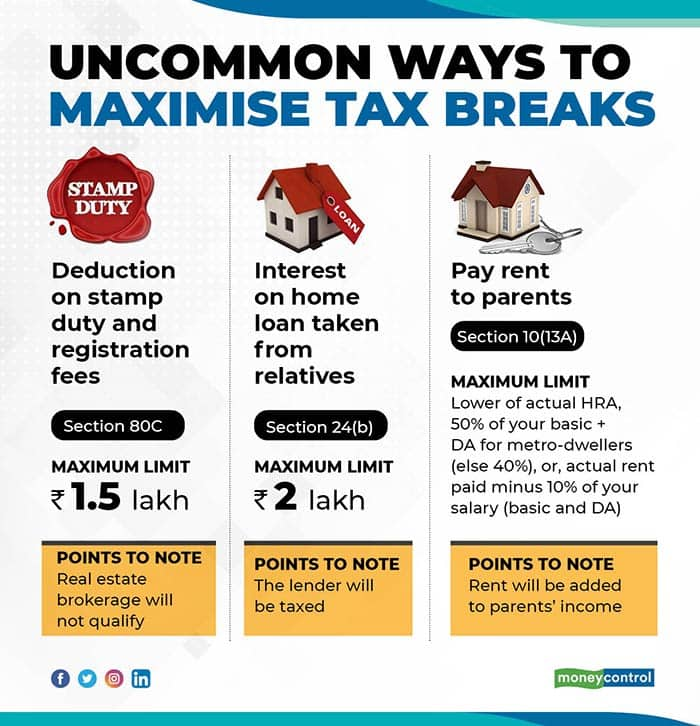

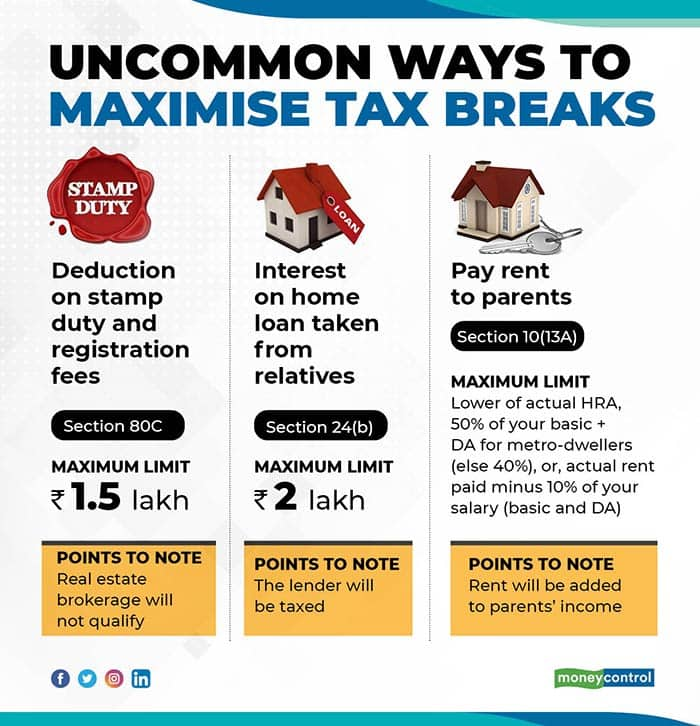

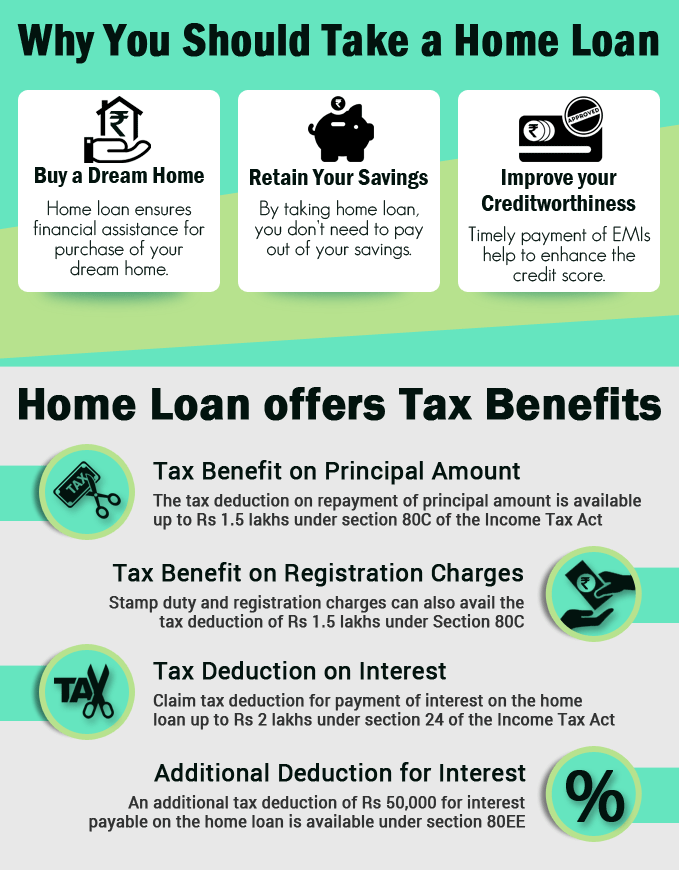

Tax Rebate On Interest On Housing Loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as a deduction Yes you can claim both HRA House Rent Allowance and deduction on home loan interest in India under certain conditions This can be beneficial for taxpayers who are paying rent and also have a home loan

Tax Rebate On Interest On Housing Loan

Tax Rebate On Interest On Housing Loan

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Union Budget 2023 Tax Rebate On Housing Loan Interest Expected To Hike

https://img.staticmb.com/mbcontent/images/uploads/2023/1/Union-Budget-2023.jpg

How Housing Loan Tax Benefit

https://financialcontrol.in/wp-content/uploads/2020/02/section-24-of-income-tax-act.jpg

