Tax Rebate On Medical Bills Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

Web 17 juil 2019 nbsp 0183 32 The deduction u s 80DDB for the expenditure on the medical treatment of the specified diseases can be claimed by Resident Individuals Indian or foreign citizen for Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self

Tax Rebate On Medical Bills

Tax Rebate On Medical Bills

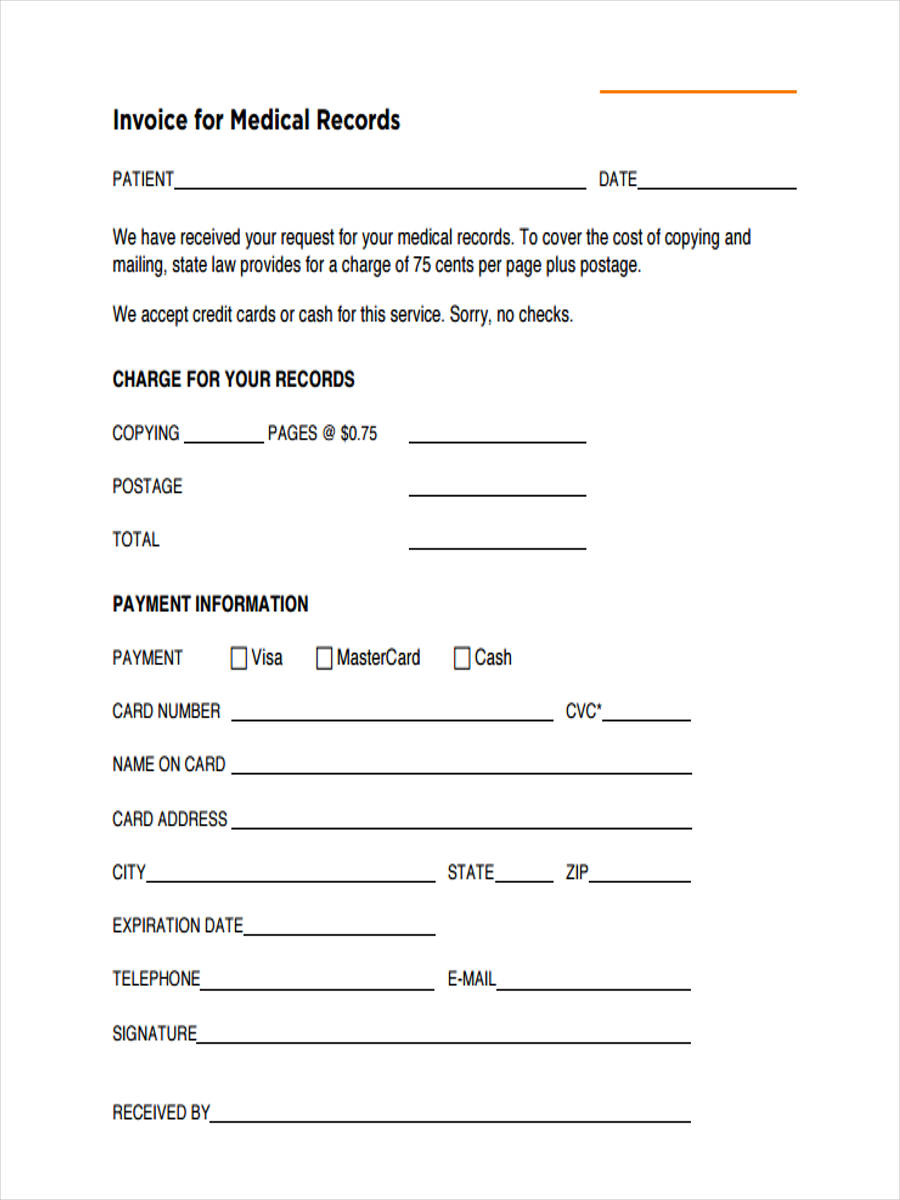

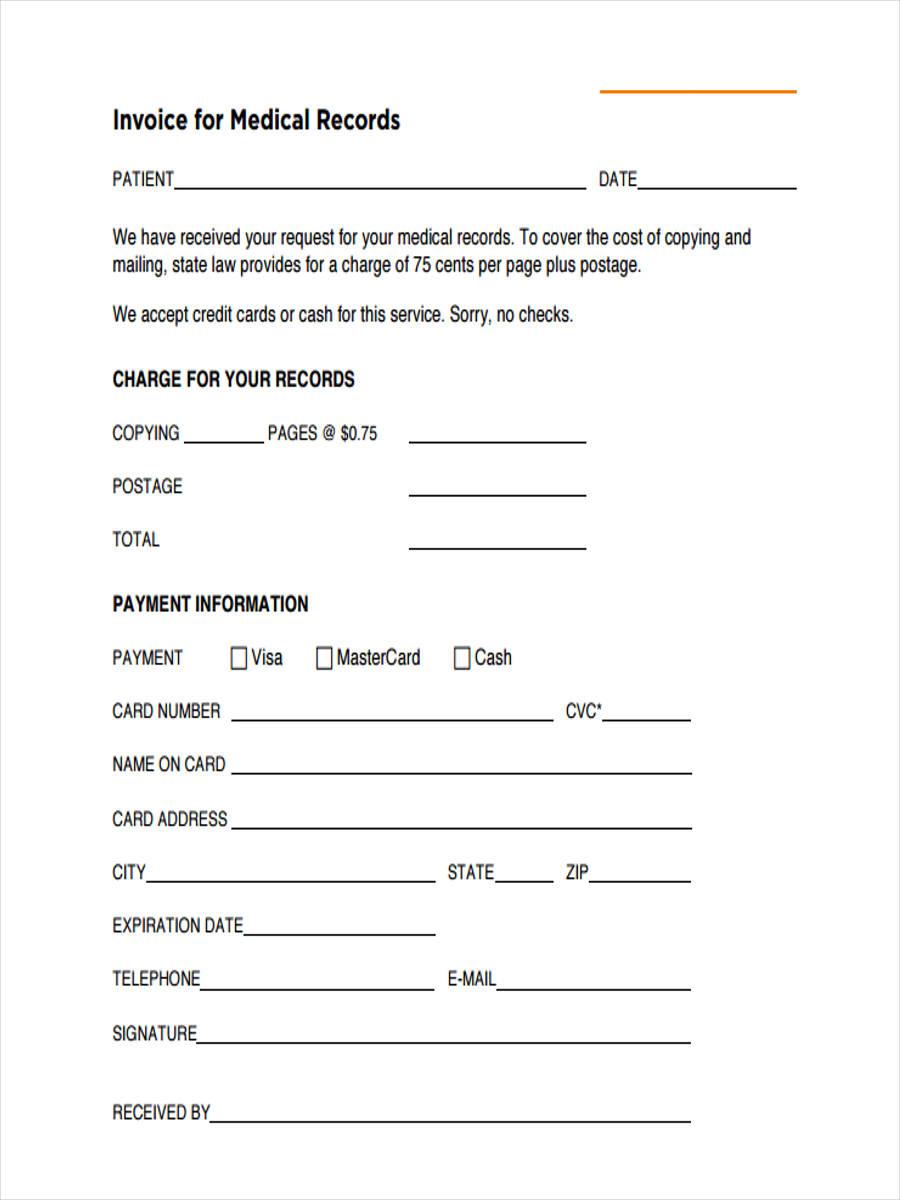

https://images.sampleforms.com/wp-content/uploads/2017/05/Medical-Records-Invoice.jpg

