Tax Rebate On Lic Premium Web 1 d 233 c 2021 nbsp 0183 32 Tax benefit in respect of premium paid for life insurance policies Section 80C of the Income Tax Act allows an individual and a Hindu Undivided Family HUF to claim

Web 6 mai 2023 nbsp 0183 32 income tax rates and tax benefits from life insurance and rates for assessment year 2022 2023 financial year 2021 2022 content is in english Web 23 juin 2018 nbsp 0183 32 The investment in life insurance can be deducted up to Rs 1 50 000 Rs 1 Lakh upto A Y 2014 15 It a common perception that Premium Paid on all Life Insurance Policies qualifies for deduction

Tax Rebate On Lic Premium

Tax Rebate On Lic Premium

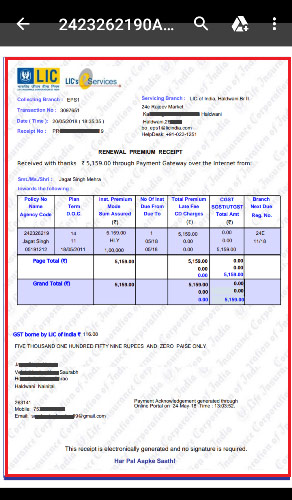

https://4.bp.blogspot.com/-ylSGi97GyHc/WwaQqoPhFhI/AAAAAAAAM9M/T7KhotkjY10trGIySdmT5FDhqj29W8DsQCK4BGAYYCw/s1600/how%2Bto%2Bdownload%2Blic%2Bpolicy%2Bpremium%2Breceipt.jpg

