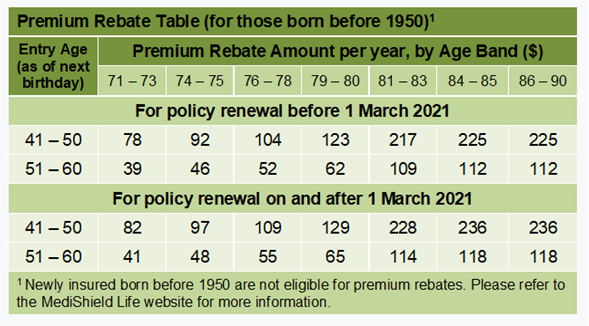

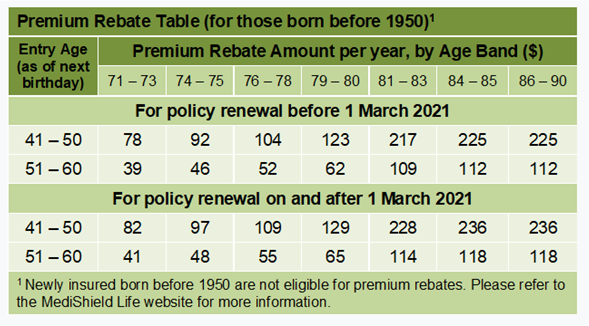

Tax Rebate On Life Insurance Premium Web Amount of Life Insurance Relief allowed You may claim the lower of a the difference between 5 000 and your CPF contribution or b up to 7 of the insured value of your

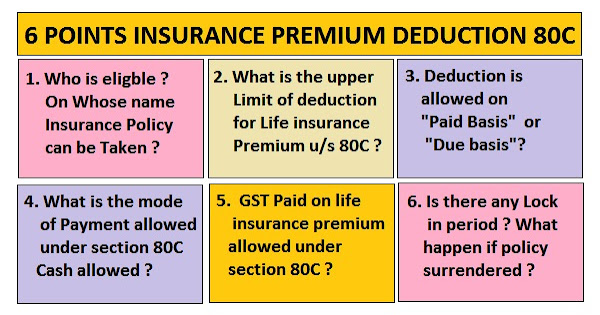

Web 23 juin 2018 nbsp 0183 32 Life Insurance Plans are very popular as a tool to get deduction u s 80C of the I T Act The investment in life insurance can be deducted up to Rs 1 50 000 Rs 1 Lakh upto A Y 2014 15 It a Web 26 juin 2018 nbsp 0183 32 An individual and a HUF can claim this deduction under Section 80C for life insurance premium paid up to Rs 1 5 lakh every year This deduction is available along

Tax Rebate On Life Insurance Premium

Tax Rebate On Life Insurance Premium

https://www.cpf.gov.sg/content/dam/web/member/faq/healthcare-financing/images/Imagepremiumrebatetable2.png

The Private Health Insurance Rebate Explained ISelect

https://www.iselect.com.au/content/uploads/2018/05/Private-Health-Insurance-Rebate_table.jpg

LIFE INSURANCE PREMIUM DEDUCTION U S 80C SIMPLE TAX INDIA

https://4.bp.blogspot.com/-BizvQ5yzwcE/Wk6EIQIdpuI/AAAAAAAAD1A/c-dEh2yYEIoa76gqycE-oOaJOcVZU941ACLcBGAs/w600-h315-p-k-no-nu/life%2Binsurance%2Bpremium%2Bdeduction%2Bunder%2B80C.jpg

