Tax Rebate On Interest Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Web 9 nov 2020 nbsp 0183 32 Interest Deduction A deduction for taxpayers who pay certain types of interest Interest deductions reduce the amount of income Web 22 f 233 vr 2023 nbsp 0183 32 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a

Tax Rebate On Interest

Tax Rebate On Interest

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

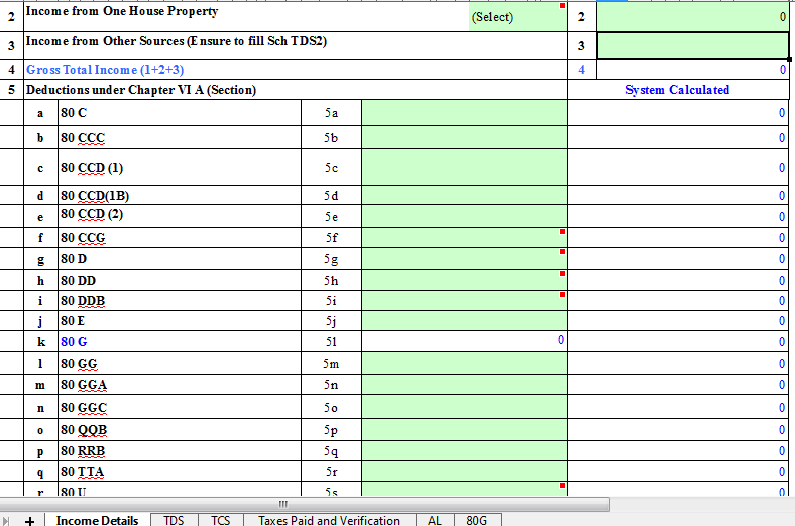

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

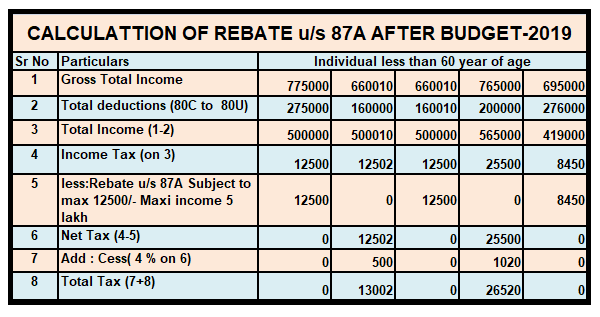

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Web 2 d 233 c 2021 nbsp 0183 32 HMRC requires UK banks and building societies to annually submit information about interest paid or credited to reportable persons This information is Web Section 24 under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these

Web Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post Web 20 juil 2016 nbsp 0183 32 How the tax reduction is worked out The reduction is the basic rate value currently 20 of the lower of finance costs costs not deducted from rental income in

Download Tax Rebate On Interest

More picture related to Tax Rebate On Interest

Section 80TTA Deduction Of Interest From Savings Account TaxAdda

https://taxadda.com/wp-content/uploads/ITR-1-1.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Web 11 janv 2023 nbsp 0183 32 Section 80C Deduction Terms and conditions for home buyers to avail of benefits under Section 80C How to maximise tax rebate under Section 80C Deductions allowed on home loan interest Web 16 mars 2023 nbsp 0183 32 Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest

Web Tax is deducted at the basic 20 rate so for every 163 100 of statutory interest you earn you pay 163 20 in tax To give you an idea of how it relates to the size of PPI payouts I ve jotted Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Note 1 Trusts for the benefit of ill or disabled persons and testamentary trusts

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-State-Tax-Rebate-Info_1-post.jpg

https://www.abnamro.nl/.../mortgage-interest-deductions.html

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

https://www.investopedia.com/terms/i/interes…

Web 9 nov 2020 nbsp 0183 32 Interest Deduction A deduction for taxpayers who pay certain types of interest Interest deductions reduce the amount of income

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Latest Income Tax Rebate On Home Loan 2023

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

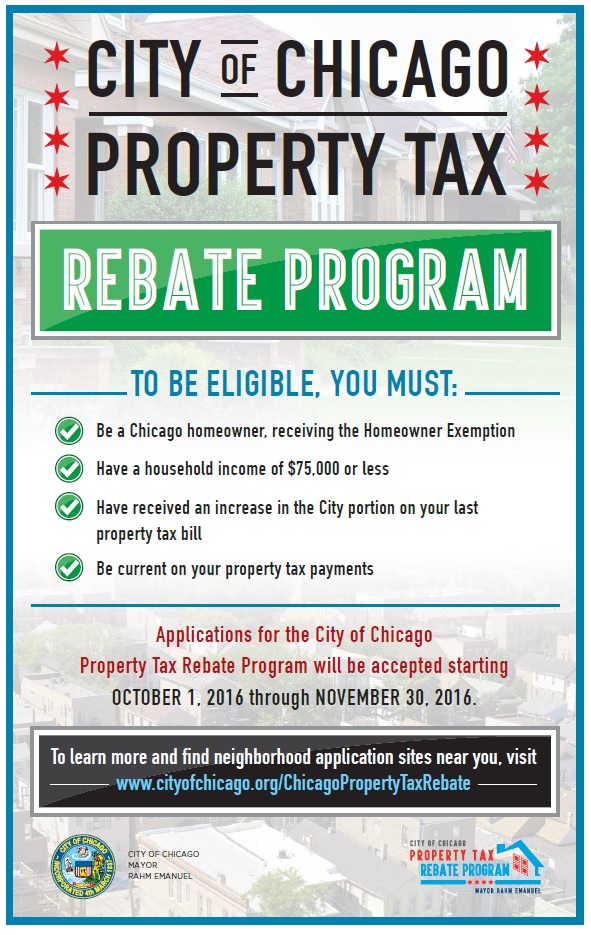

Uptown Update Property Tax Rebate Program Open Through November

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Property Tax Rebate Application Printable Pdf Download

Tax Rebate On Interest - Web interest rebate means the amount and insuring the goods including any GST payable by the Owner except to the extent that the Owner is entitled to an input tax credit quot the