Tax Rebate On Leave Encashment Web 30 juil 2019 nbsp 0183 32 This guide will discuss the tax implication on the money received in lieu of leaves Budget 2023 update The leave encashment tax exemption limit for non

Web 27 avr 2022 nbsp 0183 32 Actual leave encashment amount Rs 1 lakh Average salary of last 10 months Rs 15 lakh Rs 1 5 lakh x 10 months Hence total leave encashment of Rs Web 15 mars 2022 nbsp 0183 32 Tax on Leave Encashment The following conditions are applicable while considering taxation on leave encashment If a person is a government employee be it

Tax Rebate On Leave Encashment

Tax Rebate On Leave Encashment

https://www.relakhs.com/wp-content/uploads/2023/05/Leave-Encashment-Tax-Implications.jpg

.jpg)

Leave Encashment Rules Exemption Encashment And Tax Calculation

https://global-uploads.webflow.com/6145f7156a1337613524d548/646c4d9e6d7d19a7a405ce0a_leave encashment (1).jpg

Leave Encashment Income Tax Section 10 10AA Leave Encashment

https://i.ytimg.com/vi/nzuP2BplAlE/maxresdefault.jpg

Web Leave encashment means selling of un availed leaves by an employee to his employer for an extra salary amount This encashment of un availed leave can be either be at the Web 4 mai 2022 nbsp 0183 32 Leave encashment received 4 08 450 Tax exemption least of the following 1 Amount notified by the government 2 Actual leave encashment 3 Average salary

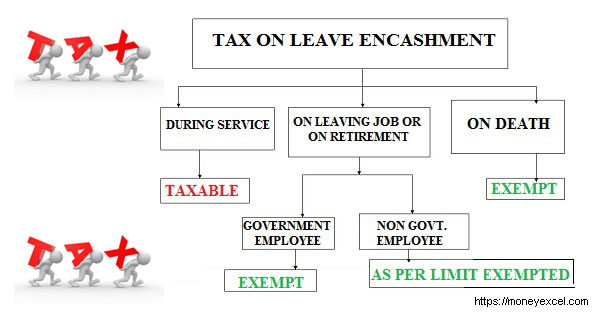

Web Exemption limit of Rs 3 lakh is the maximum that a taxpayer can claim in a lifetime If you have claimed a tax exemption of Rs 1 00 000 during a financial year on receipt of leave encashment then a maximum Web Leave Encashment during the tenure of the service is fully taxable in all cases relief u s 89 if applicable may be claimed during the income tax return At the time of retirement

Download Tax Rebate On Leave Encashment

More picture related to Tax Rebate On Leave Encashment

Leave Encashment Calculation Tax Implications Outsource Bookkeeping

http://outsourcebookkeepingindia.com/wp-content/uploads/2020/05/leave-encashment-calculation-tax-implications.jpg

Anil Rego Why Is My Leave Encashment Not Exempt From Tax Rediff

https://im.rediff.com/money/2022/oct/06tax-guru-anil-rego-leave-encashment.jpg?w=670&h=900

Leave Encashment Tax Update 25

https://www.appsjankari.com/wp-content/uploads/2023/02/leave-encashment-tax-update-min.jpg

Web 28 juin 2018 nbsp 0183 32 The tax treatment of Leave encashment is explained with the help of following table Here salary means Basic Dearness Allowance forms part of pay Web 4 oct 2022 nbsp 0183 32 Tax obligation in case of encashment of leaves on resignation or retirement Government Employees The amount earned by encashing leaves by a government employee is fully exempt without any

Web Govt Employees Central Govt and State Govt employees only Leave encashment of accumulated leave at the time of retirement whether on superannuation or otherwise Web 31 mai 2023 nbsp 0183 32 CBDT Central Board of Direct Taxes vide its notification S O 2276 E dated the 24th May 2023 has increased the maximum amount receivable by its employees as

Leave Encashment Exemption For Government Employees Income Tax Rule

https://www.igecorner.com/wp-content/uploads/2020/09/leave_encashment-1068x601.png

Leave Encashment Tax Exemption Increased To Rs 25 Lakhs

https://www.taxmani.in/wp-content/uploads/2023/05/leave-encashment-tax-exemption-increased-to-Rs-25-Lakhs.jpg

https://tax2win.in/guide/leave-encashment-tax

Web 30 juil 2019 nbsp 0183 32 This guide will discuss the tax implication on the money received in lieu of leaves Budget 2023 update The leave encashment tax exemption limit for non

.jpg?w=186)

https://www.financialexpress.com/money/income-tax/leave-encashment...

Web 27 avr 2022 nbsp 0183 32 Actual leave encashment amount Rs 1 lakh Average salary of last 10 months Rs 15 lakh Rs 1 5 lakh x 10 months Hence total leave encashment of Rs

Leave Encashment Tax free Limit Increased Government Increases Tax

Leave Encashment Exemption For Government Employees Income Tax Rule

All About Leave Encashment And Its Tax Implications

Leave Encashment

Simple Guide To Tax Rule On Leave Encashment While Job Or Quitting

Increased Limit Tax Exemption On Leave Encashment For Salaried Employees

Increased Limit Tax Exemption On Leave Encashment For Salaried Employees

Leave Encashment Calculation Tax Exemption Other Rules Razorpay

Go Away Encashment Paid As Per Part 43B f Of Revenue Tax Act ITAT

Income Tax Exemption Limit For Leave Encashment Upon Retirement For

Tax Rebate On Leave Encashment - Web 26 avr 2022 nbsp 0183 32 Salary per day x unutilised leave considering maximum 30 days leave per year for every year of completed service Rs 1 5 lakh 30 days Rs 5 000 per day x