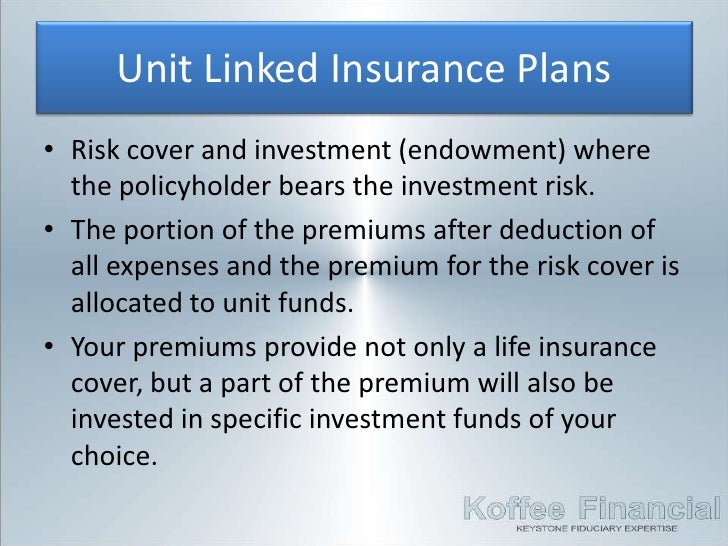

Web Tax Exemption on Insurance Premiums Salaried employees and businessmen can invest in life insurance or medical insurance in order to consider themselves eligible for tax Web 13 juin 2022 nbsp 0183 32 Section 80C of the Income Tax Act provides a deduction of up to Rs 1 5 lakh for the premiums paid on life insurance Deductions are available for the policy taken

Web Rebate is an AIA product specific term that refers to the method that the AIA Insurance Superannuation Scheme No2 uses to pass back the tax savings for the tax deduction Web Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM

Download Tax Rebate On Life Insurance Premium

More picture related to Tax Rebate On Life Insurance Premium

Notice Regarding Rebate On Late Fee Of Renewal Premium Mahalaxmi Life

https://mahalaxmilife.com.np/wp-content/uploads/2020/09/Rebate-on-Renewal-scaled.jpg

3 Insurance Life Insurance

https://image.slidesharecdn.com/kflifeinsurance-120729085430-phpapp02/95/3-insurance-life-insurance-18-728.jpg?cb=1343552917

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Web 9 oct 2017 nbsp 0183 32 Section 33 4d of the Personal Income Tax Act PITA 2011 as amended provides for tax deductibility of premium on life insurance and deferred annuity on an Web 26 juin 2020 nbsp 0183 32 In B C regulations under the Financial Institutions Act currently permit rebating up to a maximum amount equal to 25 of premiums However B C s rebating rules are under review Tax

Web Section 80C provides deduction in respect of various items like life insurance premium investment in Public Provident Fund investment in NSC repayment of principal Web 26 juil 2021 nbsp 0183 32 Updated Jul 26 2021 Fact checked Most types of life insurance are not tax deductible This is because according to the ATO insurance premiums aren t tax

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

https://i.ytimg.com/vi/jZcpVwGx4EE/maxresdefault.jpg

Notice Regarding Late Fee Rebate On Renewal Premium Mahalaxmi Life

https://mahalaxmilife.com.np/wp-content/uploads/2020/06/Rebate-Notice.jpeg

https://www.iras.gov.sg/.../tax-reliefs/life-insurance-relief

Web Amount of Life Insurance Relief allowed You may claim the lower of a the difference between 5 000 and your CPF contribution or b up to 7 of the insured value of your

https://taxguru.in/income-tax/insurance-pre…

Web 23 juin 2018 nbsp 0183 32 Life Insurance Plans are very popular as a tool to get deduction u s 80C of the I T Act The investment in life insurance can be deducted up to Rs 1 50 000 Rs 1 Lakh upto A Y 2014 15 It a

