Tax Rebate On Joint Home Loan Interest Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can

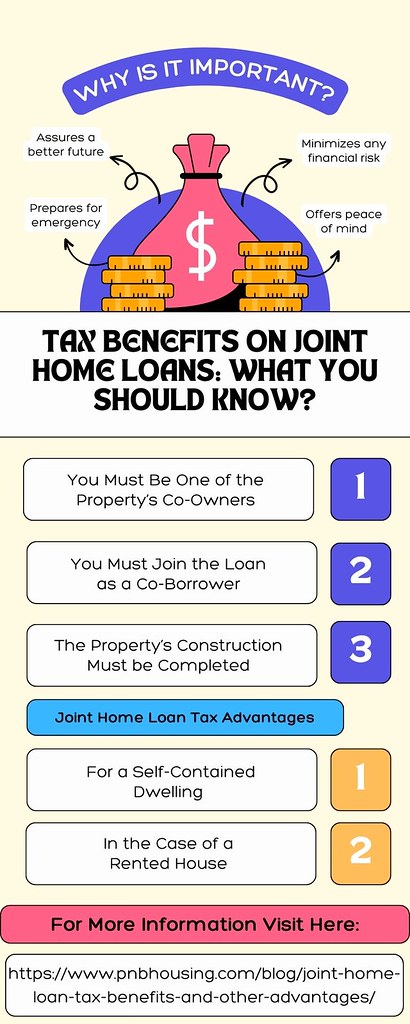

Web 26 juil 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have Web 7 avr 2022 nbsp 0183 32 What are the Joint Home Loan Tax Advantages 1 For a Self Contained Dwelling In their Income Tax Return each co owner who is a loan co applicant can

Tax Rebate On Joint Home Loan Interest

Tax Rebate On Joint Home Loan Interest

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

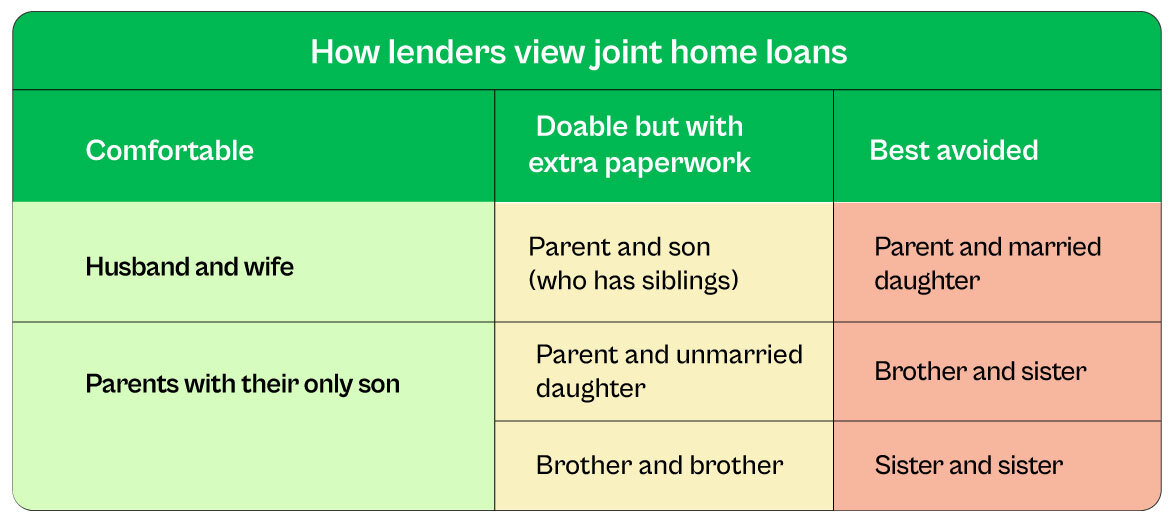

A Son Can Take A Joint Home Loan With His Parents As Co borrowers But

https://pbs.twimg.com/media/FjN11WtaEAA7UrK.jpg

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

https://image5.slideserve.com/11208876/apply-for-joint-home-loan-today-l.jpg

Web 22 janv 2020 nbsp 0183 32 Tax Benefit on Joint Home Loan For claiming tax benefits you should be a co applicant as well as a joint owner of the loan Know Web 28 f 233 vr 2023 nbsp 0183 32 You may receive interest benefits up to Rs 2lakhs per joint owner with one self occupied property Each co borrower can claim up to Rs 1 50lakhs in tax

Web 10 juil 2020 nbsp 0183 32 Each co owner can claim a deduction of a maximum of Rs 1 50 000 for repayment of principal under section 80C This is within the total limit of Section 80C of Rs 1 50 000 Hence as a family you will be Web 19 sept 2020 nbsp 0183 32 The tax benefits for interest and repayment of principal amount of home loan can be claimed only if one is a joint owner as well as a co borrower servicing the home loan My wife and

Download Tax Rebate On Joint Home Loan Interest

More picture related to Tax Rebate On Joint Home Loan Interest

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Home Loan Tax Benefit 2023 24 Deduction Joint Home Loan Tax Benefit

https://i.ytimg.com/vi/vJqobTCJWoc/maxresdefault.jpg

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

https://image5.slideserve.com/11208876/easy-approvals-l.jpg

Web 16 oct 2012 nbsp 0183 32 There is no upper limit for tax exemption on the interest amount paid except that each co borrower can claim rebate of up to Rs 150000 only in any financial years Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Web How to Claim Tax Benefit for Joint Home Loan More than one person can enjoy tax benefits as the tax for joint loans as it is divided among the co applicants Tax rebate of Web 16 mars 2021 nbsp 0183 32 Interest Payment Joint Home Loans Both Joint owners can avail additional deduction of up to a maximum of Rs 2 lakh each on the interest paid towards

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Tax Benefits On Joint Home Loans What You Should Know Flickr

https://live.staticflickr.com/65535/52773812937_399406e2fb_b.jpg

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can

https://taxguru.in/income-tax/tax-benefits-home-loan-joint-owners.html

Web 26 juil 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have

8 Benefits Of Joint Home Loan Tax Benefits On Joint Home Loan

Rising Home Loan Interests Have Begun To Impact Homebuyers

Tax Benefit On Joint Home Loan In Telugu 2019 Investment Tips YouTube

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

HOW TO SAVE MORE TAX ON JOINT HOME LOAN BHAVEN CFP YouTube

HOW TO SAVE MORE TAX ON JOINT HOME LOAN BHAVEN CFP YouTube

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

Tax Rebate On Joint Home Loan Interest - Web 28 f 233 vr 2023 nbsp 0183 32 You may receive interest benefits up to Rs 2lakhs per joint owner with one self occupied property Each co borrower can claim up to Rs 1 50lakhs in tax