Tax Rebate On Housing Loan Before Possession Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates are

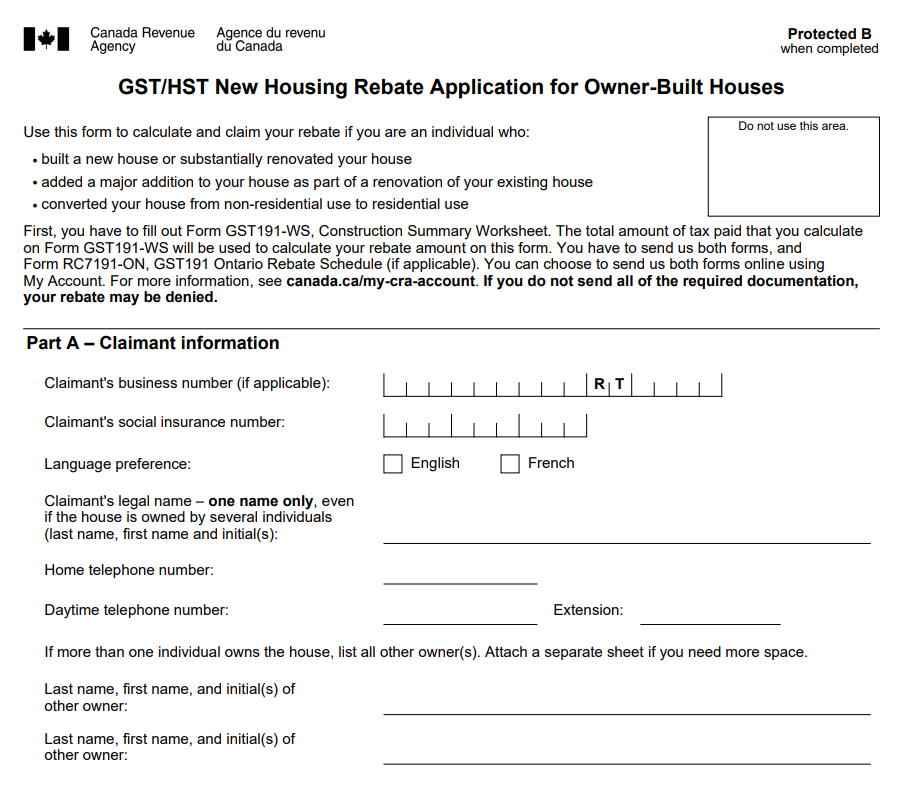

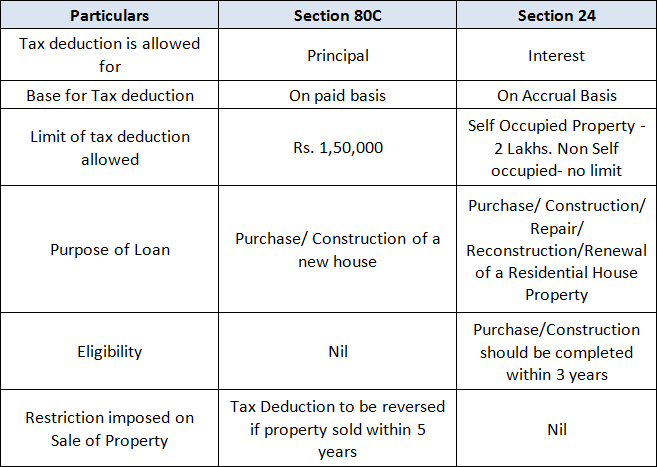

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession can be claimed over the next 5

Tax Rebate On Housing Loan Before Possession

Tax Rebate On Housing Loan Before Possession

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only Web Le plafonnement du cr 233 dit d imp 244 t pour la r 233 sidence principale et les travaux de d 233 veloppement durable est de 8 000 euros pour un c 233 libataire et de 16 000 euros pour

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web 31 mai 2022 nbsp 0183 32 First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17 However there