Private Health Insurance Rebate Navy Health

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

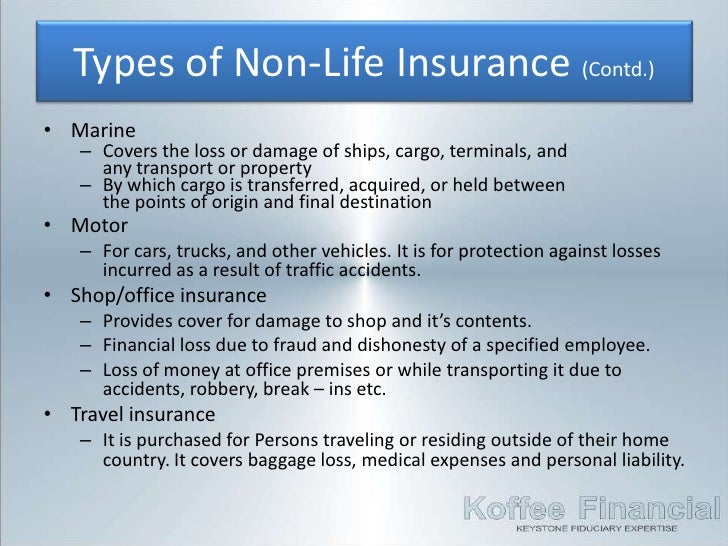

4 Insurance Non Life Insurance

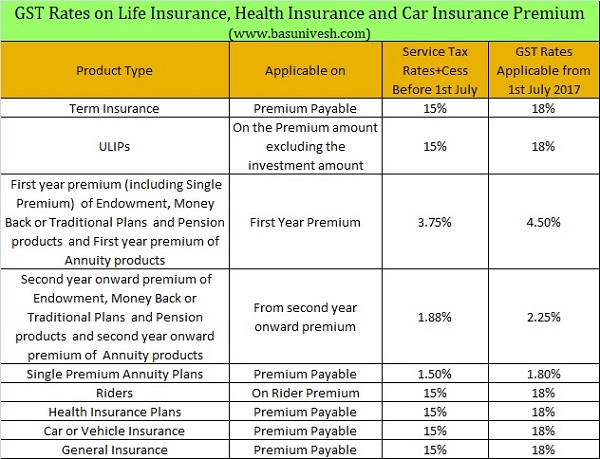

GST Rates On Life Insurance Health Insurance And Car Insurance Premium

Anything To Everything Income Tax Guide For Individuals Including

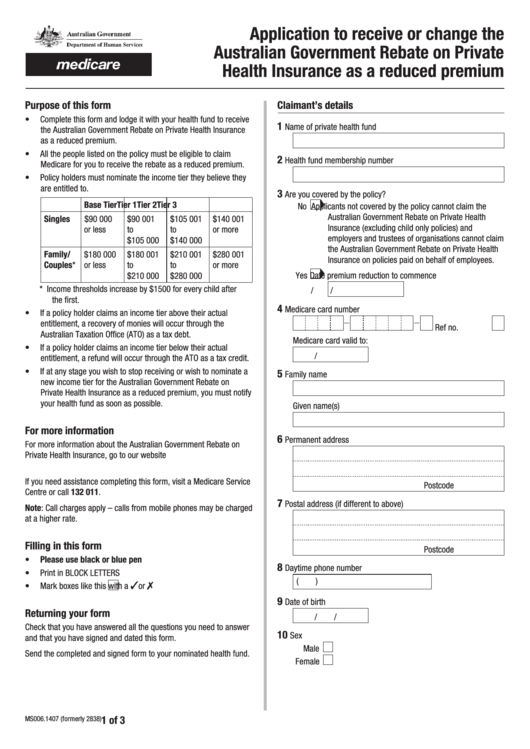

Fillable Application To Receive Or Change The Australian Government

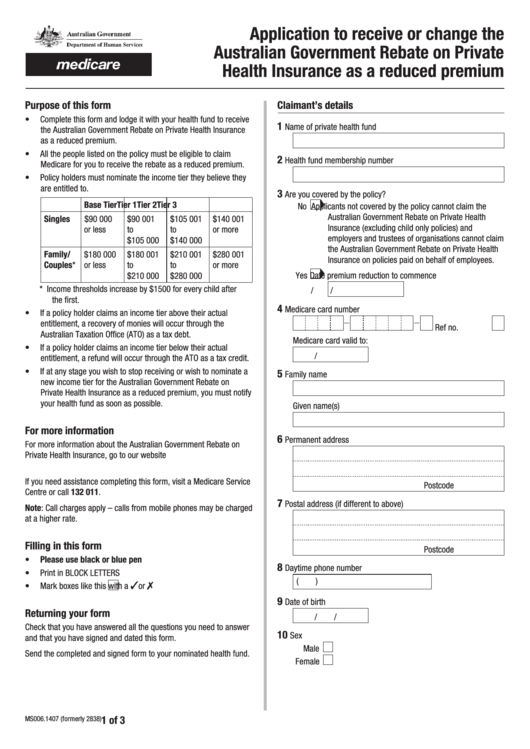

Fillable Application To Receive Or Change The Australian Government

LIfe Insurance Marketing

Pay Less Income Tax With This One Simple Tip LCF On Personal Finance

What Is A Life Insurance Premium Ideas Qarbit

Tax Rebate On Life Insurance Premium - Web 13 juin 2022 nbsp 0183 32 Section 80C of the Income Tax Act provides a deduction of up to Rs 1 5 lakh for the premiums paid on life insurance Deductions are available for the policy taken