Tax Rebate On Insurance Premium In Pakistan 2023 Pdf Rule 5 specifies adjustments including the exclusion of non deductible expenditures allowances reserves and provisions exceeding limits set by the Insurance Ordinance 2000 Notably deductions for insurance or re insurance premiums paid to overseas entities are subject to a 5 withholding tax Mutual Insurance Association and

Prior to Finance Act 2023 all types of fertilizers including DAP were exempt from sales tax Through Finance Act 2023 a reduced rate of 5 sales tax has been imposed on import and local supply of DAP only However excess input tax if Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM

Tax Rebate On Insurance Premium In Pakistan 2023 Pdf

Tax Rebate On Insurance Premium In Pakistan 2023 Pdf

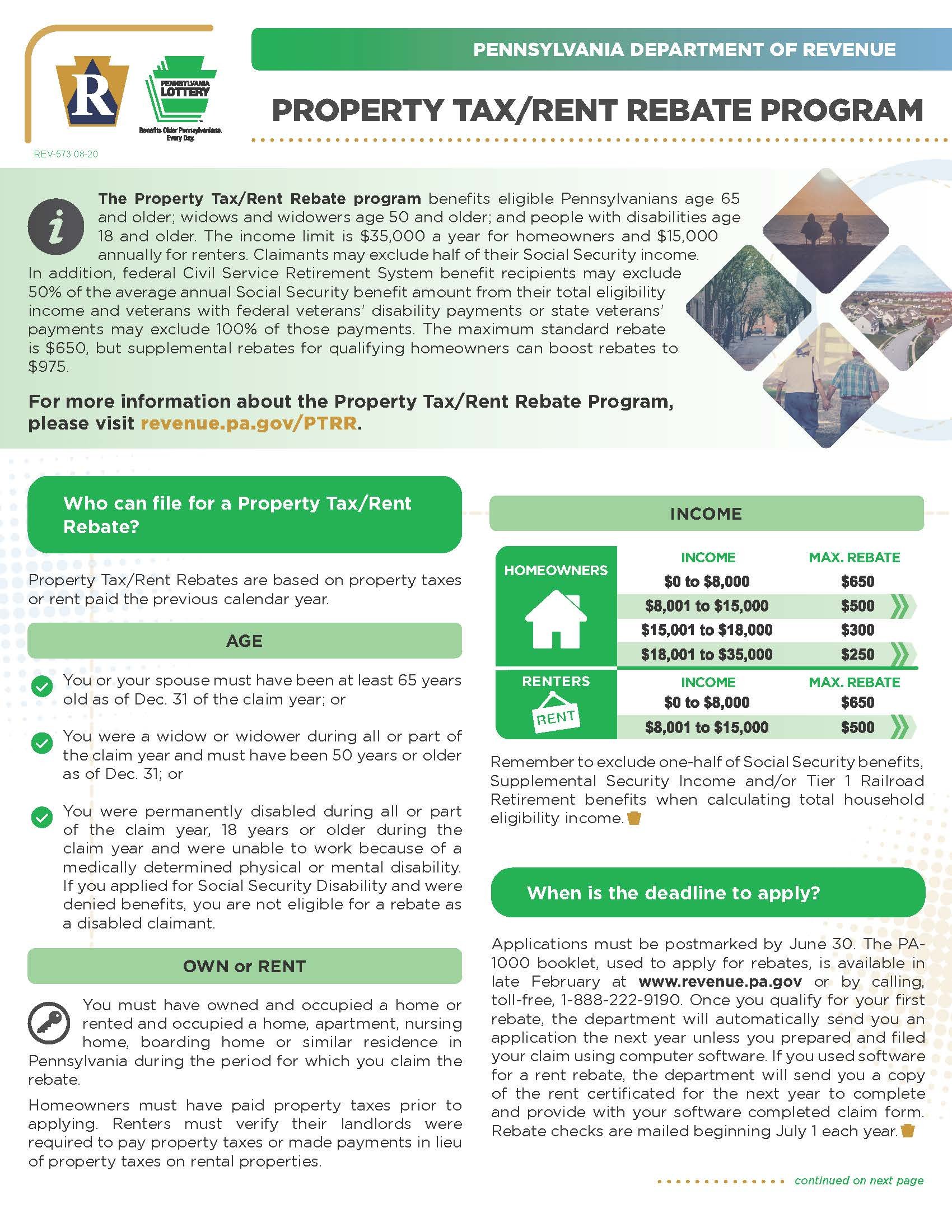

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

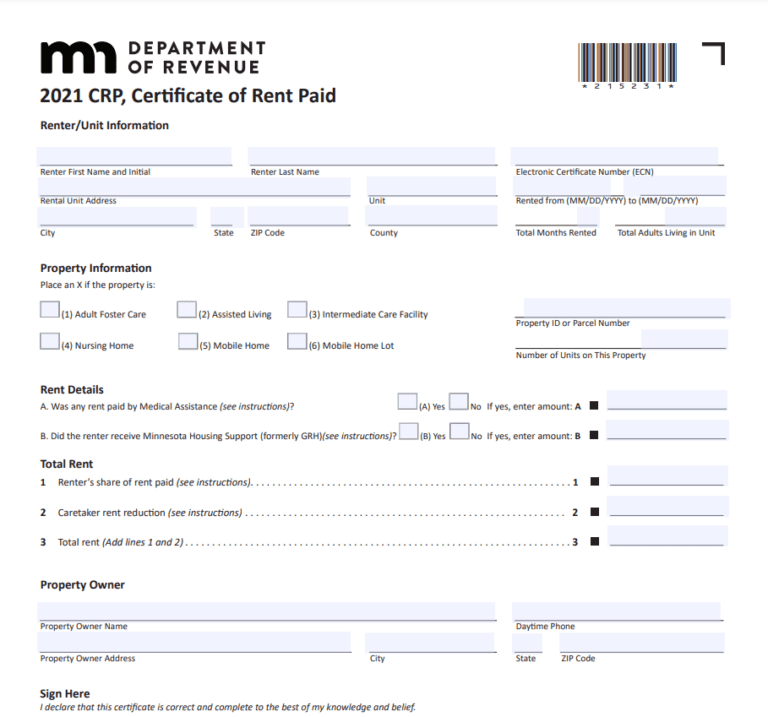

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

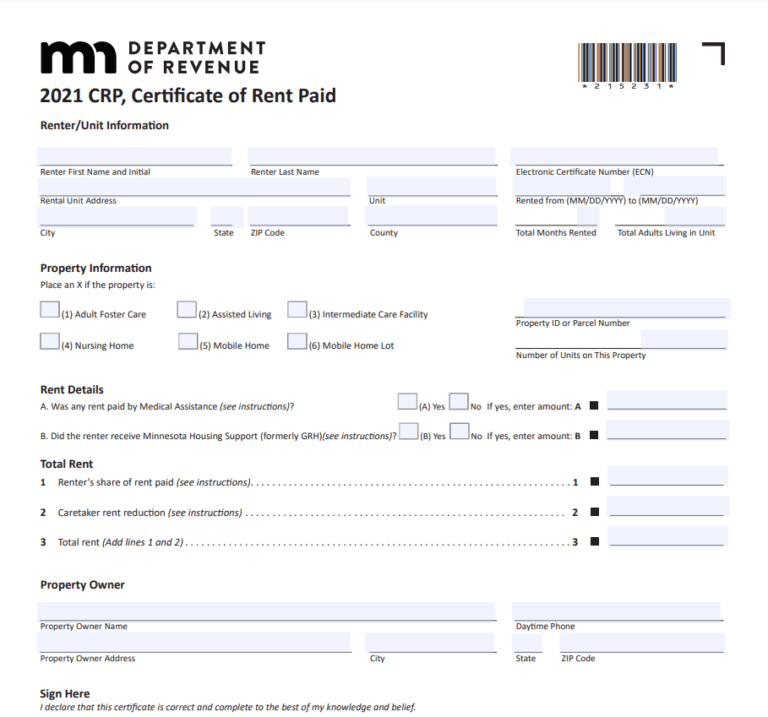

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Through FA 2023 the Government has introduced new slab rates for super tax for taxpayers having income in excess of Rs 350 million As a result the highest slab rate of 10 will be applicable on taxpayers all of TAX UPDATE TAXATION OF SALARY IN PAKISTAN TAX YEAR 2023 Applicable July 01 2022 to June 30 2023 as updated vide the Finance Act 2022 Tariq Abdul Ghani Maqbool Co Chartered Accountants ABOUT THIS WRITE UP

Tax on certain payments to non residents 35 7 Tax on shipping and air transport income of a non resident person 36 7A Tax on shipping of a resident person 36 7B Tax on profit on debt 37 7C Tax on builders 37 7D Tax on developers 38 7E Tax on deemed income 39 8 General provisions relating to taxes imposed under sections 5 6 and 7 41 For Tax Year 2023 where income exceeds Rs 300 000 000 Insurance premium or reinsurance premium 5 00 Advertisement services relaying from outside Pakistan 10 rendered by Pakistan Stock Exchange Limited and Pakistan Mercantile Exch ange Limited inspection certification testing and training services oilfield services

