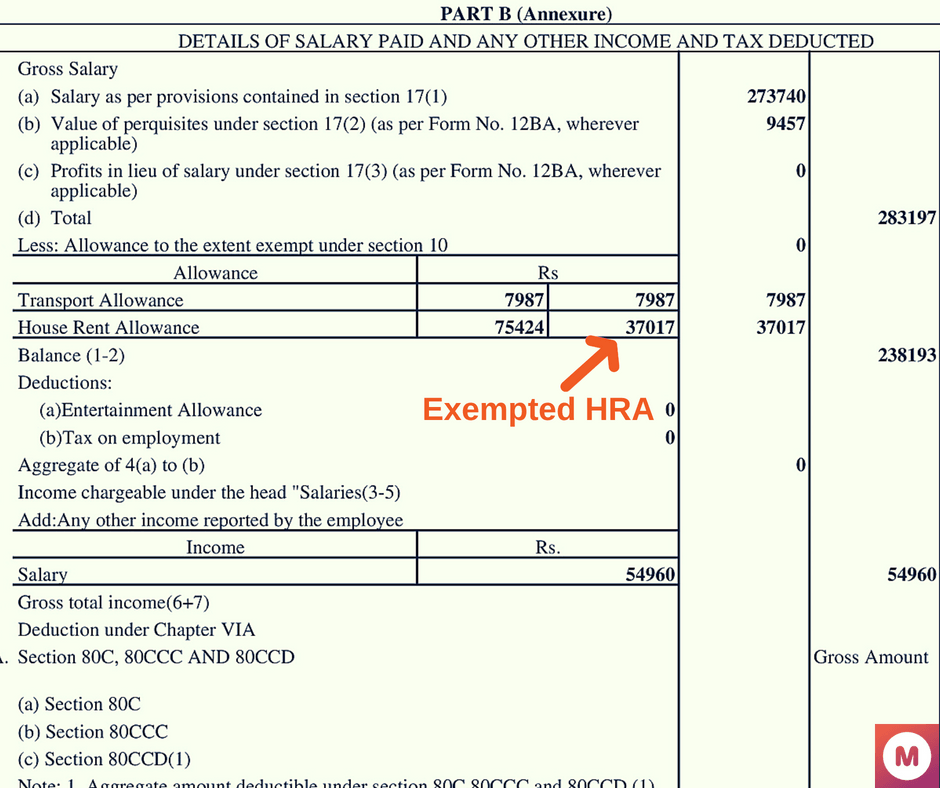

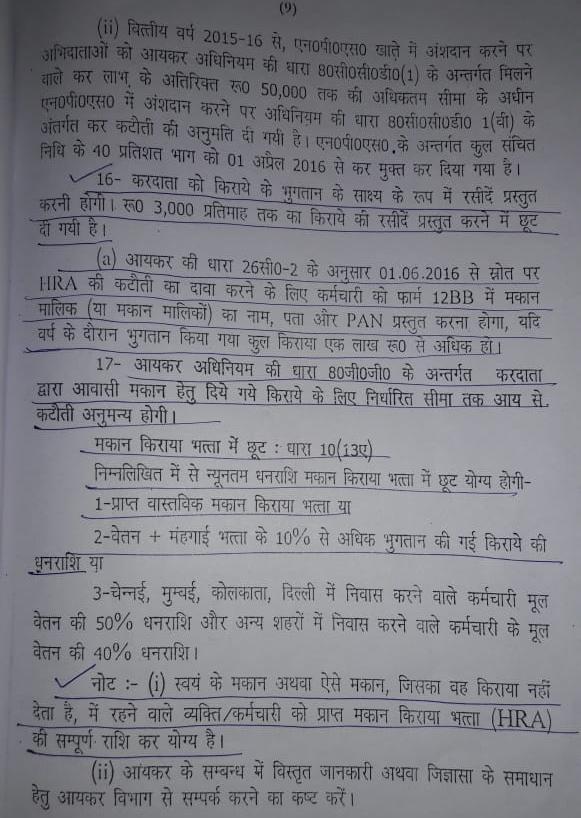

Tax Rebate On Hra Web 28 juin 2018 nbsp 0183 32 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A HRA exemption limit HRA calculation Example 2 How to claim tax exemption on HRA How to claim

Tax Rebate On Hra

Tax Rebate On Hra

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/w1200-h630-p-k-no-nu/hra-exemptoin.JPG

