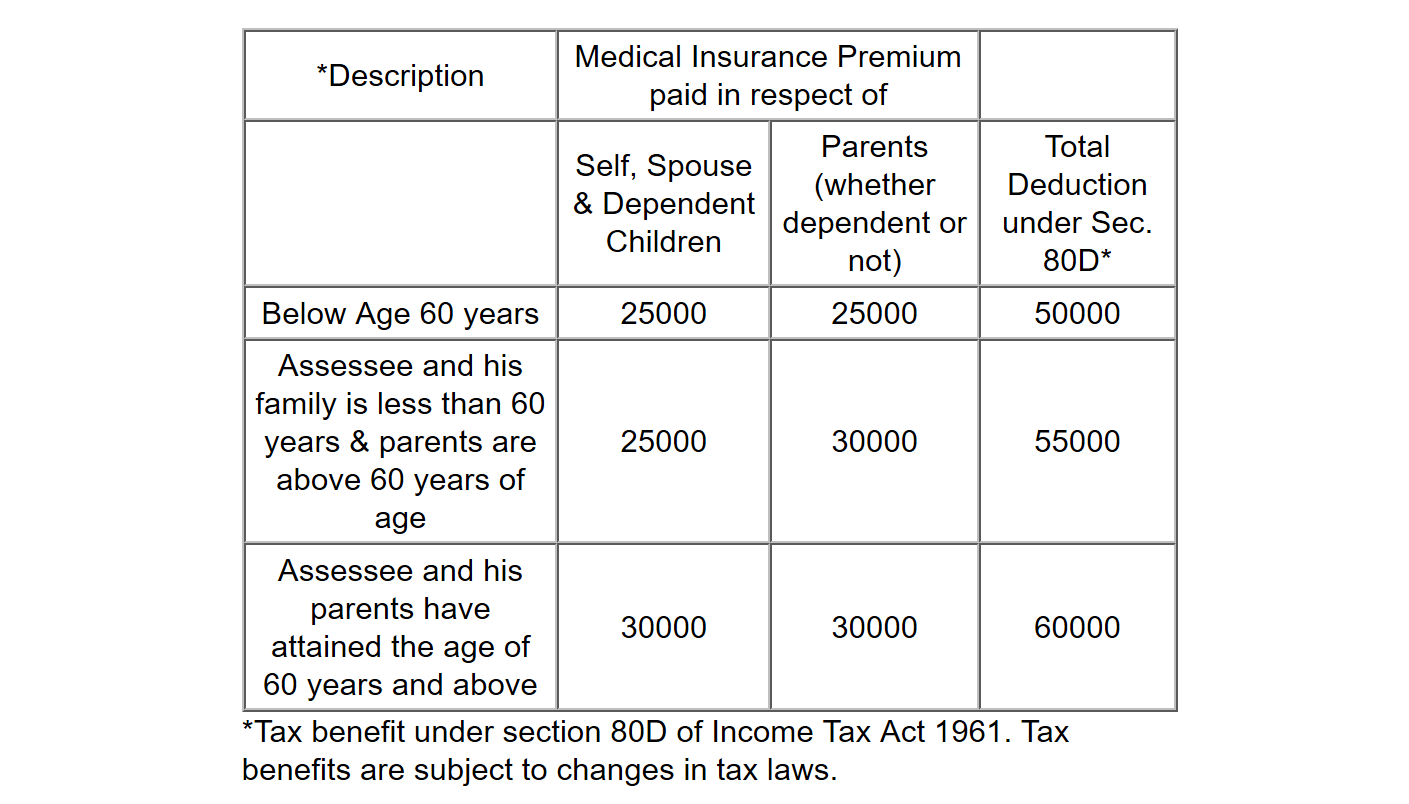

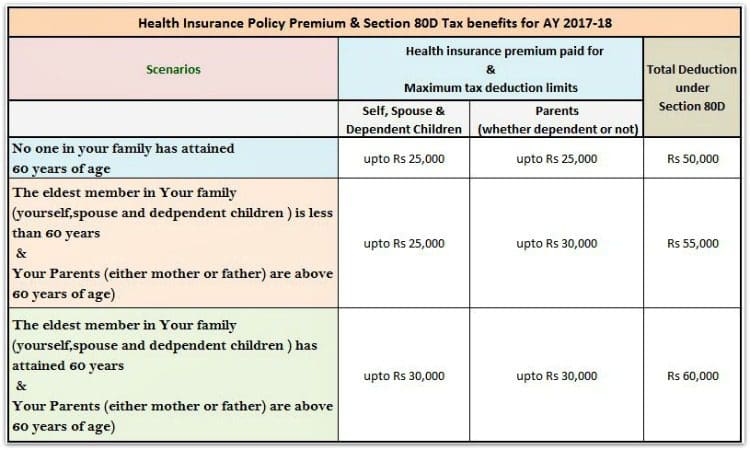

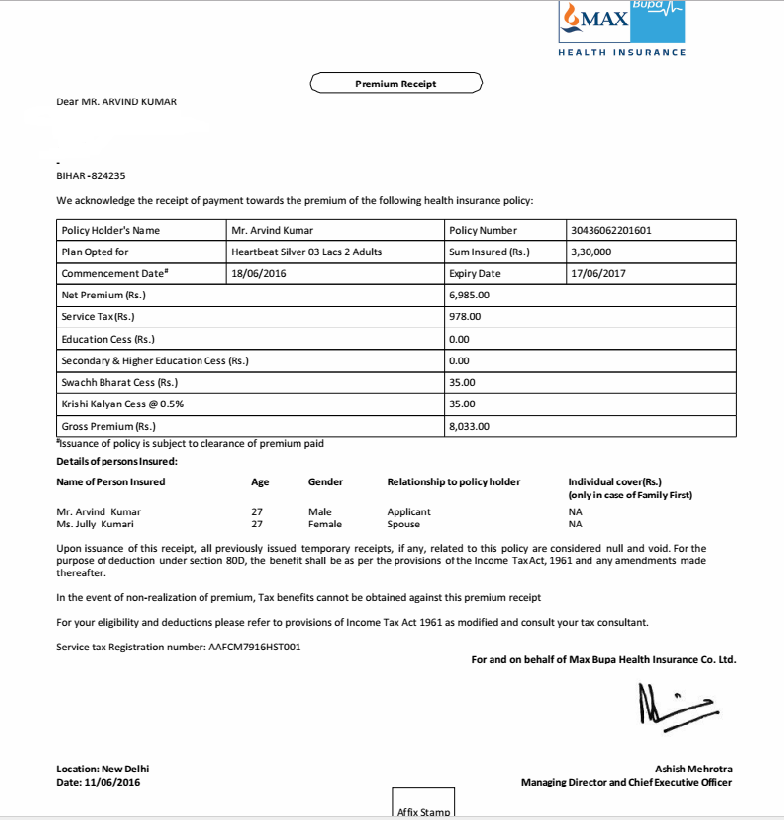

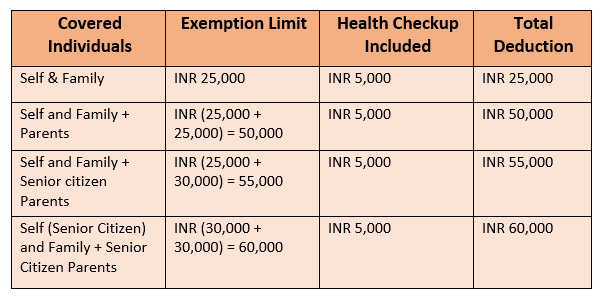

Tax Rebate On Medical Insurance Premium Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses

Web The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through Web 21 sept 2020 nbsp 0183 32 21 Sep 2020 26 247 Views 3 comments In the present scenario due to arise of Covid 19 many people are purchasing Health Insurance policies Premiums

Tax Rebate On Medical Insurance Premium

Tax Rebate On Medical Insurance Premium

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Anthem Releases Medical Loss Ratio Rebate Information Hometown

https://i1.wp.com/hometowninsurancepros.com/wp-content/uploads/2020/08/Anthem-2019-MLR.jpg?resize=790%2C1024&ssl=1

Insurers Paid 447 Million In Medical Loss Ratio Rebates For 2016

https://www.modernhealthcare.com/assets/interactive/20180103_barchart/rebatechart.png

