Tax Rebate On Life Insurance Web 11 nov 2019 nbsp 0183 32 Section 33 4 d of Personal Income Tax Act PITA allows a deducon of the annual amount of any premium paid by an individual in respect of insurance on his life

Web 26 juil 2021 nbsp 0183 32 Jul 26 2021 Fact checked Most types of life insurance are not tax deductible This is because according to the ATO insurance Web Updated 4 August 2023 This helpsheet deals with chargeable event gains arising from UK life insurance policies It covers the most common circumstances that you re likely to

Tax Rebate On Life Insurance

Tax Rebate On Life Insurance

https://i2.wp.com/greatoutdoorsabq.com/wp-content/uploads/2019/02/tax-on-life-insurance-payout-1.jpg

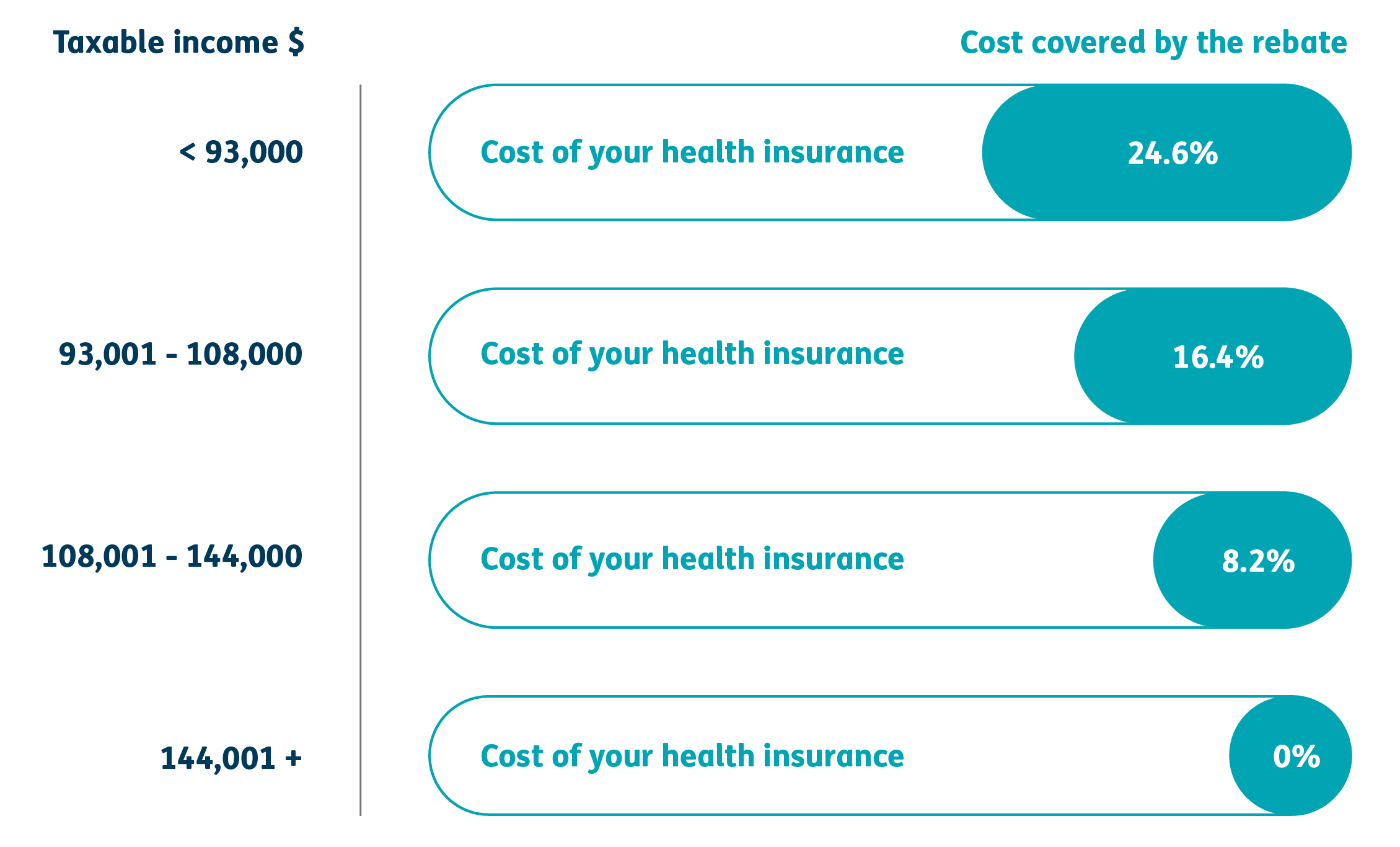

The Private Health Insurance Rebate Explained ISelect

https://www.iselect.com.au/content/uploads/2018/05/Private-Health-Insurance-Rebate_table.jpg

