Tax Rebate On Housing Loan Interest Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 31 mai 2022 nbsp 0183 32 You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your employer The process to claim housing loan tax Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Tax Rebate On Housing Loan Interest

Tax Rebate On Housing Loan Interest

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

Web July 7 2022 5 min read share the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections Web 5 sept 2023 nbsp 0183 32 Benefits of Section 80EEA are offered to home loans sanctioned between 1 April 2019 and 31 March 2022 Borrowers whose loans were approved during this period

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Download Tax Rebate On Housing Loan Interest

More picture related to Tax Rebate On Housing Loan Interest

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

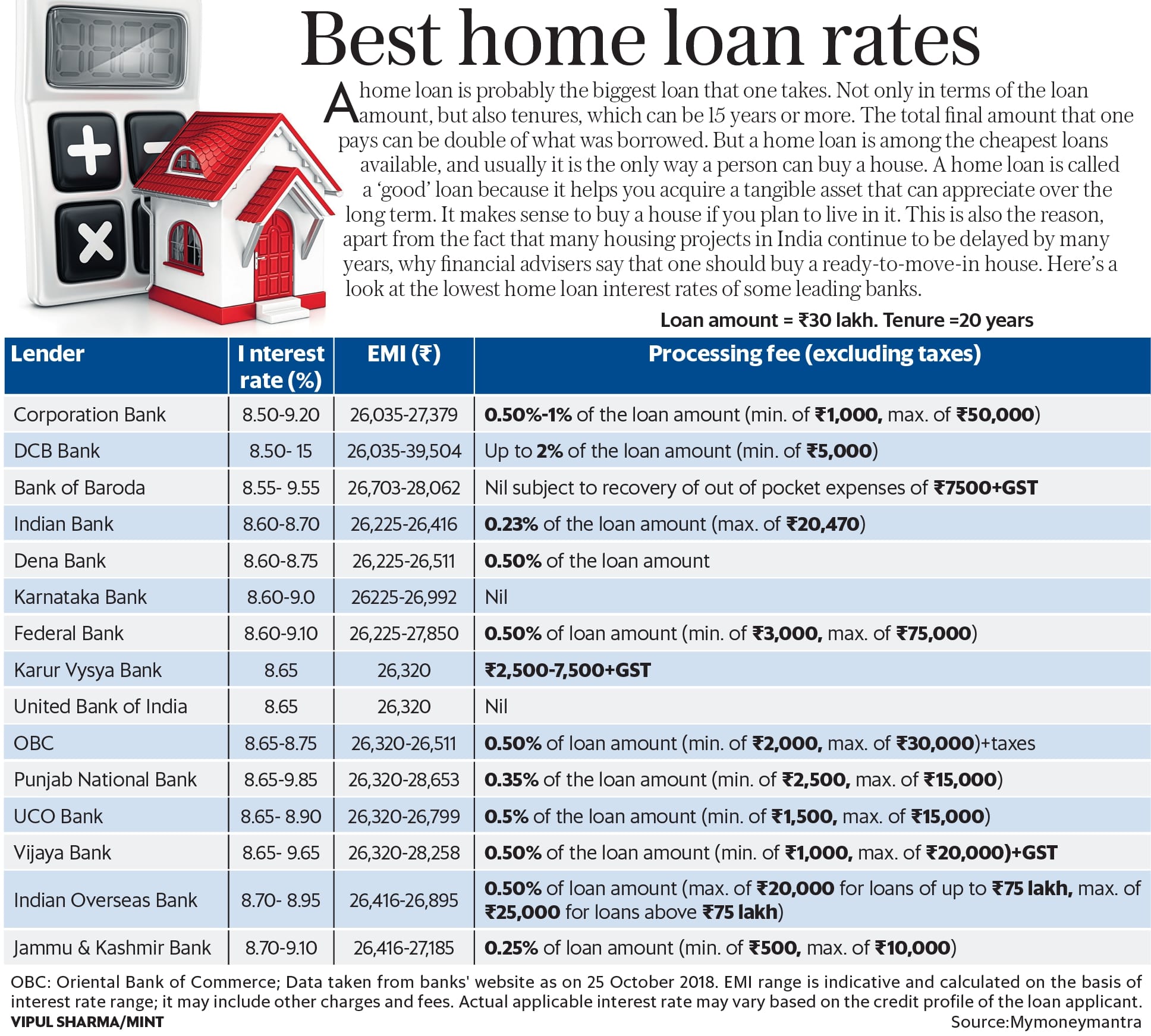

Are Home Loan Interest Rates Going Up Funaya Park

https://i.pinimg.com/originals/b7/04/0f/b7040fce085c54337a780ffde783f042.jpg

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Web 30 janv 2023 nbsp 0183 32 According to real estate experts budget 2023 should increase the tax rebate on home loan interest to Rs 5 Lakh under Section 24 b The government should revise the price bandwidths for houses to Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 while

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as

Home Loan Brochure Home Sweet Home Insurance Accident Lawyers And

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://navi.com/blog/tax-benefit-on-home-loan

Web 31 mai 2022 nbsp 0183 32 You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your employer The process to claim housing loan tax

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

Home Loan Brochure Home Sweet Home Insurance Accident Lawyers And

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Public Bank Housing Loan Interest Rate 2019 Buying Your First Home

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

Public Bank Housing Loan Interest Rate 2019 Best Housing Loans In

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Tax Rebate On Housing Loan Interest - Web 5 sept 2023 nbsp 0183 32 Benefits of Section 80EEA are offered to home loans sanctioned between 1 April 2019 and 31 March 2022 Borrowers whose loans were approved during this period