Web Tax Benefits on Medical Insurance Section 80D of the Income Tax Act 1961 allows individuals and Hindu Undivided Family HUF to avail health insurance tax benefit on the premium paid If your annual income Web 10 mars 2023 nbsp 0183 32 Is Health Insurance Tax Deductible Health insurance costs may be tax deductible but it depends on how much you spent on medical care for the year and whether you re self employed The rules

Web 12 juil 2023 nbsp 0183 32 For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your Web You ll use Form 1095 A to quot reconcile quot your 2022 premium tax credits when you file your 2022 taxes If you got excess advance payments of the premium tax credit APTC for

Download Tax Rebate On Medical Insurance Premium

More picture related to Tax Rebate On Medical Insurance Premium

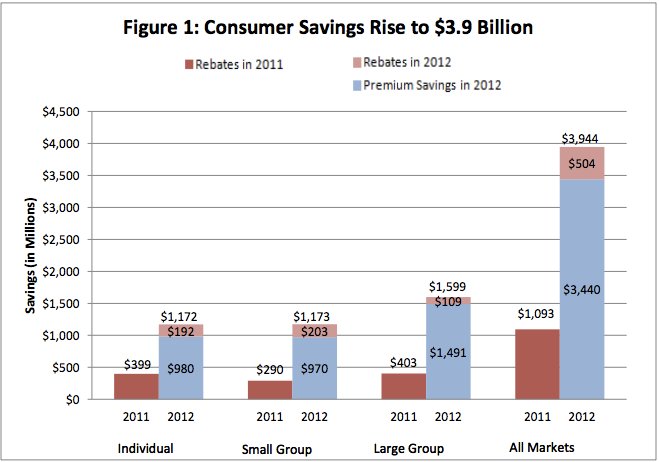

Health Insurance Rebates Sending 500 Million Back To Consumers

http://i.huffpost.com/gen/1202466/original.jpg

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

https://1.bp.blogspot.com/-e7M8q_wmnrg/V24ELtVM3WI/AAAAAAAAGaI/tPaf_vkBm-gAVt0-4k8bDqVODrYOTlkawCLcB/s1600/Tax%2BBenefit%2Bof%2BBuying%2BHealth%2BInsurance%2Bin%2BIndia%2BNRI.png