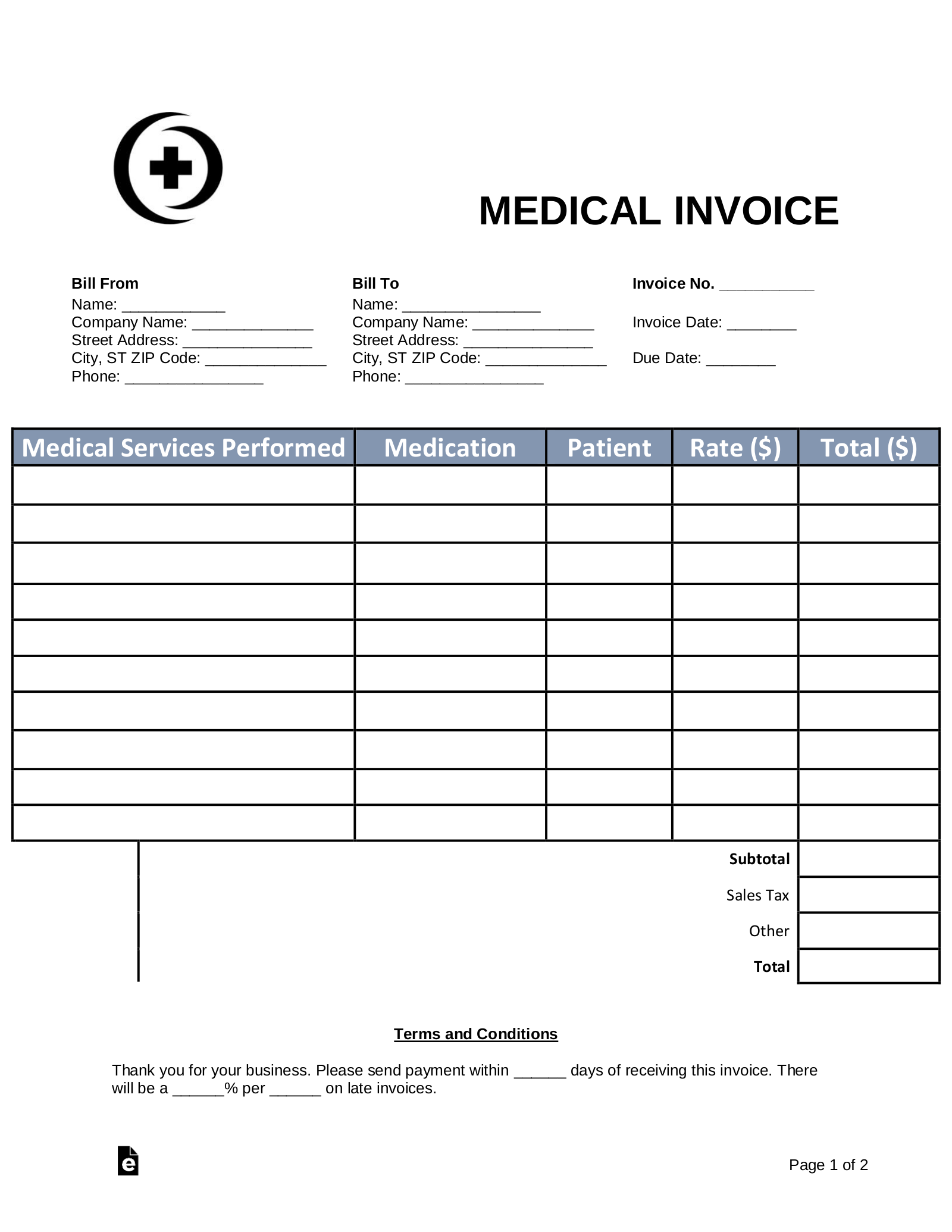

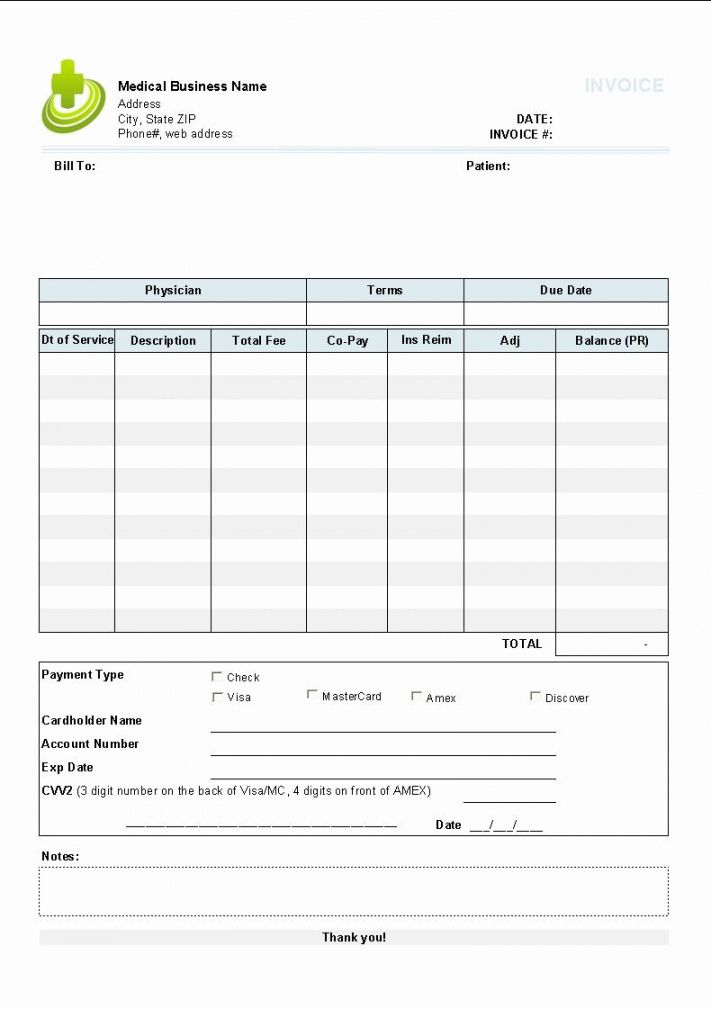

Editable Medical Bill Template Pdf

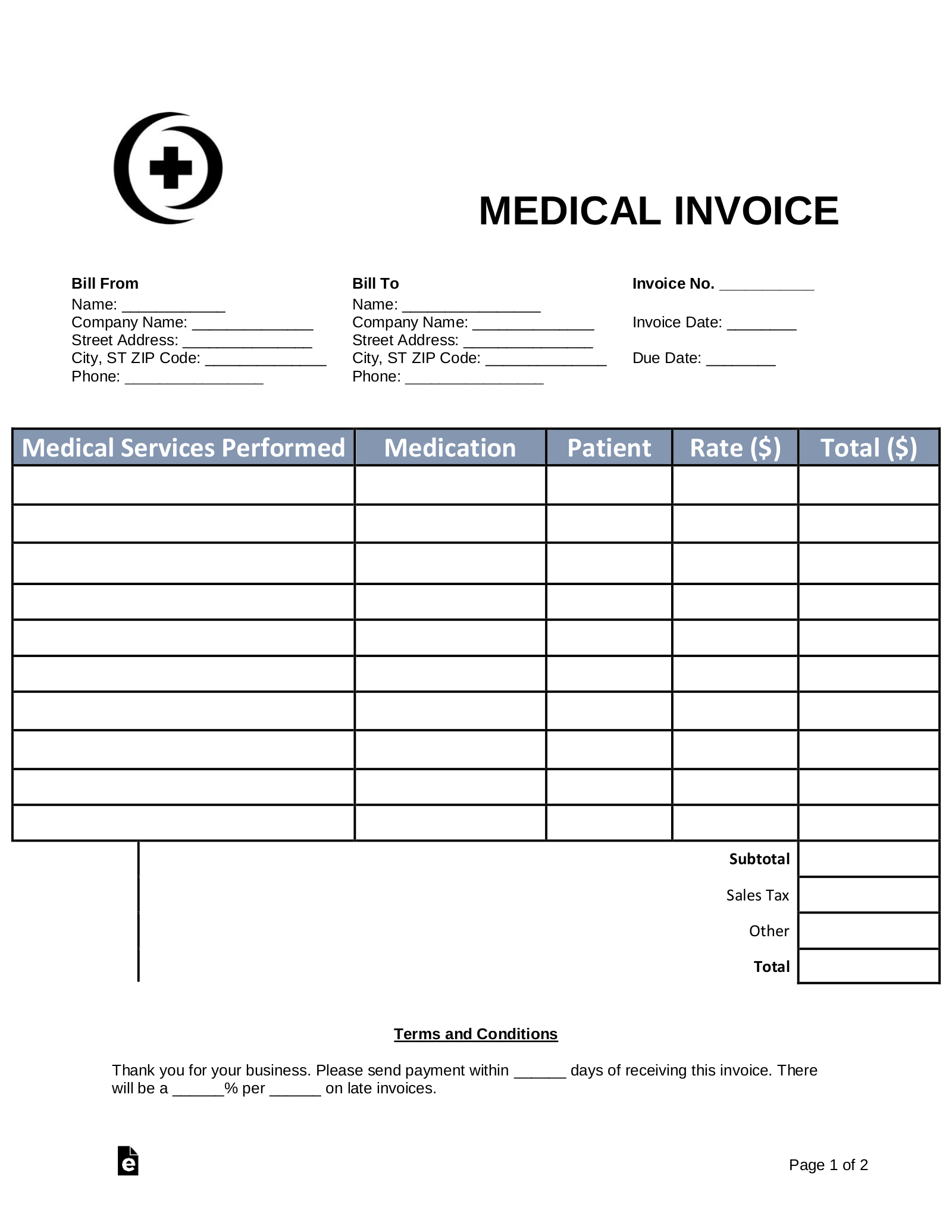

https://eforms.com/images/2016/10/medical-invoice-template.png

