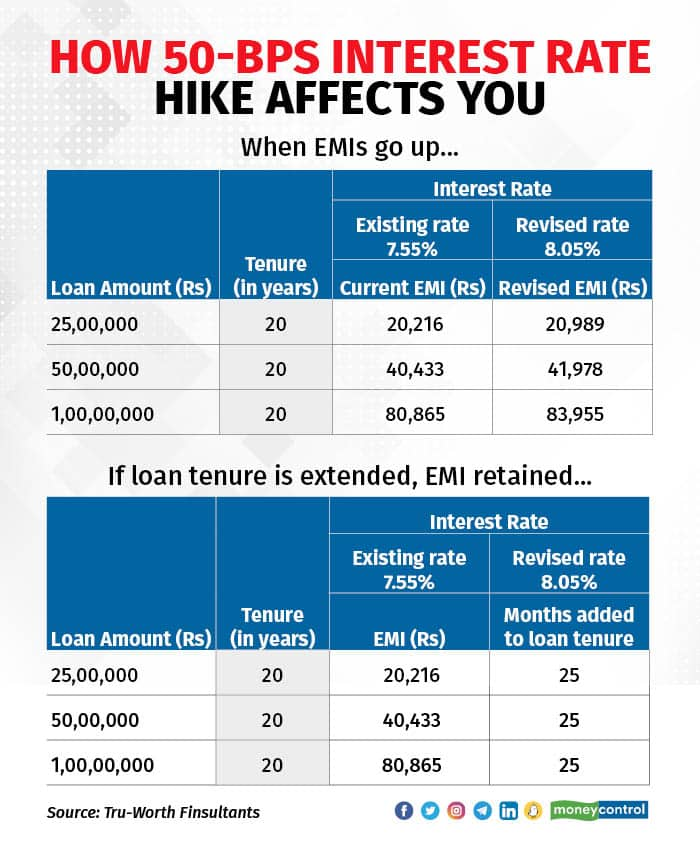

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

https://images.moneycontrol.com/static-mcnews/2022/08/home-loan-700X700.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

Rising Home Loan Interests Have Begun To Impact Homebuyers

What You Required To Learn About House Equity Loan

Latest Income Tax Rebate On Home Loan 2023

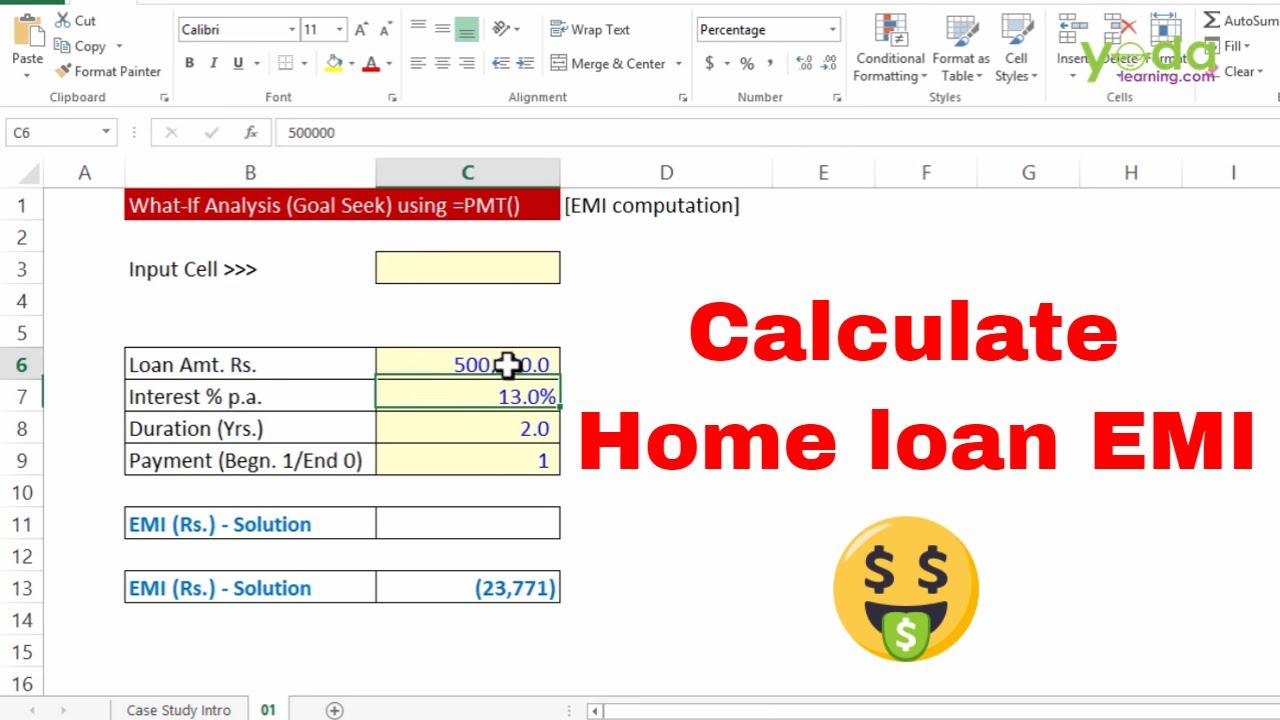

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Signs That You re Paying Too Much For Your Home

Tax Rebate On House Loan Interest - Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on