Download Tax Rebate On Insurance Premium In Pakistan 2023 Pdf

More picture related to Tax Rebate On Insurance Premium In Pakistan 2023 Pdf

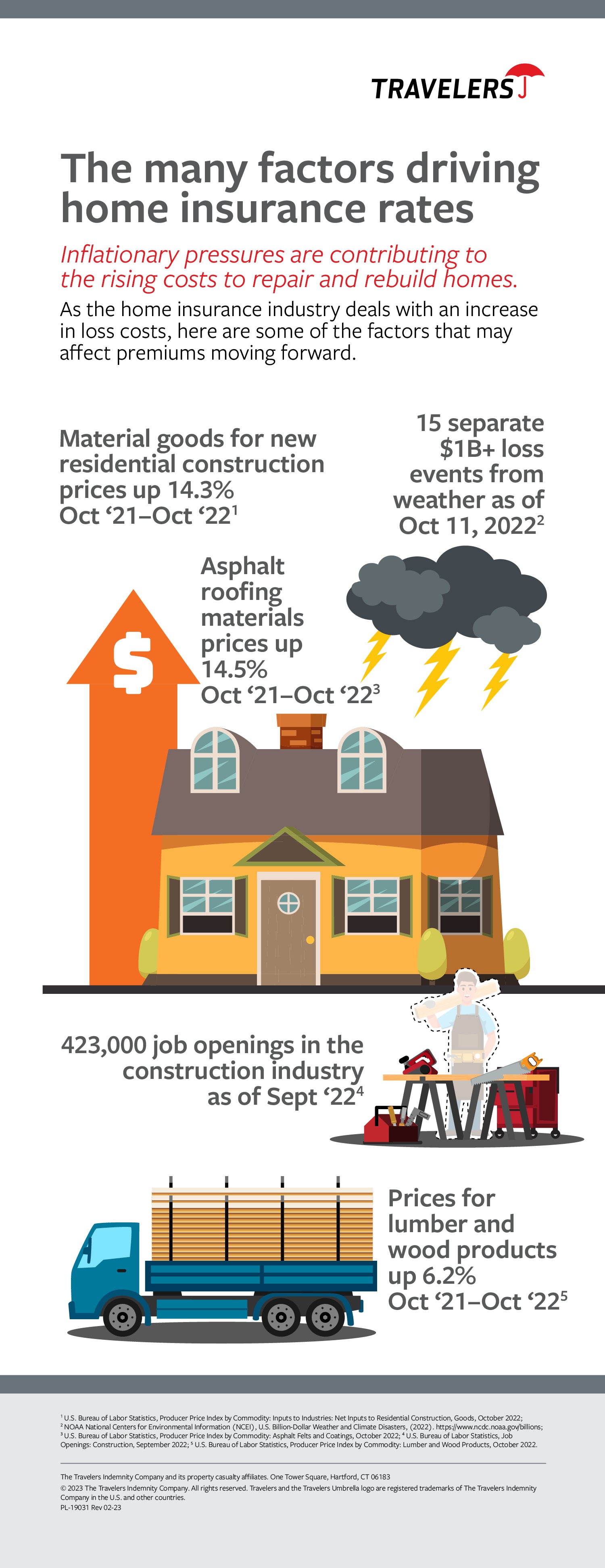

Why Homeowners Insurance Premiums Are Rising And What You Can Do

https://www.travelers.com/iw-images/resources/Individuals/Large/home/insuring/pi-home-severity-trends-infographic.jpg

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png)

How To Calculate Insurance Premiums

https://www.investopedia.com/thmb/kWgOwwf1YxM0tj29brUNt9cbnKA=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

3 Amendments of the Sales Tax Act 1990 In the Sales Tax Act 1990 the following further amendments shall be made namely 1 in section 2 a in clause 12 after the word include the words and comma production transmission and distribution of electricity shall be added Income Tax Sr No Title 1 C P No 4614 2022 Judgment dated 05 10 2022 of the Honorable High Court of Sindh Karachi declaring section 7E of Income Tax Ordinance 2001 Intra Vires 2 Landmark Judgment of the honorable Sindh High Court in department s favour on the issue of Clause 47B of 2nd Schedule to the Income Tax

Personal deductions credits Special straight deduction is available for Zakat paid under the Zakat and Usher Ordinance A rebate at the average rate of tax is allowed on donations made to any approved non profit organisation on the lower of donation value and 30 of the individual s taxable income If you have invested in shares or paid an insurance premium you may be eligible for a tax credit The tax credit is equal to a percentage of the amount invested or paid subject to certain