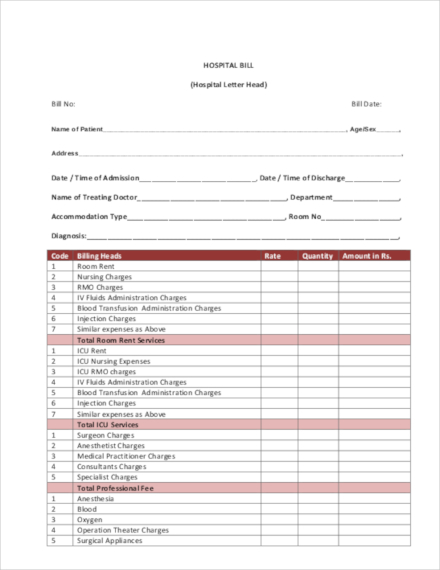

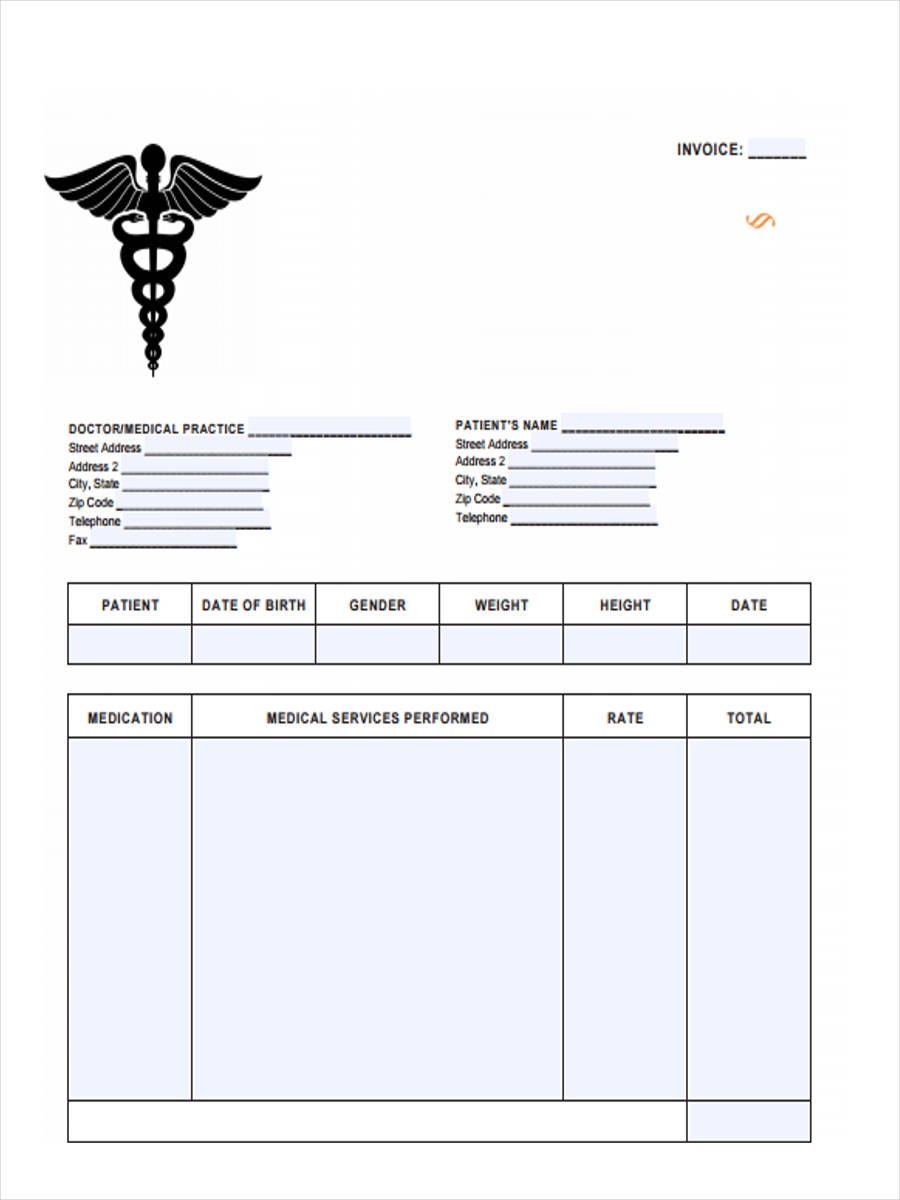

Free Medical Invoice Template Printable Templates

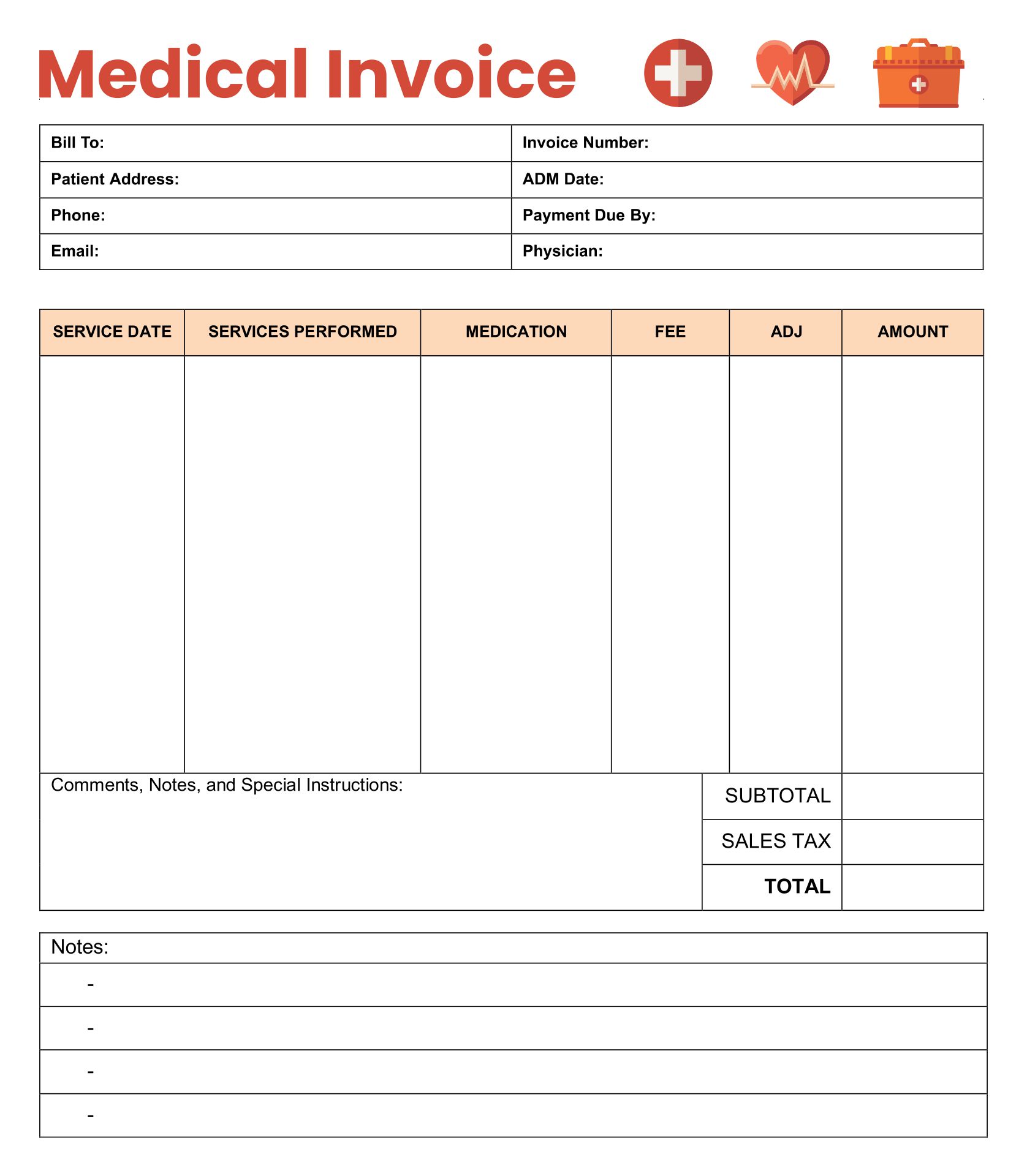

http://www.printablee.com/postpic/2010/04/medical-office-invoice-template_254889.jpg