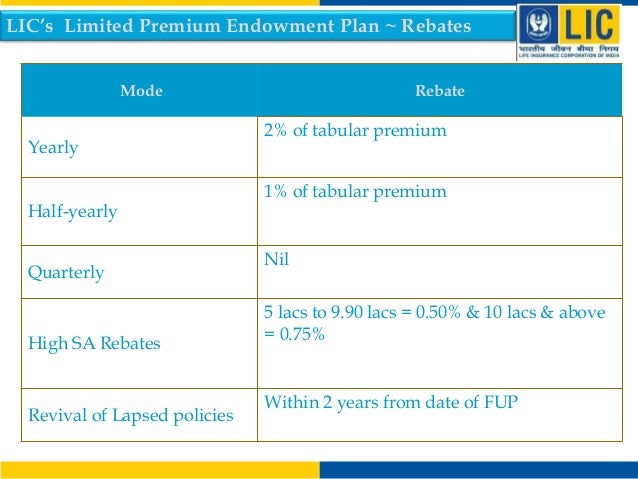

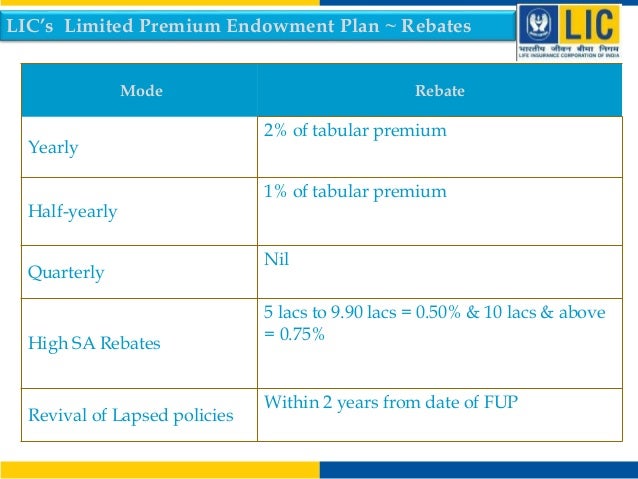

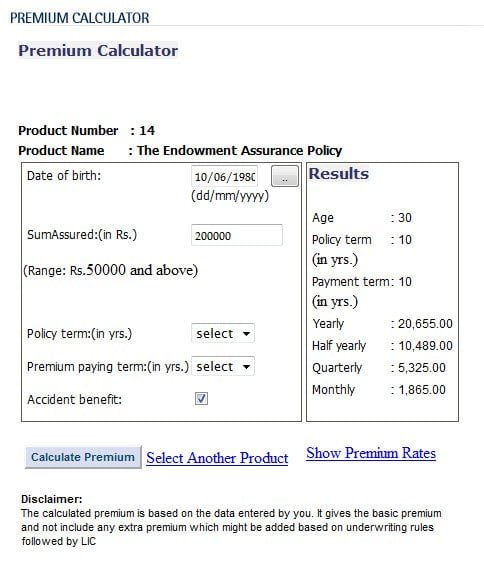

LIC s Limited Premium Endowment Plan 830

https://image.slidesharecdn.com/licslimitedpremiumendowmentplan-830-141215030050-conversion-gate02/95/lics-limited-premium-endowment-plan-830-4-638.jpg?cb=1426829977

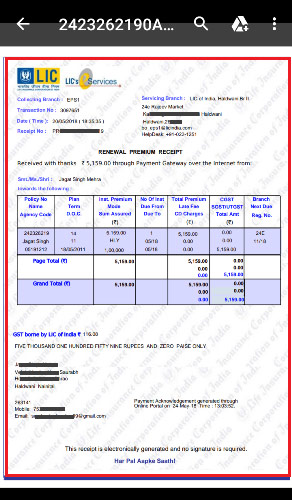

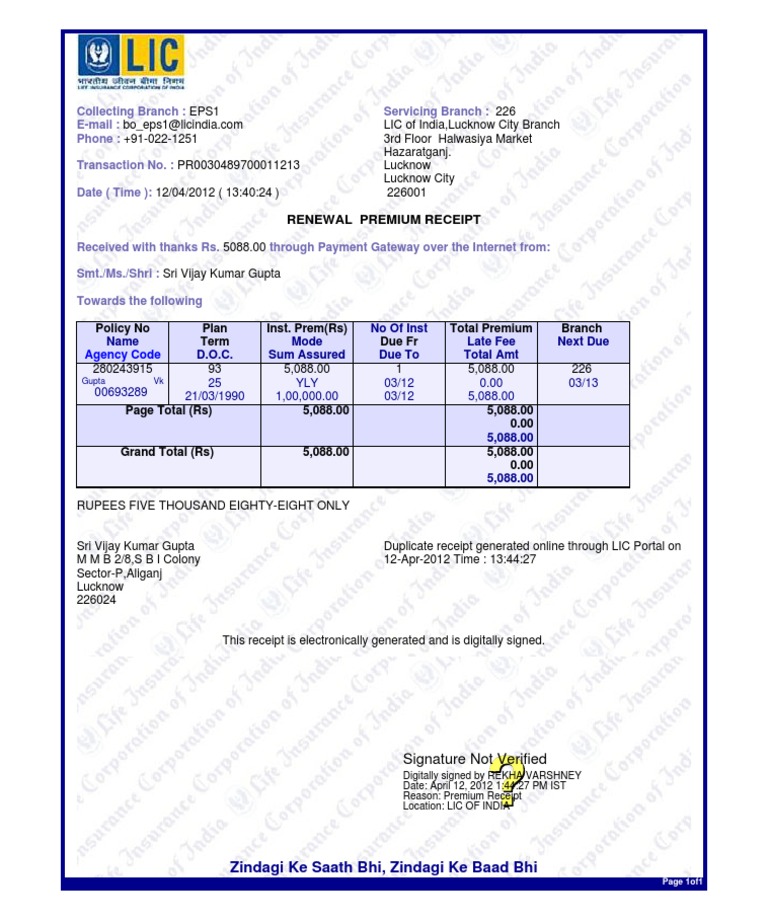

Download LIC Premium Payment Receipt Online CA Assisted Income Tax

https://i1.wp.com/etaxadvisor.com/wp-content/uploads/2020/04/LIC1.png?ssl=1

Web 21 sept 2020 nbsp 0183 32 It means If you paid a premium of more than 20 percent you could only claim a deduction of 20 percent of the sum assured which is not more than the overall limit of sec 80C along with deduction u s Web 3 avr 2023 nbsp 0183 32 An individual and a HUF can claim this deduction under Section 80C for life insurance premium paid up to Rs 1 5 lakh every year This deduction is available along