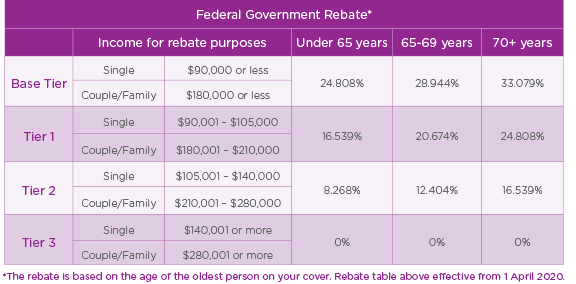

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Web 9 juin 2019 nbsp 0183 32 Under Section 80D a resident individual can claim a tax deduction of up to 25 000 in a year for medical insurance premiums If you were to claim tax benefit proportionately you would Web 6 sept 2023 nbsp 0183 32 The Affordable Care Act requires insurance companies to spend at least 80 or 85 of premium dollars on medical care with the rate review provisions

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Web 4 juin 2022 nbsp 0183 32 Tax benefit on Insurance Premium Mediclaim amp Medical Expenses TG Team Income Tax Articles Featured Download PDF 04 Jun 2022 107 041 Views

Medical Claim Medical Claim Tax

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

https://www.policybazaar.com/health-insurance/section80d-deductions

Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses

https://www.irs.gov/affordable-care-act/individuals-and-families/the...

Web The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through

How To Download Max Life Insurance Premium Receipt Online

Medical Claim Medical Claim Tax

Why Is Medicare

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Health Insurance Premium Receipt Insurance

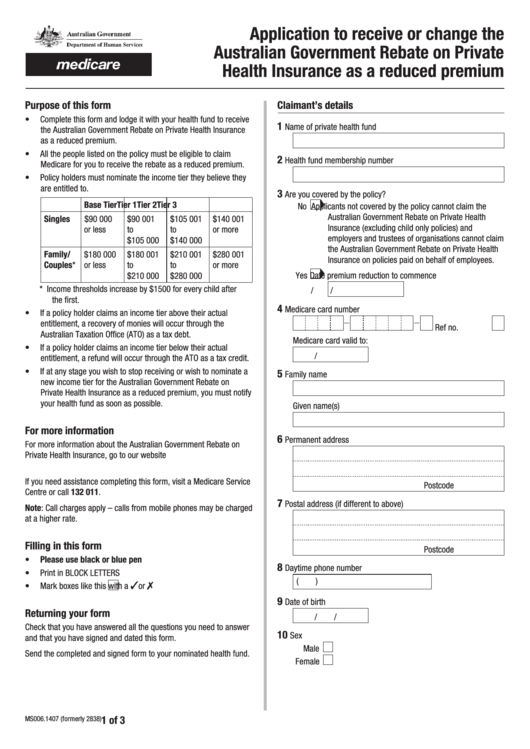

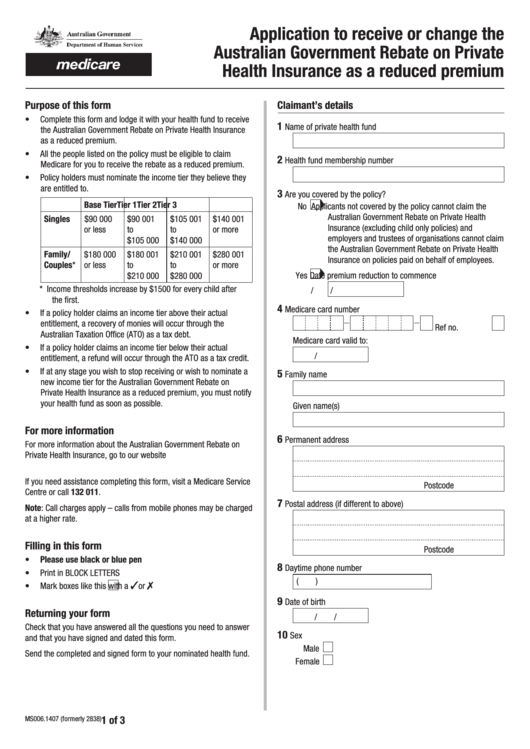

Fillable Application To Receive Or Change The Australian Government

Fillable Application To Receive Or Change The Australian Government

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Premium Calculator Of State Life Insurance Savings Tax rebate

Who Will Get Health Insurance Rebate Checks Anceinsru

Tax Rebate On Medical Insurance Premium - Web 11 mai 2023 nbsp 0183 32 A premium tax credit also called a premium subsidy lowers the cost of your health insurance The discount can be applied to your insurance bill every month or you