HRA House Rent Allowance Calculation And Tax Paying Taxes Rent

https://i.pinimg.com/originals/3d/e6/36/3de636def95dfd90c5bc3274aa076c0f.jpg

HRA Income Tax Rebate On HRA House Rent Allowance

https://i.ytimg.com/vi/I57qzsh9Q04/maxresdefault.jpg

Web Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Web 9 f 233 vr 2023 nbsp 0183 32 What is House Rent Allowance HRA HRA Exemption rules and Calculation Can a taxpayer claim both deduction on Home Loan amp HRA What if you don t receive

Web 10 f 233 vr 2023 nbsp 0183 32 Conditions to claim rebate under Section 10 13A Following are the key conditions you ought to fulfil Only salaried individuals can claim deductions under this Web For example if your basic salary including Dearness Allowance is INR 50 000 month you receive a HRA of INR 12 000 month and the actual rent paid is Rs 15 000 month the

Download Tax Rebate On Hra

More picture related to Tax Rebate On Hra

Income Tax HRA

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

How To Get More Out Of Your HRA Taxpayers Forum

http://im.rediff.com/getahead/2011/jun/21table3.gif

Danpirellodesign Income Tax Rebate On Home Loan And Hra

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/HRA.jpg

Web Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid amount After entering all the information the calculator will show you Web 26 janv 2022 nbsp 0183 32 Budget 2022 House Rent Allowance HRA tax exemption Expectation Salaried employees living in a rented home are eligible to lower their taxes to some extent by claiming House Rent Allowance HRA

Web Calculate You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can Web 19 avr 2021 nbsp 0183 32 Tax benefits for home loans are available for interest payment as well as for repayment of the principal amount I get many questions about whether one can claim

HRA TAX REBATE NEW NOTIFICATION AND LIMITS YouTube

https://i.ytimg.com/vi/Ej6bt4hwOm0/maxresdefault.jpg

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

https://i.ytimg.com/vi/TwVhPWbbcIU/maxresdefault.jpg

https://taxguru.in/income-tax/house-rent-allo…

Web 28 juin 2018 nbsp 0183 32 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

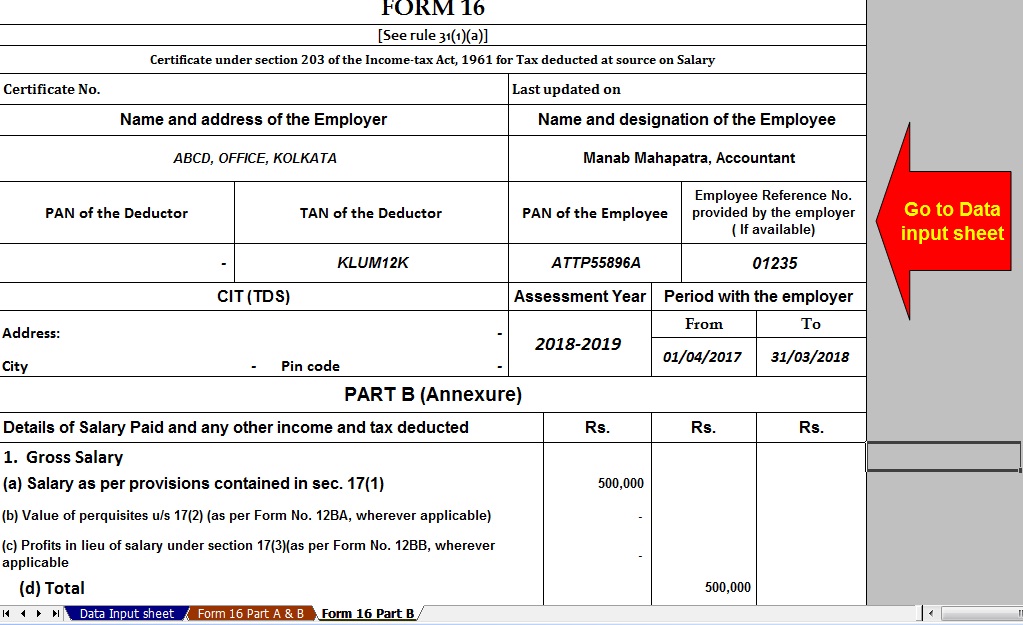

Download Automated Tax Computed Sheet HRA Calculation Arrears

HRA TAX REBATE NEW NOTIFICATION AND LIMITS YouTube

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

How To Save Tax On HRA

Documents Required To Claim HRA CommonFloor Groups Invoice Template

Documents Required To Claim HRA CommonFloor Groups Invoice Template

How To Calculate Tax Rebate On Hra PRORFETY

Form 12BB To Claim HRA Deduction By Salaried Employees

Complete Guide On Rent Slips Receipts And Claim HRA Tax House Rent

Tax Rebate On Hra - Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer gives