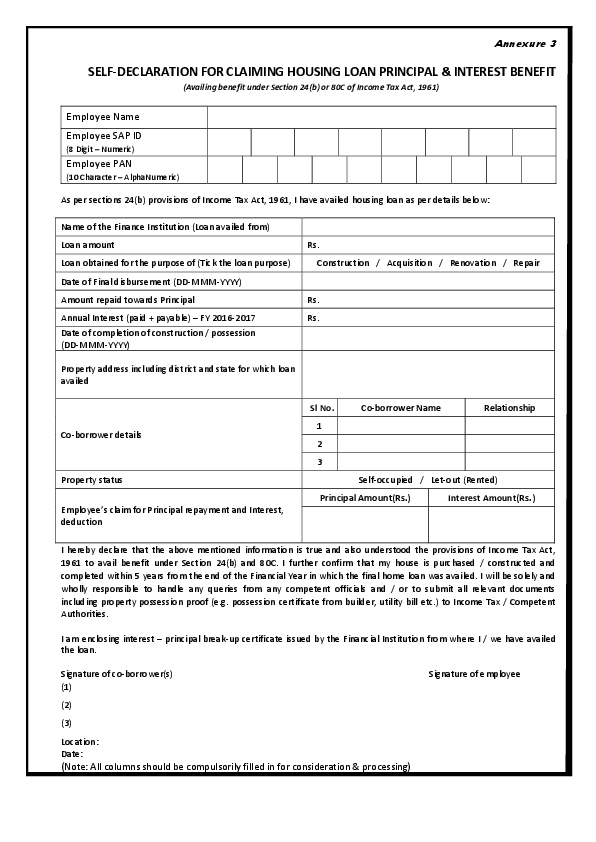

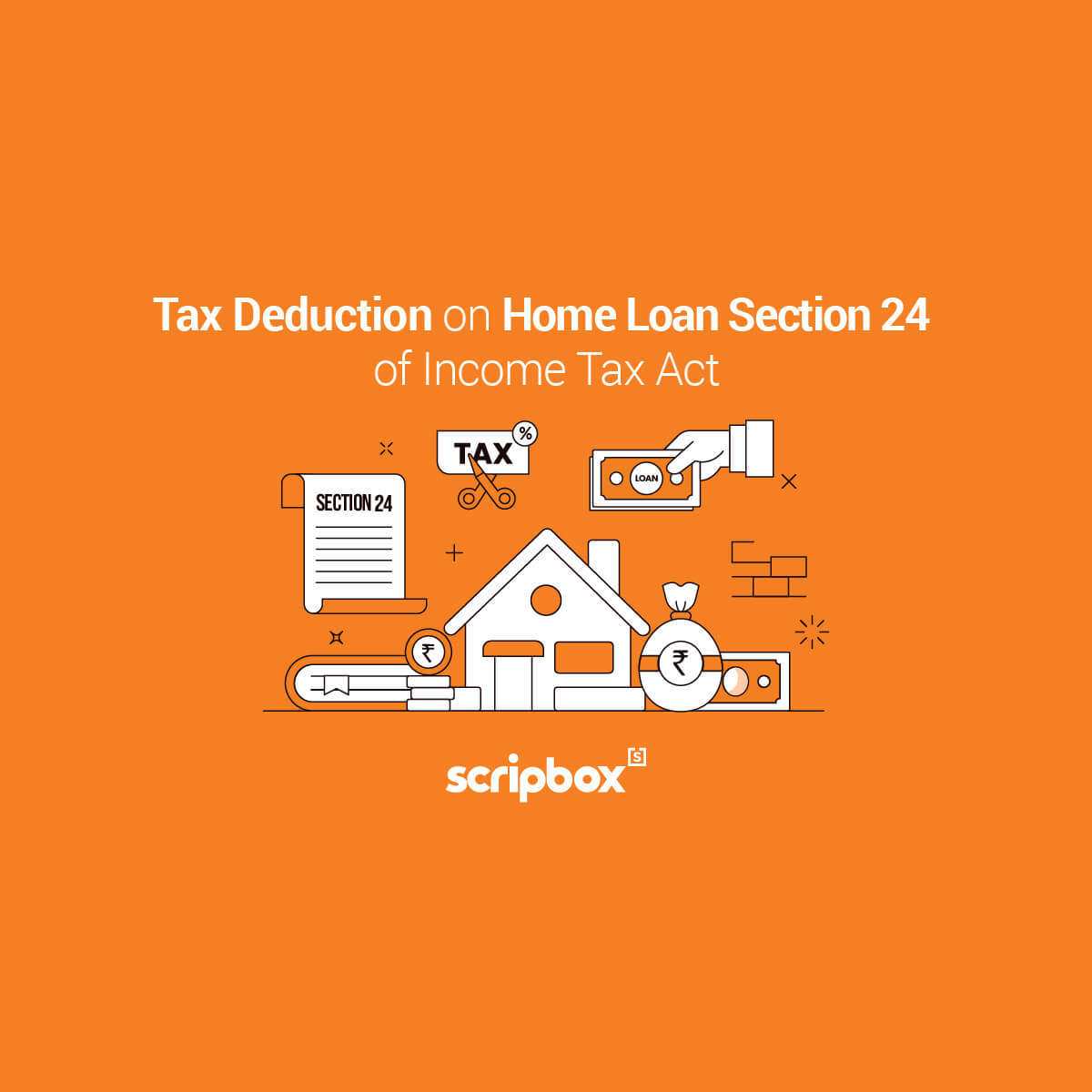

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a maximum of Rs 2 lakh in a given fiscal year Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

The income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that allows tax rebate on a home loan include Section 80C Section 24 and Section 80EE if you are planning to apply for a home loan or have already applied for a home loan and In India taxpayers can claim tax deductions on home loan interest under Section 24 b of the Income Tax Act This deduction is available for self occupied properties that are completed within five years and for which the loan was taken for acquisition or construction