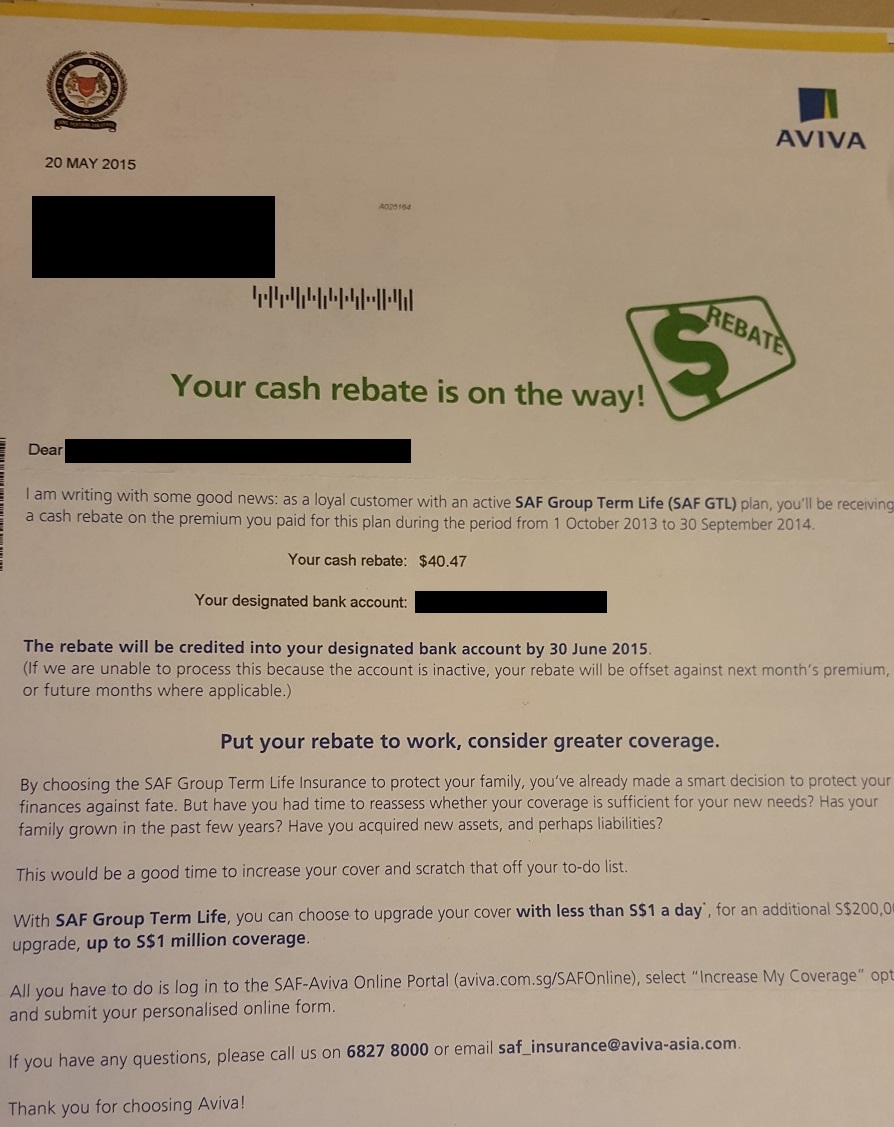

Premium Calculator Of State Life Insurance Savings Tax rebate

https://i.pinimg.com/originals/1b/f7/1f/1bf71f3892b43d8202305bb537e6baa5.png

Web Is this the first time you are claiming the relief Login with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax Web 27 mars 2023 nbsp 0183 32 Usually the gain has a 20 deemed tax credit attached which means that if the policyholder is a basic rate taxpayer they do not have any further tax to pay For