Web 1 Premium paid on his life insurance policy of Rs 8 400 Policy was taken in April 2011 and sum assured was Rs 25 000 2 Premium of Rs 1 000 on his another life insurance Web Tax Benefits The premiums paid towards these plans are eligible for tax deductions under Section 80C up to a specified limit currently Rs 1 5 lakh per annum as of September

Download Tax Rebate On Lic Premium

More picture related to Tax Rebate On Lic Premium

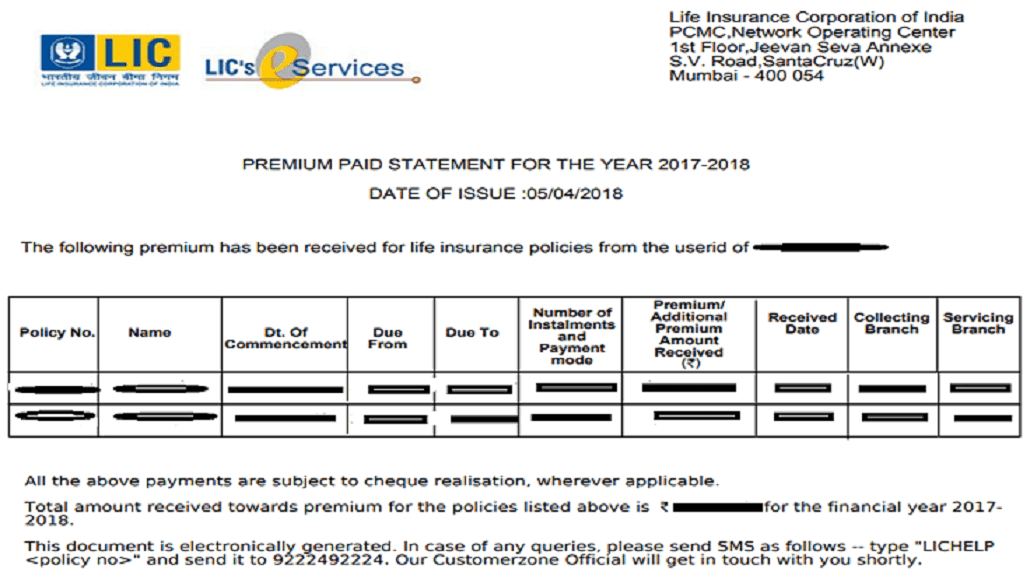

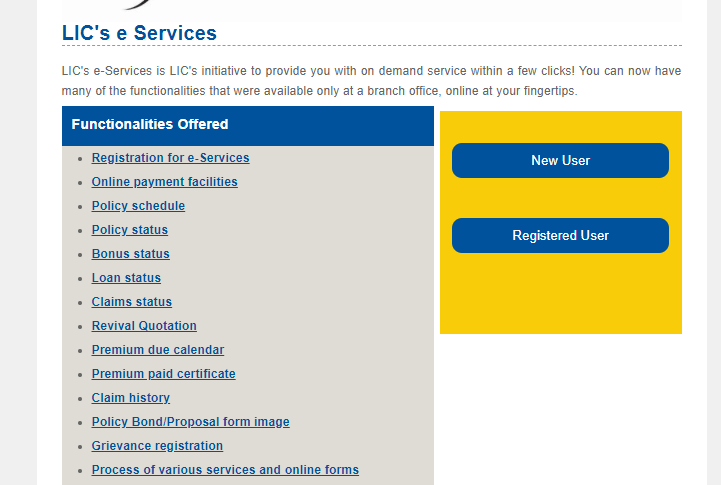