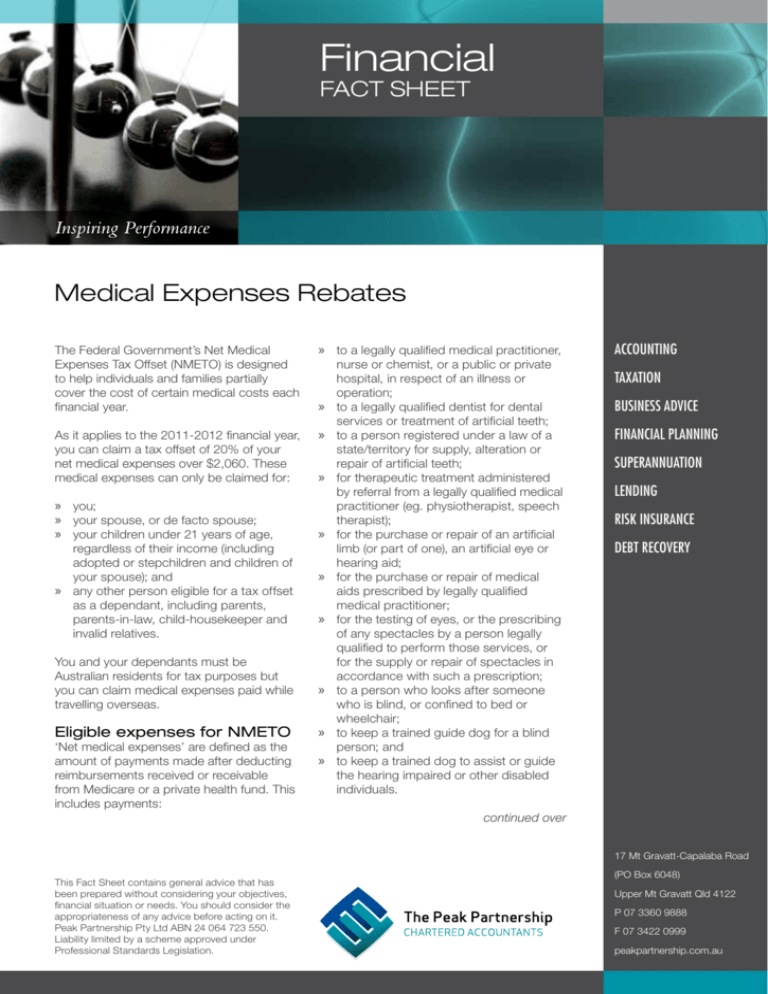

Web 5 sept 2023 nbsp 0183 32 The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a

Web If you have spent less than Rs 15 000 then only the incurred expense is tax free E g if your medical expense in a year with supporting bills was Rs 9 000 you will get a tax exemption of Rs 9 000 only out of the Web What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section 80D This

