Tax Rebate On Insurance Policies Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

Web 5 d 233 c 2013 nbsp 0183 32 Insurance Premium Tax IPT is a tax on general insurance premiums There are 2 rates a standard rate 12 a higher rate 20 for travel insurance certain Web 11 nov 2019 nbsp 0183 32 The law only allows as tax relief the insurance premiums paid during the year preceding the year of assessment YOA This provision is the reason you should

Tax Rebate On Insurance Policies

Tax Rebate On Insurance Policies

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

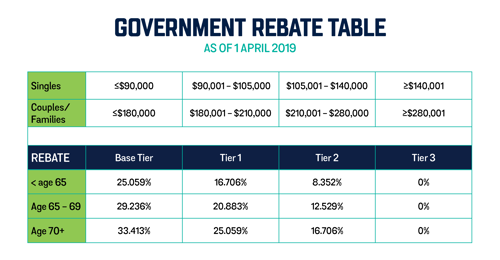

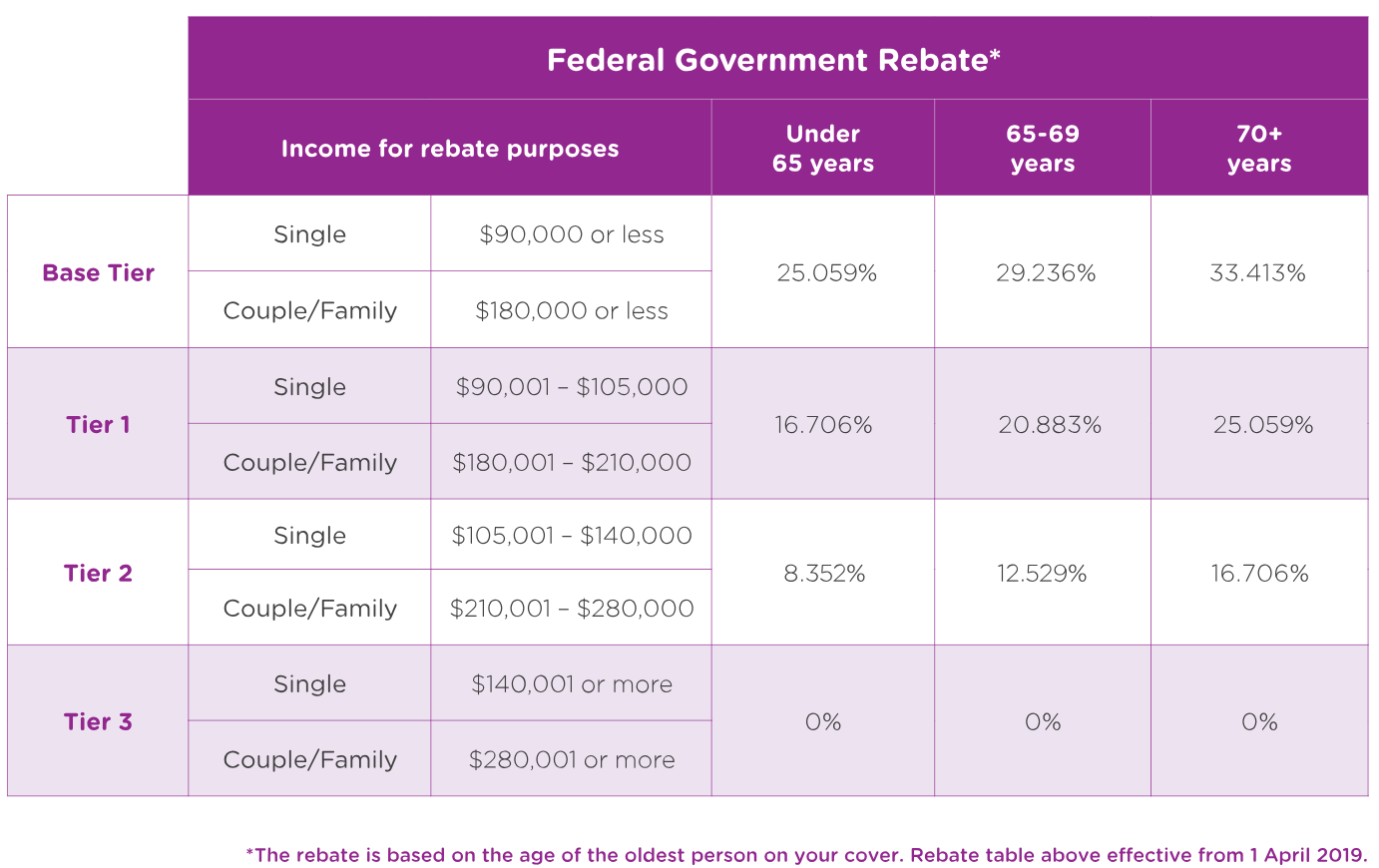

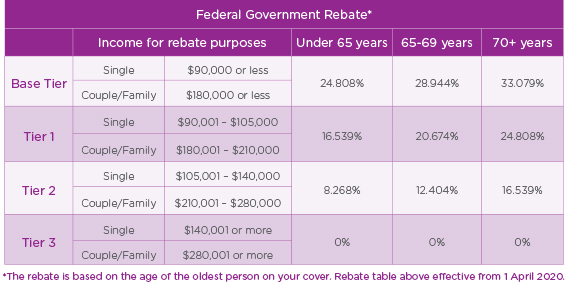

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

The Private Health Insurance Rebate Explained ISelect

https://www.iselect.com.au/content/uploads/2018/05/Private-Health-Insurance-Rebate_table.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in Web 27 mars 2023 nbsp 0183 32 Guidance The profits from the surrender of certain life insurance policies are treated as savings income rather than capital gains and taxed last after all other

Web 7 juin 2022 nbsp 0183 32 Life insurance premiums under most circumstances are not taxed i e no sales tax is added or charged These premiums are also not tax deductible If an employer pays life insurance premiums Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Tax Rebate On Insurance Policies