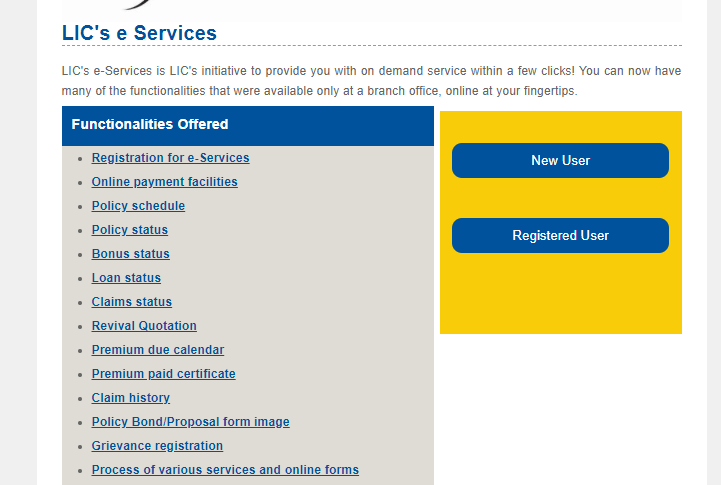

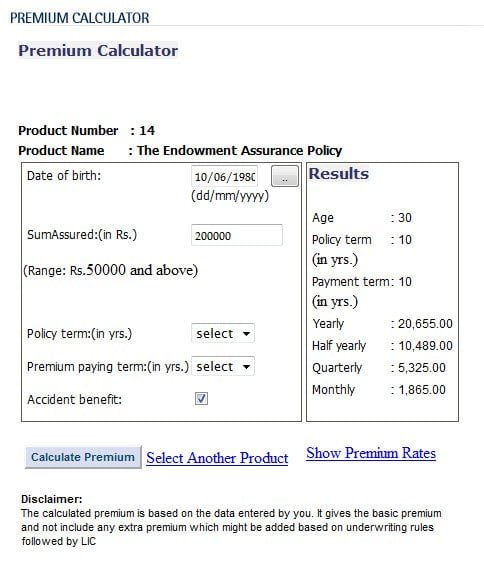

How To Download LIC Premium Paid Certificate Online For IT Returns

https://1.bp.blogspot.com/-3zy5hTwg9Tw/XiXUWba6qLI/AAAAAAAADKY/pvK8fpFJ0EERQF8kNgNagrXCpqLMtDcwgCLcBGAsYHQ/s1600/LIC%2BPremium%2BPaid%2BCertificate%2B5.png

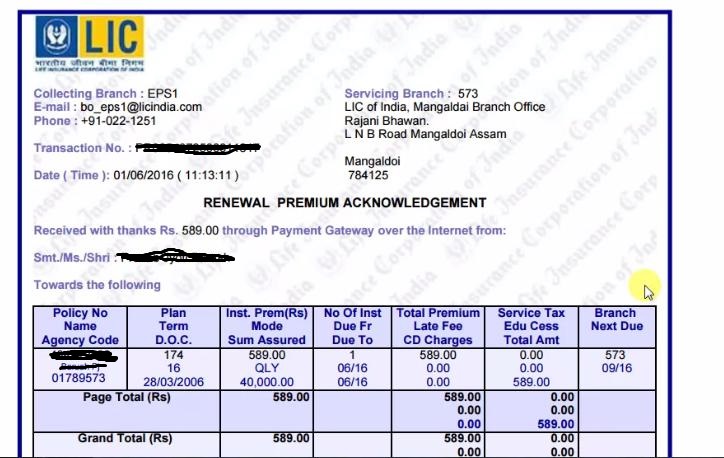

How To Download LIC Premium Paid Receipt

https://3.bp.blogspot.com/-ushCyeq4jEE/WKM3HbMy0AI/AAAAAAAAB_0/TGYHRfm7aqo-lj6YQrFBQtmCCvpm2W_IgCLcB/s1600/55.jpg