Download Tax Rebate On Interest On Housing Loan

More picture related to Tax Rebate On Interest On Housing Loan

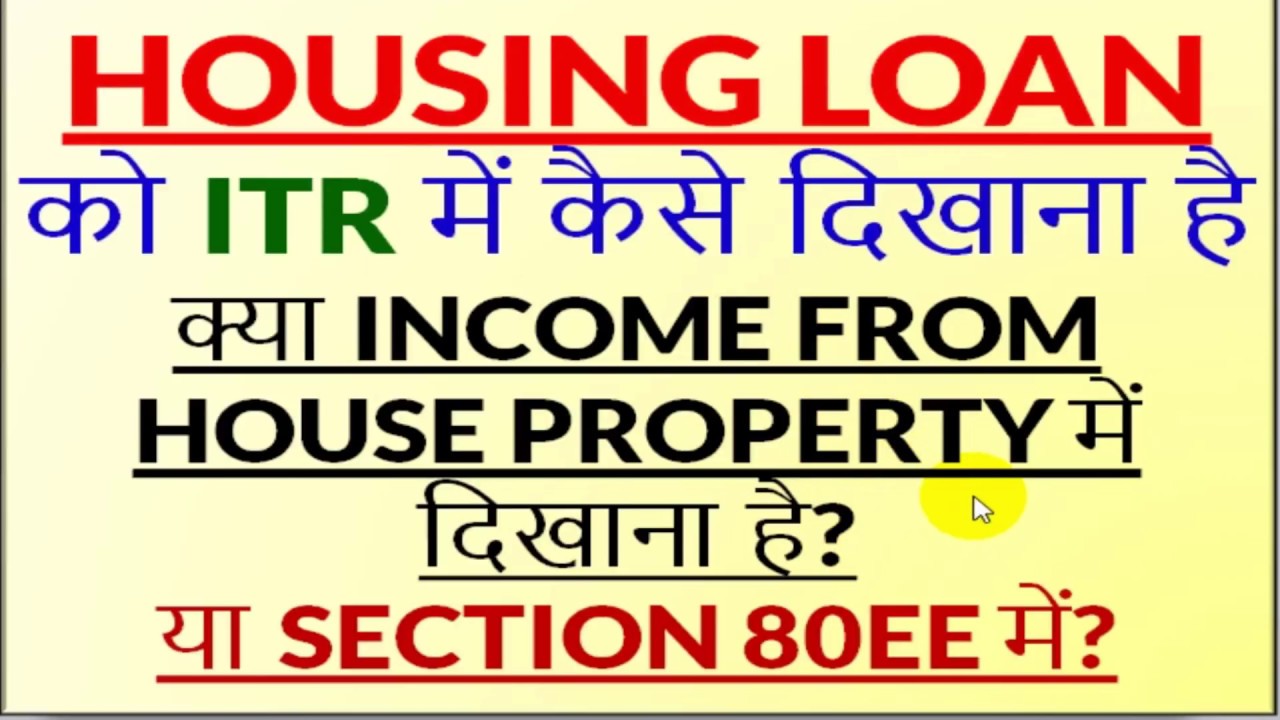

Section 80EE Income Tax Deduction For Interest On A Home Loan

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

How To Claim Interest On Home Loan Deduction While Efiling ITR

https://mytaxcafe.com/how-to-e-file/images/ITR/12.jpg

Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh tax deductions on home loan interest payment Benefits of this provision are applicable only only housing loans sanctioned between between 1 April 2019 and 31 March 2022 For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till 31 March 2024

Section 80EE of the Income Tax Act Under this section you can claim a tax benefit of up to Rs 50 000 on the Home Loan interest component It can be beneficial to identify which components of your Home Loans can be taxed and which can be eligible for a rebate If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

Paying A Home Loan EMI Or Staying On Rent Know The Tax Benefits

https://images.moneycontrol.com/static-mcnews/2020/01/Preeti-Jan-14.jpg

How To Declare Home Loan In Income Tax Grizzbye

https://0.academia-photos.com/attachment_thumbnails/51719845/mini_magick20180818-9322-1ak7apf.png?1534603265

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and

https://cleartax.in/s/deductions-under-section24...