Download Tax Rebate On Housing Loan Before Possession

More picture related to Tax Rebate On Housing Loan Before Possession

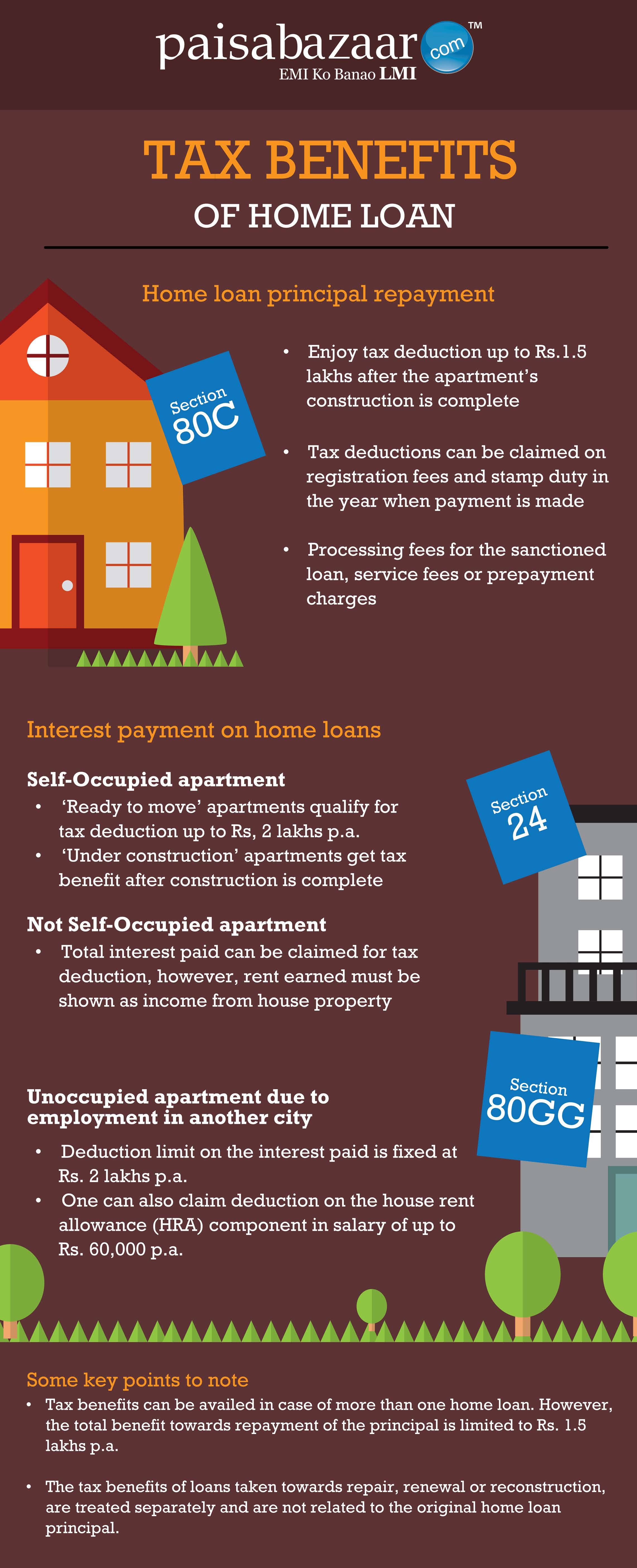

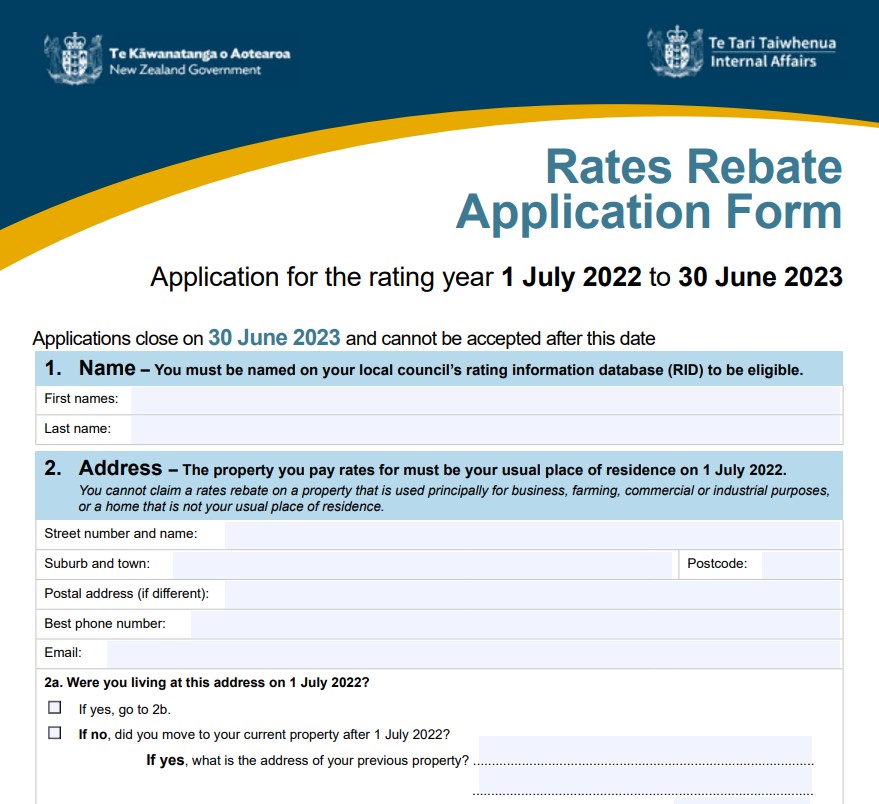

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

HST Rebate Form For New Housing 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/08/HST-Rebate-Form-2021.png

Web 21 sept 2022 nbsp 0183 32 Autres cas d exon 233 ration de la taxe fonci 232 re Une dur 233 e de 15 ans d exon 233 ration de taxe fonci 232 re peut 234 tre accord 233 e en cas de contrat de location Web 9 sept 2023 nbsp 0183 32 A home loan borrower can end up losing up to 85 of tax benefits available on the home loan premium payment if the builder fails to deliver possession of the

Web 4 ao 251 t 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get some Web 5 f 233 vr 2023 nbsp 0183 32 The maximum amount that can be claimed is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Ontario New Housing Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Ontario-New-Housing-Rebate-Form-2023.png

https://www.bajajhousingfinance.in/claim-tax-benefit-on-home-loan...

Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates are

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate

Gst New Housing Rebate Application Form Printable Rebate Form

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

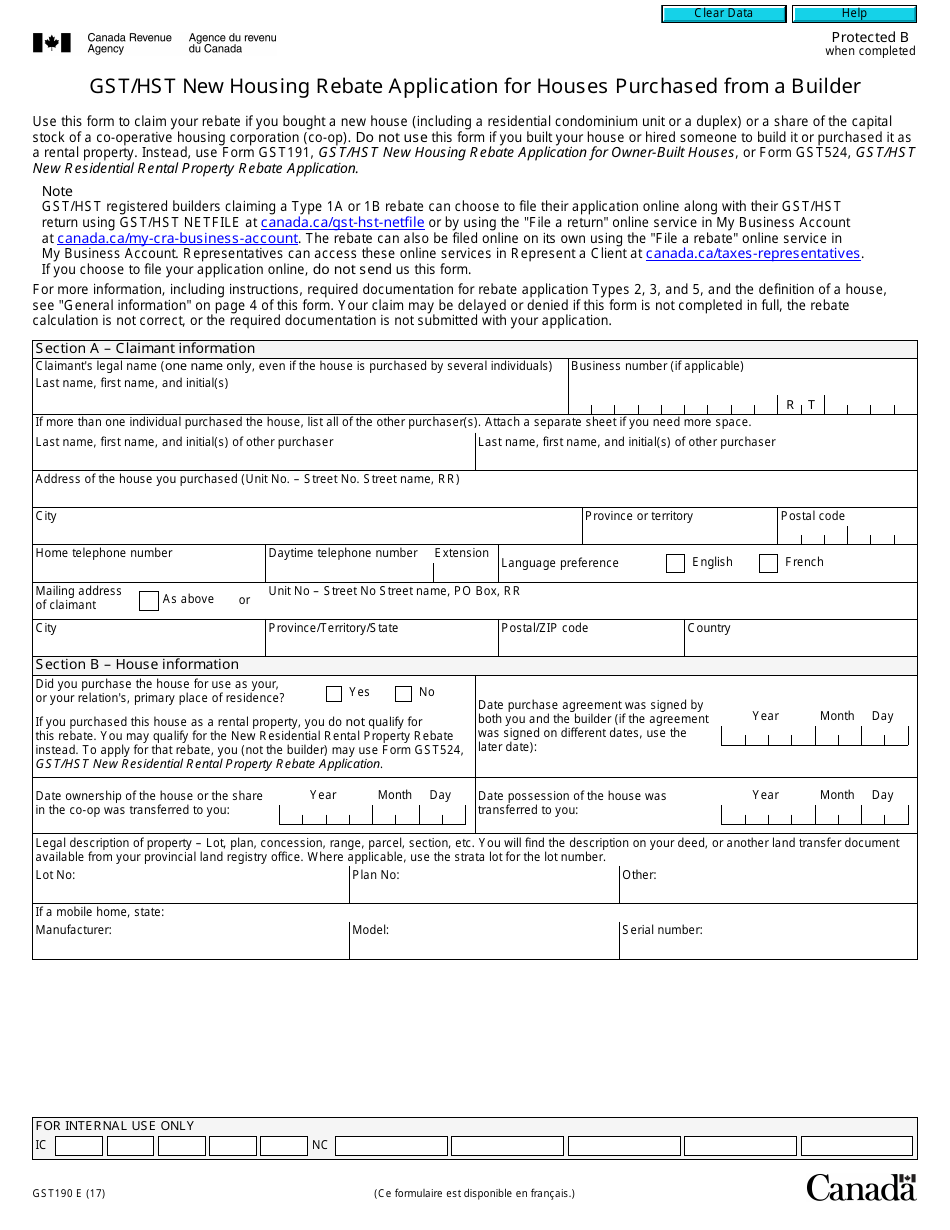

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Property Tax Rebate Application Printable Pdf Download

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Payment View

Payment View

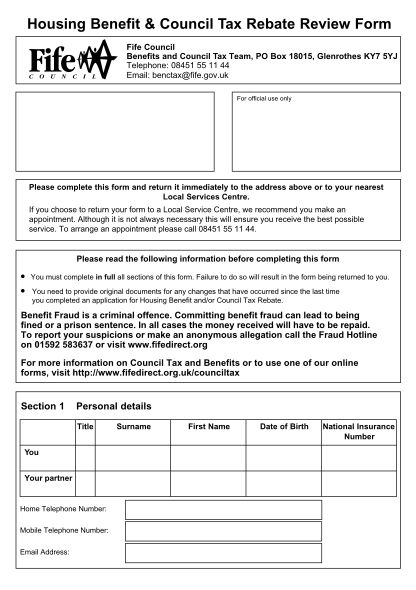

84 Can You Apply For Housing Benefit Online Page 3 Free To Edit

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Tax Rebate On Housing Loan Before Possession - Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only