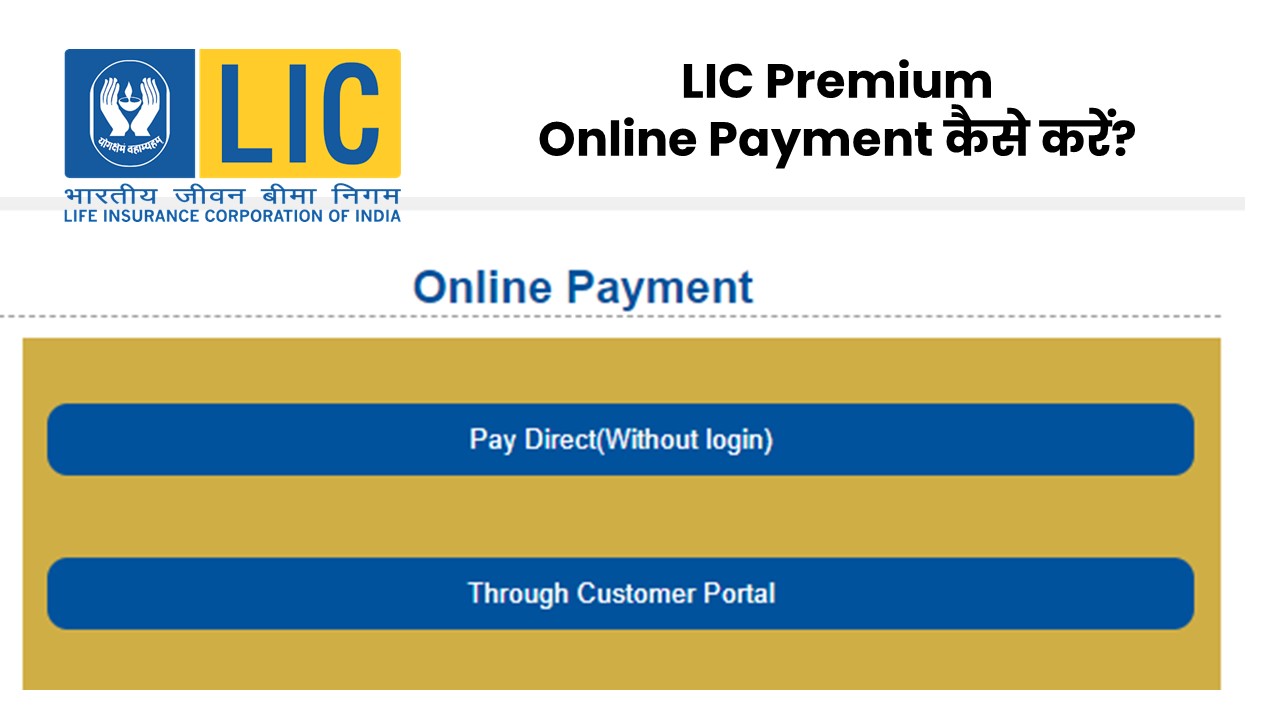

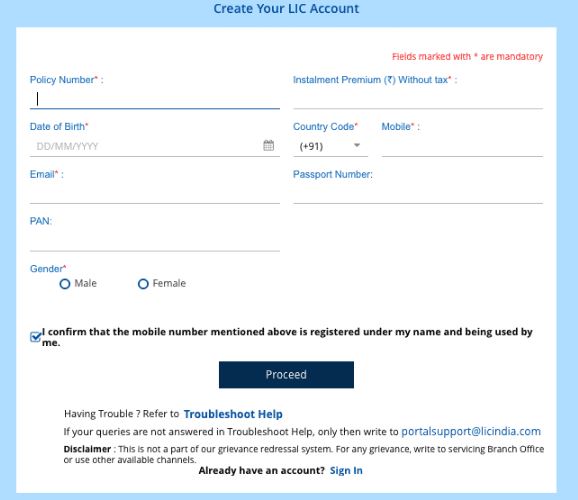

Online LIC Premium Payment LIC Premium Receipt Download

https://www.softfeed.in/wp-content/uploads/2021/12/lic-premium-online-payment.jpg