Download Tax Rebate On Medical Bills

More picture related to Tax Rebate On Medical Bills

Editable Medical Bill Template Pdf

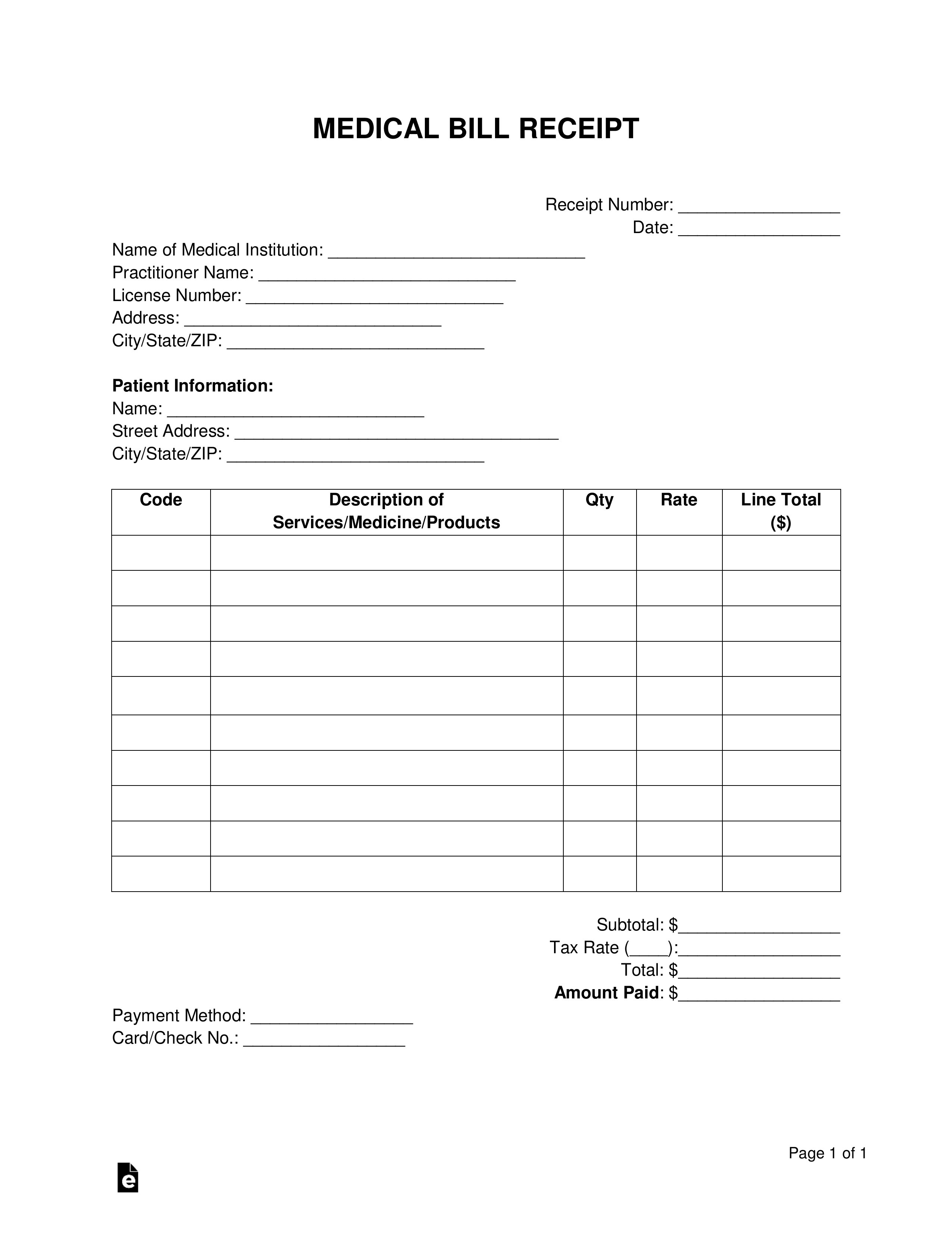

https://eforms.com/images/2019/01/Medical-Bill-Receipt-Template.png

Printable Medical Billing Forms Template Printable Templates

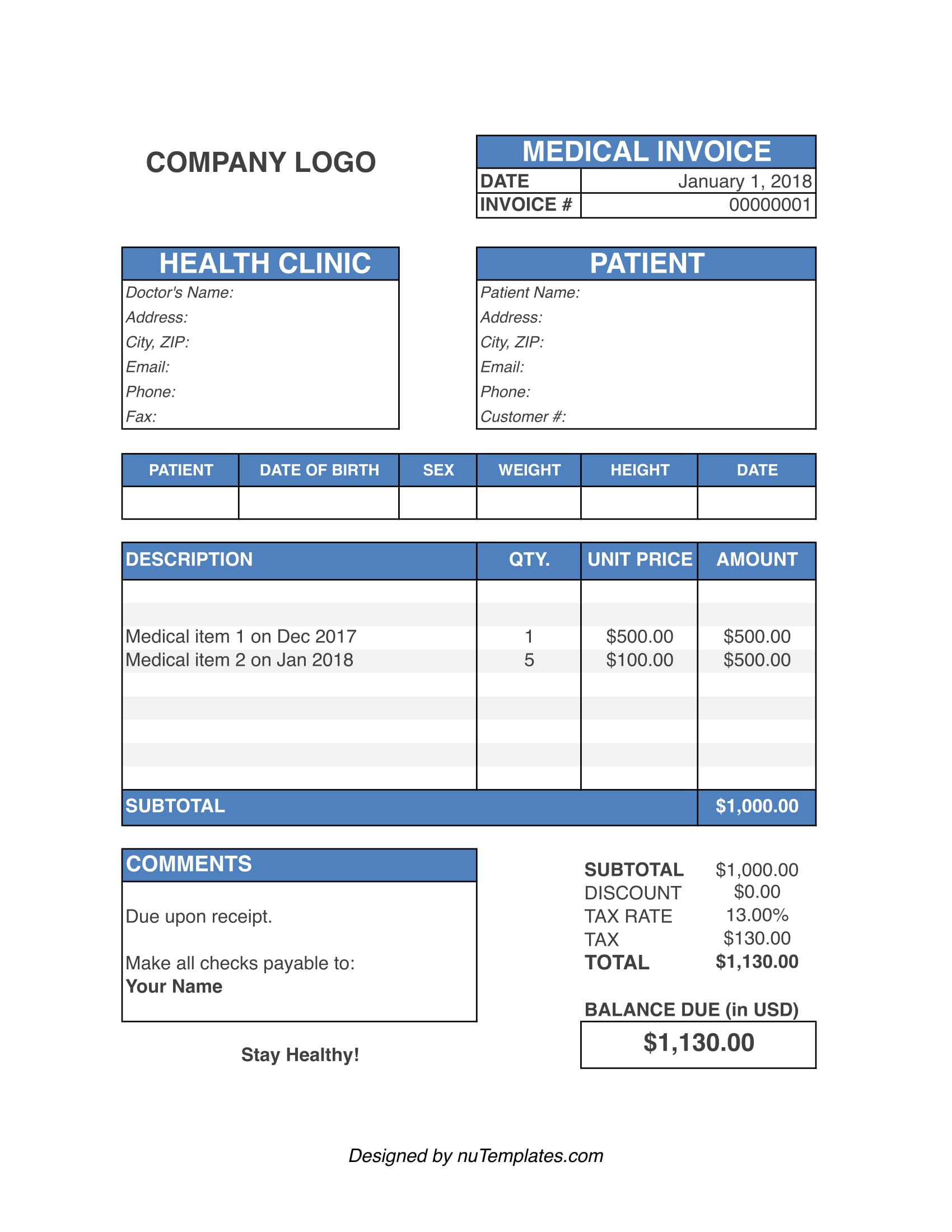

https://www.nutemplates.com/wp-content/uploads/medical-invoice-jpg.jpg

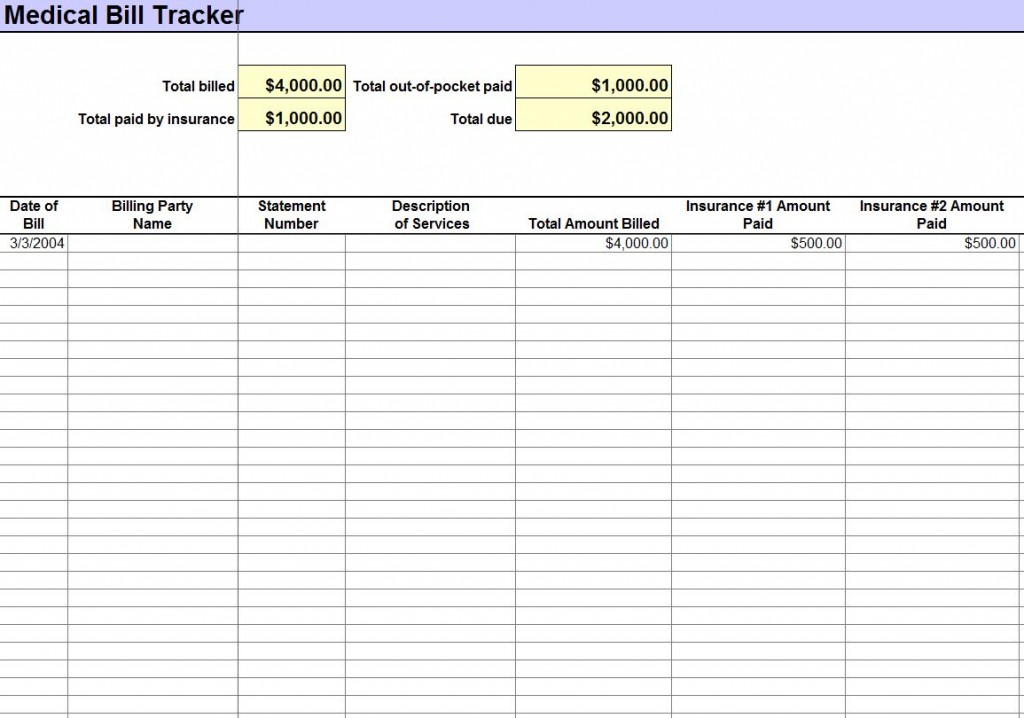

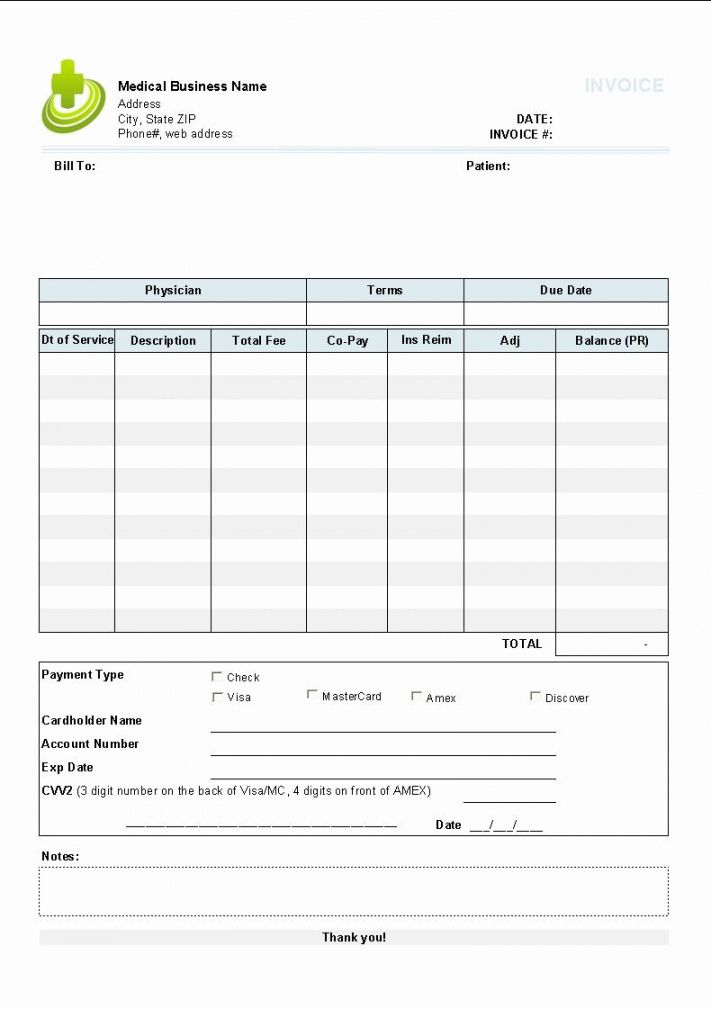

Medical Bill Template Medical Bill Template Excel

https://exceltemplates.net/wp-content/uploads/2013/07/Medical-Bill-Template-1024x718.jpg

Web You must reduce your eligible medical expenses if you receive a reimbursement from either a government a public authority a society an association a fund If you receive a Web 20 sept 2020 nbsp 0183 32 Section 80DDB allows deductions up to Rs 40 000 on medical expenditure for specified diseases for self or dependent Rs 1 00 000 if self or dependent is a senior

Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other Web 1 Exemption from regular medical expenses It comes under section 10A of the Income Tax Act 196 The tax exemption limit is of up to Rs 15 000 If your employer provides