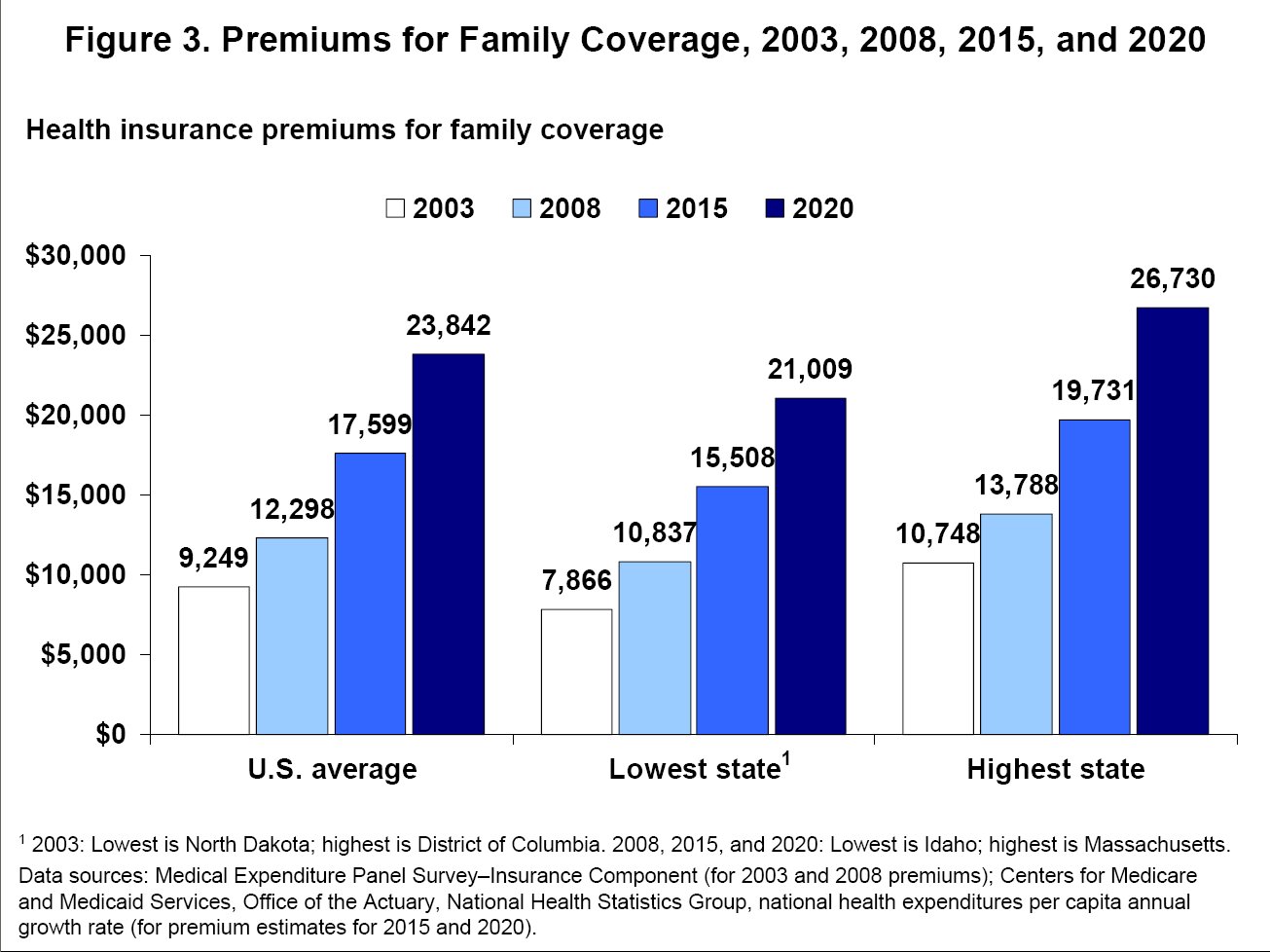

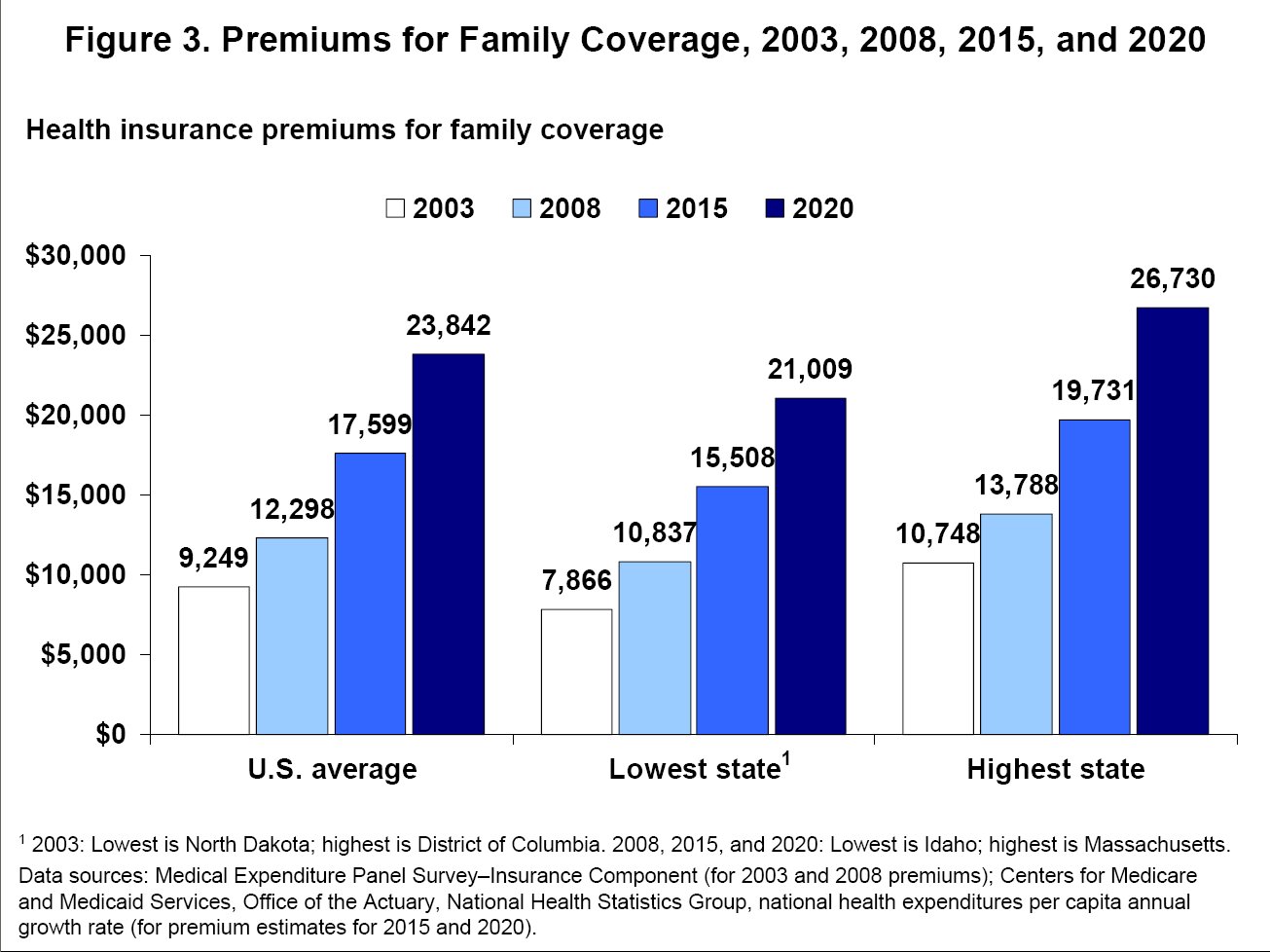

How Fast Are Healthcare Insurance Premiums Rising

http://www.theglitteringeye.com/images/PremiumsForFamilyCoverage2003-2020.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

https://pkrevenue.com/fbr-unveils-tax-rules-on...

Rule 5 specifies adjustments including the exclusion of non deductible expenditures allowances reserves and provisions exceeding limits set by the Insurance Ordinance 2000 Notably deductions for insurance or re insurance premiums paid to overseas entities are subject to a 5 withholding tax Mutual Insurance Association and

https://download1.fbr.gov.pk/Docs/...

Prior to Finance Act 2023 all types of fertilizers including DAP were exempt from sales tax Through Finance Act 2023 a reduced rate of 5 sales tax has been imposed on import and local supply of DAP only However excess input tax if

Is The Quote Fair How To Calculate An Insurance Premium

How Fast Are Healthcare Insurance Premiums Rising

Section 87A Income Tax Rebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Income Tax Rebate U s 87A For The Financial Year 2022 23

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

China Announced The Cancellation Of Export Tax Rebates For 146 Types Of

Tax Rebate Defined taxservices Www smarttaxservicestx Tax

Personal Tax Relief 2021 L Co Accountants

Tax Rebate On Insurance Premium In Pakistan 2023 Pdf - NOTE ON TAX CREDITS AND ADVANCE TAX ADJUSTMENTS FOR THE YEAR ENDING 30 JUNE 2023 TAX YEAR 2023 INCOME TAX ORDINANCE 2001 This note is prepared for the benefit of employees of clients of