Web FAQs on Income Tax Exemption on LIC Premium What is the limit of LIC exemption in income tax The maximum limit of LIC exemption is Rs 1 5 lakh under Section 80C Web 9 avr 2019 nbsp 0183 32 The overall premium will come to Rs 20 983 Loaded 0 Thus a substantial amount of GST which is applicable to the basic premiums in both the cases can be claimed for getting tax saving

Web 3 mars 2017 nbsp 0183 32 Illustratively if the premium is Rs 10 000 the life cover sum assured should be Rs 1 lakh for the maturity proceeds to be tax free If say the sum assured is Rs Web 14 d 233 c 2022 nbsp 0183 32 However the premiums paid by you for your parents or your in laws are not eligible for deduction Nor can your parents claim tax benefits for premiums paid by

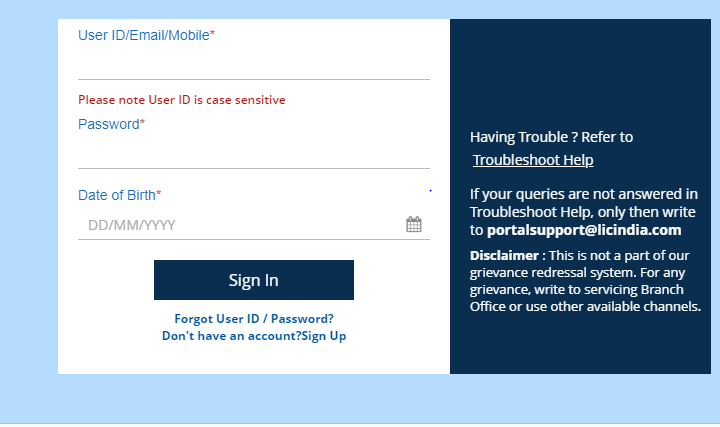

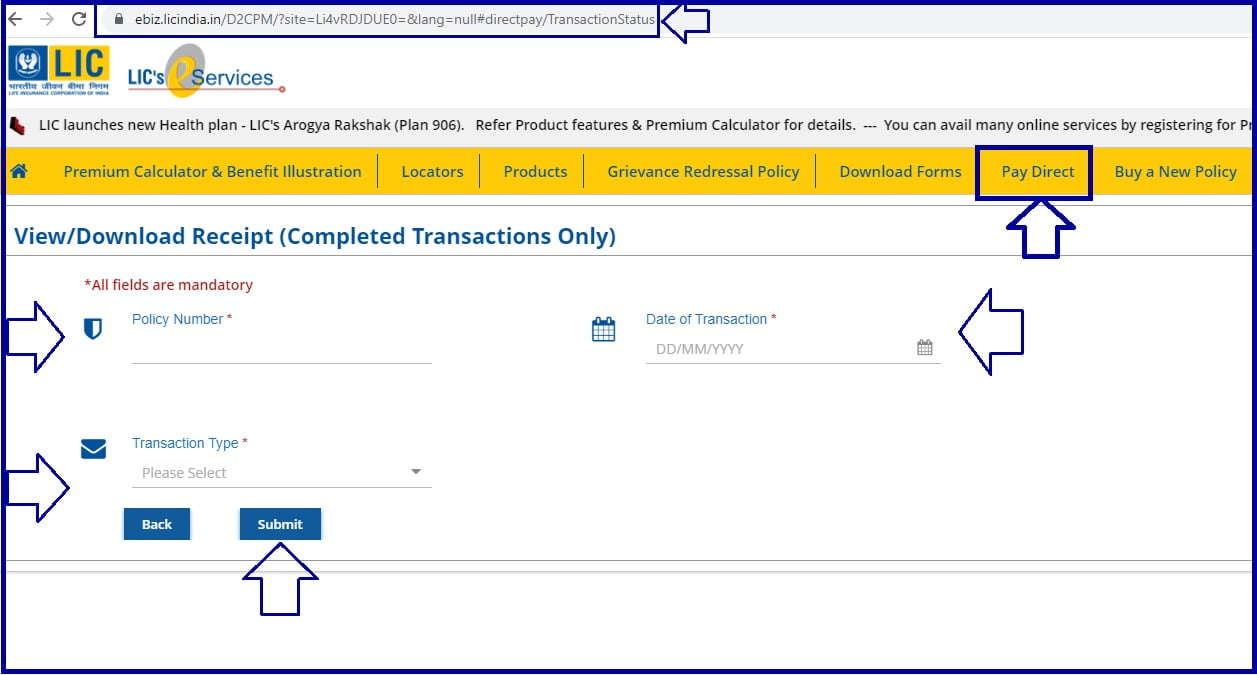

How To Download LIC Premium Payment Receipt Online E filing Of Income

https://etaxadvisor.com/wp-content/uploads/2020/04/LIC-2-1.png

Opportunity To Revive The Discontinued LIC Policy Offer Ends Tomorrow

https://images.tv9hindi.com/wp-content/uploads/2022/03/LIC-Policy2.jpg

https://news.cleartax.in/it-conditions-attached-with-the-lic-premium...