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as a deduction

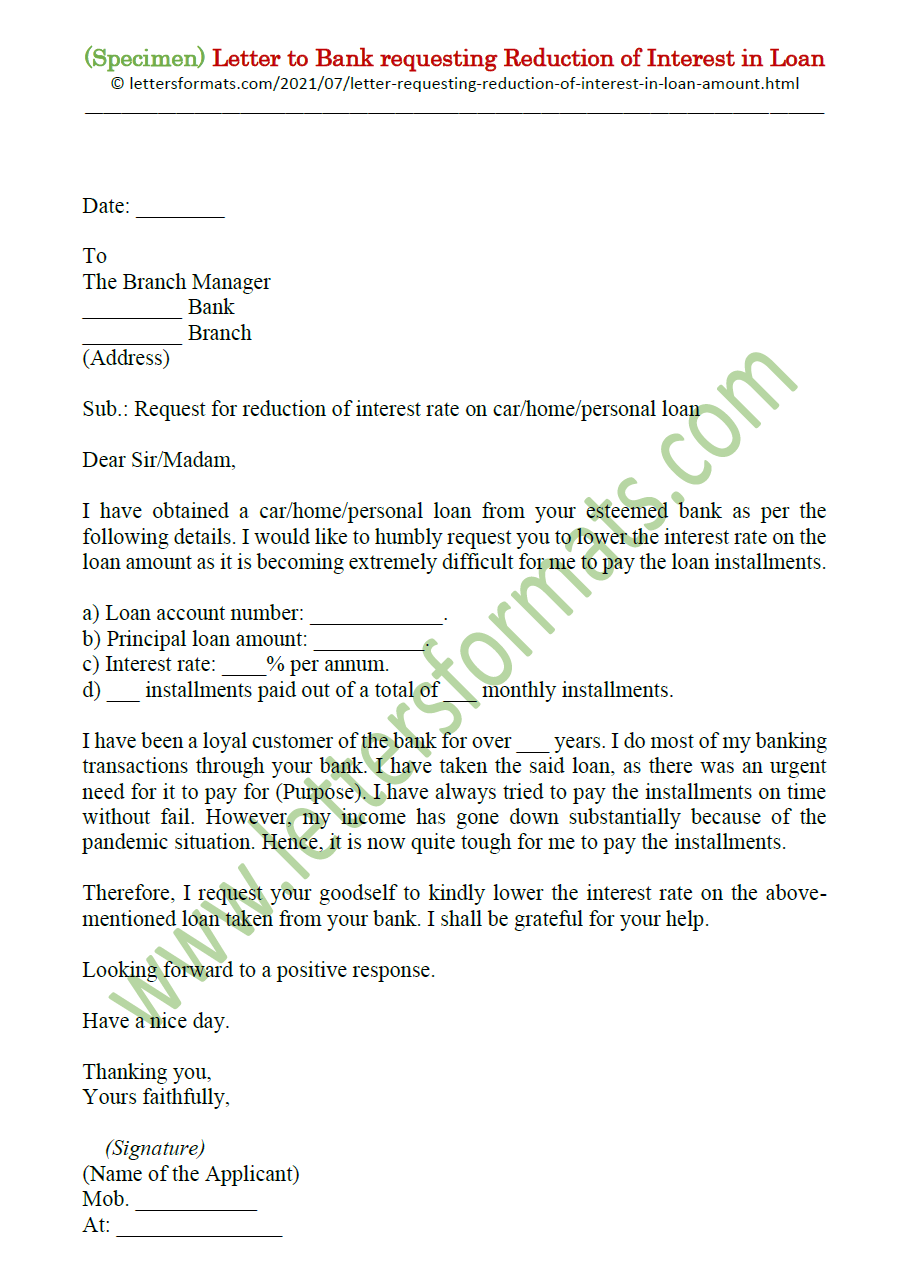

Sample Letter To Bank Requesting Reduction Of Interest In Loan

Paying A Home Loan EMI Or Staying On Rent Know The Tax Benefits

How To Fill Housing Loan Interest And Principal In Income Tax Return

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Home Loan Tax Benefit 2018 19 Home Sweet Home Insurance Accident

Home Loan Tax Benefit 2018 19 Home Sweet Home Insurance Accident

House Loan Limit In Income Tax Home Sweet Home

Property Tax Rebate Application Printable Pdf Download

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

Tax Rebate On Interest On Housing Loan - The income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that allows tax rebate on a home loan include Section 80C Section 24 and Section 80EE if you are planning to apply for a home loan or have already applied for a home loan and