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

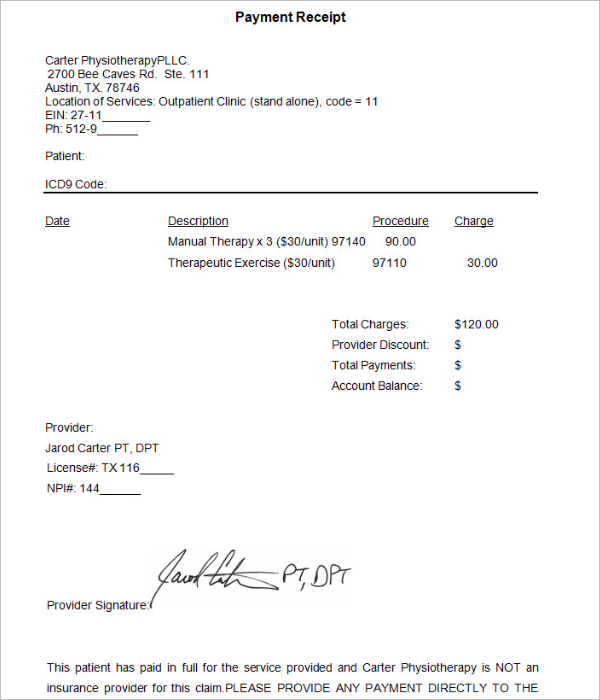

Free Medical Bill Receipt Template Pdf Word Eforms Medical Receipt

https://images.template.net/wp-content/uploads/2018/12/Hospital-Medical-Bill-Receipt.jpg

https://economictimes.indiatimes.com/wealth/t…

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 The deduction u s 80DDB for the expenditure on the medical treatment of the specified diseases can be claimed by Resident Individuals Indian or foreign citizen for

Medical Expenses Rebates

Private Health Insurance Rebate Navy Health

Sample Of A Medical Bill Bill Template Receipt Template Invoice

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Free Medical Bill Receipt Template Pdf Word Eforms Free Medical Bill

Printable 25 Fake Medical Bills Format In 2020 With Images Invoice

Printable 25 Fake Medical Bills Format In 2020 With Images Invoice

National Budget Speech 2022 SimplePay Blog

Printable Format Medical Records Invoice Template Free Printable

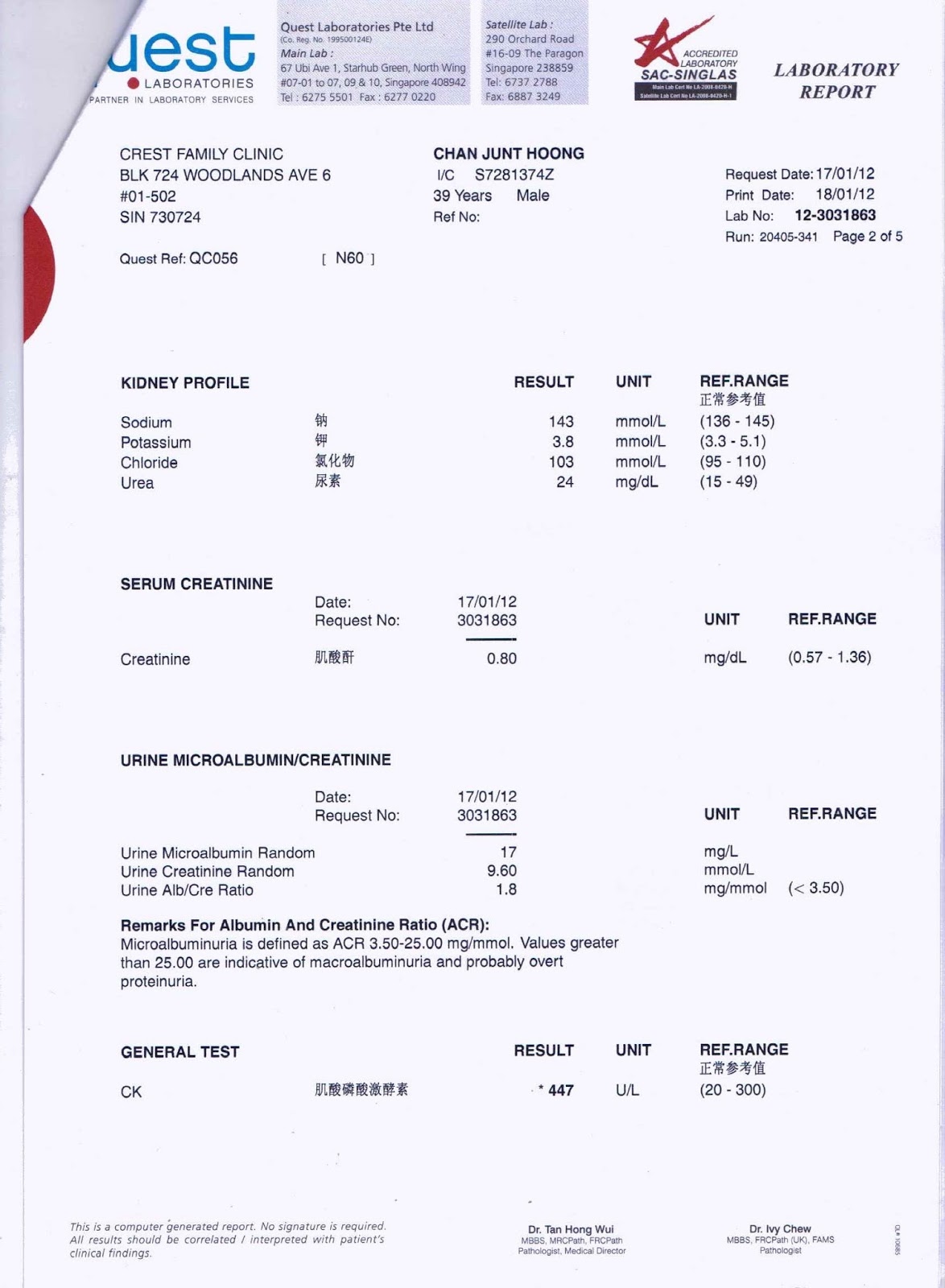

Chan Junt Hoong s Blog Continuation From Chan Junt Hoong s Mobile Blog

Tax Rebate On Medical Bills - Web 3 ao 251 t 2023 nbsp 0183 32 Medical insurance premium paid for individuals and families Rs 25 000 Rs 50 000 in case of senior citizen Medical insurance premium paid for your parents Rs