More picture related to Tax Rebate On Insurance Policies

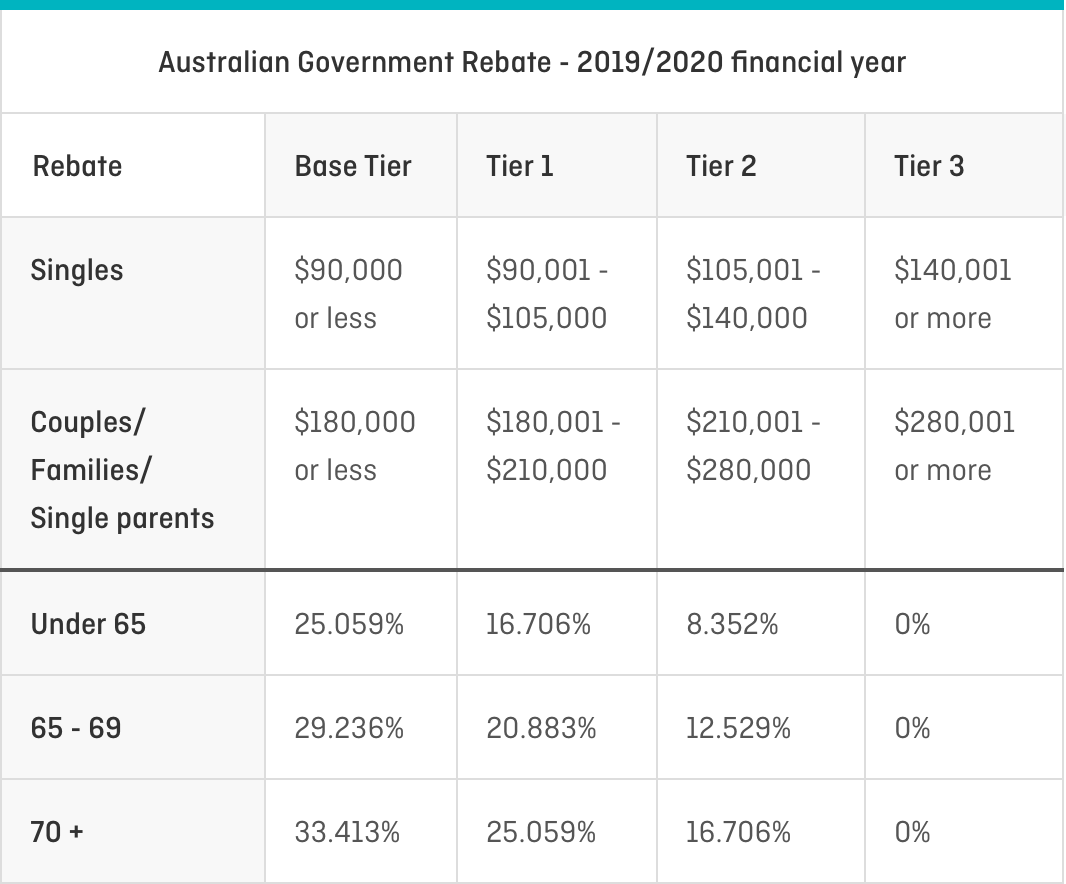

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

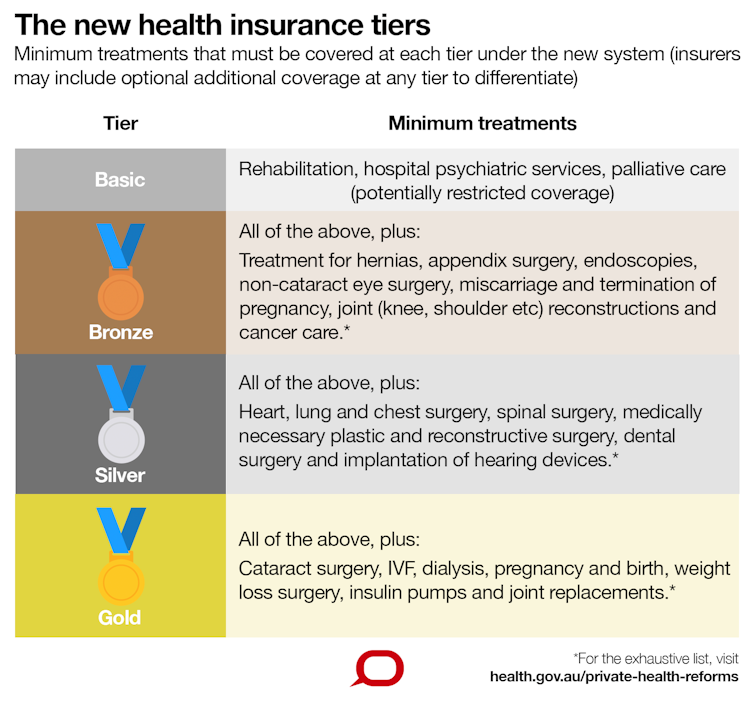

Premiums Up Rebates Down And A New Tiered System What The Private

https://images.theconversation.com/files/266265/original/file-20190328-139341-1ig2dxy.png?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web Il y a 1 jour nbsp 0183 32 Sept 11 2023 2 14 PM PT California is eliminating its popular electric car rebate program which often runs out of money and has long waiting lists to focus