Web Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM Web 4 janv 2023 nbsp 0183 32 Updated Jan 4 2023 12 31pm Editorial Note We earn a commission from partner links on Forbes Advisor Commissions do not affect our editors opinions or evaluations Getty Life insurance

Download Tax Rebate On Life Insurance

More picture related to Tax Rebate On Life Insurance

Tax And Rebates HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

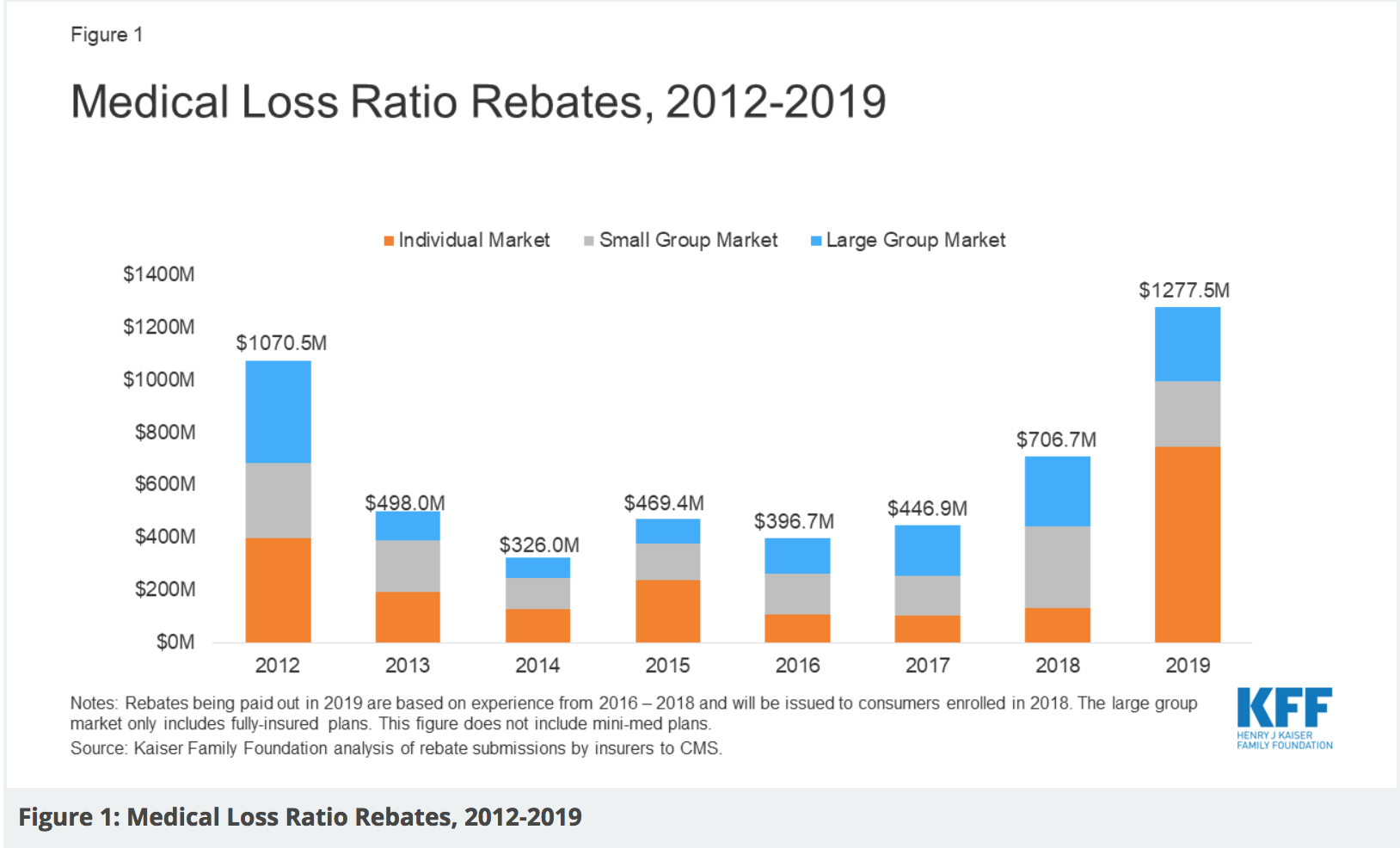

Texas Has Third Highest Insurance Rebates For Individual Market D

https://assets.dmagstatic.com/wp-content/uploads/2019/09/Screen-Shot-2019-09-13-at-2.11.29-PM.png