Web 1 d 233 c 2021 nbsp 0183 32 Tax benefit in respect of premium paid for life insurance policies Section 80C of the Income Tax Act allows an individual and a Hindu Undivided Family HUF to claim

https://licindia.in/tax-benefit

Web 6 mai 2023 nbsp 0183 32 income tax rates and tax benefits from life insurance and rates for assessment year 2022 2023 financial year 2021 2022 content is in english

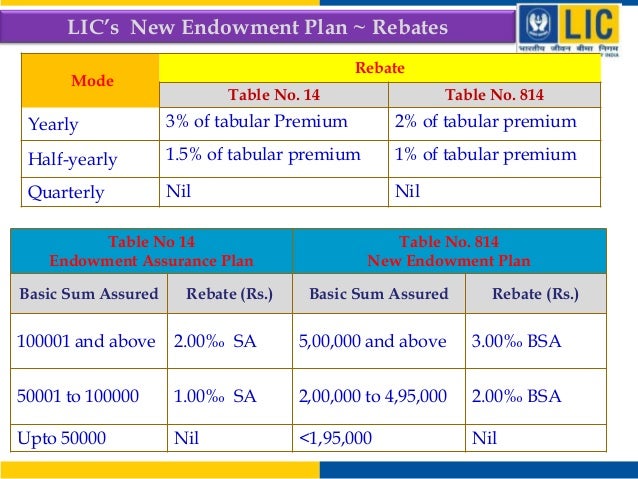

LIC s New Policy Endowment Plan Table 814 Vs LIC Endowment Plan 14

How To Download LIC Premium Payment Receipt Online E filing Of Income

LIC Receipt

How To Get Lic Premium Receipt For Ecs Payment Payment Poin

How To Download LIC Premium Payment Receipt Online E filing Of Income

LIC India Premium Calculator To Find Your LIC Premium

LIC India Premium Calculator To Find Your LIC Premium

Download Income Tax LIC Premium Paid Certificate

LIC Premium Receipt Download Get LIC Payment Receipt Ebiz licindia in

Certificate Life Insurance Corporation Life Insurance Policy

Tax Rebate On Lic Premium - Web 3 avr 2023 nbsp 0183 32 An individual and a HUF can claim this deduction under Section 80C for life insurance premium paid up to Rs 1 5 lakh every year This deduction is available along