Web Is this the first time you are claiming the relief Login with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax Web 27 sept 2012 nbsp 0183 32 If you had an individual insurance policy in 2011 and you claimed the standard deduction on your taxes like most taxpayers instead of itemizing you will not

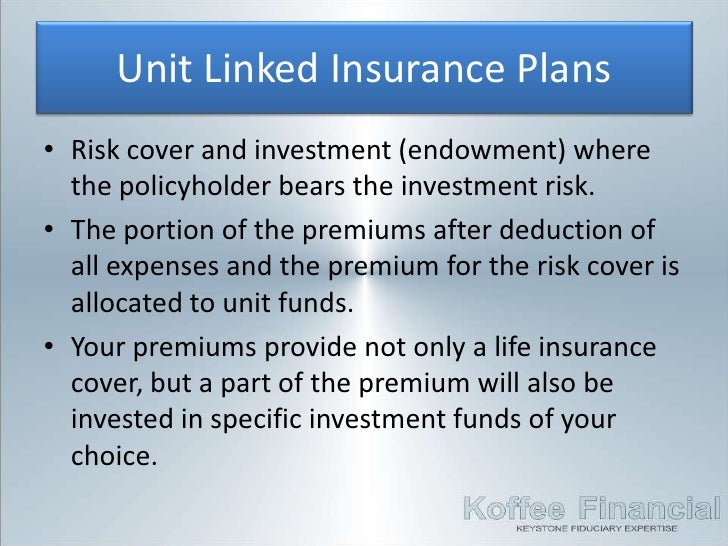

3 Insurance Life Insurance

https://image.slidesharecdn.com/kflifeinsurance-120729085430-phpapp02/95/3-insurance-life-insurance-18-728.jpg?cb=1343552917

I m Getting A Health Insurance Rebate Chris Schiffner s Corner Of

http://www.schiffner.com/wp-content/uploads/2012/08/page1of2.jpg

https://www.myinsuranceclub.com/articles/tax-rebates-in-life-insurance...

Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

https://www.gov.uk/guidance/insurance-premium-tax

Web 5 d 233 c 2013 nbsp 0183 32 Insurance Premium Tax IPT is a tax on general insurance premiums There are 2 rates a standard rate 12 a higher rate 20 for travel insurance certain

Health Insurance Rebate Is It Time To Ditch The Private Health

3 Insurance Life Insurance

Private Health Insurance Quote Qantas Insurance

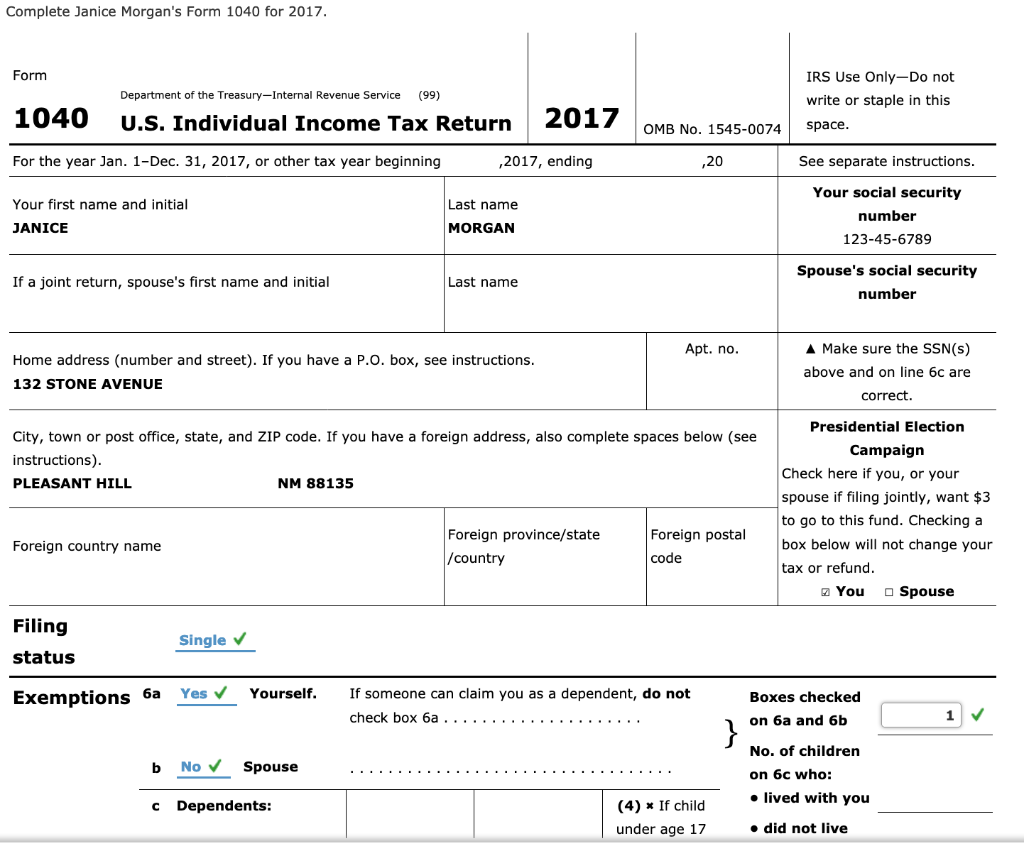

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

All About Income Tax Rules Applicable For Life Insurance Policies

All About Income Tax Rules Applicable For Life Insurance Policies

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Florida Agency To Fight FEMA Ban On Flood Insurance Commission Rebating

Military Journal Nm State Rebate 2022 According To The Department

Tax Rebate On Insurance Policies - Web 27 mars 2023 nbsp 0183 32 Guidance The profits from the surrender of certain life insurance policies are treated as savings income rather than capital gains and taxed last after all other