Rebating Meaning In Insurance What Is Insurance Rebating The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

Web 27 sept 2021 nbsp 0183 32 Life insurance offers desirable tax advantages though it is not exactly tax free Here are ways your life insurance benefits could be taxed Withdrawing too much Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

Web 4 ao 251 t 2023 nbsp 0183 32 Guidance Gains on UK life insurance policies Self Assessment helpsheet HS320 Find out how you should enter chargeable event gains from UK life insurance Web 3 avr 2023 nbsp 0183 32 Income received from insurance policies issued on or after 1 April 2023 other than unit linked policies having a premium or aggregate of premium exceeding Rs 5

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Rebate On Life Insurance Premia Contribution To Provident Fund Etc

http://taxdose.b-cdn.net/wp-content/uploads/2018/05/Rebate-on-life-insurance-premia-contribution-to-provident-fund-etc1.png

https://www.linkedin.com/pulse/tax-rebate-3-other-benefits-life...

Web 11 nov 2019 nbsp 0183 32 Section 33 4 d of Personal Income Tax Act PITA allows a deducon of the annual amount of any premium paid by an individual in respect of insurance on his life

https://www.finder.com.au/life-insurance/life …

Web 26 juil 2021 nbsp 0183 32 Jul 26 2021 Fact checked Most types of life insurance are not tax deductible This is because according to the ATO insurance

Notice Regarding Rebate On Late Fee Of Renewal Premium Mahalaxmi Life

Private Health Insurance Rebate Navy Health

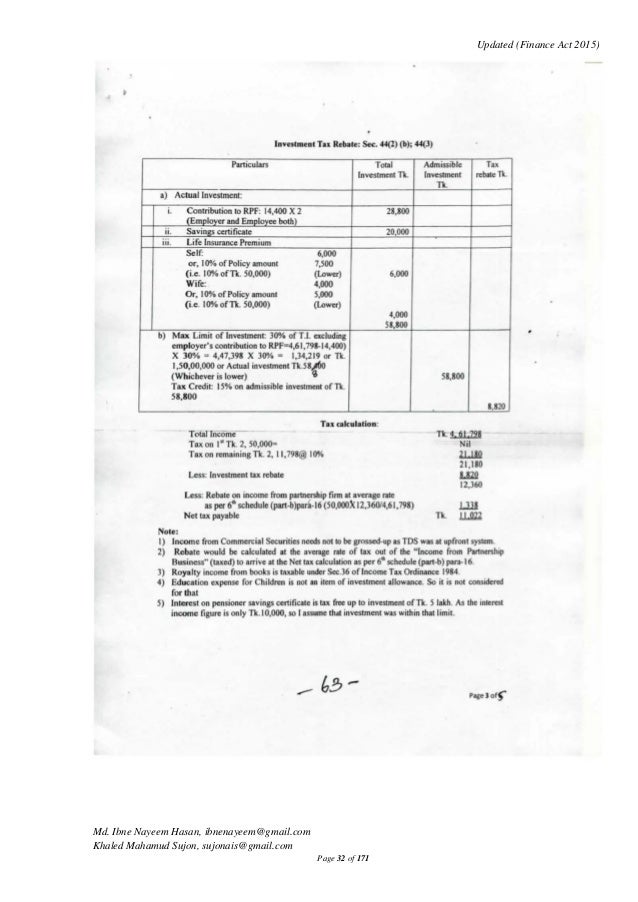

Anything To Everything Income Tax Guide For Individuals Including

Whole Life Insurance Life Insurance Rebate

Life Insurance Tax Irrevocable Life Insurance Trust Ilit Estate

Do You Pay Taxes For Life Insurance Insurance Policy

Do You Pay Taxes For Life Insurance Insurance Policy

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

4 Insurance Non Life Insurance

Life Insurance Telemarketing Life Insurance Rebate In Income Tax

Tax Rebate On Life Insurance - Web 27 mars 2023 nbsp 0183 32 Usually the gain has a 20 deemed tax credit attached which means that if the policyholder is a basic rate taxpayer they do not have any further tax to pay For